The DR-350111 form stands as a meticulous document purposed for the self-audit of intangible taxes, primarily beneficial for taxpayers within Florida. By covering a comprehensive spectrum of intangible assets such as bonds, stocks, mutual funds, loans, and trusts, the form facilitates taxpayers in accurately evaluating their tax liabilities. The form is methodically divided into several sections, each designed for the detailed enumeration and valuation of different categories of intangible assets. Taxpayers and their spouses are required to provide personal details including names and Social Security Numbers (SSNs) alongside the precise financial data of their intangible properties. Importantly, it states clear directives for calculating tax due, including exemptions and adjustments based on the asset's total value, thereby streamlining the intricate process of tax calculation. Additionally, it includes provisions for calculating interest on overdue taxes, ensuring that taxpayers can account for any additional charges stemming from delayed payments. The form underscores the state's requirement for filing tax returns and emphasizes the conditions under which individuals are mandated to complete this obligation. Moreover, it elucidates the criteria for exemptions, significantly aiding taxpayers in understanding which assets might be exempt from taxation. Detailed instructions accompany every segment to aid in accurate completion, ensuring taxpayers can self-audit and determine their tax responsibilities effectively. This form is a crucial tool for those seeking to comply with Florida's tax regulations, providing a structured approach to declaring intangible assets and calculating subsequent tax liabilities.

| Question | Answer |

|---|---|

| Form Name | Form Dr 350111 |

| Form Length | 8 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min |

| Other names | Intangible Tax Self Audit Worksheet tax audit worksheets form |

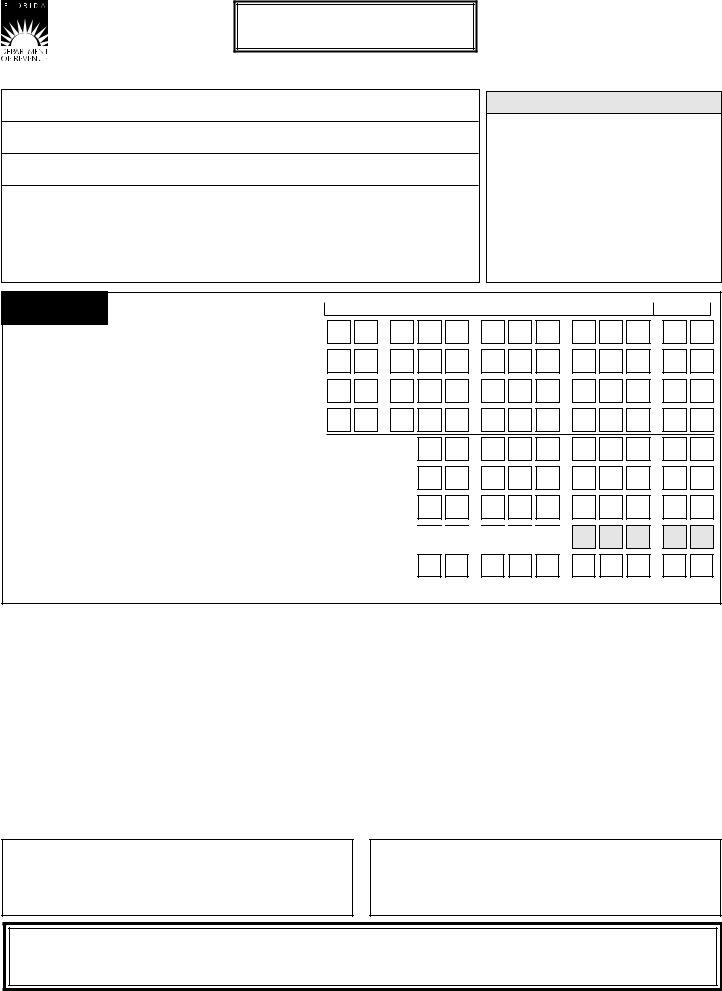

Intangible Tax

R.06/07 Page 1 of 8

Name of taxpayer

Name of spouse

Address

City, State, ZIP

Taxpayer SSN |

Spouse SSN |

|

|

DR/SATS NO

|

FOR DEPARTMENT USE ONLY |

DOC: 21 |

TAX: 03 |

SCHEDULE A

DOLLARS

CENTS

1. |

Bonds (from Schedule B, Line 9) |

1. |

2. |

Stocks, mutual funds, money market funds and |

|

|

limited partnership interest (from Schedule C, Line 10) |

2. |

3. |

Loans, notes and accounts receivable |

|

|

(from Schedule D, Line 11) |

3. |

4. |

Beneicial interest in any trust (from Schedule E, Line 12) |

4. |

,

,

,

,

,

,

,

,

,

,

,

,

.

.

.

.

5. |

Total taxable assets (total of Lines 1 through 4) |

5. |

|

|

|

, |

|

6. |

Tax due (from Tax Calculation Worksheet, Page 2, Line 6E) |

6. |

|||||

7. |

Interest |

|

|

|

|

|

|

|

(from Interest Calculation Worksheet, Page 4, Line 13) |

7. |

|||||

8. |

Penalty (not applicable) |

8. |

|||||

9. |

Total due (Line 6 + Line 7) |

9. |

|||||

,

,

,

,

,

,

,

,

,

,

0

0

0

.

.

.

.

.

0

0

FOR YEARS 1999 AND AFTER, IF YOUR TAX DUE IS LESS THAN $60.00,

YOU ARE NOT REQUIRED TO PAY THE TAX DUE.

You may reproduce this

______________________________________ |

_____________________________________ |

______________________________________ |

Taxpayer signature |

Spouse signature |

Telephone number |

______________________________________ |

_____________________________________ |

______________________________________ |

Date |

Individual or irm preparing the worksheet |

Telephone number |

THIS WORKSHEET MUST BE RETURNED

TO CLEAR YOUR ACCOUNT.

YOUR RESPONSE IS REQUIRED WITHIN 30 DAYS.

Make checks

payable to: Florida Department of Revenue

Mail to: TALLAhASSEE CENTRAL SERvICE CENTER P.O. BOX 6417

TALLAhASSEE, FL

Neither foreign currency nor funds drawn on other than U.S. banks will be accepted. Florida law requires a service fee for returned checks or drafts of fifteen ($15.00) dollars or five (5%) percent of the face amount, whichever is greater, not to exceed $150.00 (s. 215.34(2), F.S.)

www.mylorida.com/dor

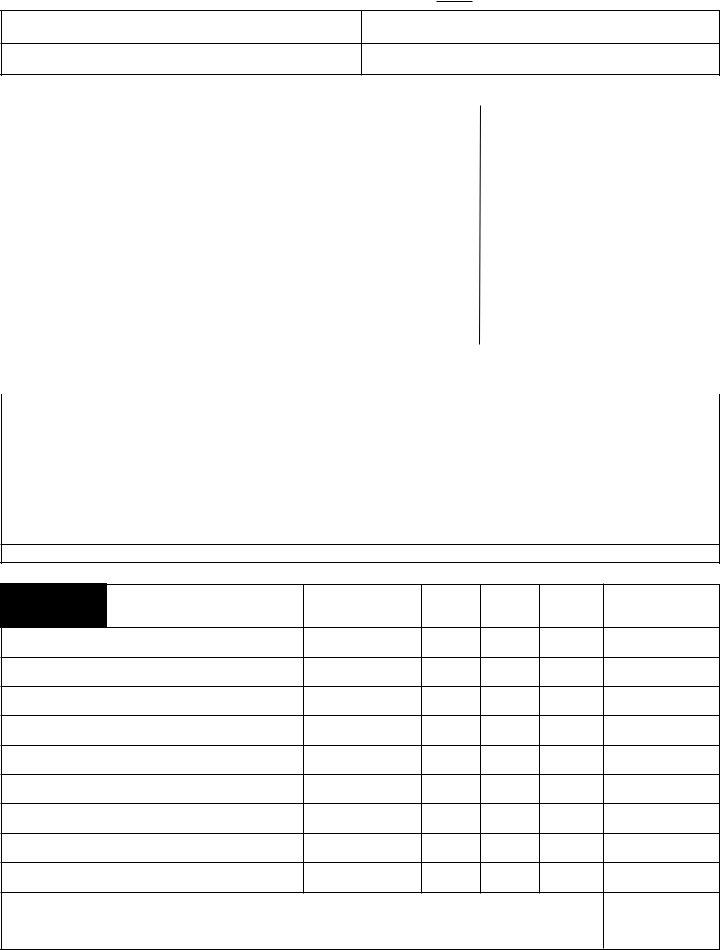

Intangible Tax

R.06/07 Page 2 of 8

Name of taxpayer:

Social security number:

Name of spouse:

Social security number:

TAX CALCULATION WORKSHEET |

|

|

|

|

|

|

[Complete only one (1) column below] |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Filing status |

|

|

Step 1 |

|

|

|

|

INDIVIDUAL |

|

|

JOINT |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If your taxable assets from |

|

|

BOX A |

|

|

|

BOX B |

|

BOX C |

|

BOX D |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Schedule A, Line 5 are: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

$100,000 or less |

Greater than $100,000 |

$200,000 or less |

Greater than $200,000 |

||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

6A. |

Taxable assets |

|

Step 2 |

|

$________________ |

|

$________________ |

$________________ |

$________________ |

||||||||||||

|

(Schedule A, Line 5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6B. |

Times tax rate |

|

|

|

|

|

X______ |

|

|

|

X______ |

|

X______ |

|

X______ |

||||||

|

|

|

|

Step 3 |

|

|

|

|

|

|

|

|

|

|

|

||||||

6C. |

Gross tax |

|

|

$________________ |

|

$________________ |

$________________ |

$________________ |

|||||||||||||

|

(Multiply Line 6A x Line 6B) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6D. |

Less exemption |

|

|

|

|

|

– $______ |

|

|

|

– $______ |

|

– $______ |

|

– $______ |

||||||

|

|

|

|

|

Step 4 |

|

|

|

|

|

|

|

|

|

|

|

|||||

6E. |

Net tax |

|

|

|

$________________ |

|

$________________ |

$________________ |

$________________ |

||||||||||||

|

(subtract Line 6D from Line 6C.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

If less than zero, enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

CARRY TOTAL TAX DUE TO SCHEDULE A, LINE 6, PAGE 1 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

TAX RATES AND EXEMPTION SCHEDULE |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INDIvIDUAL |

|

|

|

|

|

|

|

|

|

|

JOINT |

|

|

|

||

|

|

|

Assets $ 100,000 or Less |

Assets Greater than $ 100,000 |

Assets $ 200,000 or Less |

Assets Greater than $ 200,000 |

|||||||||||||||

TAX YEAR |

|

RATE |

EXEMPTION |

|

RATE |

|

EXEMPTION |

|

RATE |

|

EXEMPTION |

RATE |

|

EXEMPTION |

|||||||

|

.001 |

$ |

20.00 |

|

.0010 |

|

$ |

20.00 |

|

|

.001 |

|

$ |

40.00 |

.0010 |

|

$ |

40.00 |

|||

|

.001 |

$ |

20.00 |

|

.0015 |

|

$ |

70.00 |

|

|

.001 |

|

$ |

40.00 |

.0015 |

|

$ |

140.00 |

|||

|

.001 |

$ |

20.00 |

|

.0020 |

|

$ |

120.00 |

|

|

.001 |

|

$ |

40.00 |

.0020 |

|

$ |

240.00 |

|||

2000 |

|

.001 |

$ |

20.00 |

|

.0015 |

|

$ |

70.00 |

|

|

.001 |

|

$ |

40.00 |

.0015 |

|

$ |

140.00 |

||

|

.001 |

$ |

20.00 |

|

.0010 |

|

$ |

20.00 |

|

|

.001 |

|

$ |

40.00 |

.0010 |

|

$ |

40.00 |

|||

|

|

|

|

INDIvIDUAL - assets any amount |

|

|

|

|

|

JOINT - Assets any amount |

|

||||||||||

|

|

|

|

|

.0010 |

|

$ |

250.00 |

|

|

|

|

|

|

.0010 |

|

$ |

500.00 |

|||

2006 |

|

|

|

|

|

.0005 |

|

$ |

125.00 |

|

|

|

|

|

|

.0005 |

|

$ |

250.00 |

||

ENTER APPROPRIATE RATE AND EXEMPTION IN ShADED AREAS IN ThE TAX CALCULATION WORKShEET ABOvE

|

BONDS |

SCHEDULE B |

Name of issuer, series |

List alphabetically, one bond per line

Face Value |

Interest |

Per Bond |

Rate |

(A) |

(B) |

|

|

Maturity

Date

(C)

Number Per $100.00

Owned Value

(D)(E)

Total Taxable

Amount January 1, _____

9.TOTAL BONDS

Attach additional schedule if necessary. Photocopies of this schedule are acceptable.

CARRY THIS AMOUNT TO SCHEDULE A, LINE 1, PAGE 1 |

9. |

www.mylorida.com/dor

Intangible Tax

R.06/07 Page 3 0f 8

Name of taxpayer: |

Social security number: |

|

|

Name of spouse: |

Social security number: |

|

|

SCHEDULE C |

STOCKS, MUTUAL FUNDS, MONEY MARKET FUNDS |

|

|

Stock Code |

|||||||

|

AND LIMITED PARTNERSHIP INTERESTS |

|

|

Do not write |

|||||||

|

|

|

|

in this space |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class |

Number |

|

Just Value |

|

Total |

|

||

Name of Company Issuing Stocks |

|

Common |

of |

|

Per |

|

Just Value |

Verified |

|||

(List alphabetically - do not abbreviate) |

|

or |

Shares |

|

Share |

|

January 1, _____ |

By |

|||

|

|

|

Preferred |

(A) |

|

(B) |

|

(A x B) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. TOTAL VALUE OF STOCKS |

|

|

|

|

|

|

|

|

|

|

|

Attach additional schedule if necessary. Photocopies of this schedule are acceptable. |

|

|

|

|

|

|

|||||

CARRY THIS AMOUNT TO SCHEDULE A, LINE 2, PAGE 1 |

|

|

10. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

www.mylorida.com/dor