florida dor form dr 26s can be completed online very easily. Just make use of FormsPal PDF editor to do the job fast. To have our editor on the leading edge of convenience, we aim to adopt user-oriented features and improvements regularly. We are routinely grateful for any suggestions - play a pivotal role in revampimg the way you work with PDF files. For anyone who is seeking to begin, here's what it requires:

Step 1: Press the "Get Form" button in the top section of this webpage to access our tool.

Step 2: Using this advanced PDF editing tool, you could accomplish more than just complete forms. Edit away and make your documents seem great with custom textual content added in, or modify the file's original input to perfection - all that accompanied by an ability to insert any type of photos and sign the file off.

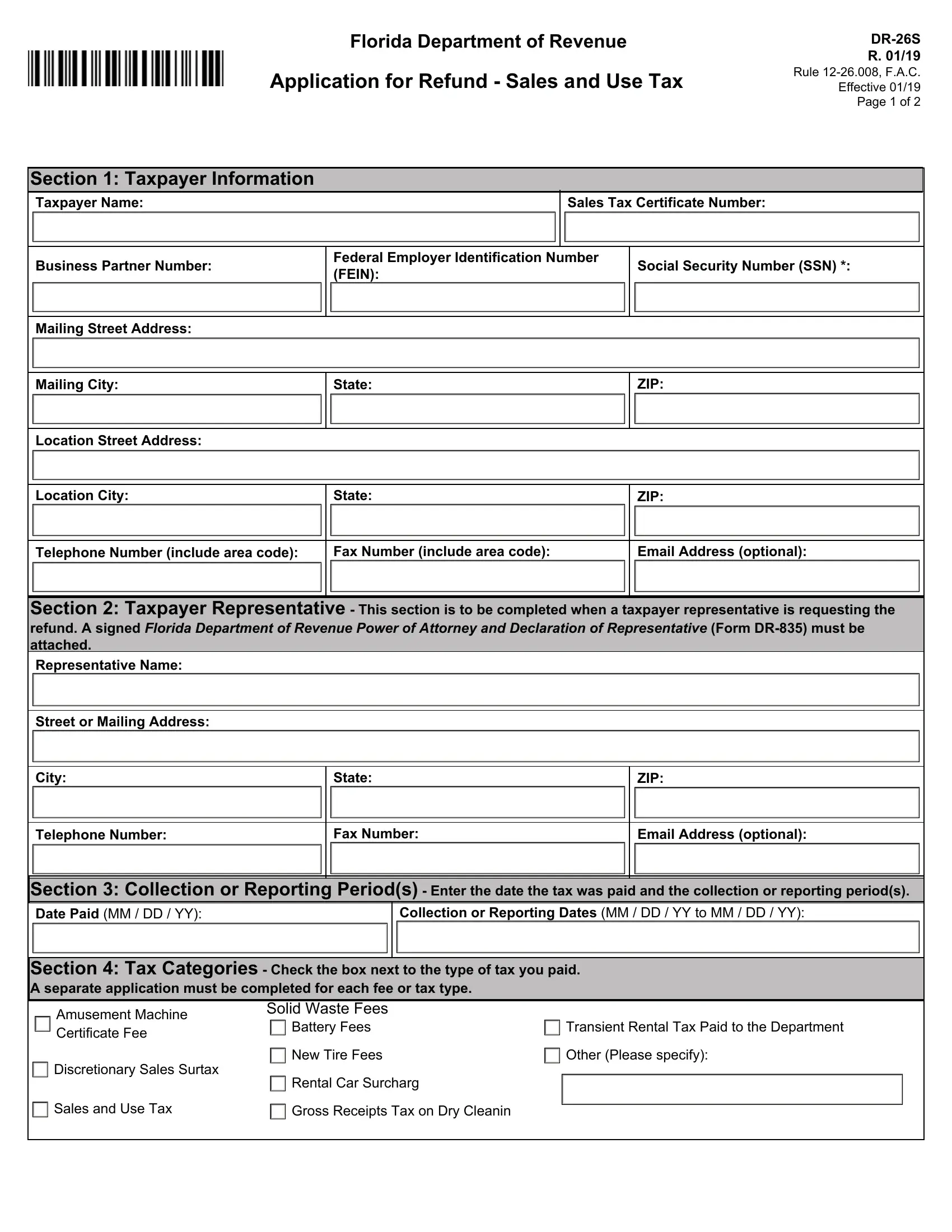

This document will need some specific details; in order to guarantee accuracy and reliability, please be sure to take heed of the next tips:

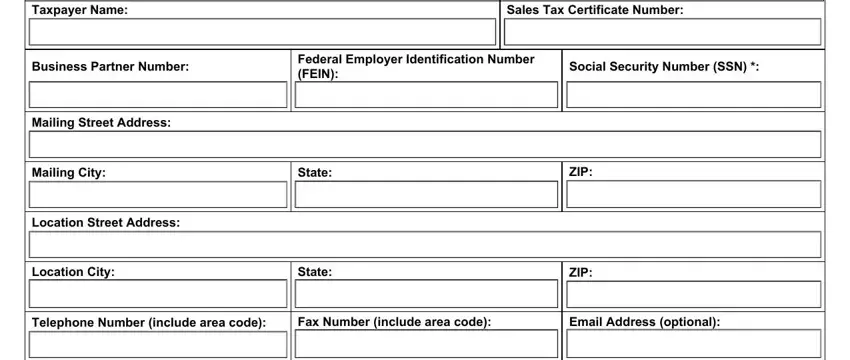

1. Complete your florida dor form dr 26s with a number of necessary blank fields. Get all of the necessary information and ensure nothing is missed!

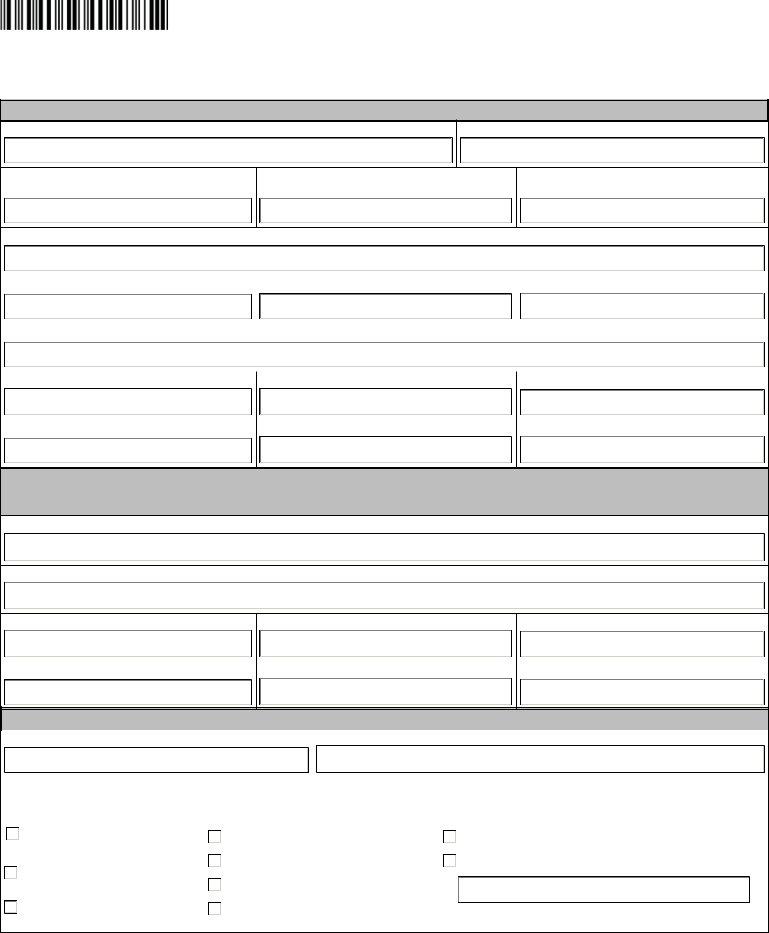

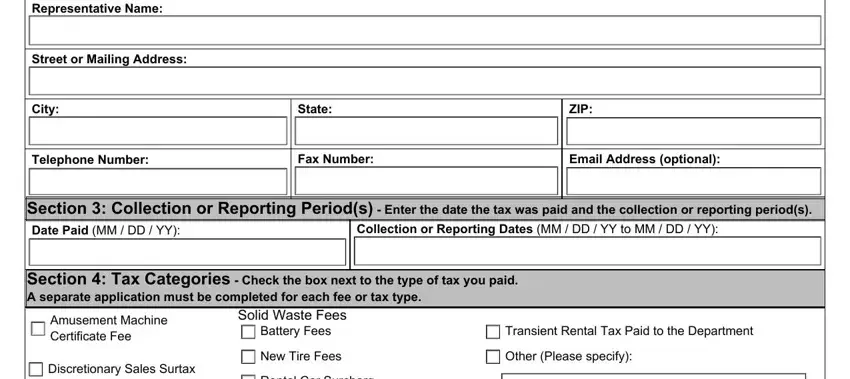

2. Soon after filling in the previous section, go on to the next stage and fill out the necessary particulars in these blank fields - Section Taxpayer Representative, Street or Mailing Address, City, State, ZIP, Telephone Number, Fax Number, Email Address optional, Section Collection or Reporting, Collection or Reporting Dates MM, Section Tax Categories Check the, Amusement Machine Certificate Fee, Discretionary Sales Surtax, Solid Waste Fees, and Battery Fees New Tire Fees Rental.

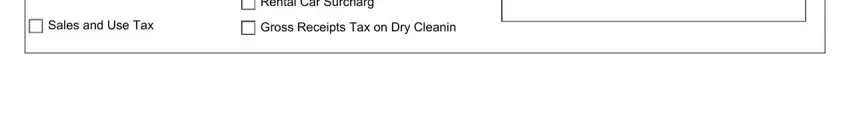

3. This next step is pretty straightforward, Sales and Use Tax, and Battery Fees New Tire Fees Rental - each one of these blanks needs to be filled out here.

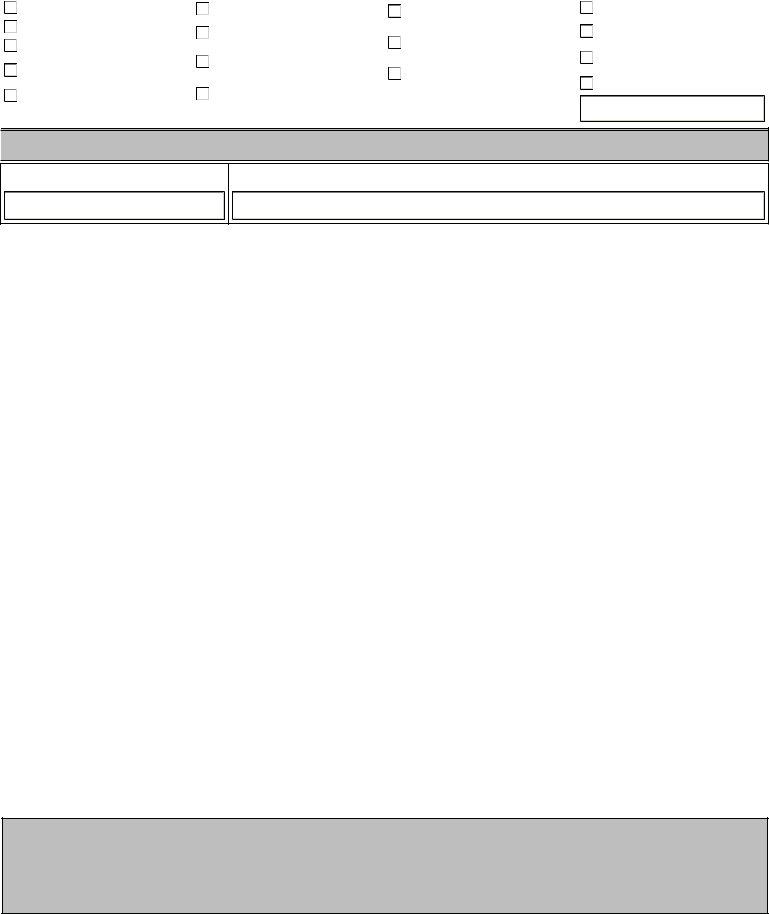

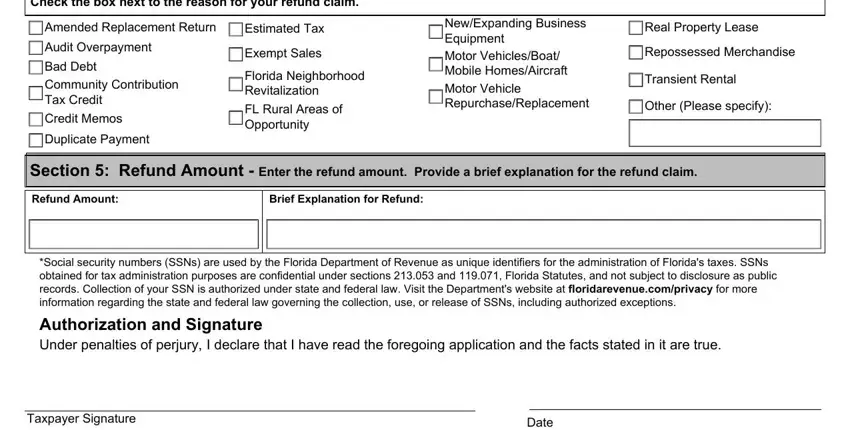

4. Filling in Check the box next to the reason, Amended Replacement Return Audit, Estimated Tax Exempt Sales Florida, NewExpanding Business Equipment, Real Property Lease Repossessed, Transient Rental, Other Please specify, Section Refund Amount Enter the, Brief Explanation for Refund, Social security numbers SSNs are, Taxpayer Signature, and Date is vital in this next form section - you'll want to don't rush and be attentive with each blank area!

As to Taxpayer Signature and Check the box next to the reason, be certain you get them right in this section. Both of these are the most significant ones in this page.

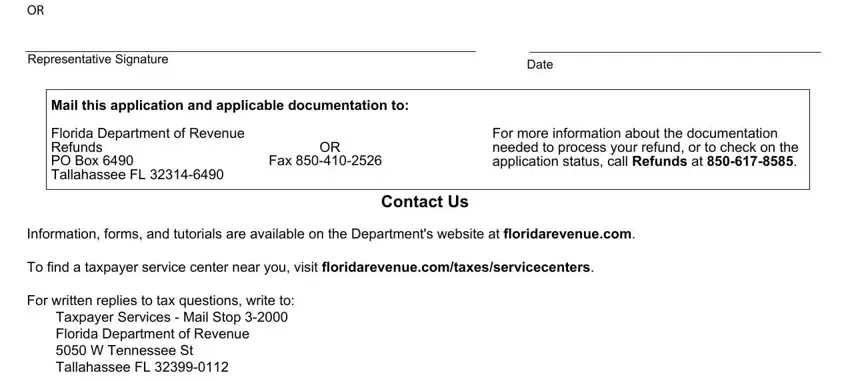

5. This document must be completed with this area. Here you have an extensive list of blanks that require accurate details to allow your form usage to be faultless: Representative Signature, Date, Mail this application and, For more information about the, Contact Us, Information forms and tutorials, and Subscribe to Receive Updates by.

Step 3: As soon as you have reviewed the information in the blanks, click "Done" to complete your document generation. Join us right now and immediately access florida dor form dr 26s, prepared for downloading. All modifications made by you are kept , allowing you to change the pdf later as needed. Here at FormsPal.com, we endeavor to make sure that all of your information is maintained protected.