If you need to fill out ctw3 2020, you won't have to install any kind of programs - simply try using our PDF editor. In order to make our editor better and simpler to work with, we continuously come up with new features, with our users' suggestions in mind. It just takes a couple of easy steps:

Step 1: First of all, open the pdf tool by clicking the "Get Form Button" above on this page.

Step 2: This tool helps you modify PDF documents in a range of ways. Enhance it with any text, correct what is already in the document, and put in a signature - all within the reach of a couple of mouse clicks!

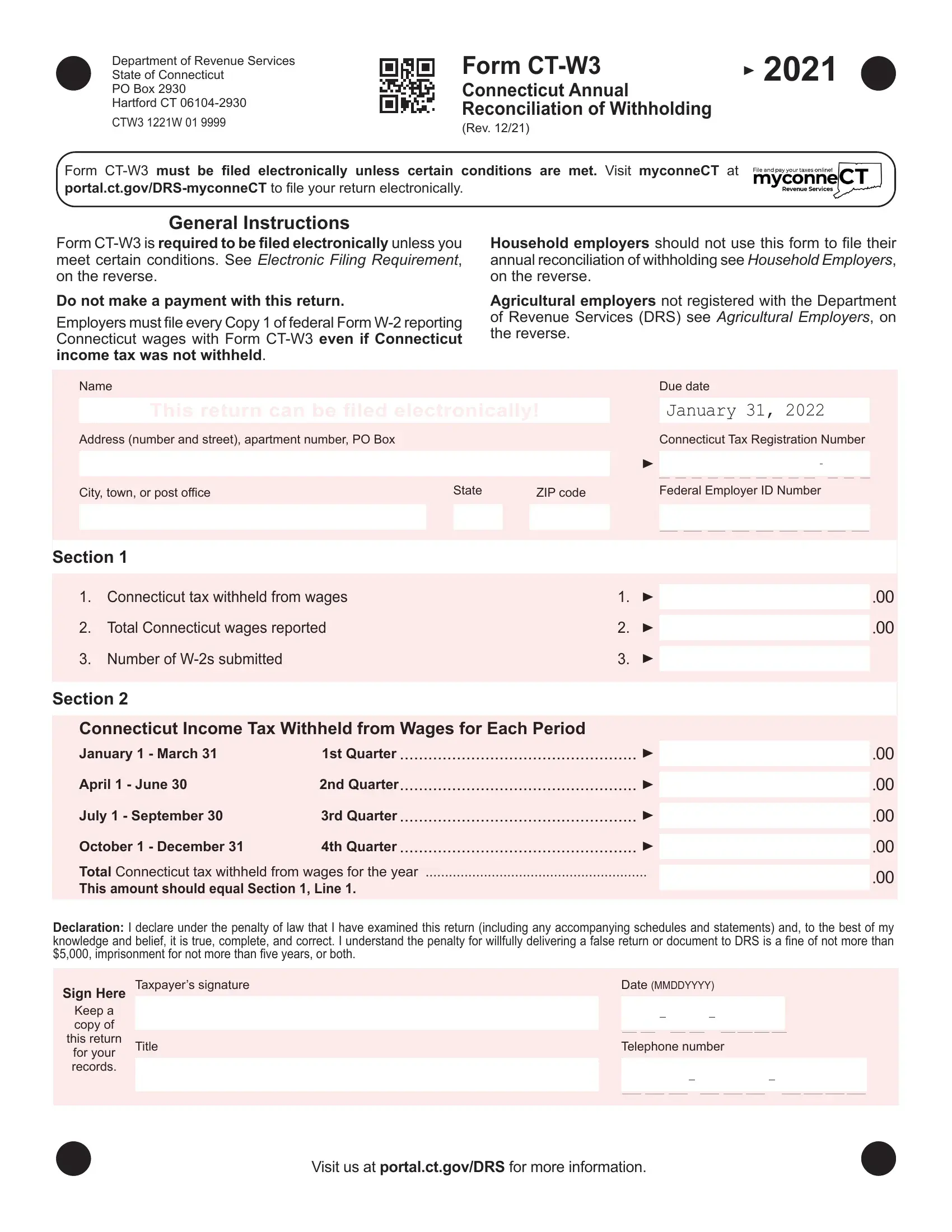

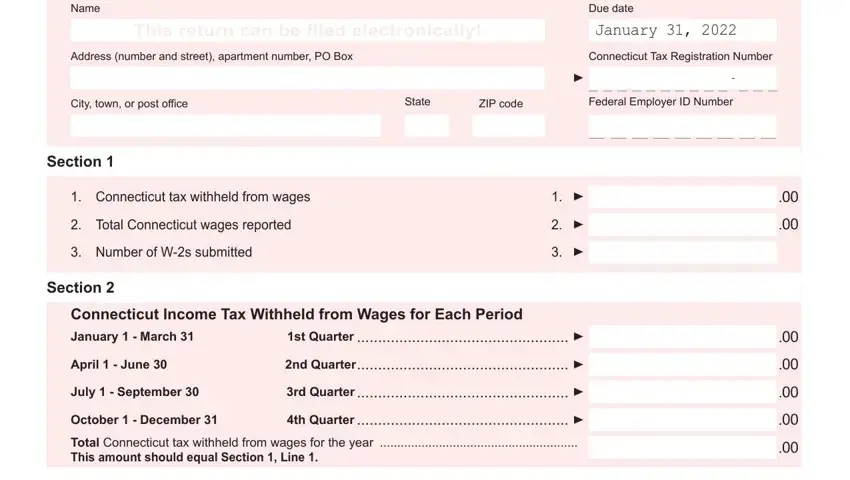

This form will require specific information to be filled in, therefore ensure that you take the time to fill in what's asked:

1. You should complete the ctw3 2020 correctly, thus be attentive while filling out the areas including all of these fields:

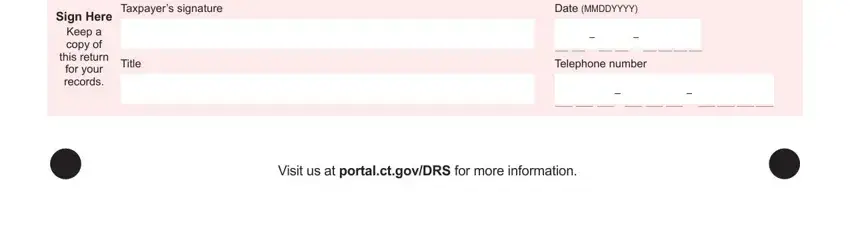

2. Right after the first section is filled out, go on to type in the relevant information in all these: Taxpayers signature, Date MMDDYYYY, Title, Telephone number, Sign Here, Keep a copy of this return, for your records, and Visit us at portalctgovDRS for.

Those who use this form generally get some things incorrect when filling out Taxpayers signature in this section. You should definitely revise what you enter here.

Step 3: After going through the filled in blanks, hit "Done" and you're done and dusted! Join us now and easily access ctw3 2020, all set for download. All changes made by you are kept , letting you edit the document later on as required. If you use FormsPal, you'll be able to complete documents without being concerned about database incidents or entries being distributed. Our secure software ensures that your private information is stored safely.