The DTE 105B form, revised as of November 2013, plays a crucial role for senior citizens, disabled persons, and surviving spouses in maintaining the homestead exemption benefits they already receive. This document, essentially a Continuing Homestead Exemption Application, must be submitted to the county auditor no later than the first Monday in June, but only under specific circumstances where changes in eligibility status have occurred. The form requires detailed information including the county, tax year, taxing district, parcel or registration number, ownership details, and the homestead address whether it pertains to real property or a manufactured or mobile home. It's designed to ensure that any shifts in the owner's situation such as a change in principal residence, ownership alterations, adjustments in the owner's disability status, or the death of the owner, are officially reported. Additionally, modifications relating to a revocable inter vivos trust or changes in income that could affect qualification under specific regulations must also be disclosed. Applicants are also required to affirm the accuracy of the information provided under the penalty of perjury, adding a layer of formal declaration to the submission process. This form underscores the importance of keeping the county auditor informed of any changes that would affect one's homestead exemption, thus ensuring that those eligible can continue to benefit from this vital support.

| Question | Answer |

|---|---|

| Form Name | Form Dte 105B |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | dte_105b dte 105 b form |

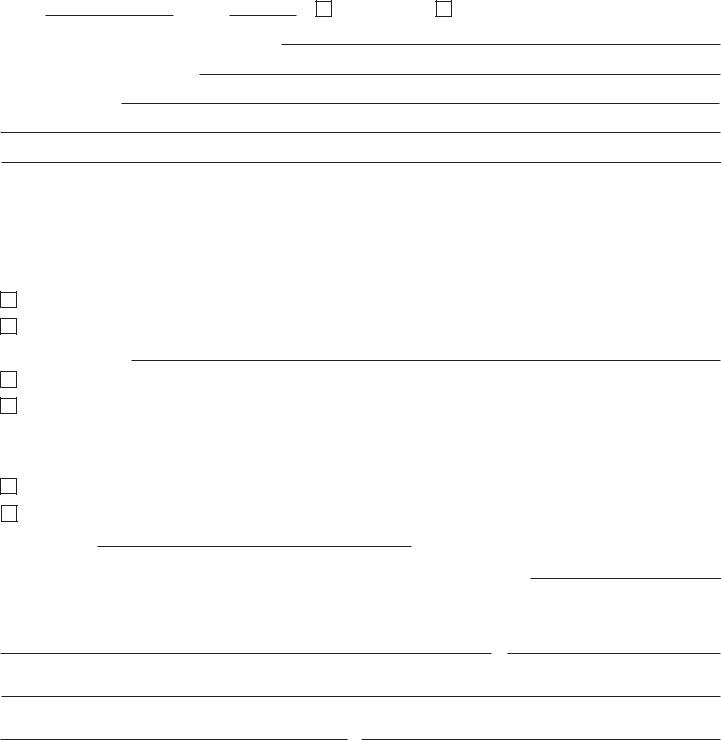

DTE 105B

Rev. 11/13

Continuing Homestead Exemption Application for Senior Citizens,

Disabled Persons and Surviving Spouses

File with the county auditor no later than the fi rst Monday in June

only if changes in your eligibility status have occurred.

To be completed by the county auditor prior to mailing:

CountyTax year

Taxing district and parcel or registration number Owner(s) as shown on the tax list Homestead address

Real property

Manufactured or mobile home

Instructions to Homestead Recipient

You must report any changes each year that would affect your homestead exemption on this form. If any have occurred, complete this form and return it to the county auditor by the first Monday in June. If no changes have occurred, you do not have to return this form.

Check any of the following changes in your eligibility status that apply:

The property described above is no longer the owner’s principal place of residence.

There has been a change in the ownership of the property.

New owner(s)

The owner’s disability status has changed. |

|

|

|

|

||

The owner has died. |

|

|

|

|

||

Name of decedent |

|

|

|

Date of death |

|

|

Name of surviving spouse |

|

|

Spouse’s age on date of death |

|

||

The property is in a revocable inter vivos trust and there has been a change thereto or a revocation thereof. The owner qualifi ed under R.C. 323.152(A)(2)(c) (Income Verifi cation) and total income has changed. Total income

Owner’s Social Security # |

|

Spouse’s Social Security # |

I declare under penalty of perjury that I have examined this application, and to the best of my knowledge and belief, it is true, correct and complete.

Signature of owner |

Date |

Mailing address

Applicant’s daytime phone number |

Applicant’s |