Working with PDF files online is always a breeze using our PDF tool. Anyone can fill in Form Drs Pw here painlessly. The editor is consistently maintained by our staff, acquiring new functions and turning out to be even more versatile. Here is what you will have to do to get going:

Step 1: First, open the tool by pressing the "Get Form Button" at the top of this site.

Step 2: With this handy PDF editing tool, you'll be able to accomplish more than just fill out blank form fields. Edit away and make your documents appear great with custom textual content added in, or adjust the file's original content to excellence - all backed up by an ability to incorporate any graphics and sign it off.

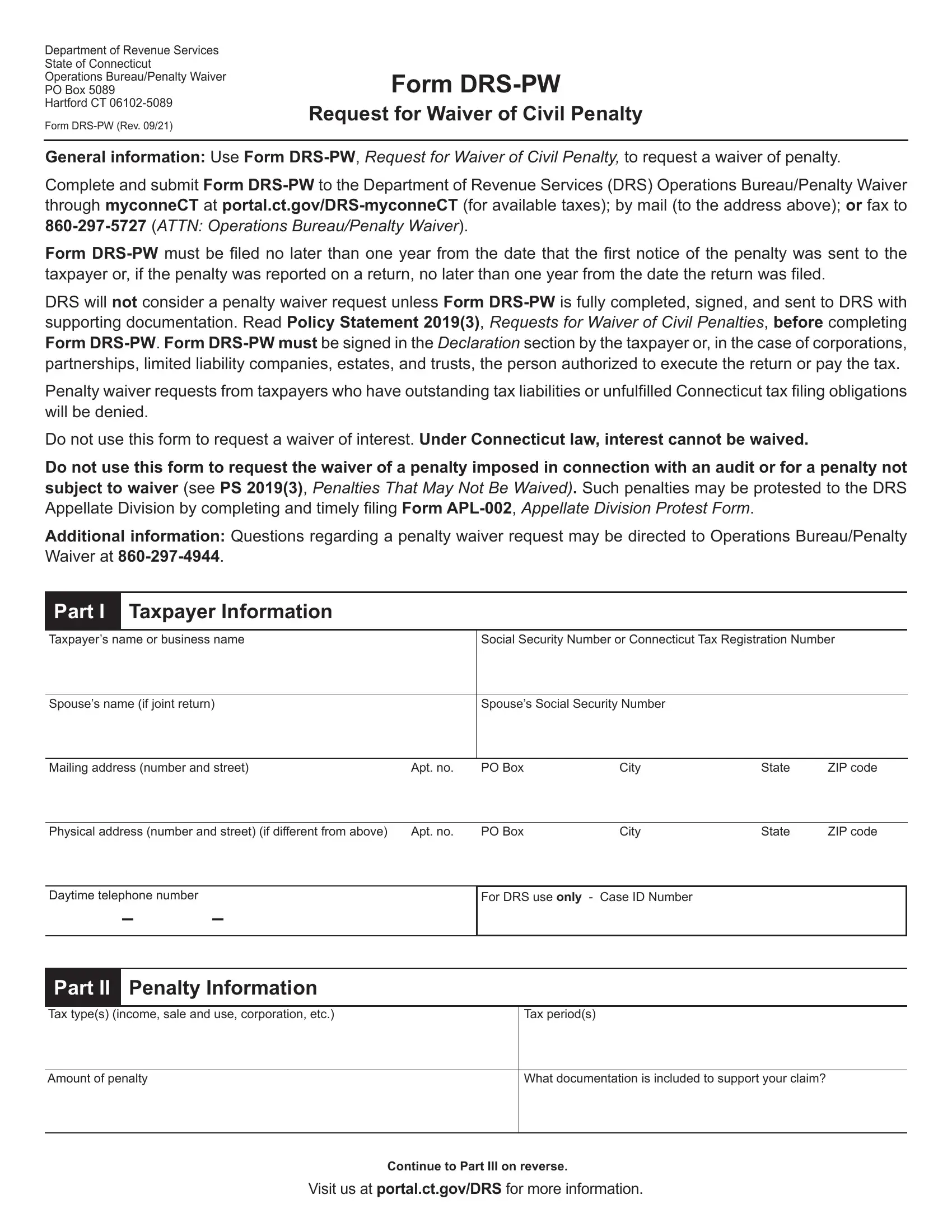

This PDF will need specific data to be filled in, therefore be sure to take the time to fill in what is asked:

1. Complete the Form Drs Pw with a selection of essential fields. Gather all of the necessary information and be sure there's nothing left out!

2. Once your current task is complete, take the next step – fill out all of these fields - Continue to Part III on reverse, and Visit us at portalctgovDRS for with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

When it comes to Continue to Part III on reverse and Visit us at portalctgovDRS for, make certain you double-check them in this current part. The two of these are the key fields in this form.

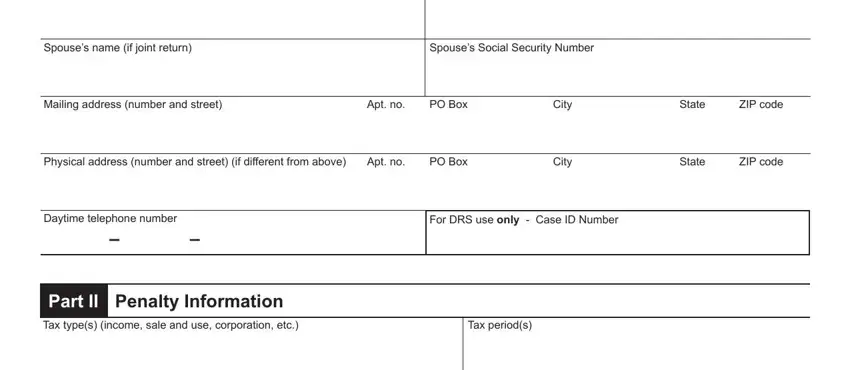

3. The third part will be simple - fill in every one of the empty fields in Provide details of why you were, Why were you unable to comply, How did you handle your other, Once the facts and circumstances, Explain how you complied with, Identify any additional, and request in order to complete this process.

4. Your next subsection needs your input in the subsequent parts: Supporting documents What type of, If you are claiming the, If you are claiming the, Declaration, IWe declare under the penalty of, IWe have read and understand the, Sign Here, Signature, Print name, and Date. Ensure you fill in all required information to move further.

5. This last point to submit this PDF form is pivotal. Make certain to fill out the required blanks, such as Sign Here, Title, Form DRSPW Back Rev, and Visit us at portalctgovDRS for, prior to using the file. If you don't, it may result in an unfinished and potentially incorrect document!

Step 3: As soon as you've reviewed the details you filled in, just click "Done" to conclude your form at FormsPal. Grab the Form Drs Pw as soon as you register online for a 7-day free trial. Easily use the pdf form in your personal cabinet, together with any modifications and changes being conveniently kept! FormsPal offers risk-free form editing with no personal data recording or distributing. Rest assured that your details are safe with us!