When using the online editor for PDFs by FormsPal, you're able to fill in or modify Dte 105A Form here and now. Our editor is constantly evolving to present the very best user experience attainable, and that is due to our resolve for constant improvement and listening closely to user feedback. With just a couple of basic steps, you are able to begin your PDF editing:

Step 1: Simply click the "Get Form Button" at the top of this site to launch our pdf file editor. There you will find all that is necessary to fill out your file.

Step 2: After you start the PDF editor, you will get the document prepared to be completed. Besides filling in different blank fields, you may also perform many other things with the form, that is adding your own text, changing the original textual content, adding illustrations or photos, placing your signature to the document, and more.

Filling out this document requires attention to detail. Ensure each and every blank field is filled out properly.

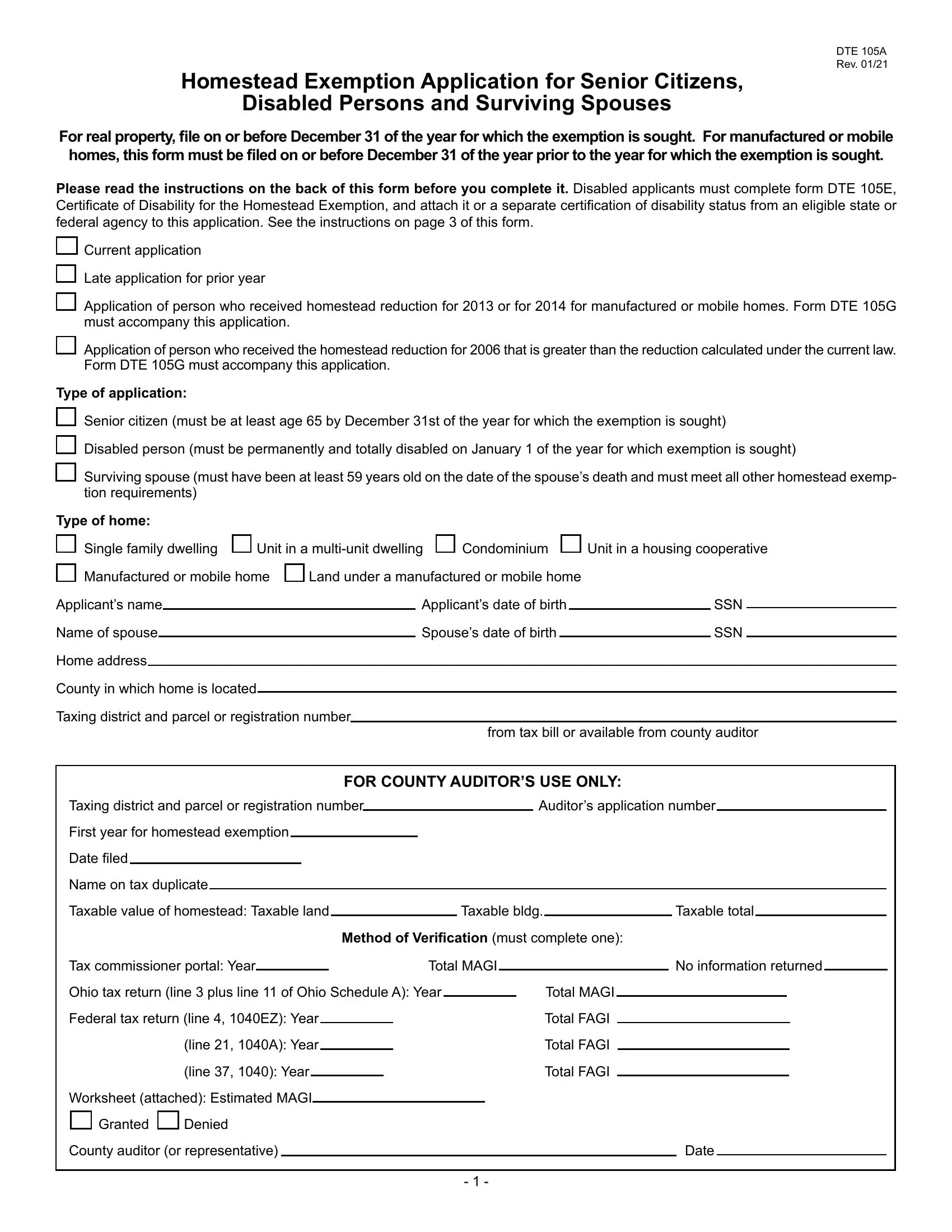

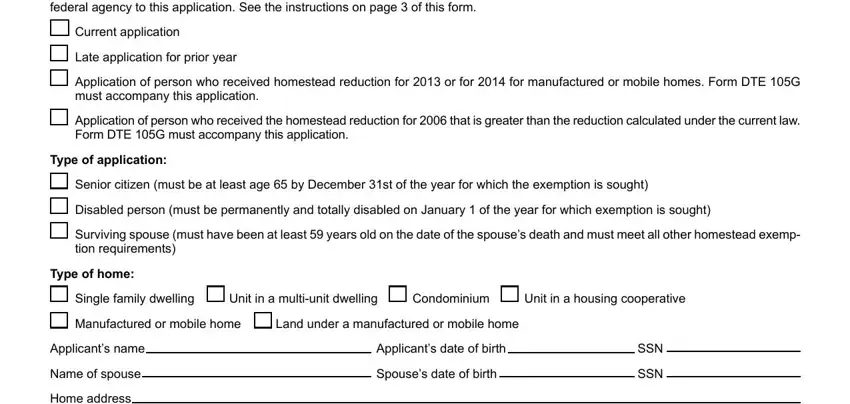

1. While filling out the Dte 105A Form, make sure to incorporate all essential blanks within the associated area. This will help to speed up the work, allowing for your information to be handled fast and accurately.

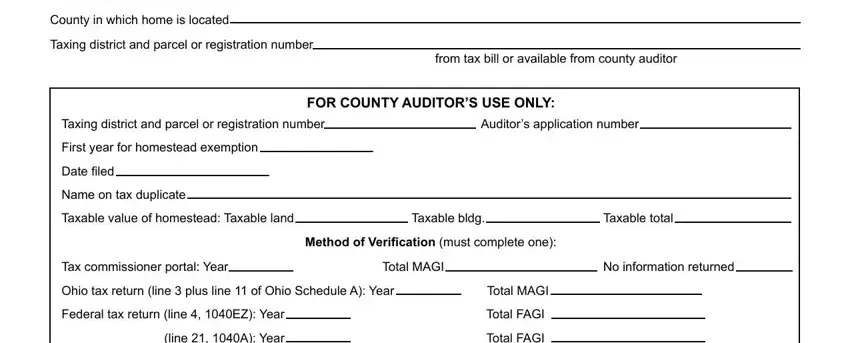

2. Once this array of fields is completed, you're ready add the essential specifics in Home address, County in which home is located, Taxing district and parcel or, from tax bill or available from, FOR COUNTY AUDITORS USE ONLY, Taxing district and parcel or, Auditors application number, Taxable bldg, Taxable total, Method of Verification must, Tax commissioner portal Year, Total MAGI, No information returned, Ohio tax return line plus line, and Federal tax return line EZ Year so that you can move forward to the next step.

When it comes to Tax commissioner portal Year and Method of Verification must, be sure that you take another look in this section. These two are definitely the key ones in the document.

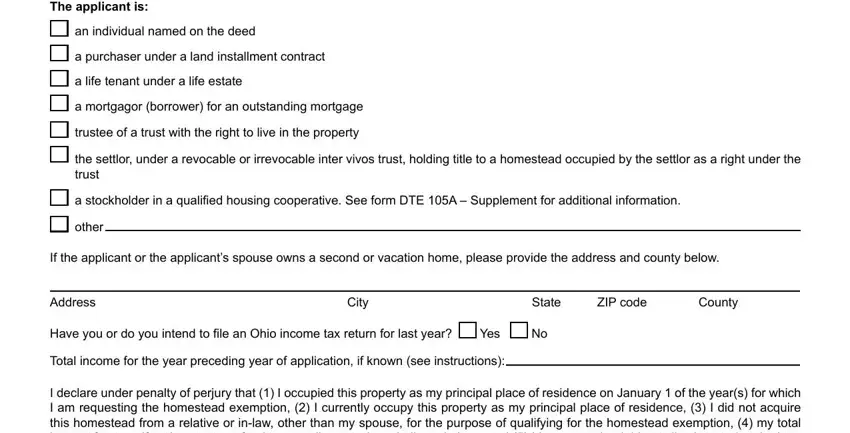

3. This subsequent segment should also be relatively easy, The applicant is, an individual named on the deed, a purchaser under a land, a life tenant under a life estate, a mortgagor borrower for an, trustee of a trust with the right, the settlor under a revocable or, a stockholder in a qualified, other, If the applicant or the applicants, Address, City, State, ZIP code, and County - each one of these form fields will need to be filled out here.

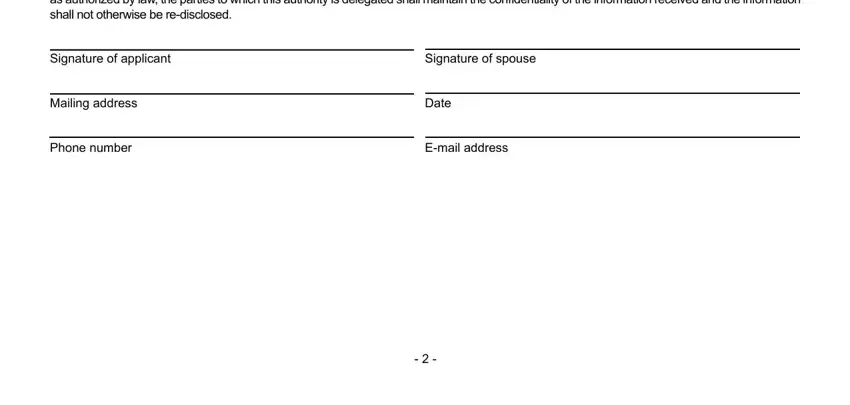

4. All set to fill out this fourth form section! Here you will get these I we acknowledge that by signing, Signature of applicant, Signature of spouse, Mailing address, Phone number, Date, and Email address form blanks to do.

Step 3: Prior to finalizing the document, double-check that blank fields were filled in the proper way. The moment you think it is all good, click on “Done." Right after creating afree trial account at FormsPal, it will be possible to download Dte 105A Form or send it through email directly. The document will also be readily accessible in your personal account with all your changes. When you work with FormsPal, you'll be able to complete forms without worrying about database leaks or entries getting shared. Our protected system ensures that your private data is maintained safely.