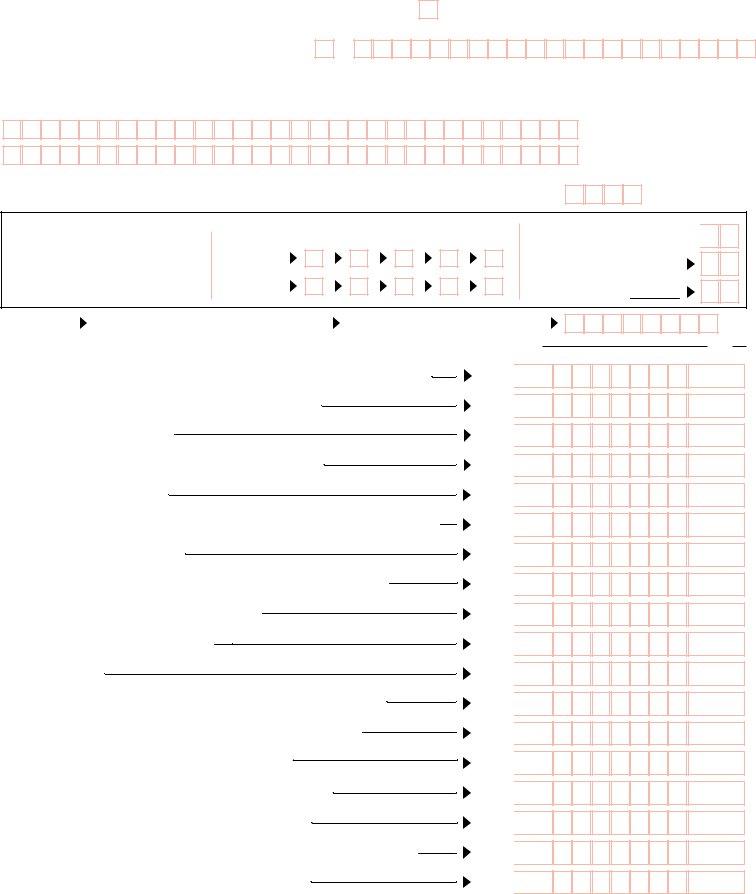

Filing taxes can often seem like a daunting task, especially when dealing with specific city requirements, such as those outlined for the City of Detroit's D-1040(NR) form. This particular form is essential for non-residents who have earned income in Detroit, ensuring that they meet their tax obligations correctly. The D-1040(NR) form is comprehensive, requiring detailed information including Social Security numbers for both the individual and spouse, if applicable, and a thorough breakdown of income and adjustments. This form encompasses sections on filing status, exemptions based on various criteria such as age, blindness, or disability, and details on income from wages earned in Detroit and other income sources. It also prompts for information on deductions, payments, and credits applicable to the taxpayer, laying out a clear method for calculating net income, taxable income, and the taxes due or refundable. Moreover, it includes specific schedules, such as Schedules N, J, M, and C, for detailed reporting on wages, other income, allowed deductions, and business or professional profit or loss, respectively. With provisions for regular, amended, and audit-triggered returns, the D-1040(NR) form is meticulously designed to capture all relevant tax information for non-residents, ensuring compliance with Detroit's income tax laws.

| Question | Answer |

|---|---|

| Form Name | Form D 1040 Nr |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | d 1040 nr, nr how d1040nr form, detroit 1040 d, mi nr |

|

City of Detroit Income Tax |

||||||||||||||||||||

|

|

|

|

|

|

Individual Return — |

|||||||||||||||

Social Security Number |

|

|

|

|

|

|

Spouse’s Social Security |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name |

|

|

|

|

|

|

|

|

|

|

MI Last Name |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2014 *10112014*

Check here if this return is for a deceased taxpayer

Spouse’s First Name |

|

MI |

|

Spouse’s Last Name |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Address (Number and Street or Rural Route)

City or Town |

|

State |

|

Zip Code |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. FILING STATUS

|

|

Single or Married Filing Separately |

|

|

Married Filing Jointly |

|

|

|

|

|

|

B. |

|

Check if you can be claimed as a dependent |

|

||

|

||

|

on another person’s tax return. |

|

|

|

EXEMPTIONS:

REGULAR 65 or OVER |

BLIND |

C. YOURSELF

D. SPOUSE

DEAF DISABLED

E. Number of Dependent Children F. Number of Other Dependents

(List names and Social Security Numbers on separate page)

G. TOTAL Number of Exemptions

Add lines C, D, E and F.

H. Amended return |

|

I. Is this amended return as a result of a federal audit? |

|

J. If Yes, enter the federal determination date |

||||||||||||||||||||

See instructions |

|

|

INCOME AND ADJUSTMENTS |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dollars |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

1. |

Total Detroit Income from |

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

1 |

|

|

|

|

|||||||||||||||

|

(work location: |

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

of |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

2. |

Other Income (or losses) (from page 2, Schedule J, line 5) |

|

|

|

2 |

|

|

|

|

|||||||||||||

W |

3. |

Subtotal (add lines 1 and 2) |

Copy |

|

|

|

3 |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Copy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Form |

4. |

|

|

|

|

|

|

|

|

|

|

Here |

|

4 |

|

|

|

|

||||||

|

|

Deductions from Income (from page 2, Schedule M, line 5) |

|

|

|

|

|

|

|

|||||||||||||||

of |

5. |

Subtotal (line 3 less line 4) |

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|||||||

|

|

6. |

Exemption amount (multiply the total number of exemptions from line G by $600.00) |

|

|

|

|

|

||||||||||||||||

|

|

|

6 |

|

|

|

|

|||||||||||||||||

|

|

|

|

AttachPAYMENTS AND CREDITS |

|

|

|

|

|

|

|

|

||||||||||||

Attach |

7. |

Net Income (line 5 less line 6) |

2 |

|

|

|

|

7 |

|

|

|

|

||||||||||||

|

|

8. |

|

|

|

|

|

|

|

W |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Renaissance Zone Deduction (attach |

8 |

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

9. |

Total Income Subject to Tax (line 7 less line 8) |

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|||||||

|

|

10. |

|

|

Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Here |

Tax (multiply line 9 by .0120 (1.20%) |

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

11. |

Tax Withheld |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Order |

12. |

2014 estimated payments, credits and other payments (see instructions) |

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|||||||||||||||||||

|

12 |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||

Money |

13. |

Detroit tax paid for you by a partnership (attach separate schedule) |

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

13 |

|

|

|

|

|||||||||||||||||

14. |

Total payments and credits (add lines 11 through 13) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

14 |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

REFUND OR TAX DUE |

|

|

|

|

|

|

|

|

|

|

|

|

||

or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

15. |

If line 14 is larger than line 10 enter amount of Overpayment |

|

|

|

15 |

|

|

|

|

|||||||||||||||

Check |

16. |

Amount to be Refunded (if amended — see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

16 |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Attach |

17. |

Amount to be Credited on 2015 Estimated Tax (if amended — see instructions) |

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

||||||||||||||||||||

|

17 |

|

|

|

|

|||||||||||||||||||

18. |

(make check payable to: Treasurer, City of Detroit) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

If line 10 is larger than line 14 enter amount of Tax Due |

|

|

|

|

|

|

|

18 |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cents

. 0 0

. 0 0

. 0 0

. 0 0

. 0 0

. 0 0

. 0 0

. 0 0

. 0 0

. 0 0

. 0 0

. 0 0

. 0 0

. 0 0

. 0 0

. 0 0

. 0 0

. 0 0

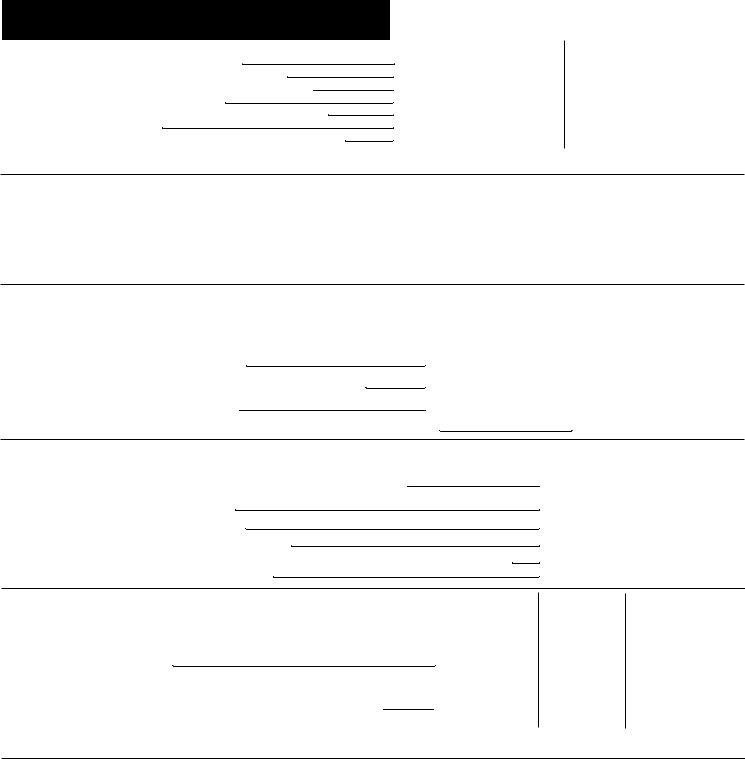

SCHEDULE N — COMPUTATION OF WAGES EARNED IN DETROIT —

DO NOT USE THIS SCHEDULE IF ALL YOUR WORK IS PERFORMED IN DETROIT

If your Detroit allocation is less than 100%, please attach letter from your employer to verify lines 1& 2 of this Schedule and your work log.

(see instructions for definition of “days worked”)

1. |

a. Number of days paid (5 day week x 52 weeks = 260 days) |

|

You |

|

|

||

|

(if other than 260 days attach explanation) |

1a. |

______________________ |

|

b. Vacation, holidays, sick, and other days not worked |

1b. |

______________________ |

|

c. Actual number of days worked everywhere (1a minus 1b) |

1c. |

______________________ |

2. |

Actual number of days worked in Detroit |

2. |

______________________ |

3. |

Percentage of days worked in Detroit (line 2 divided by line 1c) |

3. |

_______________________% |

4. |

Total wages shown on |

4. |

______________________.00 |

5. |

Wages earned in Detroit (line 4 multiplied by percentage on line 3) |

5. |

______________________.00 |

Enter total for both columns, page 1 line 1 (If multiple schedules are used the total for all line 5’s)

*10122014*

|

Spouse |

1a. |

______________________ |

1b. |

______________________ |

1c. |

______________________ |

2.______________________

3._______________________%

4.______________________.00

5.______________________.00

This schedule applies to

SCHEDULE J — Other Income (or losses) |

|

|

1. |

Rental income (or loss) from tangible property in the City of Detroit (attach federal schedule) |

1.__________________________.00 |

2. |

Net Profit (or loss) from business or profession (Schedule C line 6) |

2.__________________________.00 |

3. |

Income (losses) from DETROIT partnership and other income (attach federal schedule) |

3.__________________________.00 |

4. |

Gain (or loss) from sale or exchange of tangible property in the City of Detroit (attach federal schedule) |

4.__________________________.00 |

5. |

Total (Add lines 1, 2, 3 and 4, Enter on page 1 line 2) |

5.__________________________.00 |

SCHEDULE M — DEDUCTIONS ALLOWED ON DETROIT RETURN

You must attach copies of your federal forms to support lines 1 through 5. (See Instructions)

1.Employee Business Expenses (attach federal form 2106 and see instructions)

2.Moving Expenses (attach federal form 3903)

3.Individual Retirement Account (IRA) (attach federal form 1040, page 1)

4.Alimony (attach federal form 1040, page 1)

5.Total Deductions (add lines 1 through 4), enter total for both columns on page 1, line 4

Federal Amount |

Deductible Amount |

||

|

|

|

|

$ You |

Spouse |

You |

Spouse |

__________.00 |

__________.00 |

__________.00 |

__________.00 |

__________.00 |

__________.00 |

__________.00 |

__________.00 |

__________.00 |

__________.00 |

__________.00 |

__________.00 |

__________.00 |

__________.00 |

__________.00 |

__________.00 |

|

$ __________.00 |

__________.00 |

|

SCHEDULE C — PROFIT (OR LOSS) FROM BUSINESS OR PROFESSION. You must attach a copy of the schedule C filed with your federal income tax return. Attach a separate schedule for each business.

1. |

Net profit (or loss) from business or profession per federal Schedule C attached |

1. _________________________.00 |

2. |

Apportionment percentage from Schedule D below, line 5 — if all business was conducted in Detroit, |

|

|

enter 100% and DO NOT fill in Schedule D |

2. __________________________% |

3. |

Apportioned income (multiply line 1 by line 2) |

3. _________________________.00 |

4. |

Less: Applicable portion of net operating loss carryover |

4. _________________________.00 |

5. |

Less: Applicable portion of |

5. _________________________.00 |

6. |

Total: (enter amount on Schedule J above, line 2) |

6. _________________________.00 |

SCHEDULE D — INCOME APPORTIONMENT FORMULA:

1.Average net book value of real and tangible personal property

a.Gross annual rent paid for real property multiplied by 8

b.TOTAL (add lines 1 and 1a)

2.Total wages, salaries, commissions and other compensation of all employees

3.Gross receipts from sales made or services rendered

4.Total (add lines 1b, 2 and 3) you must compute a percentage for each line

5.Average * (enter here and on Schedule C, line 2)

Located

Everywhere I

____________.00

____________.00

____________.00

____________.00

____________.00

____________.00

Located in

Detroit II

___________.00

___________.00

___________.00

___________.00

___________.00

___________.00

Percentage

III (II divided by I)

__________________%

__________________%

__________________%

__________________%

__________________%

__________________%

__________________%

*To determine the average, divide line 4 by 3. However, if a factor does not exist, divide the sum of the percentages by the number of factors actually used. In the case of a taxpayer authorized by the Finance Director to use a special formula, attach a copy of the approval letter.

Under penalty of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true, correct and complete. If prepared by a person other than taxpayer, the declaration is based on all information of which the preparer has any knowledge.

|

|

|

( |

) |

( |

) |

|

|

|

|

|

||

Taxpayer’s Signature |

Date |

Occupation |

Home Phone |

Work Phone |

||

|

|

|

( |

) |

( |

) |

Spouse’s Signature |

Date |

Occupation |

Home Phone |

Work Phone |

||

|

|

|

|

|||

Signature of preparer other than taxpayer |

Date |

Address |

I.D. number |

|||

MAILING INSTRUCTIONS: Due Date: This return is due April 30, 2015 or at the end of the fourth month after the close of your tax year.

Returns With Payments: TREASURER, CITY OF DETROIT |

Refund and all others: DETROIT CITY INCOME TAX |

P.O. BOX 33401, Detroit, Michigan 48232 |

P.O. BOX 33402, Detroit, Michigan 48232 |