In case you want to fill out EIN, you don't have to download and install any kind of programs - simply make use of our online tool. The tool is constantly updated by our team, getting useful features and turning out to be better. Starting is simple! Everything you need to do is follow the following easy steps directly below:

Step 1: Access the form inside our editor by clicking the "Get Form Button" in the top part of this page.

Step 2: With the help of this online PDF editor, you'll be able to do more than just complete forms. Try all of the functions and make your documents appear perfect with customized text incorporated, or optimize the original input to perfection - all supported by an ability to add any type of graphics and sign it off.

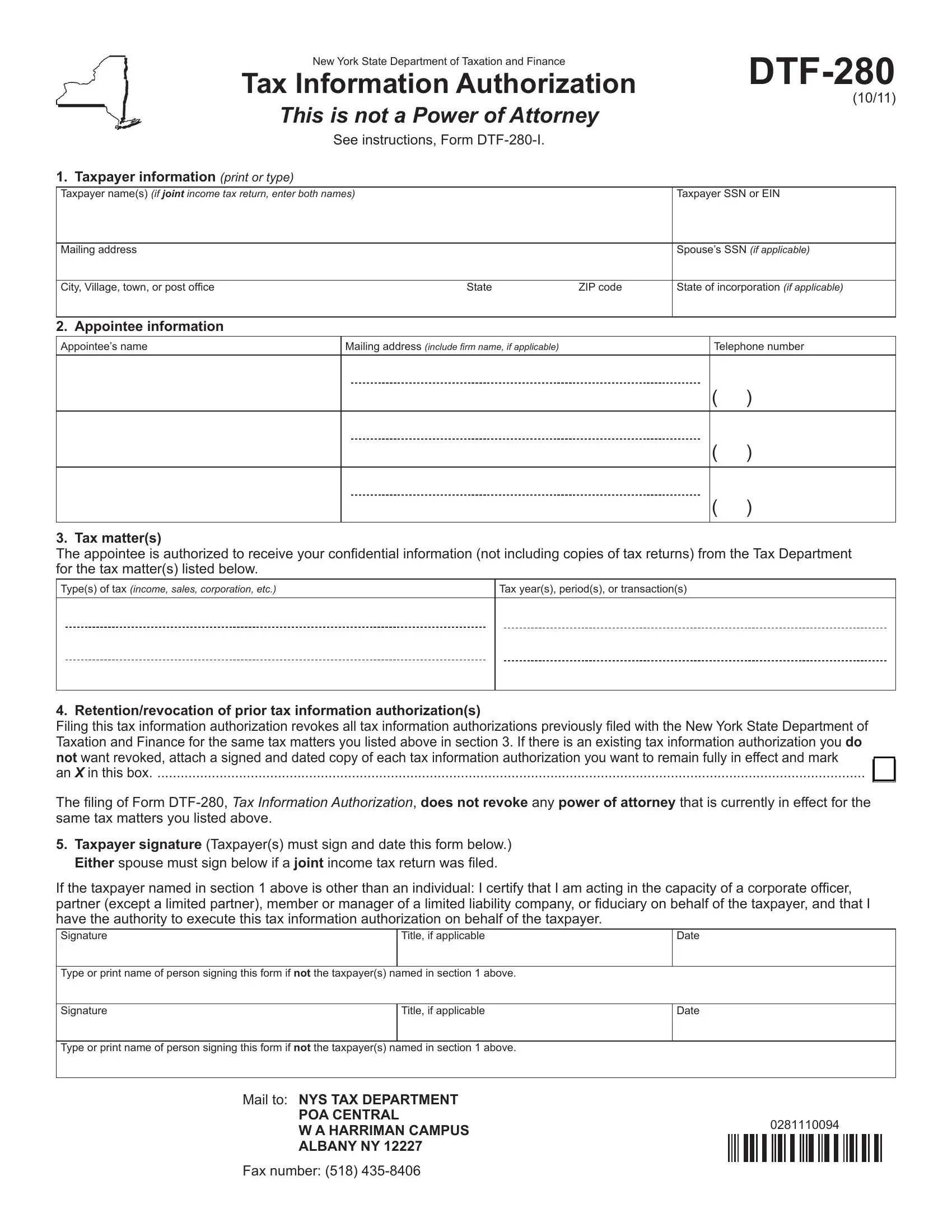

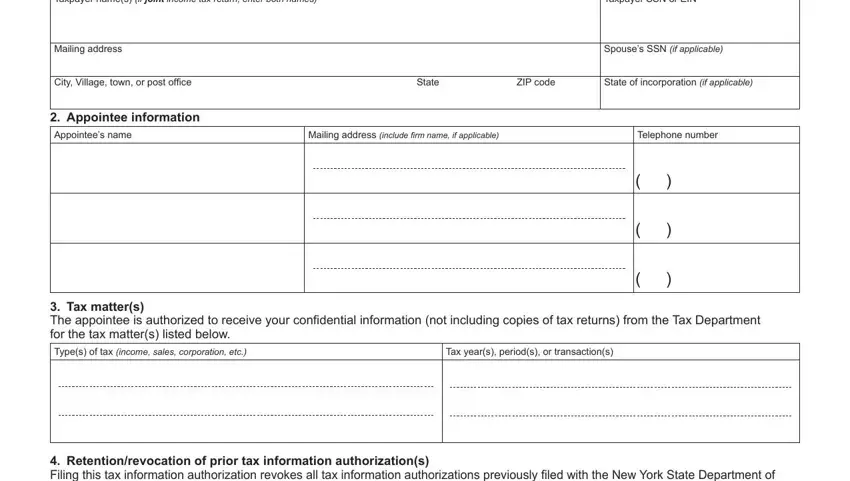

This form will require specific details to be typed in, so be certain to take whatever time to enter what is requested:

1. Begin completing your EIN with a number of major fields. Consider all of the important information and ensure absolutely nothing is forgotten!

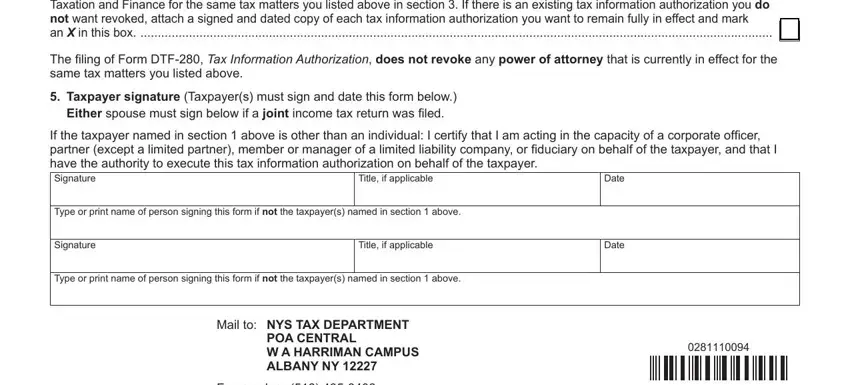

2. Once your current task is complete, take the next step – fill out all of these fields - Retentionrevocation of prior tax, The iling of Form DTF Tax, Taxpayer signature Taxpayers must, Title if applicable, Date, Type or print name of person, Signature, Title if applicable, Date, Type or print name of person, Mail to NYS TAX DEPARTMENT, POA CENTRAL W A HARRIMAN CAMPUS, and Fax number with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Be really attentive while filling out Date and Title if applicable, because this is the part where most people make mistakes.

Step 3: Look through all the details you've inserted in the form fields and then click on the "Done" button. Go for a 7-day free trial option at FormsPal and acquire direct access to EIN - which you can then use as you want from your FormsPal cabinet. FormsPal offers risk-free form completion with no personal data recording or any sort of sharing. Feel safe knowing that your information is secure here!