The DR-350111 form stands as a meticulous document purposed for the self-audit of intangible taxes, primarily beneficial for taxpayers within Florida. By covering a comprehensive spectrum of intangible assets such as bonds, stocks, mutual funds, loans, and trusts, the form facilitates taxpayers in accurately evaluating their tax liabilities. The form is methodically divided into several sections, each designed for the detailed enumeration and valuation of different categories of intangible assets. Taxpayers and their spouses are required to provide personal details including names and Social Security Numbers (SSNs) alongside the precise financial data of their intangible properties. Importantly, it states clear directives for calculating tax due, including exemptions and adjustments based on the asset's total value, thereby streamlining the intricate process of tax calculation. Additionally, it includes provisions for calculating interest on overdue taxes, ensuring that taxpayers can account for any additional charges stemming from delayed payments. The form underscores the state's requirement for filing tax returns and emphasizes the conditions under which individuals are mandated to complete this obligation. Moreover, it elucidates the criteria for exemptions, significantly aiding taxpayers in understanding which assets might be exempt from taxation. Detailed instructions accompany every segment to aid in accurate completion, ensuring taxpayers can self-audit and determine their tax responsibilities effectively. This form is a crucial tool for those seeking to comply with Florida's tax regulations, providing a structured approach to declaring intangible assets and calculating subsequent tax liabilities.

| Question | Answer |

|---|---|

| Form Name | Form Dr 350111 |

| Form Length | 8 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min |

| Other names | Intangible Tax Self Audit Worksheet tax audit worksheets form |

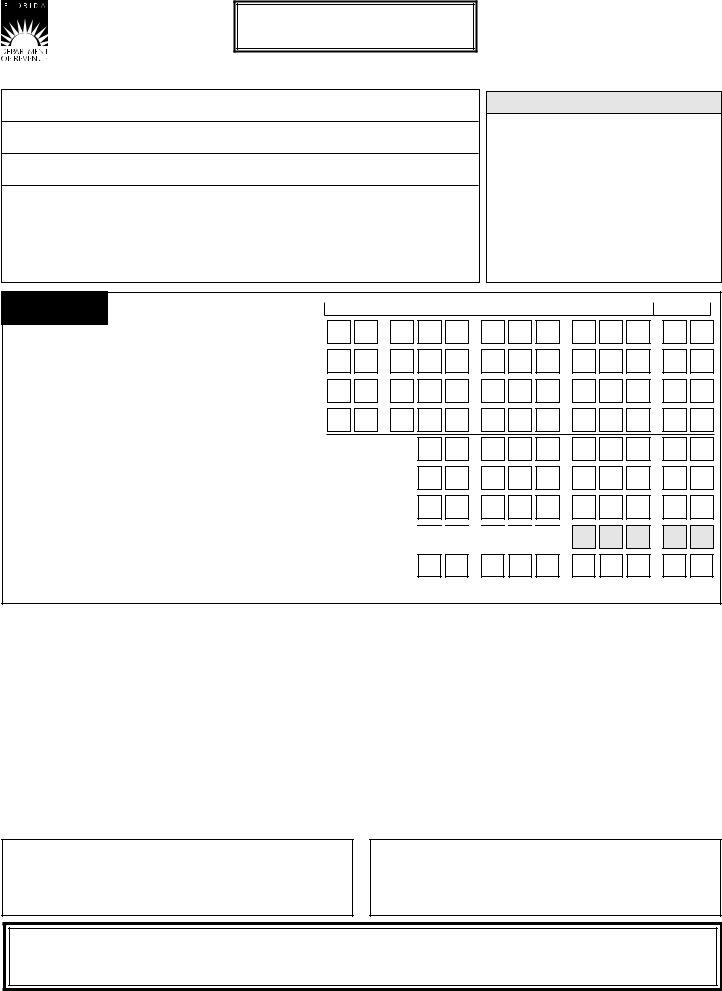

Intangible Tax

R.06/07 Page 1 of 8

Name of taxpayer

Name of spouse

Address

City, State, ZIP

Taxpayer SSN |

Spouse SSN |

|

|

DR/SATS NO

|

FOR DEPARTMENT USE ONLY |

DOC: 21 |

TAX: 03 |

SCHEDULE A

DOLLARS

CENTS

1. |

Bonds (from Schedule B, Line 9) |

1. |

2. |

Stocks, mutual funds, money market funds and |

|

|

limited partnership interest (from Schedule C, Line 10) |

2. |

3. |

Loans, notes and accounts receivable |

|

|

(from Schedule D, Line 11) |

3. |

4. |

Beneicial interest in any trust (from Schedule E, Line 12) |

4. |

,

,

,

,

,

,

,

,

,

,

,

,

.

.

.

.

5. |

Total taxable assets (total of Lines 1 through 4) |

5. |

|

|

|

, |

|

6. |

Tax due (from Tax Calculation Worksheet, Page 2, Line 6E) |

6. |

|||||

7. |

Interest |

|

|

|

|

|

|

|

(from Interest Calculation Worksheet, Page 4, Line 13) |

7. |

|||||

8. |

Penalty (not applicable) |

8. |

|||||

9. |

Total due (Line 6 + Line 7) |

9. |

|||||

,

,

,

,

,

,

,

,

,

,

0

0

0

.

.

.

.

.

0

0

FOR YEARS 1999 AND AFTER, IF YOUR TAX DUE IS LESS THAN $60.00,

YOU ARE NOT REQUIRED TO PAY THE TAX DUE.

You may reproduce this

______________________________________ |

_____________________________________ |

______________________________________ |

Taxpayer signature |

Spouse signature |

Telephone number |

______________________________________ |

_____________________________________ |

______________________________________ |

Date |

Individual or irm preparing the worksheet |

Telephone number |

THIS WORKSHEET MUST BE RETURNED

TO CLEAR YOUR ACCOUNT.

YOUR RESPONSE IS REQUIRED WITHIN 30 DAYS.

Make checks

payable to: Florida Department of Revenue

Mail to: TALLAhASSEE CENTRAL SERvICE CENTER P.O. BOX 6417

TALLAhASSEE, FL

Neither foreign currency nor funds drawn on other than U.S. banks will be accepted. Florida law requires a service fee for returned checks or drafts of fifteen ($15.00) dollars or five (5%) percent of the face amount, whichever is greater, not to exceed $150.00 (s. 215.34(2), F.S.)

www.mylorida.com/dor

Intangible Tax

R.06/07 Page 2 of 8

Name of taxpayer:

Social security number:

Name of spouse:

Social security number:

TAX CALCULATION WORKSHEET |

|

|

|

|

|

|

[Complete only one (1) column below] |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Filing status |

|

|

Step 1 |

|

|

|

|

INDIVIDUAL |

|

|

JOINT |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If your taxable assets from |

|

|

BOX A |

|

|

|

BOX B |

|

BOX C |

|

BOX D |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Schedule A, Line 5 are: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

$100,000 or less |

Greater than $100,000 |

$200,000 or less |

Greater than $200,000 |

||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

6A. |

Taxable assets |

|

Step 2 |

|

$________________ |

|

$________________ |

$________________ |

$________________ |

||||||||||||

|

(Schedule A, Line 5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6B. |

Times tax rate |

|

|

|

|

|

X______ |

|

|

|

X______ |

|

X______ |

|

X______ |

||||||

|

|

|

|

Step 3 |

|

|

|

|

|

|

|

|

|

|

|

||||||

6C. |

Gross tax |

|

|

$________________ |

|

$________________ |

$________________ |

$________________ |

|||||||||||||

|

(Multiply Line 6A x Line 6B) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6D. |

Less exemption |

|

|

|

|

|

– $______ |

|

|

|

– $______ |

|

– $______ |

|

– $______ |

||||||

|

|

|

|

|

Step 4 |

|

|

|

|

|

|

|

|

|

|

|

|||||

6E. |

Net tax |

|

|

|

$________________ |

|

$________________ |

$________________ |

$________________ |

||||||||||||

|

(subtract Line 6D from Line 6C.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

If less than zero, enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

CARRY TOTAL TAX DUE TO SCHEDULE A, LINE 6, PAGE 1 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

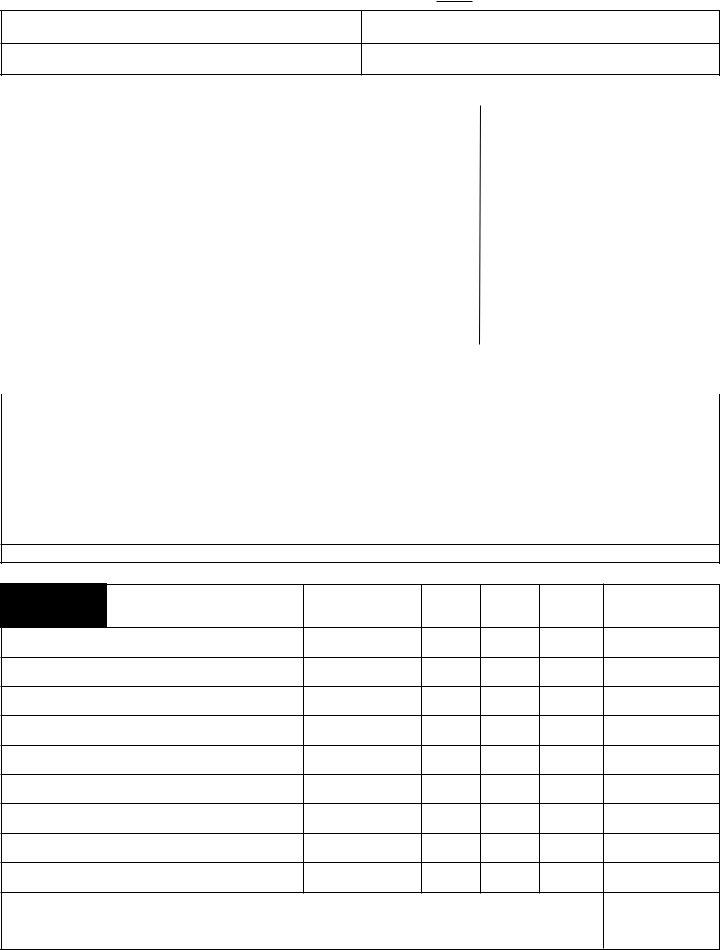

TAX RATES AND EXEMPTION SCHEDULE |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INDIvIDUAL |

|

|

|

|

|

|

|

|

|

|

JOINT |

|

|

|

||

|

|

|

Assets $ 100,000 or Less |

Assets Greater than $ 100,000 |

Assets $ 200,000 or Less |

Assets Greater than $ 200,000 |

|||||||||||||||

TAX YEAR |

|

RATE |

EXEMPTION |

|

RATE |

|

EXEMPTION |

|

RATE |

|

EXEMPTION |

RATE |

|

EXEMPTION |

|||||||

|

.001 |

$ |

20.00 |

|

.0010 |

|

$ |

20.00 |

|

|

.001 |

|

$ |

40.00 |

.0010 |

|

$ |

40.00 |

|||

|

.001 |

$ |

20.00 |

|

.0015 |

|

$ |

70.00 |

|

|

.001 |

|

$ |

40.00 |

.0015 |

|

$ |

140.00 |

|||

|

.001 |

$ |

20.00 |

|

.0020 |

|

$ |

120.00 |

|

|

.001 |

|

$ |

40.00 |

.0020 |

|

$ |

240.00 |

|||

2000 |

|

.001 |

$ |

20.00 |

|

.0015 |

|

$ |

70.00 |

|

|

.001 |

|

$ |

40.00 |

.0015 |

|

$ |

140.00 |

||

|

.001 |

$ |

20.00 |

|

.0010 |

|

$ |

20.00 |

|

|

.001 |

|

$ |

40.00 |

.0010 |

|

$ |

40.00 |

|||

|

|

|

|

INDIvIDUAL - assets any amount |

|

|

|

|

|

JOINT - Assets any amount |

|

||||||||||

|

|

|

|

|

.0010 |

|

$ |

250.00 |

|

|

|

|

|

|

.0010 |

|

$ |

500.00 |

|||

2006 |

|

|

|

|

|

.0005 |

|

$ |

125.00 |

|

|

|

|

|

|

.0005 |

|

$ |

250.00 |

||

ENTER APPROPRIATE RATE AND EXEMPTION IN ShADED AREAS IN ThE TAX CALCULATION WORKShEET ABOvE

|

BONDS |

SCHEDULE B |

Name of issuer, series |

List alphabetically, one bond per line

Face Value |

Interest |

Per Bond |

Rate |

(A) |

(B) |

|

|

Maturity

Date

(C)

Number Per $100.00

Owned Value

(D)(E)

Total Taxable

Amount January 1, _____

9.TOTAL BONDS

Attach additional schedule if necessary. Photocopies of this schedule are acceptable.

CARRY THIS AMOUNT TO SCHEDULE A, LINE 1, PAGE 1 |

9. |

www.mylorida.com/dor

Intangible Tax

R.06/07 Page 3 0f 8

Name of taxpayer: |

Social security number: |

|

|

Name of spouse: |

Social security number: |

|

|

SCHEDULE C |

STOCKS, MUTUAL FUNDS, MONEY MARKET FUNDS |

|

|

Stock Code |

|||||||

|

AND LIMITED PARTNERSHIP INTERESTS |

|

|

Do not write |

|||||||

|

|

|

|

in this space |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class |

Number |

|

Just Value |

|

Total |

|

||

Name of Company Issuing Stocks |

|

Common |

of |

|

Per |

|

Just Value |

Verified |

|||

(List alphabetically - do not abbreviate) |

|

or |

Shares |

|

Share |

|

January 1, _____ |

By |

|||

|

|

|

Preferred |

(A) |

|

(B) |

|

(A x B) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. TOTAL VALUE OF STOCKS |

|

|

|

|

|

|

|

|

|

|

|

Attach additional schedule if necessary. Photocopies of this schedule are acceptable. |

|

|

|

|

|

|

|||||

CARRY THIS AMOUNT TO SCHEDULE A, LINE 2, PAGE 1 |

|

|

10. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

www.mylorida.com/dor

Intangible Tax

R.06/07 Page 4 of 8

Name of taxpayer: |

|

|

|

|

|

|

|

|

Social security number: |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Name of spouse: |

|

|

|

|

|

|

|

|

Social security number: |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE D |

|

|

|

LOANS, NOTES AND ACCOUNTS RECEIVABLE |

|

|

Total Taxable Amount |

||||||||||||||

|

|

|

|

|

January 1, _____ |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

A. |

Accounts receivable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

B. |

Notes receivable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

C. |

Loans and advances receivable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

D. |

Other Receivables |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

11. |

TOTAL VALUE OF LOANS, NOTES AND ACCOUNTS RECEIVABLE |

|

|

|

|

|

|

|

|

|

|||||||||||

|

CARRY THIS AMOUNT TO SCHEDULE A, LINE 3, PAGE 1 |

|

|

|

|

|

|

|

11. |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

TRUST PROPERTY ONLY |

|

|

|

|

FEI Number of Trust |

||||||||

SCHEDULE E |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

BENEFICIAL INTEREST IN ANY TRUST (INDIVIDUAL RECEIVING INCOME) |

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Trust(s) iled by Florida trustee(s), ❏Yes ❏No |

If YES, go no further. |

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

If NO, see Questions 1 and 2 below: |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

1. |

Can you designate the future beneiciaries of the TRUST? |

❏Yes ❏No |

|

|

|

|

|

|

|

||||||||||||

2. |

Are you able to withdraw other than income from the TRUST? |

❏Yes ❏No |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

Total Taxable Amount |

|||||||||||||||||

IF YOUR ANSWERS TO EITHER OR BOTH OF THESE QUESTIONS IS “YES”, READ INSTRUCTIONS. |

|

||||||||||||||||||||

|

January 1, _____ |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. |

Stocks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. |

Bonds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. |

Others |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

12. |

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

CARRY THIS AMOUNT TO SCHEDULE A, LINE 4, PAGE 1 |

|

|

|

|

|

|

|

12. |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

INTEREST RATE SCHEDULE |

YEAR |

|

RATE |

|

YEAR |

|

RATE |

YEAR |

RATE |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

YEAR |

|

RATE |

YEAR |

|

RATE |

1992 |

|

|

180% |

|

1997 |

|

120% |

2002** |

46% |

||||||

1984 |

|

276% |

1988 |

|

228% |

1993 |

|

|

168% |

|

1998 |

|

108% |

2003** |

37% |

||||||

1985 |

|

264% |

1989 |

|

216% |

1994 |

|

|

156% |

|

1999 |

|

96% |

2004** |

29% |

||||||

1986 |

|

252% |

1990 |

|

204% |

1995 |

|

|

144% |

|

2000** |

|

69.5% |

2005** |

21% |

||||||

1987 |

|

240% |

1991 |

|

192% |

1996 |

|

|

132% |

|

2001** |

|

57.5% |

2006** |

11.5% |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

** For returns DUE after 1999, the Department will use a loating rate of interest subject to change every 6 months.

INTEREST CALCULATION |

(A) |

(B) |

(C) |

|

|

|

|

|

|

Interest Due |

WORKSHEET |

Enter amount from |

Interest Rate |

Days |

|

|

|

|

|

|

|

Line 6, Schedule A |

(See Interest Rate Schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Yearly Interest Rate |

|

____ % |

|

|

|

|

|

|

1. + |

|

|

|

|

|

|

|

|

||||

|

|

|

+ |

|

|

|||||

(July 1, _____ - June 30, 2007) |

|

|

|

|

|

|||||

|

|

|

|

|

(A x B) |

|||||

|

|

|

|

|

|

|

|

|

|

|

Fixed Daily Interest Rate for returns 1984 - 1999 |

|

|

|

|

|

|

|

2a. + |

||

|

.000328767 |

|

|

|

+ |

|

|

|||

(July 1, 2007 to postmark date of payment) |

|

|

|

|

|

|

||||

|

|

|

|

|

(A x B x C) |

|||||

|

|

|

|

|

|

|

|

|

|

|

**Floating Daily Interest Rate |

|

|

|

|

|

|

|

|

2b. + |

|

|

.000328767 |

|

|

|

+ |

|

|

|||

(July 1, 2007 to postmark date of payment) |

|

|

|

|

|

|

||||

|

|

|

|

|

(A x B x C) |

|||||

|

|

|

|

|

|

|

|

|

|

|

13. TOTAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

= |

|

|

|

CARRY THIS AMOUNT TO SCHEDULE A, LINE 7, PAGE 1 |

|

|

13. |

|

|

|

||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

**Calculate the total number of days from July 1 to the postmark date and enter the total days in Column C.

www.mylorida.com/dor

R.06/07 Page 5 of 8

Instructions for Completing the

Intangible Tax

General Information

The Florida Intangible Personal Property Tax is an annual tax based on the market value of the intangible property owned by a Florida resident or other individual(s) obligated to pay the intangible tax.

Intangible personal property is deined as all personal property which is not itself valuable, but is valuable because of what it represents. The most common examples are: shares of stock issued by corporations; bonds issued by corporations or state, county or municipal governments outside the state of Florida; accounts receivable or other loans which are not secured by real property; shares or units of ownership in mutual and money market funds.

Who Must File a Return**

Every person who is a legal resident or who is domiciled in this state on January 1 of the tax year is required to ile an intangible tax return if they own, manage, or control intangible personal property. Individuals and married couples can either ile Form

If tax due on Line 6 is less than $60.00, you are not required to file a return. however, we recommend that you submit a return to avoid future contact regarding this tax year. Trustees and personal representatives are required to ile a return listing all intangible property owned by the trust or estate if the beneiciaries are including the trust or estate assets on their personal return. This return is to advise the Department that the beneiciaries have iled returns, including the intangible property on their personal returns and under what number the returns have been iled.

Exemptions

See Page 2, Tax Rates and Exemption Schedule

Custodians of minors and incompetents may ile a return and claim the exemption on behalf of the minor or incompetent using the minor’s or incompetent’s social security number. Agents and iduciaries may not claim the exemption in their own right or on behalf of their principals or beneiciaries.

The following types of intangible property are exempt from taxation:

1.Money - this includes cash on hand and in the bank, certiicates of deposit, annuities and similar instruments.

2.Units of a registered investment company which is organized under an indenture of trust (unit investment trust or Massachusetts type business trust) shall have the portion of its net asset value exempt from tax which is equal to the portion of the portfolio containing United States government debt obligations. If the fund is incorporated, the entire fund is taxable.

3.All intangible property held in an employee retirement plan qualiied under section 401, United States Internal Revenue Code, as amended.

4.All intangible property held in an Individual Retirement Account (IRA) qualiied under section 408, United States Internal Revenue Code, as amended. This includes Roth and Educational IRA’s.

5.All intangible property held in a deferred compensation plan which is offered to governmental employees and qualiied under section 457, United States Internal Revenue Code, as amended.

6.Interest in a general partnership or franchise.

7.Interest in a limited partnership not registered with the Securities and Exchange Commission.

8.REMICS.

9.Bonds, notes, and other obligations issued by the state of Florida, its counties, municipalities, or other taxing districts, and the United States government and its agencies, territories and possessions. These investments when held in a fund may be taxable.

10.Notes and other obligations, except bonds, to the extent secured by a lien on real property located inside or outside the state.

Completing the Worksheet

Schedule A

To assure that your return is properly credited to your account, verify the information printed on the cover letter. Lines 1 through 8 cannot be completed until the supporting schedules have been completed. Proceed to Schedule B of the return.

Be sure that all totals from Schedules B, C, D & E have been transferred to Schedule A correctly.

Line 1 Enter the total from Schedule B, Line 9.

Line 2 Enter total from Schedule C, Line 10.

Line 3 Enter total from Schedule D, Line 11.

Line 4 Enter total from Schedule E, Line 12.

Line 5 Enter total of lines 1 through 4.

Line 6 To determine the amount of tax due you must complete the Tax Calculation Worksheet

on Page 2 of the Worksheet. Complete the Tax Calculation Worksheet by entering the amount from Schedule A, Line 5, on either Box A, Box B, Box C, or Box D of the Tax Calculation Worksheet.

Only one box is to be completed.

•Use Box A if your iling status is individual and Line 5 on Schedule A is $100,000 or less.

•Use Box B if your iling status is individual and Line 5 on Schedule A is more than $100,000.

•Use Box C if your iling status is joint and Line 5 on Schedule A is $200,000 or less.

•Use Box D if your iling status is joint and Line 5 on Schedule A is greater than $200,000.

After entering the amount on Line 5 of Schedule A on the appropriate line of the Tax Calculation Worksheet, multiply the amount by the tax rate shown on Line 6B. From Line 6C subtract the amount of your appropriate exemption shown on Line 6D. Enter the results on Line 6E of the Tax

R. 06/07

Page 6 of 8

Calculation Worksheet and on Schedule A, Line 6. If the amount is less than zero, enter 0.

The values which appear on Line 6D in each box of the Tax Calculation Worksheet are the tax dollar equivalent of the property value exemptions.

•For example, an individual having taxable intangible property valued at less than $100,000 for 2001 would be entitled to an exemption of $20,000 and is subject to only a 1 mill (.001) tax. In tax dollars this exemption is worth $20.00 ($20,000 x .001 = $20.00)

•A married couple iling a joint return having intangible property valued at more than $200,000 would be entitled to an exemption of $40,000 for 2001.

Line 7 For returns iled after the due date, enter any interest due on tax payments which are late.(See the Interest Calculation Worksheet on Page 4 and instructions for Interest on Page 8.)

Line 9 Enter the total from Lines 6 and 7. This total should agree with the amount you remit with the worksheet. Be sure to sign and date your worksheet.

Schedule B - Bonds

List on Schedule B all taxable bonds you owned on January 1 of the applicable year. List the bonds alphabetically. This schedule requires you to provide speciic information about each bond. Columns A through E are to be completed as follows: Column A is for the denomination or dollar amount stated on the face of your bond, for example $1,000 or $10,000; Column B is the stated rate of interest paid to you by the bond issuer, for example 6% or 9%; Column C is the maturity date on which you will be paid the full amount of the bond; Column D is the number of bonds you owned on January 1 of the applicable year, for the denomination shown in Column A; Column E is the market value of the bond. Bonds have historically been valued in units of $100 and is the price generally found as the quoted market price on an exchange. The Total Taxable Amount column is for the total market value of the bonds you have listed on each line.

R.06/07 Page 7 of 8

For each line, calculate the value by multiplying Column A by Column D, then dividing the product by 100, and multiplying the product by Column E. This results in the total taxable amount for each bond listed. Total all entries in the Total Taxable Amount column and enter on Line 9. Transfer this amount to Schedule A, Line 1, on the face of your worksheet. Bonds, notes or other obligations issued by the state of Florida, its counties, municipalities or special taxing districts, the United States government, its agencies, possessions, territories, or the Commonwealth of Puerto Rico, Guam, U.S. virgin Islands, Samoa and the Northern Marianas, are exempt. however, if these investments are held in a fund, they may be taxable.

Schedule C - Stocks, Mutuals, Money Market Funds, and Limited Partnership Interests

Arrange all stocks in alphabetical order before entering the names on the schedule.

Shares of stock, money market funds, mutual funds, or the interest of a limited partner in a limited partnership which are regularly listed on any exchange or regularly traded over the counter are valued at their closing market price on the last business day of the previous calendar year. Shares or units of mutual funds, money market funds, or unit investment trusts are valued at net asset value (unless completely or partially exempt) on the last business day of the previous calendar year. (See exemption Item 2.) All shares of stock or units of a mutual fund or money market fund owned by a Florida resident are subject to

tax regardless of the physical location of the stock or unit certiicates of the location of the issuing company. (Many newspapers publish the closing market value for most stocks, mutual and money market funds in their January 1 issue.)

Shares of stock, money market funds, or an interest in a limited partnership registered with the Securities and Exchange Commission, not regularly traded on the open market are to be valued using generally accepted methods of valuation. Internal Revenue Ruling

Shares of restricted stock may be subject to a discount, reducing the taxable value. The amount of discount depends on the circumstances in each situation. Any discount taken is subject to veriication by audit. Securities purchased on margin are taxable to the purchaser.

List the name of the issuing company in the irst column. Do not abbreviate the name of the company. (Your abbreviation may not be recognized and could result in inquiries about stocks missing from your Intangible Worksheet.) Place only one name on a line. The next column is used to identify the class of stock owned, such as common or preferred. Column A is for the number of shares of stock owned. Column B is the just value per share of stock or the market price per share. The next column is the total just value or the total market value of each class of stock owned. This total is obtained by multiplying Column A by Column B. The product is placed in the Total Just value column. Now add all entries in the Total Just value Column and enter the results on Line 10. Transfer this total to Schedule A, Line 2 on the face of your Intangible Worksheet. All intangible property held in an

Individual Retirement Account (IRA) qualified under section 408, United States Internal Revenue Code, as amended, is exempt.

Schedule D - Loans, Notes, & Accounts

This schedule is used to report any loans, notes, or accounts receivable that you own. Your loans to friends or relatives should be included as taxable property. Notes secured by a lien on real property are exempt and should not be reported. Proprietorships often operate using cash basis accounting. If you are the proprietor of a business using this type of accounting system, the outstanding balance of any credit sale is an account receivable owned by you. For tax purposes, all loans, notes

or accounts receivable are to be valued at their unpaid principal balance as of January 1 of the tax year, unless the taxpayer can satisfactorily establish a lesser value. Enter the total value of all loans, notes, or accounts receivable on the proper line in Schedule D. Total the values entered in each of these lines and enter the value on Line 11. Transfer this value to Schedule A, Line 3 on the face of your Intangible Worksheet.

Schedule E - Trust Property Only

This schedule is to be used by the trust beneiciaries when they are reporting the assets of a trust for which they are the current income beneiciary. If the trust property is being returned by the trustee, DO NOT complete this schedule. If the trustee is not iling a return for the trust assets, then complete the questions in the schedule before continuing. Any current income beneiciary may ile an intangible tax return whether they have a beneicial interest in the trust or not.

A taxable interest in the trust is one in which the beneiciary may, without limitation, name the successor beneiciary. If the naming of future beneiciaries is in any way limited, this is not a taxable interest. Another way a beneiciary may have a taxable beneicial interest is by a power of invasion of the trust assets. This may be an unlimited power to invade or it may be limited to a stated percentage or dollar amount.

A power to revoke the trust is also a taxable beneicial interest in a trust.

To complete Schedule E, list the total of all stocks on Line A. Attach a separate schedule listing all stocks held in the trust. List the total of all bonds held in the trust on Line B. Attach a separate schedule listing all bonds held in the trust. List the value of any other intangible property held by the trust, such as notes or loans on Line C. Total Lines A, B and C on

line 12. Enter this total on Schedule A, Line 4.

Note to Trustees: Trustees are to complete form

D.The trust is the taxpayer and not a beneiciary of itself. Therefore Schedule E is not used by trustees to ile a return for the trust assets.

R. 06/07

Page 8 of 8

Discounts - Not Applicable

however, for future ilings, you may claim a discount for early iling provided your return with tax payment is postmarked on or before the last day of the month for claiming the discount shown on the return. Discounts are not extended when the last day of the month falls on a Saturday, Sunday or a federal or state legal holiday.

Discount |

Discount |

Discount Postmarked |

Period |

|

on or Before |

4% |

Feb. 28 |

|

March |

3% |

March 31 |

April |

2% |

April 30 |

May |

1% |

May 31 |

June |

0% |

June 30 |

|

|

|

Penalties - Not Applicable

On future ilings, full payment of the tax must be made by June 30th of the tax year to avoid any penalties. A return mailed after June 30th is not late if June 30th falls on Saturday, Sunday or a federal or state legal holiday and the return is postmarked or delivered to the Department on the next succeeding workday. Payments made after June 30th are subject to delinquency penalty, and the speciic late iling penalty.

Interest

See Interest Rate Schedule, on page 4. This is a

3.4) If the return you are iling is for a year prior to 2000, you will use the second row (ixed). For years subsequent to 1999, you will use the third row. 5)

Multiply your tax liability by the appropriate daily rate by the total number of days determined and enter on 2a if ixed or 2b for loating. 6) Add 1 and 2a or 2b to determine your total interest and enter on line 13. This amount is carried to page 1, Schedule A, line 7.

**If you have filed for homestead exemption prior to March 1st of any calendar year and were granted the exemption, you have declared your intention that Florida is your state of domicile and would be subject to intangible tax for that year.