Navigating the complexities of tax forms can often feel like trying to decipher an ancient script. Among the myriad forms that taxpayers might encounter, the DR 1316 stands out for those in Colorado. Issued by the Colorado Department of Revenue, this form is a crucial document for taxpayers aiming to claim capital gains deductions on their state income tax returns. Essentially, it serves as a Colorado Source Capital Gain Affidavit, requiring detailed documentation of each asset that qualifies for capital gains treatment, including those resulting in a loss. Taxpayers must fill it out completely and accurately to sidestep any requests for additional information or delays in processing their refunds. This involves providing an exhaustive description of the capital gains, supplementing with federal schedules or detailed explanations as necessary, and indicating the nature of these gains—whether from real estate, installment sales, the sale of stock, or gains passed through from another entity. Additionally, the form necessitates information on the sale of assets like a sole proprietorship or business interests, underscoring the requirement that each asset meets specific criteria to qualify for the deduction. The form culminates in a certification that the taxpayer holds no overdue state tax liabilities or defaults on contractual obligations to the state or any local government within Colorado, underscoring the importance of fulfilling civic duties before benefiting from state tax deductions. Completing this form not only demands meticulous attention to detail but also an understanding of applicable state tax laws, making it an indispensable part of a taxpayer’s toolkit for managing Colorado source capital gains and navigating state tax obligations effectively.

| Question | Answer |

|---|---|

| Form Name | Dr 1316 Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | instructions for dr 1316, colorado source capital gain, 1316 dunboren dr, form dr 1316 |

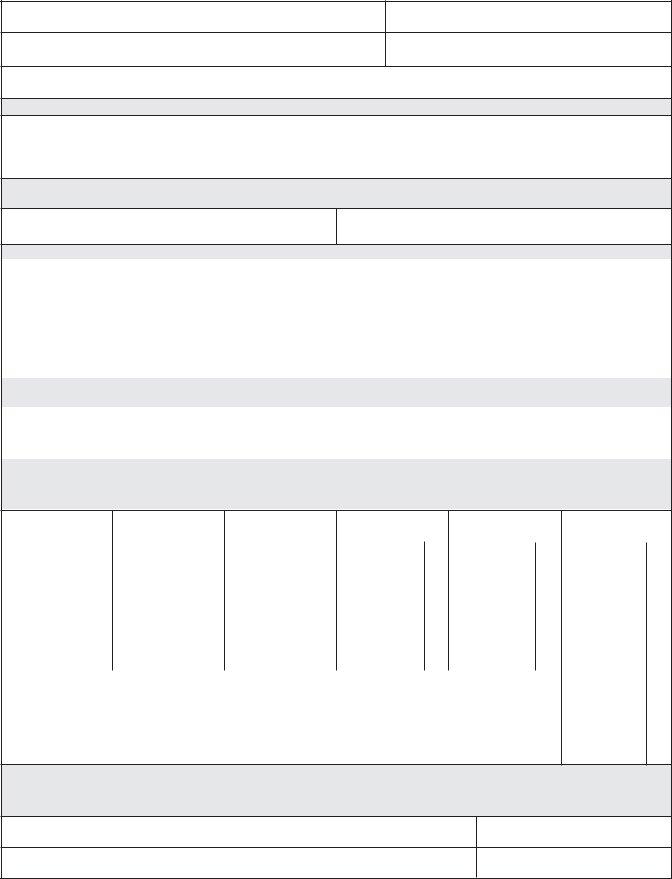

DR 1316 (08/09/06)

COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261

WWW.TAXCOLORADO.COM |

COLORADO SOURCE CAPITAL GAIN AFFIDAVIT |

This form must be completely and accurately filled out to avoid requests for additional information and/or delays in processing your refund.

Taxpayer Name

Social Security Number or Colorado Account Number

Spouse Name (if applicable)

Social Security Number

Provide the following information for each asset that qualifies under the requirements of the Colorado capital gain subtraction. Include any assets that resulted in a capital loss. Attach federal schedules and/or detailed explanation if needed. Attach additional sheets if needed.

A. Provide a brief description of the nature of the capital gain(s). Include complete address of real property.

1__________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________

2__________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________

B. If the gain is due to an installment sale, give the date of the original sale and attach a copy of Federal Form 6252 to this form.

Note: If the sale was prior to 1999, it does not qualify for the capital gain subtraction.

1 ___________________________________________________________

2 ___________________________________________________________

C. If the gain is due to the sale of stock, list the qualifying property and payroll factors of the corporation for five consecutive years.

|

|

1 |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

Year |

Year |

|

Year |

|

Year |

|

Year |

|

Year |

Year |

|

Year |

|

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property |

Property |

Property |

|

Property |

|

Property |

|

Property |

|

Property |

Property |

|

Property |

|

Property |

% |

% |

|

% |

|

% |

|

% |

|

% |

% |

|

% |

|

% |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payroll |

Payroll |

Payroll |

|

Payroll |

|

Payroll |

|

Payroll |

|

Payroll |

Payroll |

|

Payroll |

|

Payroll |

% |

% |

|

% |

|

% |

|

% |

|

% |

% |

|

% |

|

% |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. If the gain is being

time the taxpayer had ownership interest in the entity.

1 |

Entity |

|

2 |

Entity |

|

|

|

|

|

||

|

|

|

|

|

|

Account Number |

Ownership Interest (length of time) |

Account Number |

Ownership Interest (length of time) |

||

|

|

|

|

|

|

E. Additional Information (must be completed)

Note: When the sale of a sole proprietorship or business interest is treated as a sale of assets on the federal return,

you must report the assets sold on this form (attach additional pages if necessary). Each asset must meet the

capital gain subtraction requirements to qualify. Intangibles such as goodwill do not qualify.

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

Property |

Date Acquired (mo., day, yr.) |

Date Sold (mo., day, yr.) |

Sale Price |

Cost or other basis |

Gain or loss |

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

.00 |

.00 |

.00 |

|

|

|

|

|

|

2. |

|

|

|

|

|

.00 |

.00 |

.00 |

|

|

|

|

|

|

3. |

Total Gain or (Loss) |

|

.00 |

|

|

|

||

|

|

|

|

|

|

4. |

Net Capital Gain or (Loss) as reported on Federal Form 1040 or 1040A |

|

.00 |

|

|

|

||

|

|

|

|

|

|

5. |

Colorado Source Capital Gain Subtraction, enter lesser of lines 3 or 4. Enter here and on Form 104. |

|

.00 |

|

|

|

Qualifying Colorado Source Capital Gains and Losses

I attest that the taxpayer(s) shown above has no overdue state tax liabilities and is not in default on any contractual obligations owed to the state or to any local government within Colorado at the time the attached income tax return is being filed. Under penalties of perjury, I declare that to the best of my knowledge and belief, this affidavit is true, correct and complete.

Signature, Taxpayer or Duly Authorized Individual

Date

Spouse Signature (if joint return, both must sign)

Date

INCLUDE A COPY OF FEDERAL SCHEDULE D AND/OR FORM 4797 WITH THIS FORM.