edd ca forms can be filled out online without difficulty. Just use FormsPal PDF tool to accomplish the job quickly. Our professional team is always working to improve the tool and insure that it is even faster for people with its cutting-edge features. Make the most of today's modern possibilities, and find a trove of unique experiences! With some easy steps, you are able to begin your PDF editing:

Step 1: First, open the tool by pressing the "Get Form Button" above on this site.

Step 2: With this advanced PDF editing tool, you may accomplish more than merely complete blanks. Express yourself and make your docs seem faultless with customized text put in, or adjust the original input to perfection - all that supported by the capability to incorporate almost any pictures and sign the document off.

It will be straightforward to finish the pdf using this helpful tutorial! Here's what you have to do:

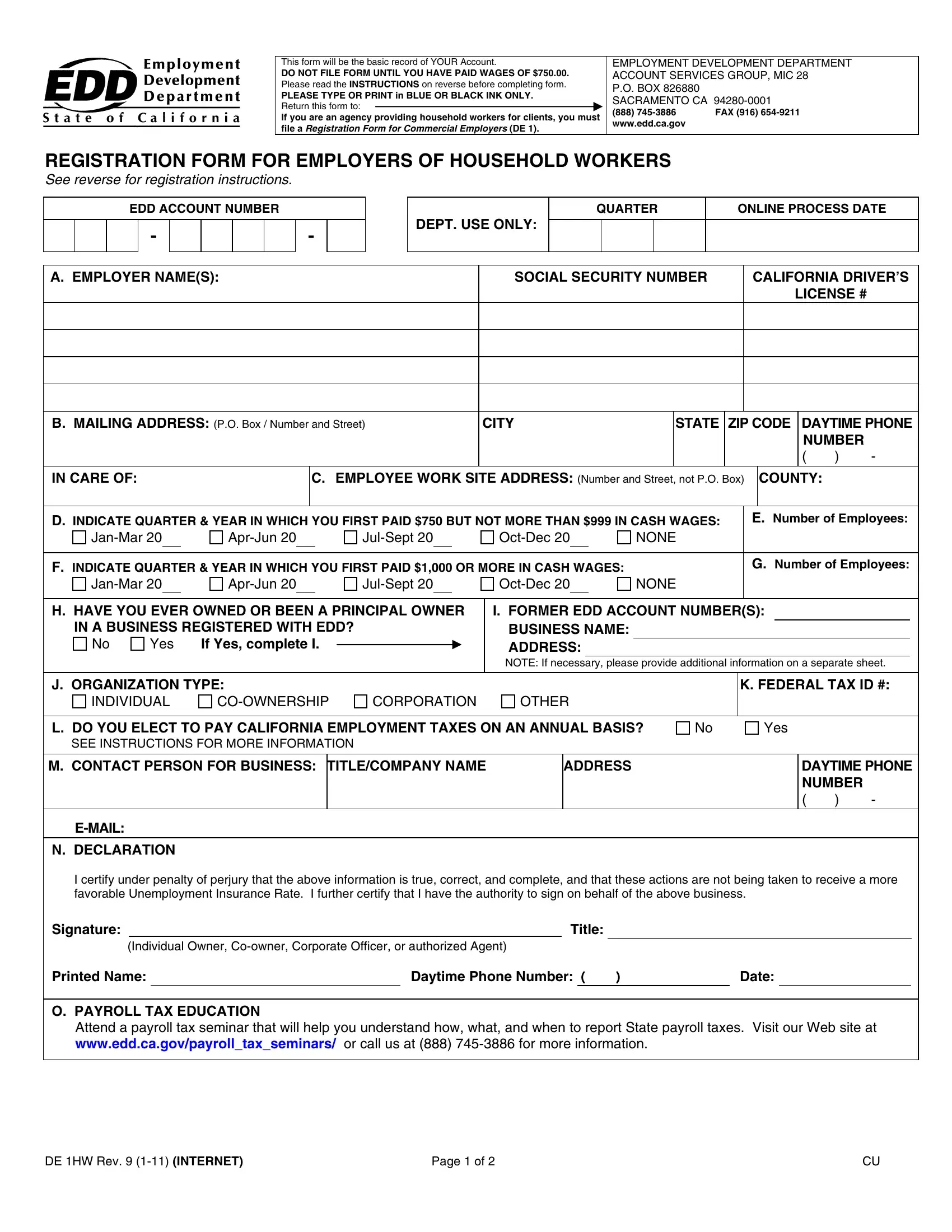

1. To start off, while filling out the edd ca forms, begin with the section that includes the next blanks:

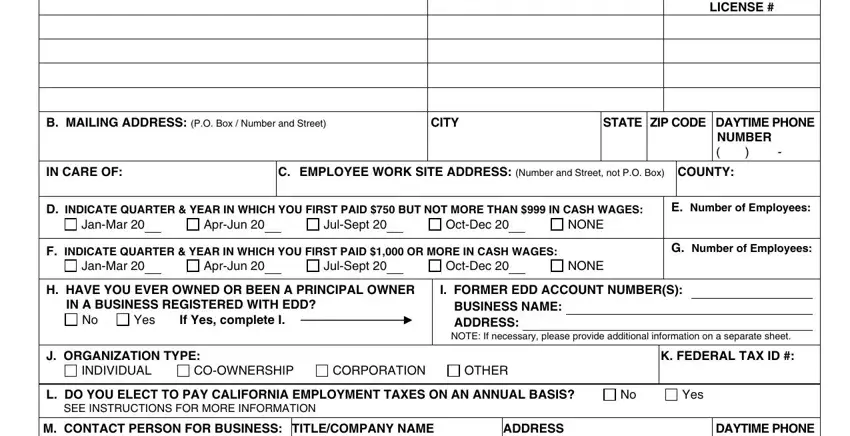

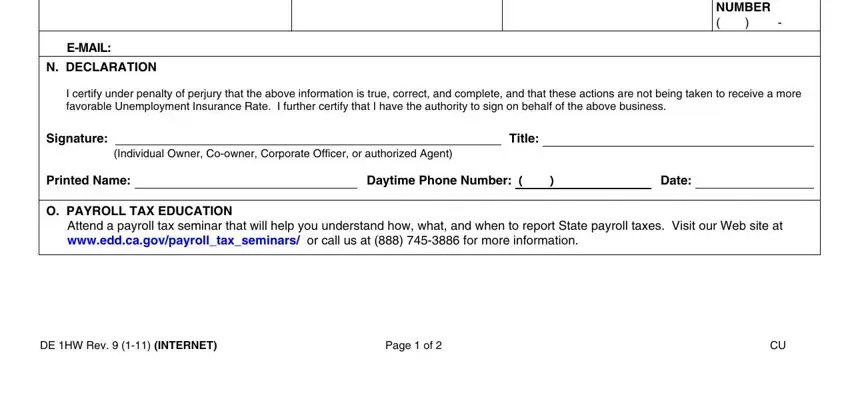

2. Once your current task is complete, take the next step – fill out all of these fields - M CONTACT PERSON FOR BUSINESS, TITLECOMPANY NAME, ADDRESS, DAYTIME PHONE NUMBER, EMAIL, N DECLARATION, I certify under penalty of perjury, Signature, Individual Owner Coowner Corporate, Title, Printed Name O PAYROLL TAX, Daytime Phone Number, Date, Attend a payroll tax seminar that, and DE HW Rev INTERNET with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

3. This next section is considered quite simple, INSTRUCTIONS FOR REGISTRATION FORM, Fax your completed registration, A EMPLOYER NAMES Enter full name, household workers, B MAILING ADDRESS Enter the, different than the mailing address, INDICATE QUARTER AND YEAR IN WHICH, E NUMBER OF EMPLOYEES Enter total, INDICATE QUARTER AND YEAR IN WHICH, G NUMBER OF EMPLOYEES Enter total, check Yes and provide account, and I J TAXPAYER TYPE Check the box - these form fields must be filled out here.

4. You're ready to proceed to this fourth form section! Here you've got all of these N DECLARATION This declaration, taxes pointing out the pitfalls, We will notify you of your EDD, and Page of blanks to do.

A lot of people frequently make some errors while completing Page of in this section. Remember to review what you type in right here.

Step 3: Make certain your information is correct and then just click "Done" to complete the task. Make a free trial account at FormsPal and acquire instant access to edd ca forms - download or modify from your FormsPal cabinet. We do not share any information you provide when dealing with forms at our site.