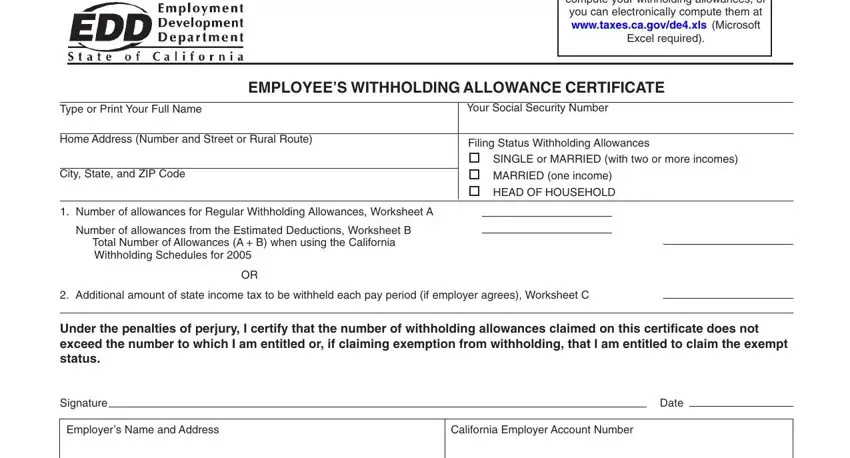

By using the online PDF tool by FormsPal, it is possible to complete or edit california de4 worksheet b here. To keep our tool on the leading edge of practicality, we aim to integrate user-driven features and improvements on a regular basis. We're routinely thankful for any suggestions - join us in remolding the way you work with PDF docs. In case you are looking to get going, this is what it will require:

Step 1: Open the PDF file in our editor by hitting the "Get Form Button" at the top of this page.

Step 2: As soon as you open the online editor, you'll see the document ready to be filled in. Apart from filling in different blanks, you might also do other sorts of things with the file, specifically adding your own textual content, editing the initial text, adding images, putting your signature on the PDF, and much more.

It will be an easy task to complete the form with our detailed guide! Here's what you must do:

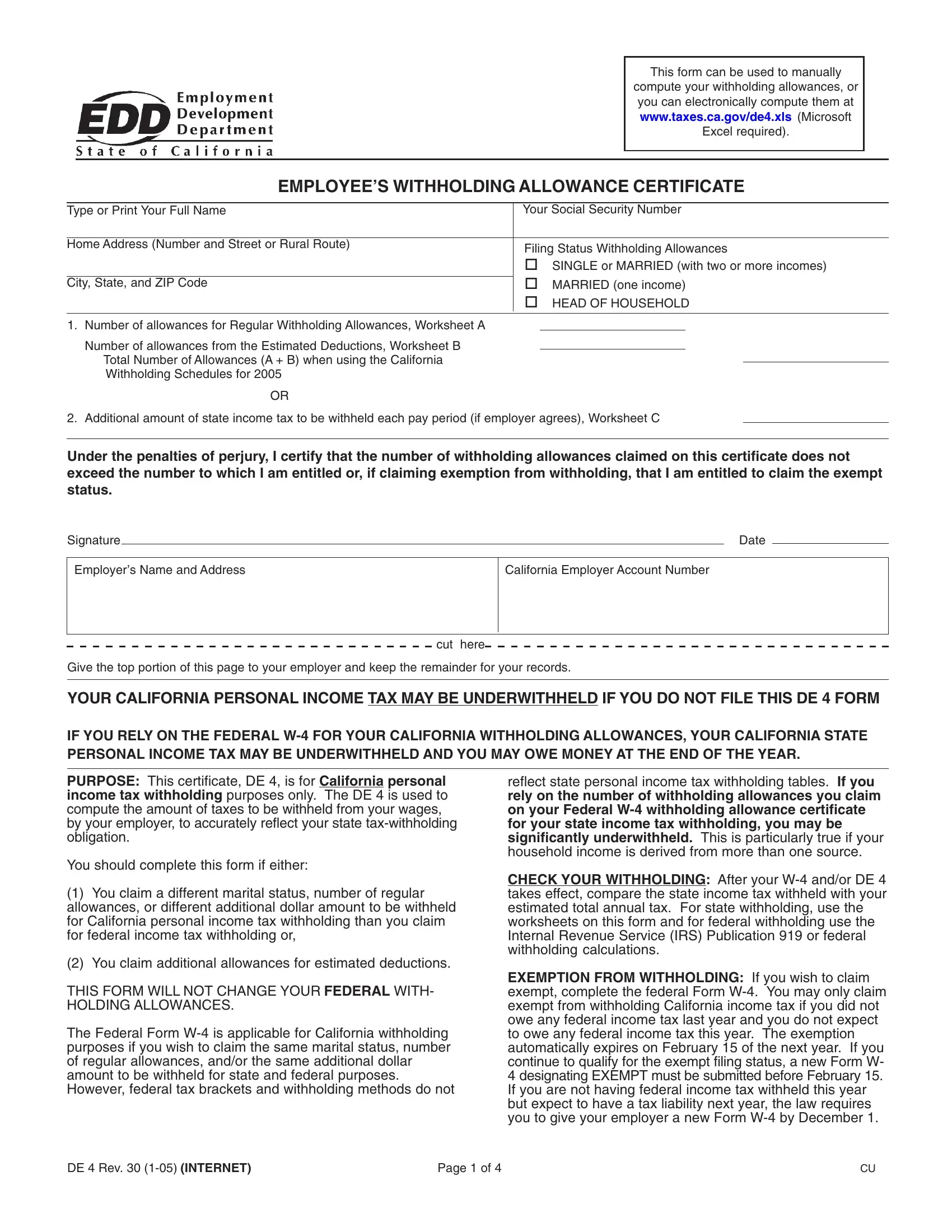

1. Complete the california de4 worksheet b with a selection of necessary blanks. Get all the necessary information and make sure nothing is forgotten!

Step 3: Once you have reviewed the information in the fields, click "Done" to conclude your FormsPal process. After setting up a7-day free trial account at FormsPal, it will be possible to download california de4 worksheet b or email it promptly. The PDF will also be at your disposal through your personal account page with all of your modifications. We do not share the details you enter whenever working with documents at our site.