It is possible to complete tax florida thereof effortlessly in our PDFinity® online PDF tool. FormsPal development team is ceaselessly working to expand the tool and ensure it is even better for clients with its many functions. Uncover an ceaselessly progressive experience now - explore and uncover new possibilities as you go! With just a few basic steps, you'll be able to start your PDF editing:

Step 1: Just hit the "Get Form Button" above on this page to start up our pdf editor. There you will find all that is necessary to work with your document.

Step 2: With our online PDF file editor, it is possible to accomplish more than simply fill out blank form fields. Edit away and make your forms look great with custom text put in, or fine-tune the original content to perfection - all comes along with the capability to add your own graphics and sign the file off.

This form will need specific information; to guarantee consistency, don't hesitate to adhere to the recommendations hereunder:

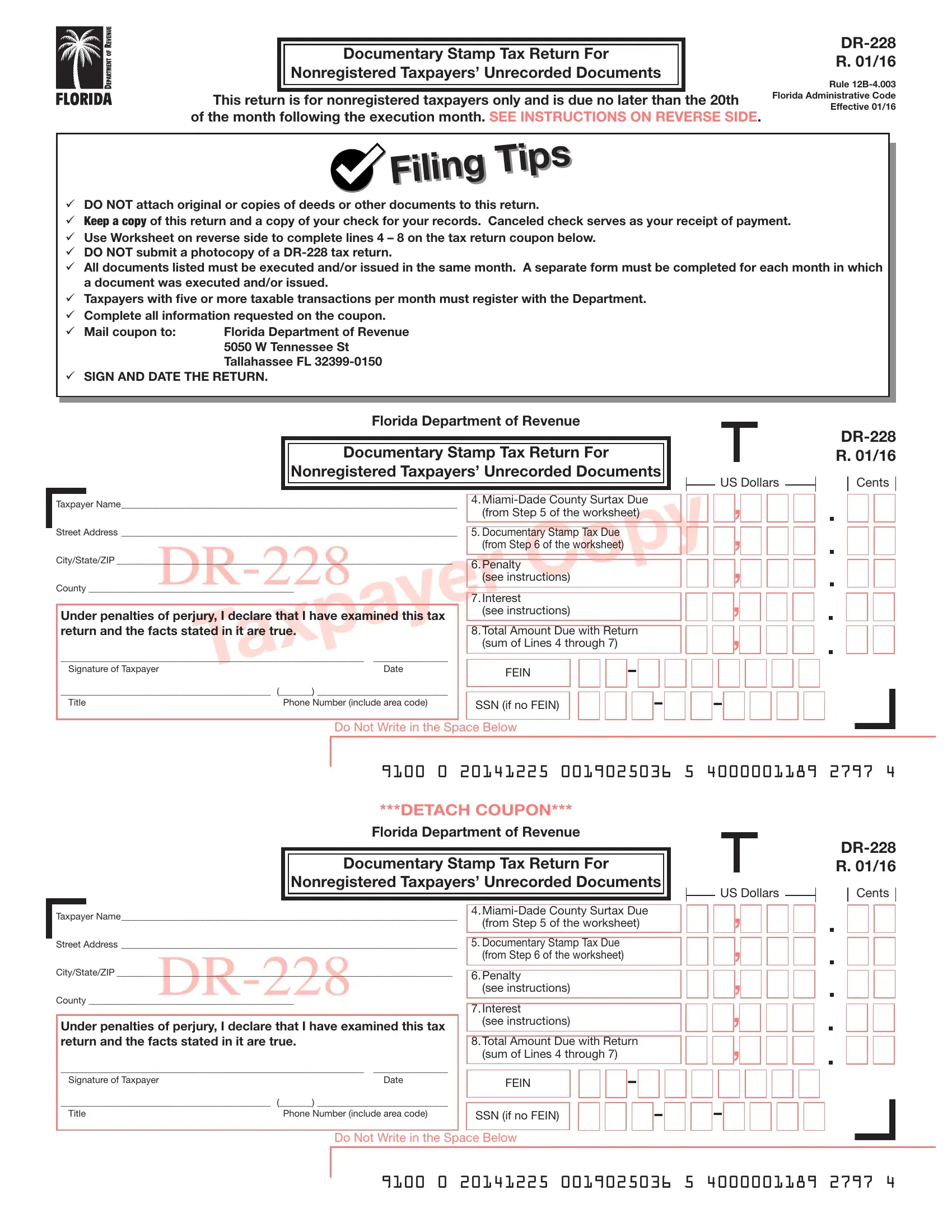

1. The tax florida thereof requires specific details to be typed in. Be sure that the next blanks are finalized:

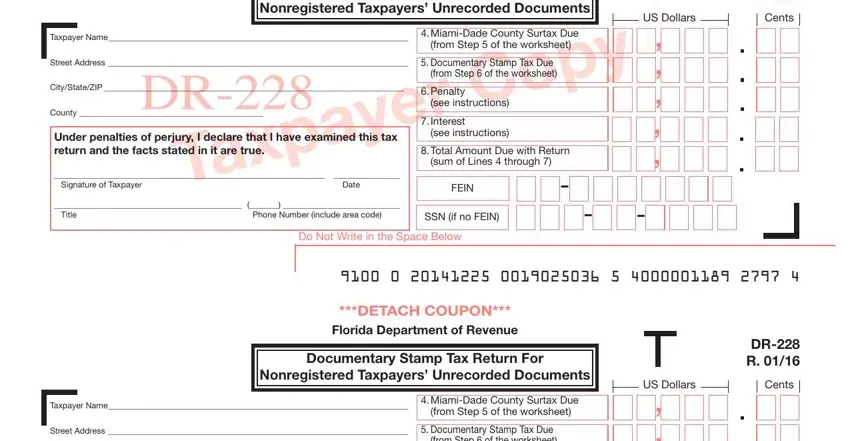

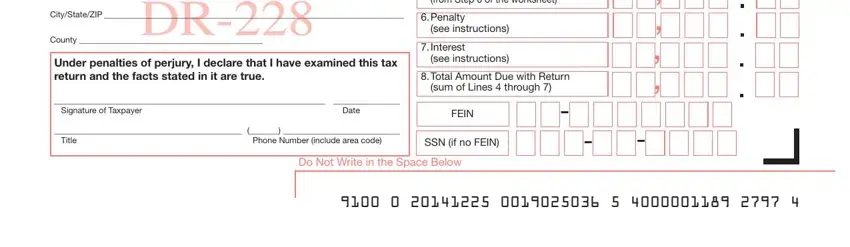

2. Right after filling out the previous step, go to the subsequent stage and fill in the necessary particulars in these fields - CityStateZIP, County, Under penalties of perjury I, Date, Title, Phone Number include area code, Documentary Stamp Tax Due from, Penalty, see instructions, Interest, see instructions, Total Amount Due with Return, sum of Lines through, FEIN, and SSN if no FEIN.

Concerning sum of Lines through and Title, ensure you don't make any errors here. Both of these could be the most significant ones in the page.

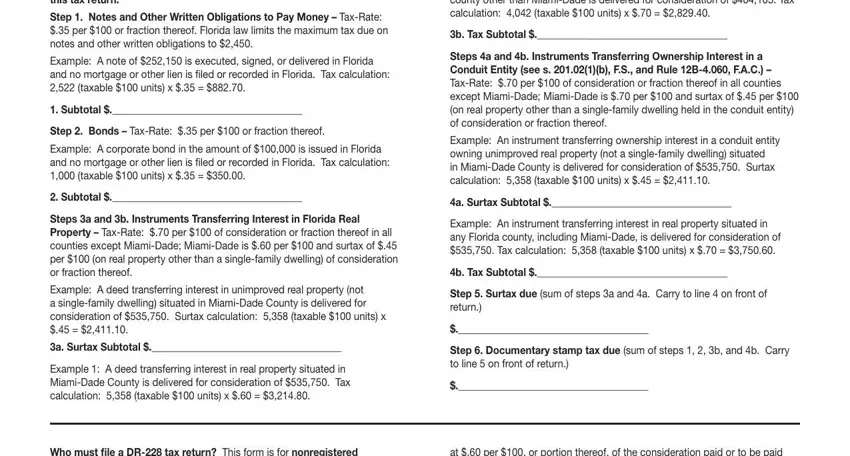

3. Completing Complete the information requested, Step Notes and Other Written, Example A note of is executed, Subtotal, Step Bonds TaxRate per or, Example A corporate bond in the, Subtotal, Steps a and b Instruments, Example A deed transferring, a Surtax Subtotal, Example A deed transferring, Who must ile a DR tax return This, Example A deed transferring, b Tax Subtotal, and Steps a and b Instruments is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Step 3: As soon as you have reviewed the information in the document, simply click "Done" to conclude your FormsPal process. Obtain your tax florida thereof when you register here for a 7-day free trial. Readily use the pdf file from your personal cabinet, together with any edits and adjustments being conveniently saved! FormsPal is devoted to the confidentiality of our users; we ensure that all information going through our editor is protected.