In today's intricate world of compliance and financial transactions, understanding and properly completing tax-related forms like the DOA-6448 (R11/2012) is essential for entities and individuals engaging with agencies like the State of Wisconsin's Division of Executive Budget and Finance, Department of Administration State Controller’s Office. This form acts as a Substitute W-9, crucial for Taxpayer Identification Number (TIN) Verification, and ensures that entities, whether individual sole proprietors, corporations, government entities, or other specified groups, can correctly report and verify their tax identification details to avoid backup withholding or potential penalties. The meticulous instructions accompanying the form guide through the proper entry of legal names, designations, addresses, and the appropriate TIN—be it a Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN). Furthermore, certification by the taxpayer affirms their TIN's accuracy and declares their exemption status from backup withholding. The DOA-6448 form underscores the interplay between state-level operational requirements and federal tax regulations, aiming to streamline financial matters while ensuring compliance with broader tax reporting and withholding mandates.

| Question | Answer |

|---|---|

| Form Name | Doa 6448 Form |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | DOA 6448 doa 6448 form |

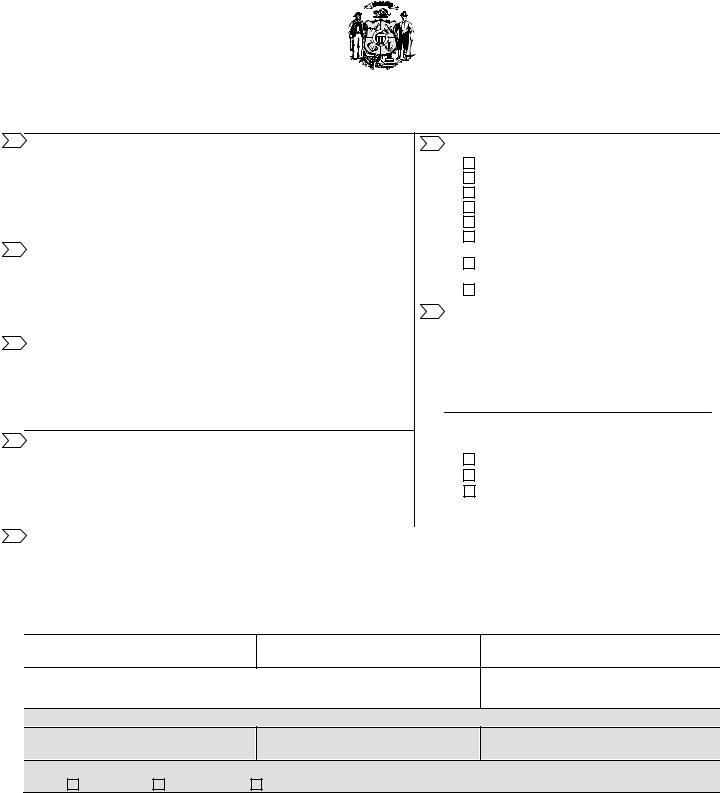

State of Wisconsin |

Division of Executive Budget and Finance |

Department of Administration |

State Controller’s Office |

|

|

Substitute |

DO NOT send to IRS |

|

Taxpayer Identification Number (TIN) Verification

Print or Type

Please see attachment or reverse for complete instructions.

This form can be made available in alternate formats to individuals with disabilities upon request.

Legal Name (as entered with IRS) |

Entity Designation (check only one) Required |

|

If Sole Proprietorship or LLC Single Owner, enter your Last, First, M. I. |

Individual/Sole Proprietor/LLC Single Owner |

|

|

||

|

Corporation (includes service corporations) |

|

|

Limited Liability Company - Partnership |

|

Trade Name |

||

Limited Liability Company - Corporation |

||

Enter Business Name if different from above. |

||

|

Government Entity |

|

|

Hospital Exempt from Tax or Government |

|

Remit Address (where check should be mailed) |

Owned |

|

PO Box or Number and Street, City, State, ZIP + 4 |

Long Term Care Facility Exempt from Tax or |

|

|

Government Owned |

|

|

All Other Entities |

|

Taxpayer Identification Number (TIN) |

|

|

If you are a sole proprietor and you have an EIN, |

|

Order Address (where order should be mailed; complete only if different from remit) |

you may enter either your SSN or EIN. However, |

|

PO Box or number and street, City, State, ZIP + 4 |

the IRS prefers that you show the SSN. Enter |

|

your 9 digit number only, no dashes. |

||

|

1099 Address (for return of 1099 form; complete only if different from remit) |

Check Only One Required (see “Instructions”) |

PO Box or number and street, City, State, ZIP + 4 |

Social Security Number (SSN) |

|

|

|

Employer Identification Number (EIN) |

|

Individual Taxpayer Identification Number |

|

for U.S. Resident Aliens (ITIN) |

|

|

Certification |

|

Under penalties of perjury, I certify that: |

|

1.The number shown on this form is my correct taxpayer identification number, AND

2.I am not subject to backup withholding because (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding.

3.I am a U.S. person (including a US resident alien).

Printed Name

Printed Title

Telephone Number

Signature

Date (MM/DD/CCYY)

For Agency Use Only

Agency Number

Contact

Phone Number

Change

Name

Address

Other (explain)

Return completed form via facsimile machine or to the address listed below.

For your convenience this form has been designed for return in a standard Window envelope.

Forms may be returned to:

Fax Number

Attn:

Instructions for Completing Taxpayer Identification Number Verification

(Substitute

Legal Name As entered with IRS

Individuals: Enter Last Name, First Name, M.I.

Sole Proprietorships: Enter Last Name, First Name, M.I.

LLC Single Owner: Enter owner's Last Name, First Name, M.I.

All Others: Enter Legal Name of Business

Trade Name

Individuals: Leave Blank

Sole Proprietorships: Enter Business Name

LLC Single Owner: Enter LLC Business Name

All Others: Complete only if doing business as a D/B/A

Remit Address

Address where payment should be mailed.

Order Address

Address where order should be mailed. Complete only if different from remit address.

1099 Address

Address where 1099 should be mailed. Complete only if different from remit address.

Entity Designation

Check ONE box which describes the type of business entity.

Taxpayer Identification Number (TIN)

LIST ONLY ONE: Social Security Number OR Employer Identification Number OR Individual Taxpayer Identification Number. See “What Name and Number to Give the Requester” at right.

If you do not have a TIN, apply for one immediately. Individuals use federal form

Certification

You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the Certification, but you must provide your correct TIN.

Privacy Act Notice

Section 6109 requires you to furnish your correct TIN to persons who must file information returns with the IRS to report interest, dividends, and certain other income paid to you, mortgage interest you paid, the acquisition or abandonment of secured property, or contributions you made to an IRA. The IRS uses the numbers for

identification purposes and to help verify the accuracy of your tax return. You must provide your TIN whether or not you are required to file a tax return. Payers must generally withhold 28% of taxable interest, dividend, and certain other payments to a payee who does not furnish a TIN to a payer. Certain penalties may also apply.

What Name and Number to Give the Requester

For this type of account: |

Give name and SSN of: |

||

1. |

Individual |

The individual |

|

2. |

Two or more individuals (joint |

The actual owner of the account |

|

|

account) |

or, if combined funds, the first |

|

|

|

individual on the account 1 |

|

3. |

Custodian account of a minor |

The minor 2 |

|

|

(Uniform Gift to Minors Act) |

|

|

4. a. The usual revocable savings |

The |

||

|

trust (grantor is also trustee) |

|

|

|

b. |

The actual owner 1 |

|

|

is not a legal or valid trust |

|

|

|

under state law |

|

|

5. |

Sole proprietorship or Single- |

The owner |

3 |

|

Owner LLC |

|

|

|

|

|

|

For this type of account: |

Give name and EIN of: |

||

6. |

Sole Proprietorship or Single- |

The owner 3 |

|

|

Owner LLC |

|

|

7. |

A valid trust, estate, or pension |

Legal entity 4 |

|

|

trust |

|

|

8. |

Corporation or LLC electing |

The corporation |

|

|

corporate status on Form |

|

|

|

8832 |

|

|

9. |

Association, club, religious, |

The organization |

|

|

charitable, educational, or |

|

|

|

other |

|

|

10. Partnership or |

The partnership |

||

|

LLC |

|

|

11. A broker or registered |

The broker or nominee |

||

|

nominee |

|

|

12. Account with the Department |

The public entity |

||

|

of Agriculture in the name of a |

|

|

|

public entity (such as a state |

|

|

|

or local government, school |

|

|

|

district or prison) that receives |

|

|

|

agricultural program payments |

|

|

|

|

|

|

1List first and circle the name of the person whose number you furnish. If only one person on a joint account has an SSN, that person’s number must be furnished.

2 Circle the minor’s name and furnish the minor’s SSN.

3 You must show your individual name, but you may also enter your business or D/B/A name. You may use either your SSN or EIN (if you have one).

4 List first and circle the name of the legal trust, estate, or pension trust. (Do not furnish the TIN of the personal representative or trustee unless the legal entity itself is not designated in the account title.)

NOTE: If no name is circled when more than one name is listed, the number will be considered to be that of the first name listed.

Taxpayer Identification Request

In order for the State of Wisconsin to comply with the Internal Revenue Service regulations, this letter is to request that you complete the enclosed Substitute Form

Please return or FAX the Substitute Form

We are required to inform you that failure to provide the correct Taxpayer Identification Number (TIN) / Name combination may subject you to a $50 penalty assessed by the Internal Revenue Service under section 6723 of the Internal Revenue Code.

Only the individual’s name to which the Social Security Number was assigned should be entered on the first line.

The name of a partnership, corporation, club, or other entity, must be entered on the first line exactly as it was registered with the IRS when the Employer Identification Number was assigned.

DO NOT submit your name with a Tax Identification Number that was not assigned to your name. For example, a doctor MUST NOT submit his or her name with the Tax Identification Number of a clinic he or she is associated with.

Thank you for your cooperation in providing us with this information. Please return the completed form to:

Phone:

Enclosure