If you intend to fill out FYI, you don't need to download any sort of applications - simply try our PDF tool. Our team is continuously endeavoring to expand the tool and make it much better for people with its many functions. Enjoy an ever-improving experience today! It merely requires a couple of simple steps:

Step 1: First of all, access the pdf tool by pressing the "Get Form Button" in the top section of this page.

Step 2: With the help of our handy PDF editor, you could do more than merely fill in blank fields. Try all of the features and make your docs appear faultless with custom text incorporated, or modify the file's original input to excellence - all comes along with the capability to incorporate just about any pictures and sign the file off.

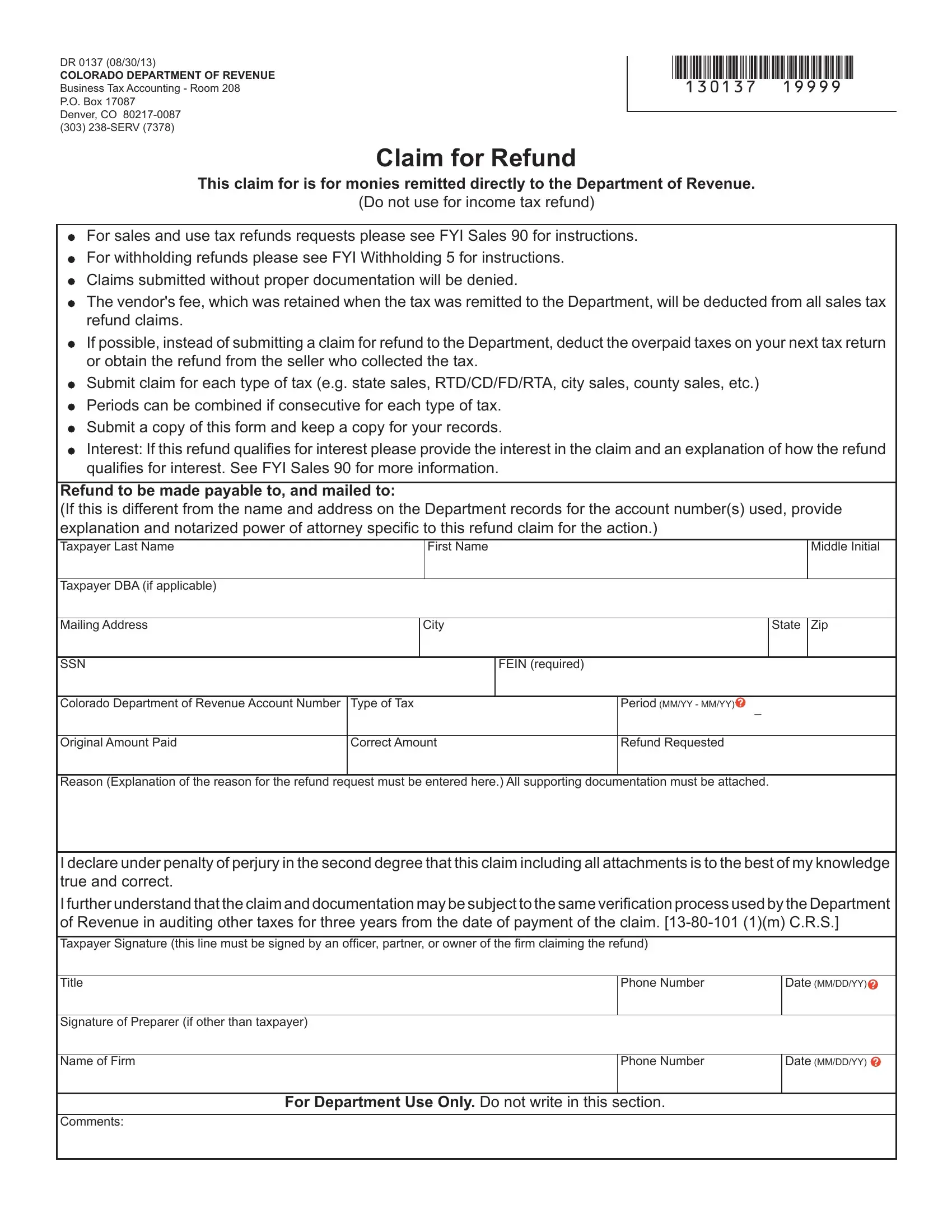

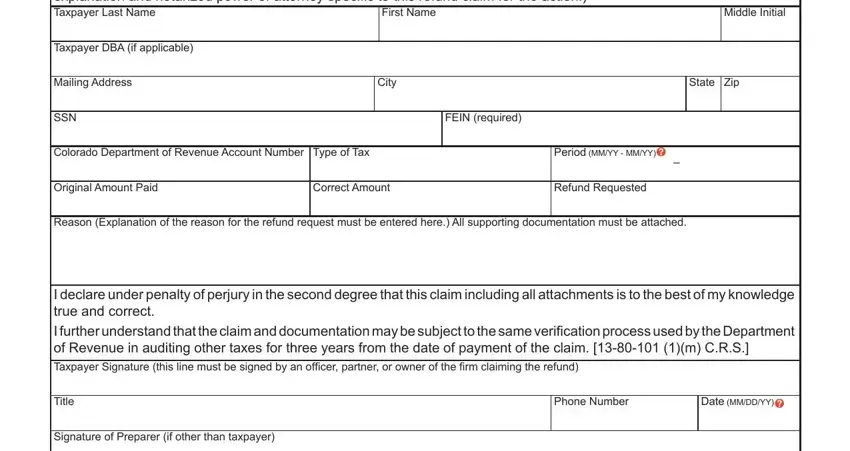

As a way to complete this form, make sure you type in the required information in each and every field:

1. Firstly, while filling in the FYI, begin with the part that has the following fields:

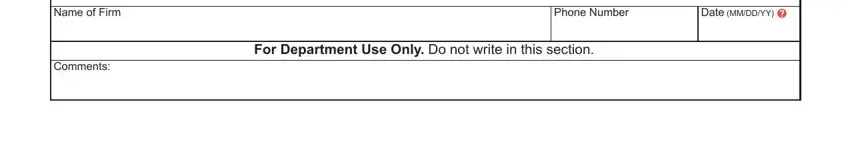

2. Immediately after the first part is filled out, go on to type in the applicable details in these - Name of Firm, Comments, Phone Number, Date MMDDYY, and For Department Use Only Do not.

Concerning Phone Number and Name of Firm, be sure that you do everything correctly in this current part. Those two could be the most significant fields in the PDF.

Step 3: Proofread what you have entered into the blanks and then click on the "Done" button. Join us today and instantly obtain FYI, ready for download. All changes made by you are preserved , letting you modify the form at a later time if required. FormsPal is focused on the confidentiality of our users; we make sure all personal information entered into our system remains confidential.