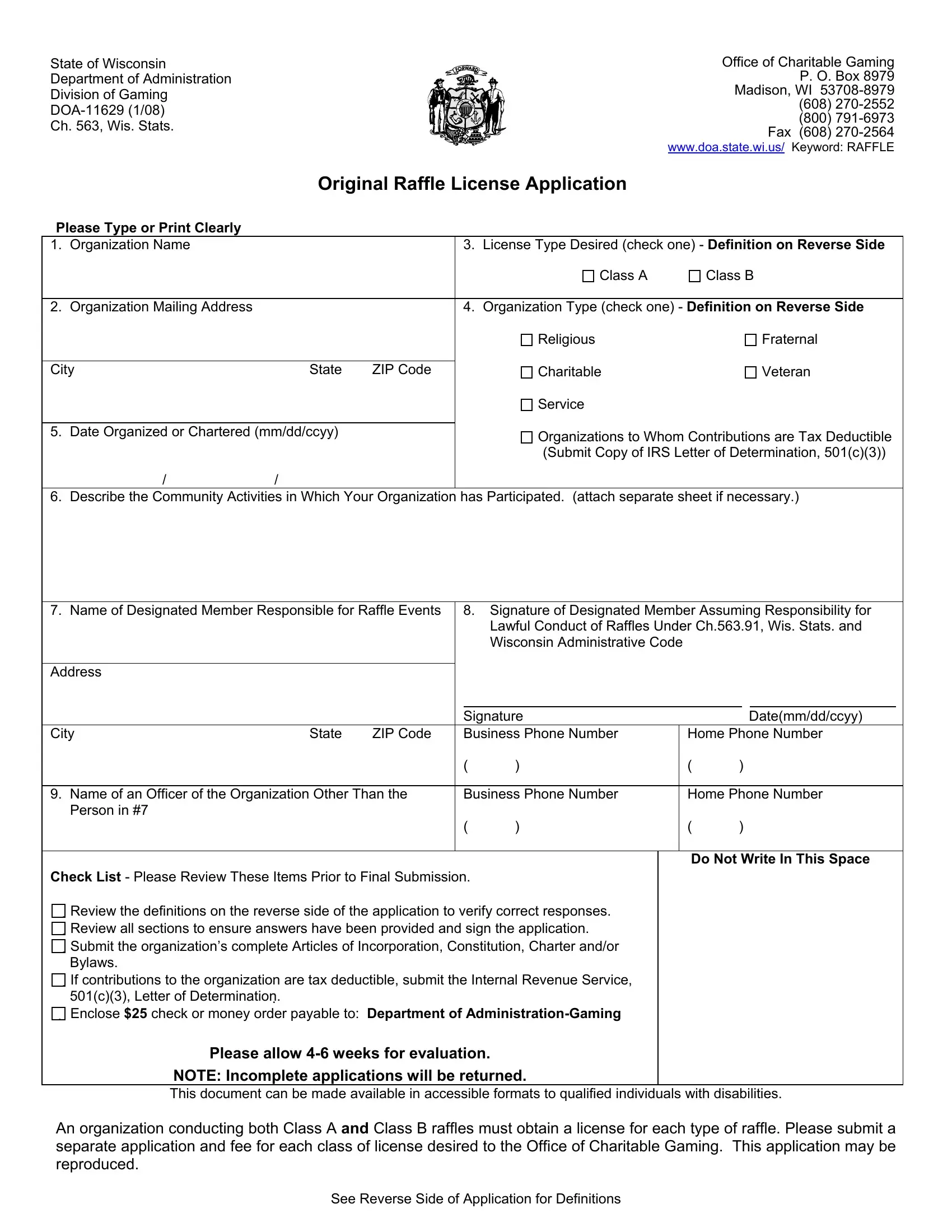

State of Wisconsin

Department of Administration

Division of Gaming

DOA-11629 (1/08)

Ch. 563, Wis. Stats.

Office of Charitable Gaming

P. O. Box 8979

Madison, WI 53708-8979

(608) 270-2552

(800) 791-6973

Fax (608) 270-2564

www.doa.state.wi.us/ Keyword: RAFFLE

Original Raffle License Application

Please Type or Print Clearly

1. |

Organization Name |

|

3. |

License Type Desired (check one) - Definition on Reverse Side |

|

|

|

|

|

|

Class A |

|

Class B |

|

|

|

|

|

|

|

|

|

|

|

2. |

Organization Mailing Address |

|

4. |

Organization Type (check one) - Definition on Reverse Side |

|

|

|

|

|

|

Religious |

|

|

|

Fraternal |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

ZIP Code |

|

|

Charitable |

|

|

|

Veteran |

|

|

|

|

|

|

Service |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Date Organized or Chartered (mm/dd/ccyy) |

|

|

|

Organizations to Whom Contributions are Tax Deductible |

|

|

|

|

|

|

|

|

|

|

|

|

(Submit Copy of IRS Letter of Determination, 501(c)(3)) |

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

6. Describe the Community Activities in Which Your Organization has Participated. (attach separate sheet if necessary.) |

|

|

|

|

|

|

|

|

|

7. |

Name of Designated Member Responsible for Raffle Events |

|

8. Signature of Designated Member Assuming Responsibility for |

|

|

|

|

|

|

Lawful Conduct of Raffles Under Ch.563.91, Wis. Stats. and |

|

|

|

|

|

|

Wisconsin Administrative Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

|

Date(mm/dd/ccyy) |

City |

State |

ZIP Code |

|

Business Phone Number |

|

Home Phone Number |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

9. Name of an Officer of the Organization Other Than the |

|

Business Phone Number |

|

Home Phone Number |

|

Person in #7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do Not Write In This Space |

Check List - Please Review These Items Prior to Final Submission. |

|

|

|

|

|

|

|

|

|

Review the definitions on the reverse side of the application to verify correct responses. |

|

|

|

|

|

|

|

Review all sections to ensure answers have been provided and sign the application. |

|

|

|

|

|

|

|

Submit the organization’s complete Articles of Incorporation, Constitution, Charter and/or |

|

|

|

|

|

|

|

Bylaws. |

|

|

|

|

|

|

|

|

|

|

|

|

|

If contributions to the organization are tax deductible, submit the Internal Revenue Service, |

|

|

|

|

|

|

|

501(c)(3), Letter of Determination. |

|

|

|

|

|

|

|

|

|

|

|

|

Enclose $25 check or money order payable to: Department of Administration-Gaming |

|

|

|

|

|

|

|

|

Please allow 4-6 weeks for evaluation. |

|

|

|

|

|

|

|

|

NOTE: Incomplete applications will be returned. |

|

|

|

|

|

|

This document can be made available in accessible formats to qualified individuals with disabilities.

An organization conducting both Class A and Class B raffles must obtain a license for each type of raffle. Please submit a separate application and fee for each class of license desired to the Office of Charitable Gaming. This application may be reproduced.

See Reverse Side of Application for Definitions

Application Definitions

License Type

Class A Raffle License

The license type required to conduct a raffle in which some or all of the tickets for that raffle are sold on days other than the same day as the raffle drawing.

Class B Raffle License

The license type required to conduct a raffle in which all of the tickets for that raffle are sold on the same day as the raffle drawing.

Organization Type

Religious An established religious institution or group thereof. If not, additional background information is requested.

Veteran An established group of past participants in the United States Armed Forces. If not, additional background information is requested.

Fraternal An organization with a representative form of government that (1) operates under the lodge system with a ritualistic form of work; (2) is organized to promote the payment of life, sickness, accident or other insurance benefits to its members; and (3) is organized to carry on some worthy civic or service purpose.

Service An organization which has, as a minimum, the benefit, the growth and the general welfare of the community as one of its principle purposes. This category includes a labor organization or political party, but excludes a trade association, a social club or a political group created exclusively for political purposes under whose name candidates appear on a ballot at any election.

Charitable An organization will be classed as such if the dominant purpose of its work is for the public good, and the work done for its members is but the means adopted for this purpose. Include registration certificate issued from the State of Wisconsin.

501(c) (3) Internal Revenue Service Determination Letter stating that contributions to your organization are deductible for income tax purposes.

Qualified Organizations must be “local” as defined in Ch.563.905, Wis. Stats. Definitions: (1) “Local organization” means an organization whose activities are limited to this state or to a specific geographical area within this state; and, as required in Ch.563.90, Wis. Stats., must be in existence for at least one year immediately preceding its application or belong to a state or national organization that has been in existence for at least three years.