This PDF editor makes it easy to fill out the dd 2762 dd2762 form document. You will be able to obtain the form effortlessly through using these simple actions.

Step 1: Choose the button "Get Form Here".

Step 2: Now it's easy to change the dd 2762 dd2762 form. The multifunctional toolbar will allow you to include, erase, adapt, and highlight text or perhaps conduct other sorts of commands.

Complete the next parts to complete the document:

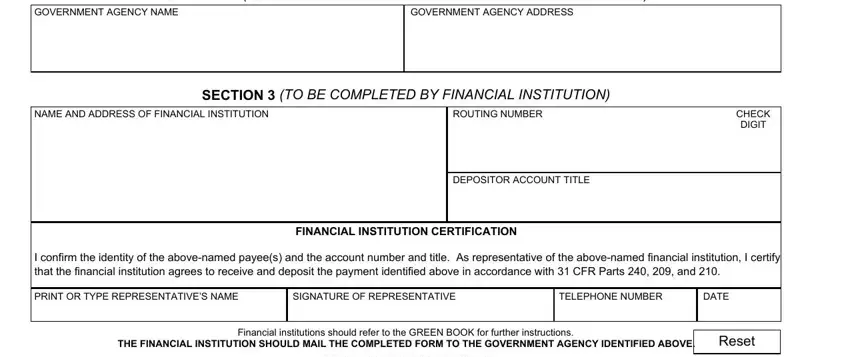

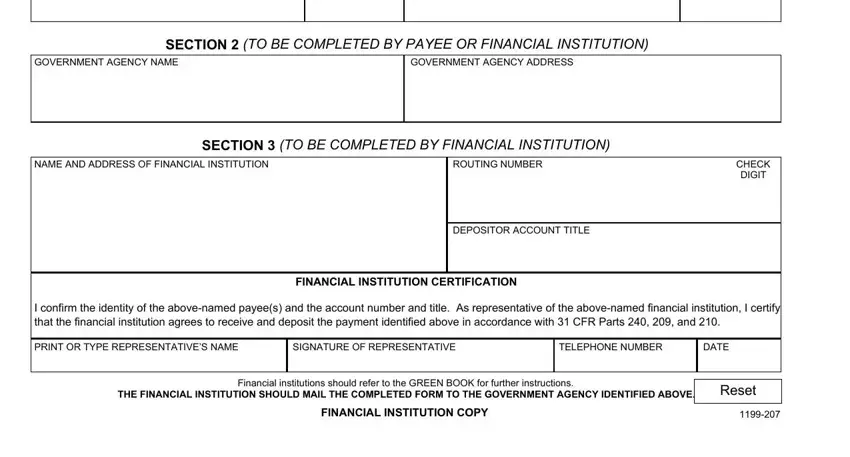

You should submit the GOVERNMENT AGENCY NAME, GOVERNMENT AGENCY ADDRESS, SECTION TO BE COMPLETED BY PAYEE, NAME AND ADDRESS OF FINANCIAL, ROUTING NUMBER, SECTION TO BE COMPLETED BY, CHECK DIGIT, DEPOSITOR ACCOUNT TITLE, FINANCIAL INSTITUTION CERTIFICATION, I confirm the identity of the, PRINT OR TYPE REPRESENTATIVES NAME, SIGNATURE OF REPRESENTATIVE, TELEPHONE NUMBER, DATE, and Financial institutions should field with the appropriate information.

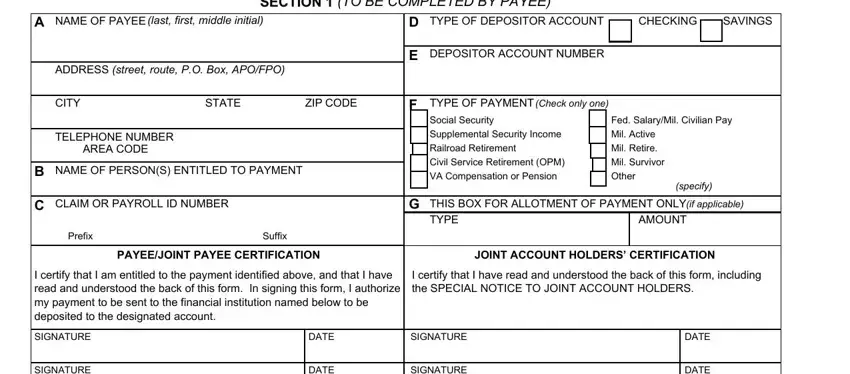

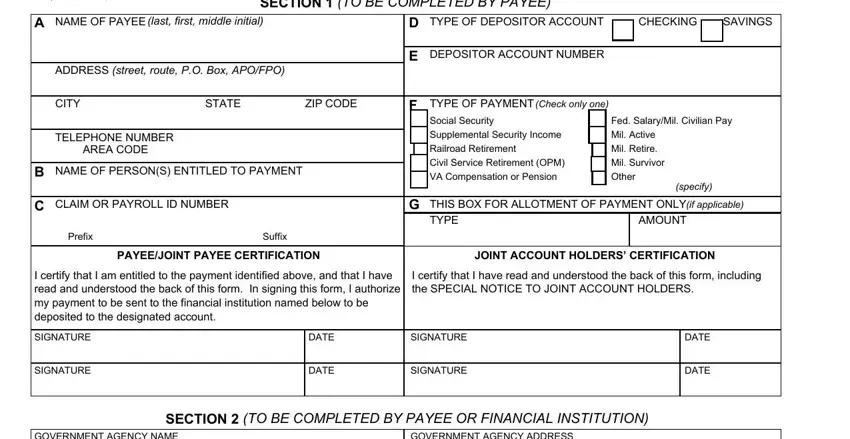

You'll be requested to write down the data to help the platform fill in the part A separate form must be completed, SECTION TO BE COMPLETED BY PAYEE, NAME OF PAYEE last first middle, ADDRESS street route PO Box APOFPO, CITY, STATE, ZIP CODE, TELEPHONE NUMBER AREA CODE, NAME OF PERSONS ENTITLED TO PAYMENT, CLAIM OR PAYROLL ID NUMBER, Prefix, Suffix, TYPE OF DEPOSITOR ACCOUNT, CHECKING, and SAVINGS.

Through section SIGNATURE, DATE, SIGNATURE, DATE, GOVERNMENT AGENCY NAME, GOVERNMENT AGENCY ADDRESS, SECTION TO BE COMPLETED BY PAYEE, NAME AND ADDRESS OF FINANCIAL, ROUTING NUMBER, SECTION TO BE COMPLETED BY, CHECK DIGIT, DEPOSITOR ACCOUNT TITLE, FINANCIAL INSTITUTION CERTIFICATION, I confirm the identity of the, and PRINT OR TYPE REPRESENTATIVES NAME, identify the rights and obligations.

Finalize by reading these fields and writing the appropriate particulars: A separate form must be completed, SECTION TO BE COMPLETED BY PAYEE, NAME OF PAYEE last first middle, ADDRESS street route PO Box APOFPO, CITY, STATE, ZIP CODE, TELEPHONE NUMBER AREA CODE, NAME OF PERSONS ENTITLED TO PAYMENT, CLAIM OR PAYROLL ID NUMBER, Prefix, Suffix, TYPE OF DEPOSITOR ACCOUNT, CHECKING, and SAVINGS.

Step 3: Once you press the Done button, your finished form may be transferred to any of your devices or to email provided by you.

Step 4: Try to make as many copies of your document as you can to stay away from potential problems.

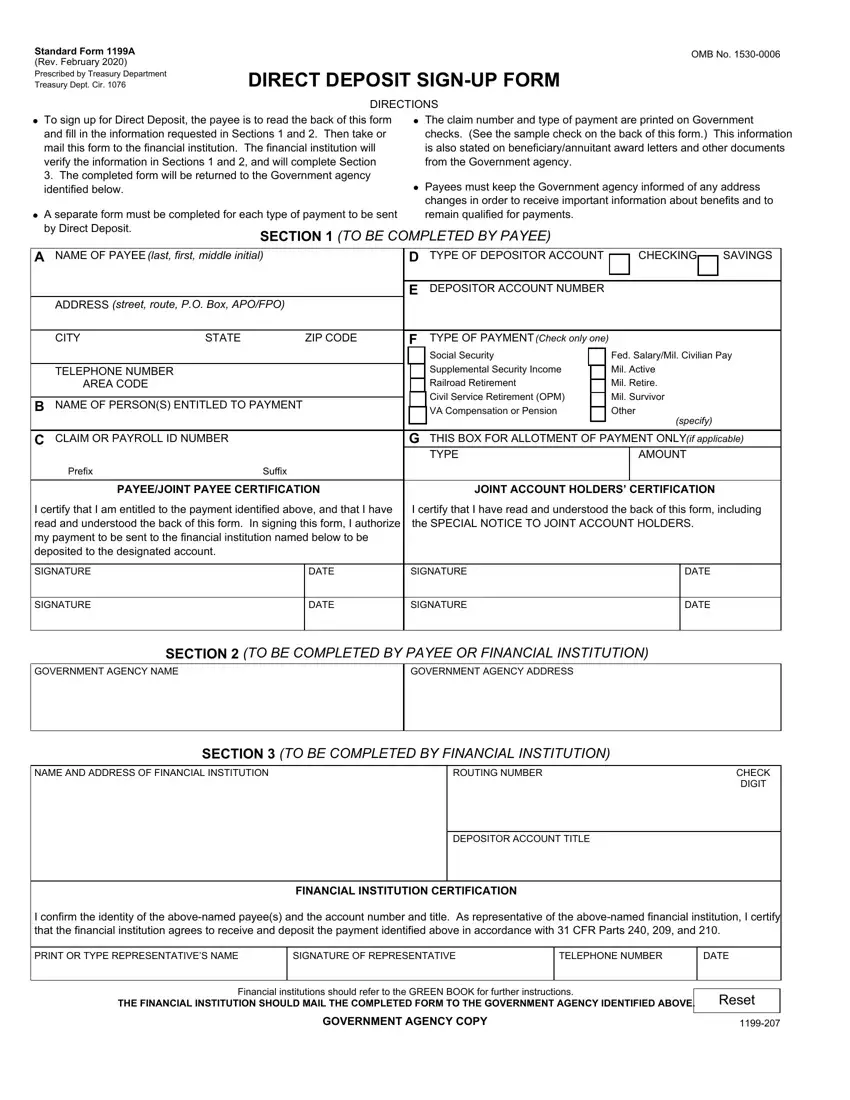

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section A separate form must be completed for each type of payment to be sent by Direct Deposit.

A separate form must be completed for each type of payment to be sent by Direct Deposit. The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency. Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section A separate form must be completed for each type of payment to be sent by Direct Deposit.

A separate form must be completed for each type of payment to be sent by Direct Deposit. The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency. Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section A separate form must be completed for each type of payment to be sent by Direct Deposit.

A separate form must be completed for each type of payment to be sent by Direct Deposit. The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency. Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.