portability transfer homestead can be filled out with ease. Simply try FormsPal PDF editing tool to complete the job fast. In order to make our editor better and more convenient to work with, we consistently develop new features, with our users' suggestions in mind. Getting underway is easy! Everything you need to do is follow the next basic steps directly below:

Step 1: Just press the "Get Form Button" at the top of this site to access our form editor. This way, you'll find all that is required to work with your document.

Step 2: Once you start the online editor, you will see the form ready to be filled out. Besides filling in different blank fields, you could also perform other things with the form, including adding your own words, modifying the original text, inserting illustrations or photos, putting your signature on the form, and more.

It's straightforward to fill out the form with our practical tutorial! Here is what you need to do:

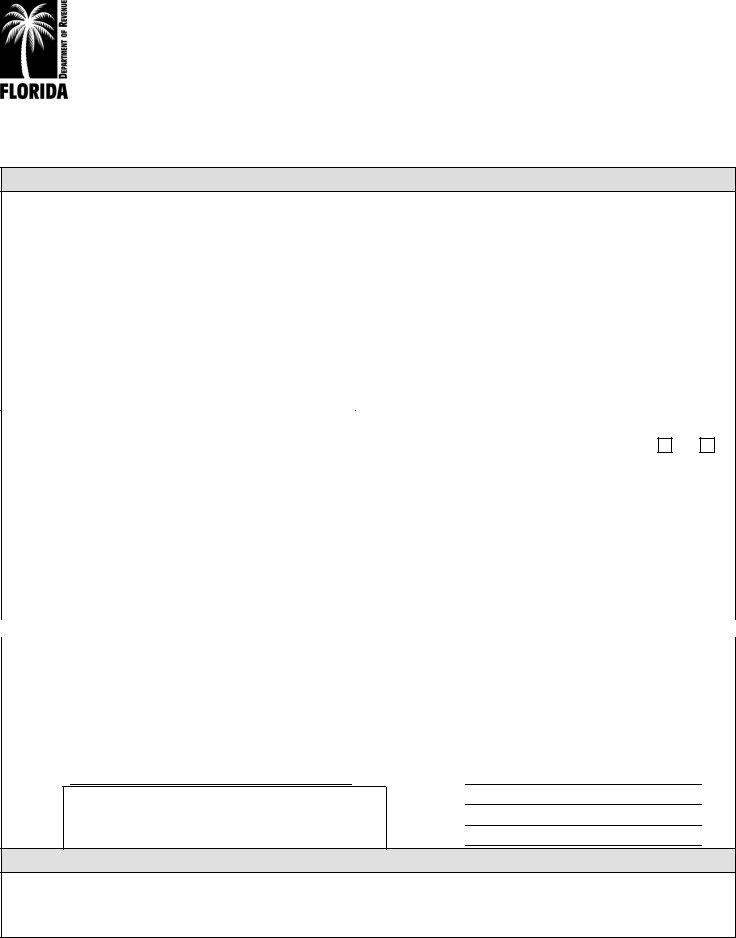

1. You should fill out the portability transfer homestead accurately, thus be attentive while working with the segments including all these fields:

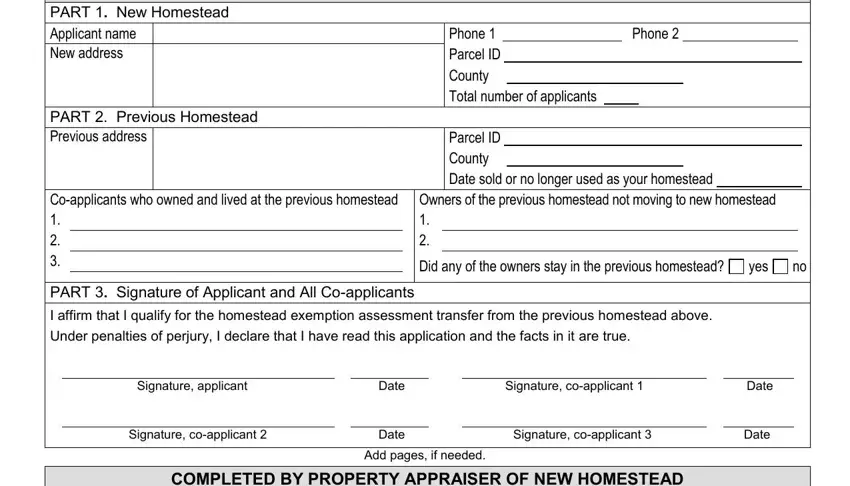

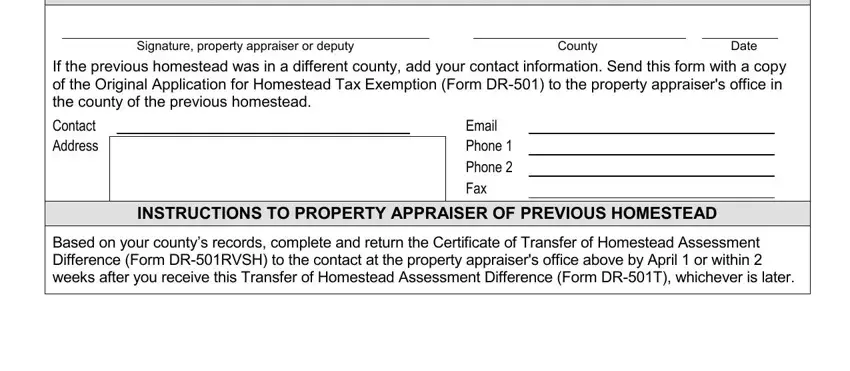

2. Just after filling in the previous step, go to the next part and complete the essential details in these blank fields - Signature property appraiser or, County, Date, If the previous homestead was in a, Contact Address, Email Phone Phone Fax, INSTRUCTIONS TO PROPERTY APPRAISER, and Based on your countys records.

Those who work with this PDF often make errors while completing Date in this area. Ensure you read again everything you type in here.

Step 3: Always make sure that your information is accurate and then just click "Done" to finish the task. Acquire the portability transfer homestead once you subscribe to a 7-day free trial. Conveniently view the form inside your personal cabinet, along with any edits and adjustments automatically preserved! When you use FormsPal, you can easily complete documents without stressing about personal information breaches or records being shared. Our secure platform ensures that your private information is stored safe.