NONIMMIGRANT TREATY TRADER/INVESTOR VISA APPLICATION INSTRUCTIONS

This form, together with Form DS-160, Online Nonimmigrant Visa Application, constitutes the application for an E-1 Treaty Trader or E-2 Treaty Investor Nonimmigrant Visa. See visa requirements below. Incomplete or undocumented applications will be returned.

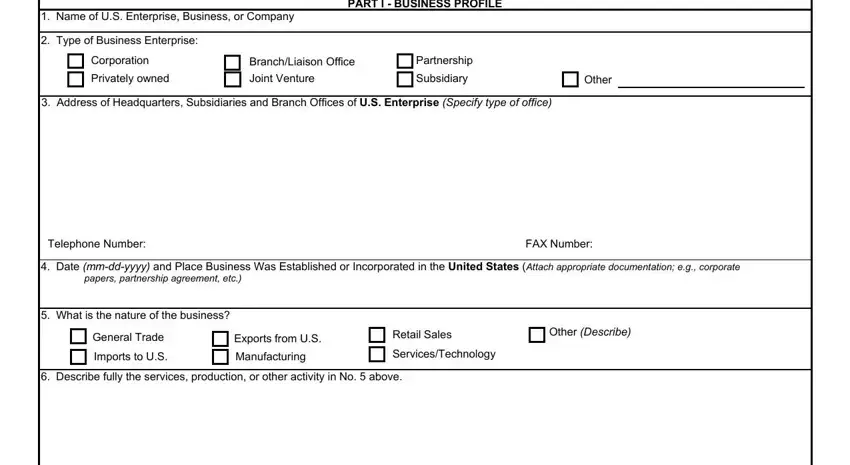

All first-time applicants seeking Treaty Trader or Treaty Investor status must complete Parts I and II. Parts I and II must be updated periodically. All individual applicants must complete Part III and Form DS-160. You must answer all relevant questions. Enter "Not applicable" where appropriate. If an enterprise is not yet fully operational, estimates and projections should be made concerning potential income, job creation, volume of sales, etc.

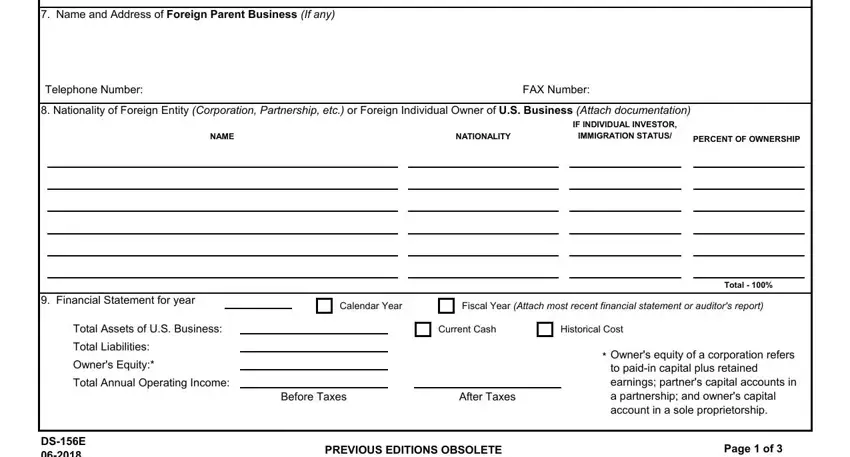

Supporting documents should be submitted in a binder with a table of contents and tabs. The following are examples of supporting documentation which should be attached to first-time applications (not every type of document is applicable in each case; the consular officer may request additional information if required): Evidence of possession and control of investment funds (bank records, financial statements, loans, savings, promissory notes, etc.); evidence of remittance to the United States (bank drafts, transfers, exchange permits, receipts, etc.); evidence of establishment of business in the United States

(articles of incorporation, partnership agreement, organization and staffing charts, shares, titles, contracts, receipts, licenses, leases, etc.); evidence of the nationality of the investors/traders (passports, articles of incorporation of parent company, stock exchange listings, etc.) ; evidence of trade between the United States and the treaty country (invoices, bills of lading, customs clearances, warehouse receipts, shipping receipts, sales receipts, contracts, etc.) ; evidence of investment in the United States (titles, receipts, contracts, loans, bank statements, etc.) ; evidence of substantiality (financial statements, audits, U.S. corporate or business tax returns, etc.); evidence that the enterprise is not marginal (payroll records, IRS Form 941, personal tax returns, evidence of other personal assets and income) ; evidence that the business is a real, operating enterprise (annual reports, catalogs, sales literature, news articles, and other evidence as appropriate) ; curriculum vitae of the proposed visa recipient (optional). Specific instructions may vary by post and applicants should refer to post websites for more details.

Use additional sheets of paper, as necessary, to complete responses.

TREATY TRADER AND TREATY INVESTOR VISA REQUIREMENTS

Section 101(a)(15)(E) of the Immigration and Nationality Act provides nonimmigrant visa status for a national of any of the countries with which the United States maintains an appropriate treaty of commerce and navigation, who is coming to the United States to carry on substantial trade, including trade in services or technology, principally between the United States and the treaty country, or to develop and direct the operations of an enterprise in which the national has invested, or is actively in the process of investing, a substantial amount of capital. The requirements for Treaty Trader and Treaty Investor visas are further elaborated in 22 CFR Part 41.51. These requirements are summarized below:

Requirements for a Treaty Trader (E-1) nonimmigrant visa are:

1.The applicant must be a national of a treaty country.

2.The trading firm for which the applicant is coming to the United States must have the nationality of the treaty country.

3.The international trade must be "substantial" in the sense that it is of a high enough quantum and continuity of trade.

4.The trade must be principally between the United States and the treaty country, which means that more than 50%) of the international trade involved must be between the United States and the country of the applicant's nationality. Trade means the international exchange of goods, services and technology. The item of trade, and title of that item, must pass from one party to the other in exchange for consideration.

5.The applicant must be employed in a supervisory or executive capacity, or possess specialized skills essential to the successful and efficient operation of the commercial enterprise. Ordinarily skilled or unskilled workers generally do not qualify.

Requirements for a Treaty Investor (E-2) nonimmigrant visa are:

1.The investor, either a real or corporate person, must be a national of a treaty country.

2.The investment must be substantial. It must be sufficient to ensure the treaty investor's commitment to the successful operation of the enterprise. The percentage in investment required for a low-cost business enterprise is generally higher than the percentage of investment required for a high-cost enterprise.

3.The investment must be in a real operating commercial enterprise. Speculative or idle investment does not qualify. Uncommitted funds in a bank account or similar security are not considered an investment.

4.The investment may not be marginal. It must have the capacity to generate significantly more income than just to provide a living to the investor and family, or it must have a significant economic impact in the United States.

5.The investor must have control of the funds, and the investment must be at risk in the commercial sense. Loans secured with the assets of the investment enterprise are not considered to be at risk.

6.The investor must be coming to the United States solely to develop and direct the enterprise. If the applicant is not the principal investor, he or she must be employed in a supervisory, executive, or specialized skills capacity. Ordinarily skilled and unskilled workers generally do not qualify.

CONFIDENTIALITY AND PAPERWORK REDUCTION ACT STATEMENTS

Confidentiality Statement - INA Section 222(f) provides that visa issuance and refusal records shall be considered confidential and shall be used only for the formulation, amendment, administration, or enforcement of the immigration, nationality, and other laws of the United States. Certified copies of visa records may be made available to a court which certifies that the information contained in such records is needed in a case pending before the court.

Paperwork Reduction Act Statement - *Public reporting burden for this collection of information is estimated to average 4 hours per response, including time required for searching existing data sources, gathering the necessary documentation, providing the information and/or documents required, and reviewing the final collection. You do not have to supply this information unless this collection displays a currently valid OMB control number. If you have comments on the accuracy of this burden estimate and/or recommendations for reducing it, please send them to: PRA_BurdenComments@state.gov

DS-0156-E |

Instruction Page 1 of 1 |

06-2018 |

|

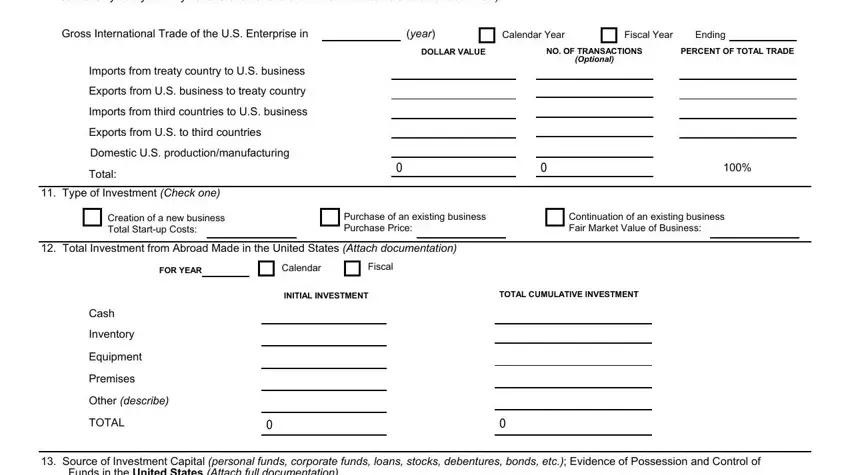

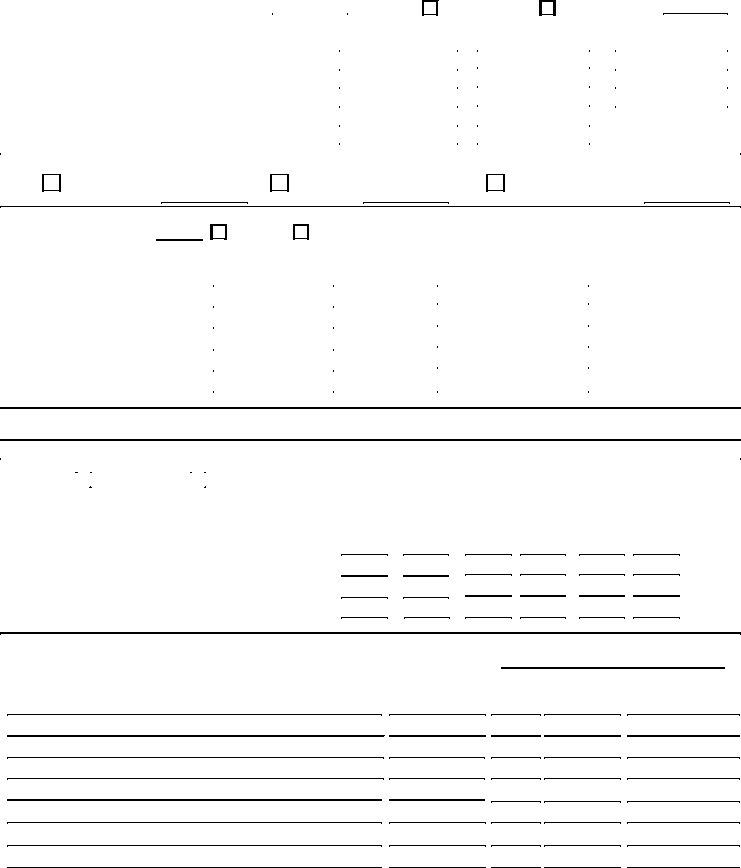

10.To measure the amount of international trade with the United States, please complete the following. (For trade in merchandise, exports and imports,T refer to shipment and sale of goods across international boundaries. For trade in services and technology, exports and imports, refer to the sale of services by treaty-country nationals to nationals of the United States and other countries.)

Gross International Trade of the U.S. Enterprise in |

|

(year) |

|

DOLLAR VALUE |

|

NO. OF TRANSACTIONS |

|

PERCENT OF TOTAL TRADE |

|

Imports from treaty country to U.S. business |

|

|

(Optional) |

|

|

|

|

|

|

|

|

Exports from U.S. business to treaty country |

|

|

|

|

|

|

|

|

|

|

|

|

Imports from third countries to U.S. business |

|

|

|

|

|

|

Exports from U.S. to third countries |

|

|

|

|

|

|

Domestic U.S. production/manufacturing |

|

|

|

100% |

|

Total: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

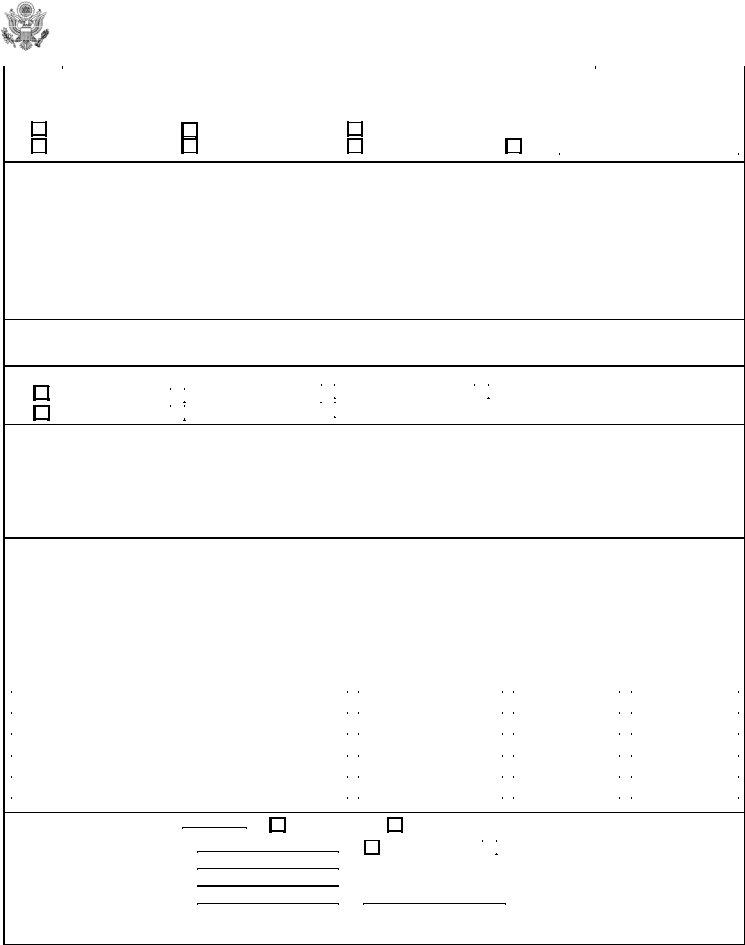

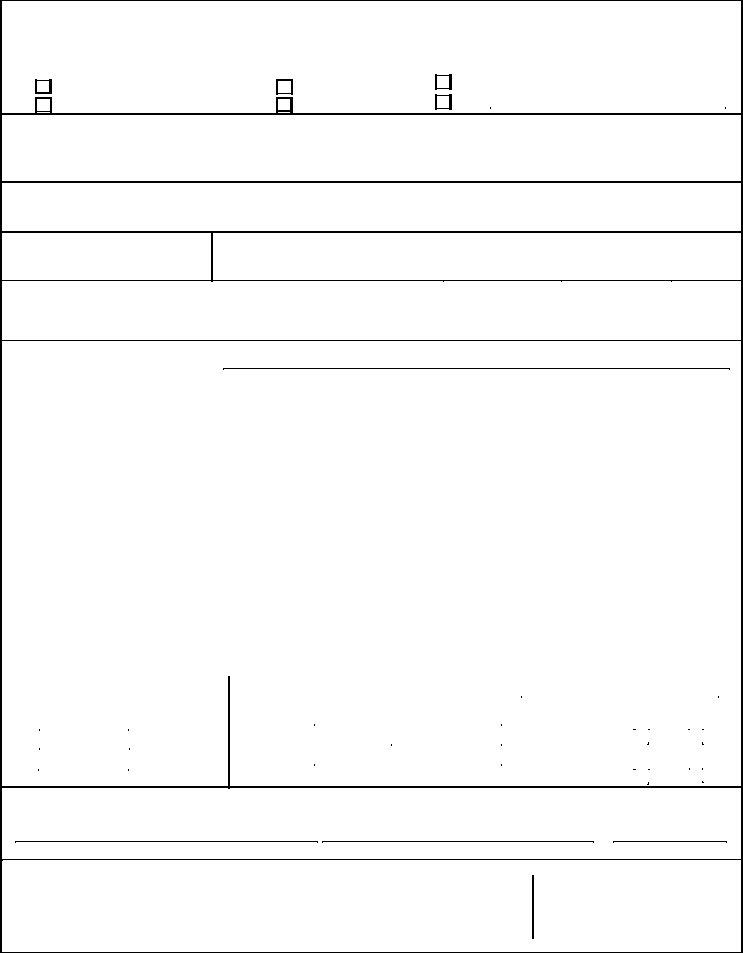

11. Type of Investment (Check one) |

|

|

|

|

|

Creation of a new business Total Start-up Costs:

Purchase of an existing business Purchase Price:

Continuation of an existing business Fair Market Value of Business:

12. Total Investment from Abroad Made in the United States (Attach documentation)

FOR YEAR

Cash

Inventory

Equipment

Premises

Other (describe)

TOTAL

Calendar Fiscal

INITIAL INVESTMENT |

|

TOTAL CUMULATIVE INVESTMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13.Source of Investment Capital (personal funds, corporate funds, loans, stocks, debentures, bonds, etc.); Evidence of Possession and Control of Funds in the United States (Attach full documentation)

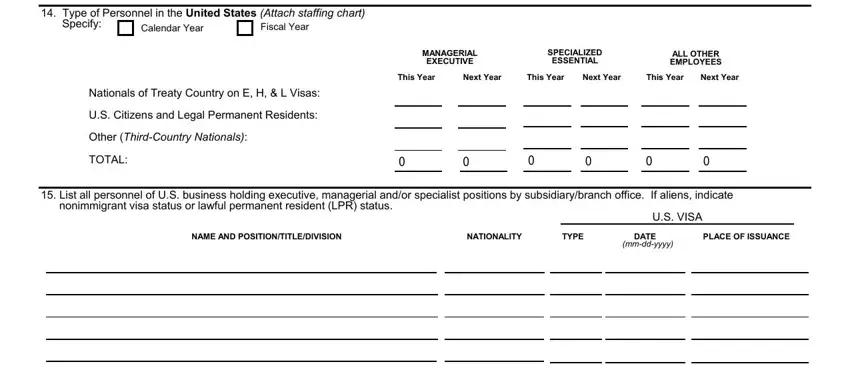

PART II - STAFF

14. Type of Personnel in the United States (Attach staffing chart) |

|

|

|

|

Specify: |

|

Calendar Year |

|

Fiscal Year |

|

SPECIALIZED |

|

|

|

|

|

|

|

|

|

MANAGERIAL |

ALL OTHER |

|

|

|

|

EXECUTIVE |

ESSENTIAL |

EMPLOYEES |

|

|

|

|

This Year |

Next Year |

This Year |

Next Year |

This Year Next Year |

Nationals of Treaty Country on E, H, & L Visas:

U.S. Citizens and Legal Permanent Residents:

Other (Third-Country Nationals):

TOTAL:

15. List all personnel of U.S. business holding executive, managerial and/or specialist positions by subsidiary/branch office. If aliens, indicate nonimmigrant visa status or lawful permanent resident (LPR) status.

U.S. VISA

NAME AND POSITION/TITLE/DIVISION |

NATIONALITY |

TYPE |

DATE |

PLACE OF ISSUANCE |

(mm-dd-yyyy)