INFORMATION AND INSTRUCTIONS FOR COMPLETING THE EMPLOYER OF HOUSEHOLD

WORKER(S) QUARTERLY REPORT OF WAGES AND WITHHOLDINGS

For assistance in completing this form, obtaining additional forms, or inquiries regarding reporting wages or the subject status of employees, please call our Taxpayer Assistance Center at (888) 745-3886. For TTY (nonverbal) access, call (800) 547-9565. For additional information, you may also refer to the Household Employer’s Guide (DE 8829) or visit our Web site at www.edd.ca.gov

INSTRUCTIONS:

Please make any corrections to the name, address, or ownership on the front of this form. Always keep a copy of this form for your records.

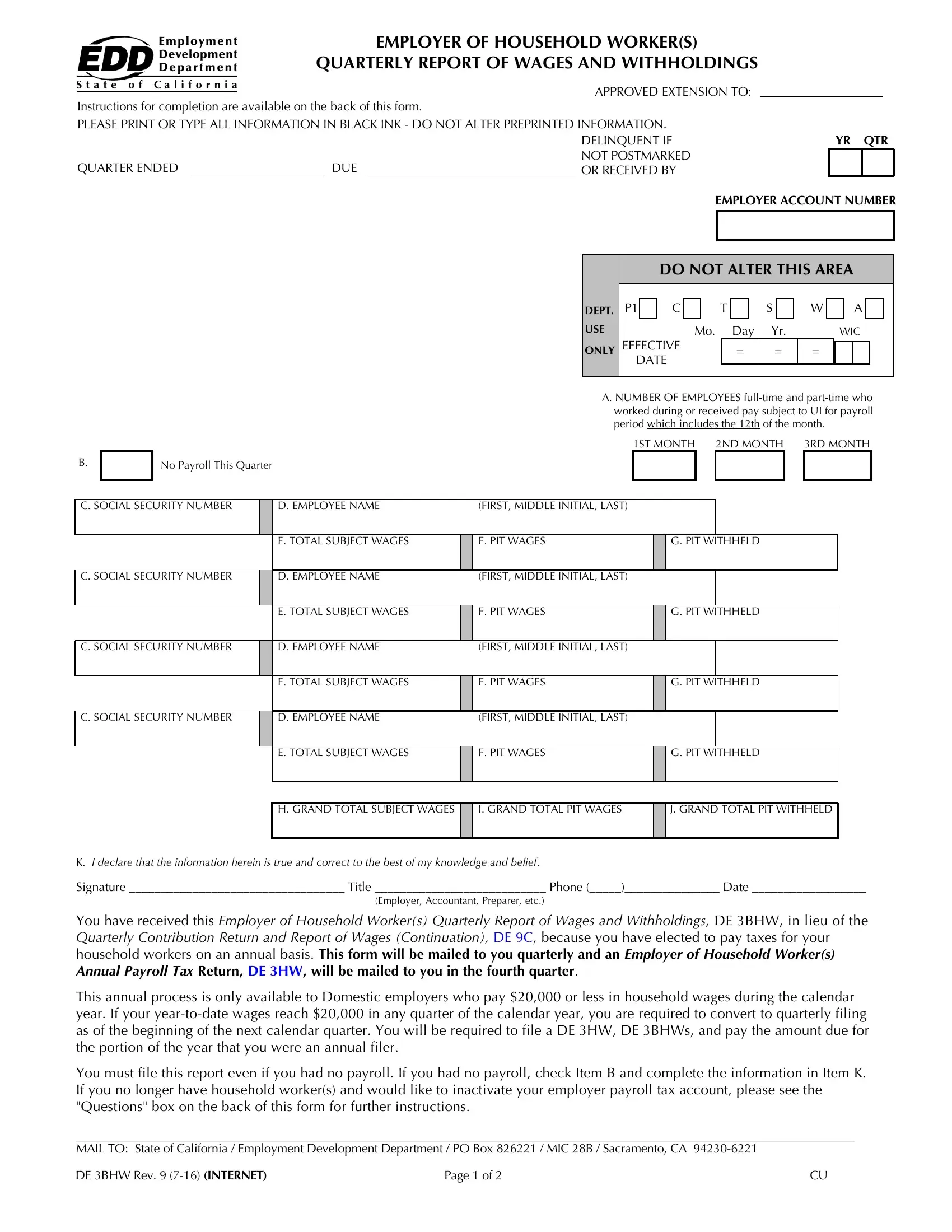

ITEM A. Number of Employees: Enter the number of full-time and part-time workers who worked during or received pay subject to Unemployment Insurance for the payroll period which includes the 12th of the month. Please provide a count for each of the three months. Blank fields will be identified as missing data.

ITEM B. No Payroll This Quarter: If you had no payroll, mark this box and enter “0” in each of the three boxes in Item A, and in the Grand Total Boxes, Items H, I, and J.

ITEM C. Social Security Number (SSN): Enter the SSN of each employee to whom you paid wages in subject employment during the quarter. If an employee does not have an SSN, report their name, wages and/or withholdings without the SSN. TAKE IMMEDIATE STEPS TO SECURE A NUMBER and provide EDD with the correct information as soon as possible on a DE 3BHW writing “Amended” at the top of the form.

ITEM D. Employee Name: Enter the full first name, middle initial (if any), and last name of each employee to whom you paid wages in household employment during the quarter (e.g., Jane L Doe). If you report last name first, include a “comma” after the last name, followed by a space, first name, space, then middle initial (e.g., Doe, John A).

ITEM E. Total Subject Wages: Enter the full amount of wages (including cents) paid, cash and non-cash, to each employee during the quarter (e.g., $1,000 should be entered as 1000.00). Generally, all wages are considered “subject” wages. If you need further assistance, refer to the Household Employer’s Guide (DE 8829) or contact our Taxpayer Assistance Center at (888) 745-3886.

ITEM F. PIT Wages: Enter the amount of all wages (including cents) paid during the quarter that are subject to California Personal Income Tax (PIT), even if you did not withhold PIT. Enter the PIT wages for each employee, even if the figures are the same as the total subject wages.

ITEM G. PIT Withheld: Enter the amount of PIT withheld (including cents) from each employee’s wages during the quarter.

ITEM H. Grand Total Subject Wages: Enter the total subject wages (Item E) paid to all employees during the quarter.

ITEM I. Grand Total PIT Wages: Enter the total PIT wages (Item F) paid to all employees during the quarter.

ITEM J. Grand Total PIT Withheld: Enter the total PIT withheld (Item G) from all employees during the quarter.

ITEM K. Please sign, state your title, enter your telephone number, and date the form.

NOTE: Payment of Taxes for Household Employers Who Have Elected to Pay Taxes Annually: Payment of all taxes and withholdings for the calendar year is due and payable with the Employer of Household Worker(s) Annual Payroll Tax Return (DE 3HW) by January 31 of the following year. This includes Unemployment Insurance (UI), Employment Training Tax (ETT), State Disability Insurance (SDI) (includes Paid Family Leave amount), and Personal Income Tax (PIT) contributions and withholdings for the calendar year. Refer to the Household Employer’s Guide (DE 8829) for additional information.

QUESTIONS: What do I do if I pay more than $20,000 in a calendar year? If you pay more than $20,000 in a calendar year, you will need to file and pay all taxes owed from the beginning of the year through the end of the calendar quarter in which the amount was exceeded. Request and complete an Employer of Household Worker(s) Annual Payroll Tax Return (DE 3HW) by calling our Taxpayer Assistance Center at (888) 745-3886 and return it with your remittance to the address shown on the form. For the remainder of the calendar year you will be required to make quarterly tax payments. If you wish to return to annual reporting, you will need to file another Employer of Household Worker Election Notice (DE 89) form, which will take effect the beginning of the following year.

No longer have employees? If you no longer have employees and do not intend to hire anyone in the future, you must submit a DE 3BHW and a DE 3HW with payment of any taxes due within 10 days. You must also complete a Change of Employer Account Information (DE 24) as indicated on the front of this form. Contact our Taxpayer Assistance Center at (888) 745-3886 if you have any questions.