Working with PDF forms online can be very easy using our PDF tool. You can fill in Form Dte 105C here painlessly. To make our tool better and more convenient to utilize, we constantly work on new features, taking into account suggestions from our users. Starting is effortless! Everything you should do is follow the next basic steps directly below:

Step 1: Access the PDF doc in our tool by hitting the "Get Form Button" at the top of this page.

Step 2: After you open the editor, you will notice the document made ready to be filled out. In addition to filling in various fields, you may as well perform several other things with the PDF, namely putting on any words, changing the initial textual content, adding illustrations or photos, putting your signature on the form, and much more.

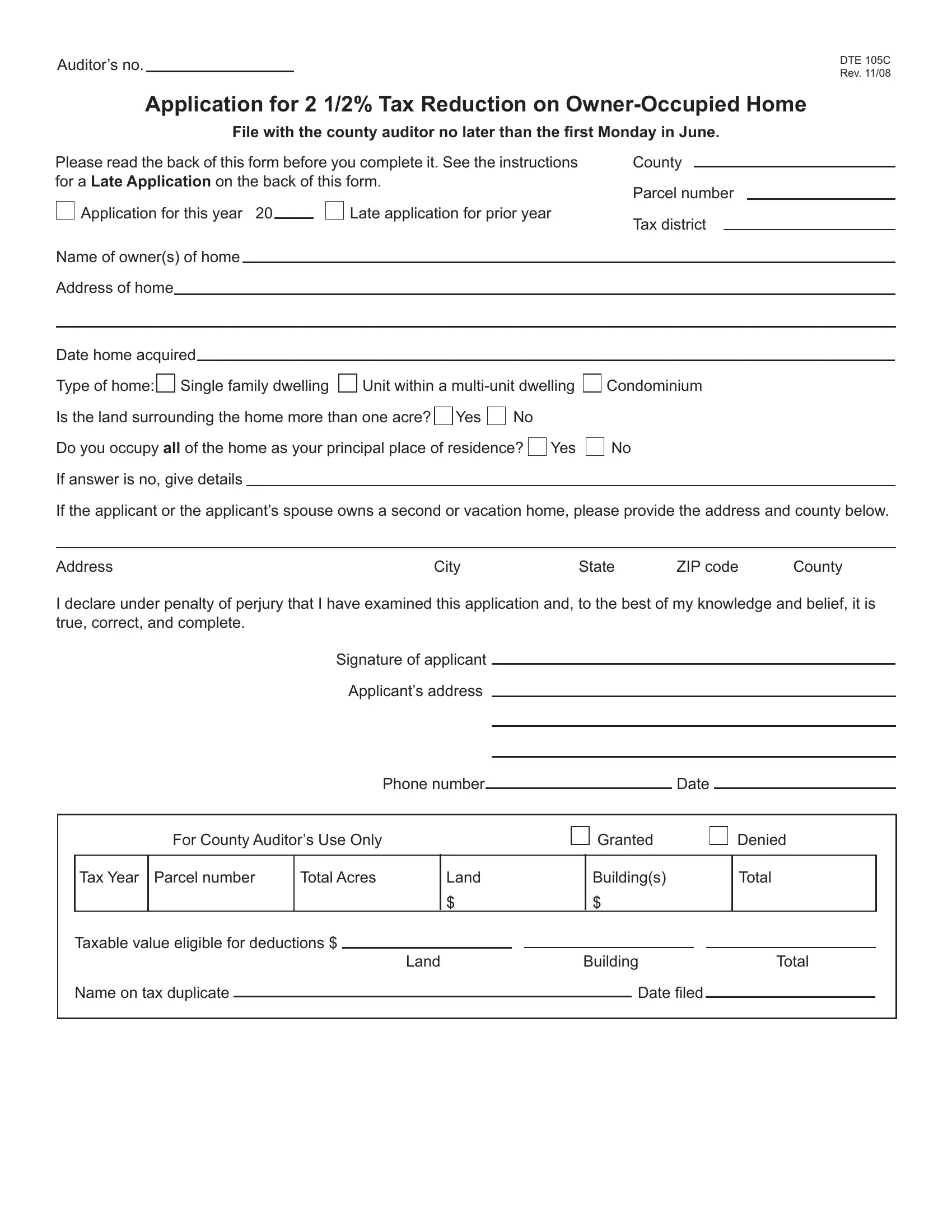

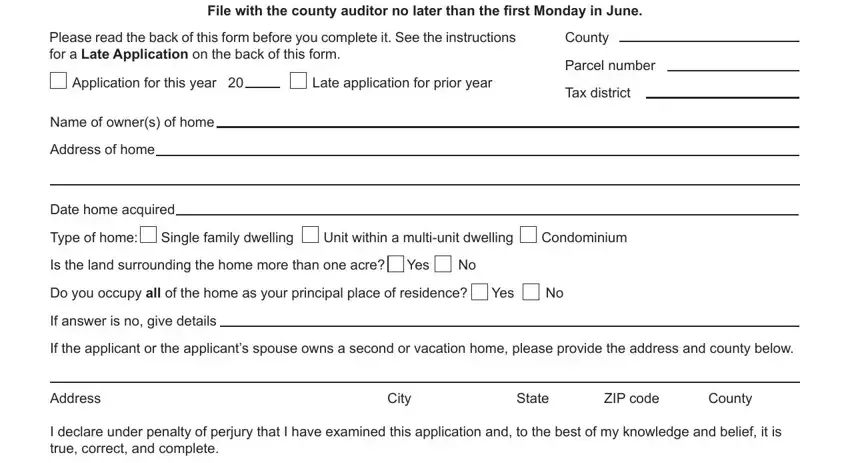

This form will need specific data to be filled in, therefore be sure to take your time to fill in exactly what is expected:

1. While filling in the Form Dte 105C, be certain to incorporate all of the necessary blanks in their associated form section. It will help expedite the process, allowing your details to be processed promptly and properly.

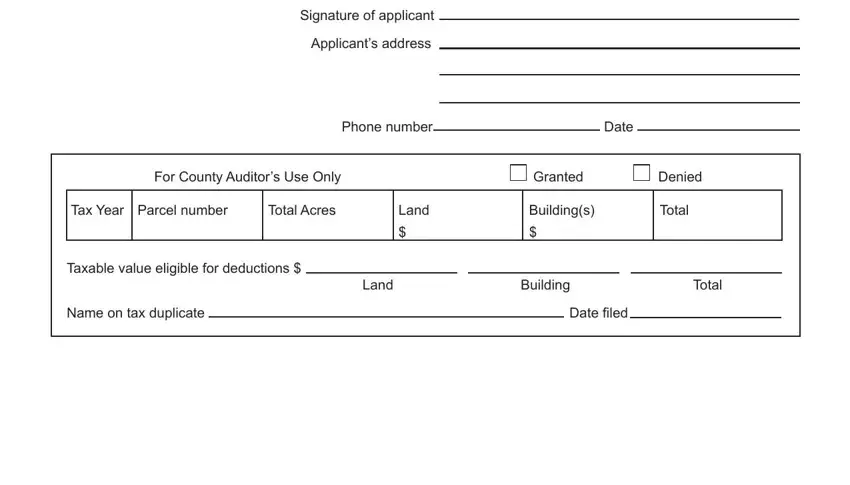

2. Once the previous array of fields is completed, you're ready to insert the required specifics in Signature of applicant, Applicants address, Phone number, Date, For County Auditors Use Only, Granted, Denied, Tax Year Parcel number, Total Acres, Land, Buildings, Total, Taxable value eligible for, Name on tax duplicate, and Land so that you can move forward further.

It's simple to get it wrong while completing the Phone number, for that reason make sure that you look again prior to when you finalize the form.

Step 3: Proofread the information you have inserted in the blanks and then hit the "Done" button. Sign up with us today and instantly gain access to Form Dte 105C, available for downloading. Each and every change you make is conveniently kept , allowing you to customize the file at a later stage when required. We do not sell or share the details that you enter when filling out documents at our site.