The DTF-805 form, crafted by the New York State Department of Taxation and Finance, serves a crucial function for individuals engaging in the casual sale of multiple motor vehicles within the same tax jurisdiction. This document intricately guides through the process of recording the purchase details of multiple vehicles, making it an essential tool for ensuring compliance with state tax regulations. Central to the form is the facility to claim exemptions from sales tax, provided certain criteria are met and duly indicated in Section 2 — Owner’s statement of the form. It underscores the necessity of marking an exemption choice clearly, attaching any required forms to justify the exemption, and warns of the tax implications should an exemption not be properly claimed. Additionally, the form mandates detailed vehicle information, spanning from year and make to the purchase price, ensuring a thorough account of each transaction. Importance is placed on the accurate completion and submission of the form to the appropriate local motor vehicle issuing office, underlining its role in the seamless operation of transactions processed by the Department of Motor Vehicles and its agents or county clerk offices. By fulfilling these requirements, purchasers certify their compliance with tax laws, acknowledging the serious consequences of willful evasion. The DTF-805, thus, not only facilitates the recording of multiple vehicle transactions but also reinforces the legal obligations tied to the sale and registration of motor vehicles in New York State.

| Question | Answer |

|---|---|

| Form Name | Form Dtf 805 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | dmv dtf 805, dtf 805 schedule form, new york dtf schedule, dtf 805 printable |

New York State Department of Taxation and Finance |

||

Schedule of Multiple Transactions – |

||

(10/11) |

||

Casual Sale of Motor Vehicle |

||

|

Instructions

Use this form to record the purchase of multiple vehicles for the same taxing jurisdiction.

If the vehicles you are registering are exempt from sales tax, mark an X in the applicable box under Section 2 — Owner’s statement. Only one box can be marked. You must complete a separate Form

Submit the completed form to your local motor vehicle issuing ofice. Use of this form is restricted to transactions processed by the Department of Motor Vehicles and its agents or county clerk ofices.

Section 1 — Purchaser name and address

Name |

|

|

Sales tax identiication number |

|

|

|

|

Street address |

|

|

Direct payment permit number |

|

|

|

DP |

City |

State |

ZIP code |

County |

|

|

|

|

Section 2 — Owner’s statement

Mark an X in only one box. You must attach a copy of any form that is required for the exemption you are claiming.

Sales and use tax will be paid with the issuance of the motor vehicle registrations.

The owner is an organization exempt from tax as described in Tax Law Article 28, section 1116(a). Attach a copy of

Form

Tax is not payable at this time. I have been authorized to make direct payment of sales and use tax to the Tax Department. My direct payment permit number is indicated above and a copy of the permit is attached.

All of the motor vehicles listed below will be used exclusively for rental or lease to customers. Sales and use tax will be paid by the customer to the rental agency or leasing company and reported and paid by the agency or company to the Tax Department.

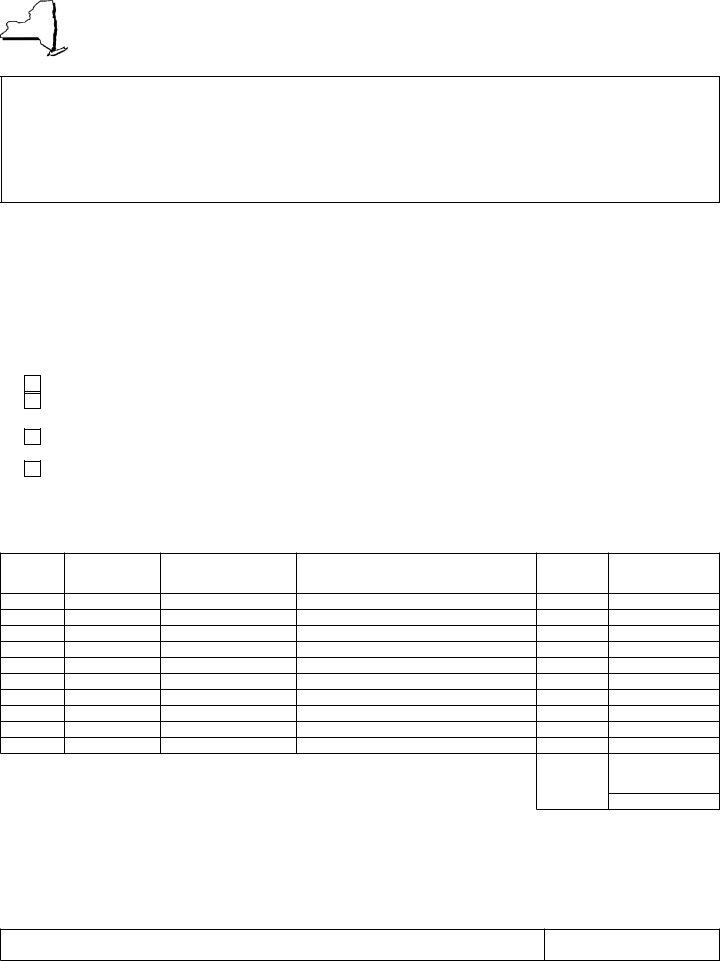

Section 3 — Vehicle information

Complete columns A through E for each vehicle

A

Year

B

Make

C

Identiication

number

D

Name and address of vendor

E

Purchase

price

Bureau

use

only

1. |

Total |

|

|

|

|

2. Location where vehicles will be principally used or garaged: |

|

Applicable |

% |

|

|

|

tax rate |

|

|||

3. |

Sales tax due (multiply line 1 by line 2) |

|

|

|

|

|

|

|

|

||

Purchaser certification — I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I make these statements and issue this exemption certiicate with the knowledge that this document provides evidence that state and local sales or use taxes do not apply to a transaction or transactions for which I tendered this document and that willfully issuing this document with the intent to evade any such tax may constitute a felony or other crime under New York State law, punishable by a substantial ine and possible jail sentence. I understand that this document is required to be iled with, and delivered to the recipient as agent for the Tax Department for the purposes of Tax Law section 1838, and is deemed a document required to be iled with the Tax Department for the purpose of prosecution of offenses. I also understand that the Tax Department is authorized to investigate the validity of tax exclusions or exemptions claimed and the accuracy of any information entered on this document.

Signature

Date