The DR 0172 form is a crucial document for contractors seeking exemption certificates for the purchase of construction and building materials in Colorado. Created by the Colorado Department of Revenue Taxpayer Service Division, this application facilitates tax-exempt purchases that are strictly intended for specific projects benefiting exempt organizations. It's important to note that this exemption strictly covers materials that become part of the final structure or public work and does not extend to equipment, supplies, or materials consumed by the contractor that do not integrate into the project. Each project requires a separate certificate, with prime contractors being responsible for issuing exemptions to their subcontractors. Accuracy in completing the form is paramount, as any errors can lead to the denial of the application. Additionally, the form serves as a declaration, under penalty of perjury, of the truthfulness and completeness of the provided information. Contractors should also be aware of procedural changes, particularly the discontinuation of issuing individual Certificates of Exemption to subcontractors, emphasizing the importance of the prime contractor in the exemption certificate issuance process.

| Question | Answer |

|---|---|

| Form Name | Form Dr 0172 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | form dr 0172 colorado, contractor application for exemption certificate dr 0172, form dr 0172 instructions, dr0172 |

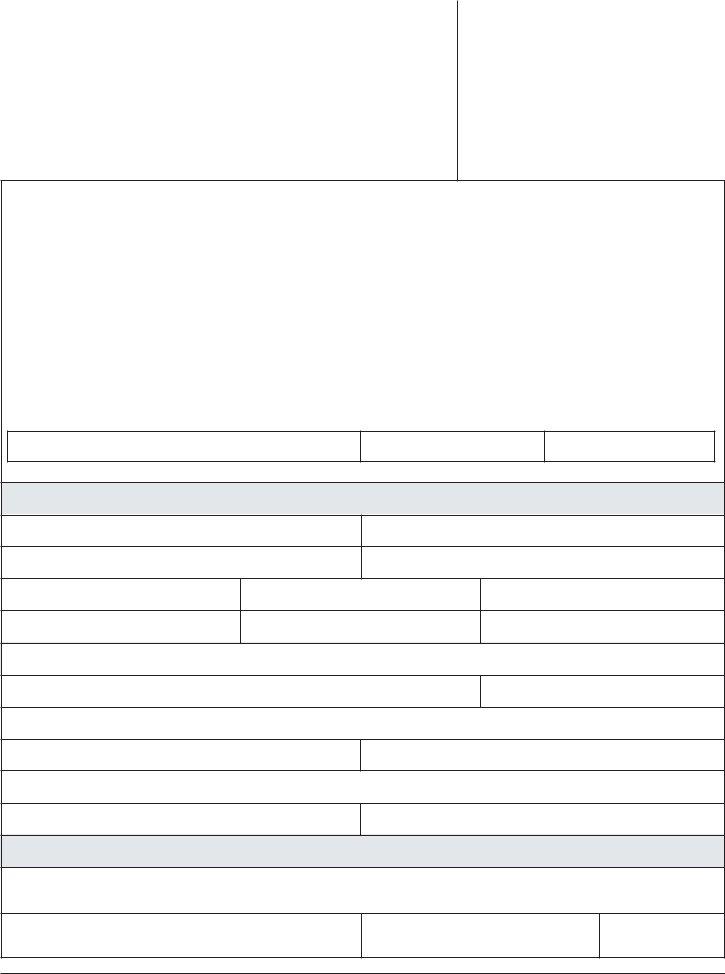

DR 0172 (10/13/05)

COLORADO DEPARTMENT OF REVENUE TAXPAYER SERVICE DIVISION DENVER CO 80261

(303)

CONTRACTOR APPLICATION FOR EXEMPTION CERTIFICATE

Pursuant to Statute

Section

Departmental Use Only

The exemption certificate for which you are applying must be used only for the purpose of purchasing construction and building materials for the exempt project described below. This exemption does not include or apply to the purchase or rental of equipment, supplies, and materials which are purchased, rented, or consumed by the contractor and which do not become a part of the structure, highway, road, street, or other public works owned and used by the exempt organization.

Any unauthorized use of the exemption certificate will result in revocation of your exemption certificate and other penalties provided by law.

A separate certificate is required for each contract.

Subcontractors will not be issued Certificates of Exemption by the Department of Revenue. It is the responsibility of the prime contractor to issue certificates to each of the subcontractors. (See reverse side.)

SEND COMPLETED FORMS TO: COLORADO DEPARTMENT OF REVENUE, DENVER, CO 80261

FAILURE TO ACCURATELY COMPLETE ALL BOXES WILL CAUSE THE APPLICATION TO BE DENIED.

Registration/Account No. (to be assigned by DOR)

89 -

Period

CONTRACTOR INFORMATION

Trade name/DBA:

Owner, partner, or corporate name:

Mailing address (City, State, Zip):

Contact Person

Fax number:

( )

Federal Employer's Identification Number: |

Bid amount for your contract: |

|

$ |

Business telephone number: |

Colorado withholding tax account number: |

( )

EXEMPTION INFORMATION |

Copies of contract or agreement pages, identifying the contracting parties, bid amount, |

|

type of work, and signatures of contracting parties MUST be attached. |

||

|

||

|

|

Name of exempt organization (as shown on contract):

Exempt organization's number:

98 -

Address of exempt organization (City, State, Zip):

Principal contact at exempt organization:Principal contact's telephone number:

Physical location of project site (give actual address when applicable and Cities and/or County (ies) where project is located)

Scheduled |

Month |

Day |

Year |

|

|

|

|

construction start date: |

|

|

|

Estimated |

Month |

Day |

Year |

|

|

|

|

completion date: |

|

|

|

I declare under penalty of perjury in the second degree that the statements made in this application are true and complete to the best of my knowledge.

Signature of owner, partner or corporate officer:

Title of corporate officer:

Date:

DO NOT WRITE BELOW THIS LINE

Special Notice

Contractors who have completed this application in the past, please note the following changes in procedure:

The Department will no longer issue individual Certificates of exemption to subcontractors. Only prime contrac- tors will receive a Contractor's Exemption Certificate on exempt projects.

Upon receipt of the Certificate, the prime contractor should make a copy for each subcontractor involved in the project and complete it by filling in the subcontractor's name and address and signing it.

The original Certificate should always be retained by the prime contractor. Copies of all Certificates that the prime contractor issued to subcontractors should be kept at the prime contractor's place of business for a minimum of three years and be available for inspection in the event of an audit.

Once an 89# has been assigned to you, please use the next five numbers following it for any applications submitted for future projects. This should be your permanent number. For instance, if you were assigned 89-