|

DTF-820 (2/12) (back) |

Instructions |

|

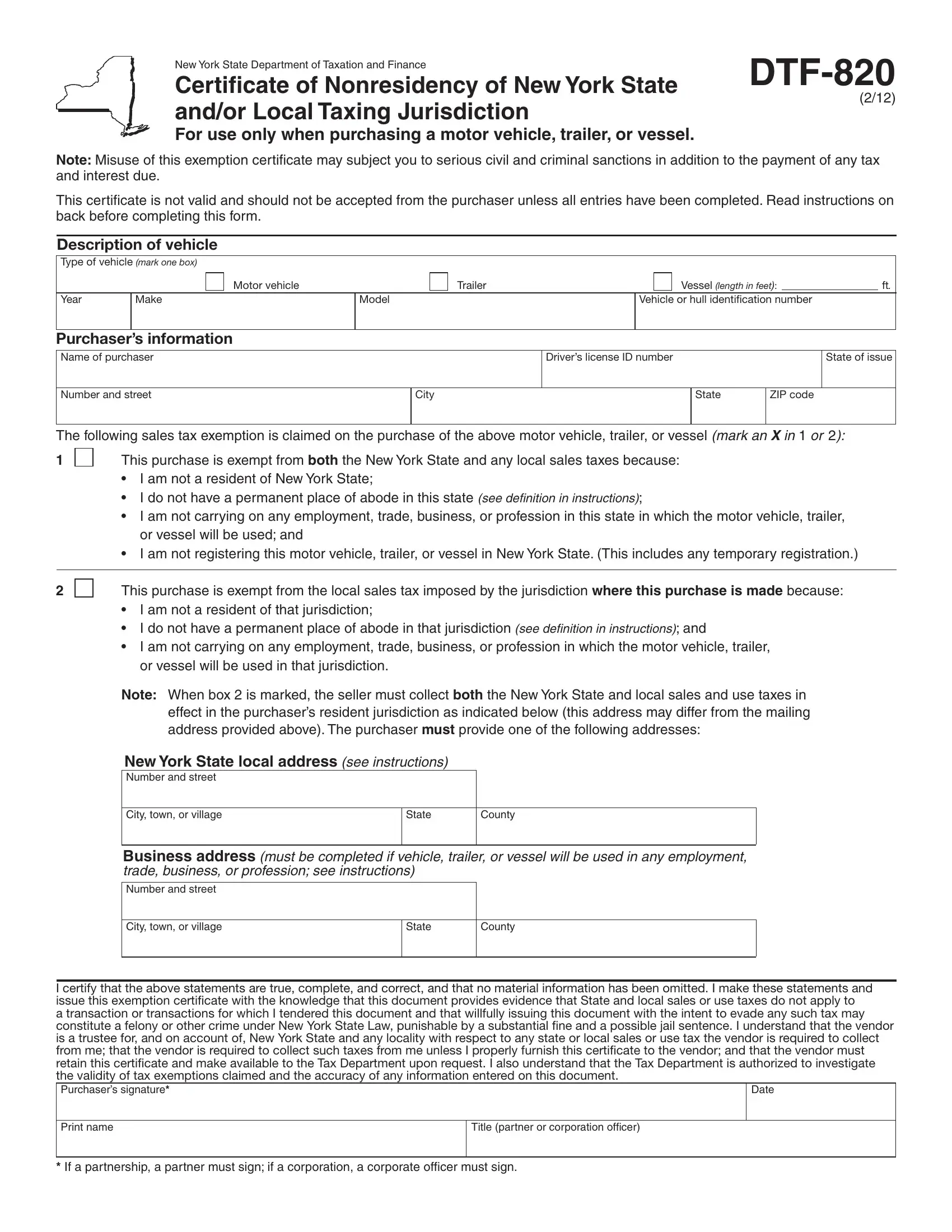

To the purchaser |

|

correctstateandlocaltaxrateforNewYorkStateaddresses. |

|

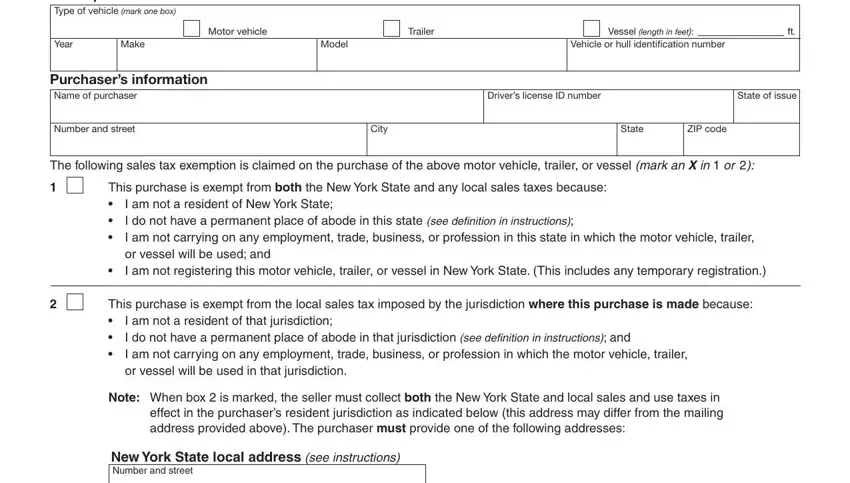

This form is to be used by: |

|

You may also use Publication 718, New York State Sales and |

|

|

Use Tax Rates by Jurisdiction, forthisdetermination. |

|

• a nonresident of New York State to claim an exemption |

|

|

|

|

Caution: DonotuseZIPcodes,includingtheZIPcode |

|

|

from both the state and local sales taxes applicable to the |

|

|

purchase of a motor vehicle, trailer, or vessel, provided |

|

indicated on a purchaser’s driver license, to determine the |

|

|

that the conditions set forth in box 1 are satisfied, and the |

appropriatesalestaxrate.TheuseofZIPcodesfortax |

|

|

purchaser supplies the vendor with a properly completed |

collection purposes results in a high degree of inaccurate tax |

|

|

copyofthiscertiicatepriortotakingdelivery;or |

|

reporting. |

|

|

• a resident of New York State to claim an exemption from |

|

|

|

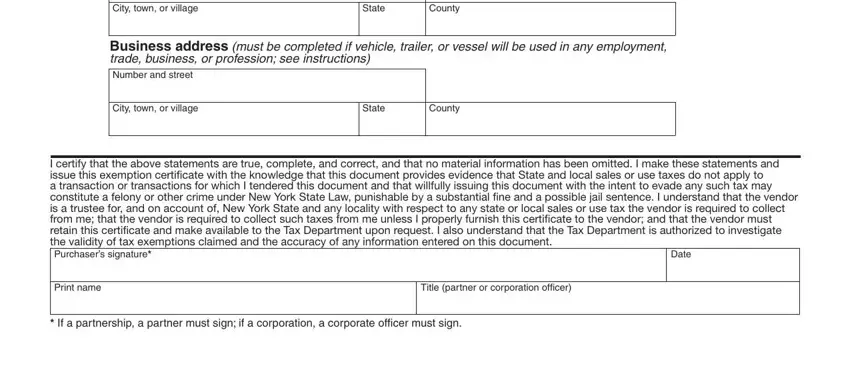

Aregisteredvendorthat,priortothepurchaser’stakingdelivery |

|

the local sales tax imposed in the taxing jurisdiction where |

|

of the motor vehicle, trailer, or vessel, accepts in good faith a |

|

the sale takes place applicable to the purchase of a motor |

|

properly completed Form DTF-820 with: |

|

vehicle, trailer, or vessel, provided that the conditions set |

|

• box 1 marked will be protected from sales tax liability for the |

|

forth in box 2 are satisfied, and the purchaser supplies the |

|

vendor with a properly completed copy of this certificate prior |

transaction;or |

|

totakingdelivery.Note: The seller must collect sales tax |

• box 2 marked will be protected from liability for failure to |

|

at the combined state and local rate in effect in the taxing |

collecttaxattherateineffectwherethesaletakesplace. |

|

jurisdictionwherethepurchaserresides. |

|

Ifbox2ismarked,thevendormustcollecttaxatthecombined |

|

For sales and use tax purposes, an individual is a resident |

|

rate in effect where the purchaser indicates the purchaser is a |

|

of the state and of any locality in which he or she maintains |

resident,asdescribedabove.Thecertiicateiscompleteifall |

|

apermanentplaceofabode.Apermanent place of abode is |

requiredentriesaremade.Acertiicateisacceptedingoodfaith |

|

a dwelling place maintained by a person, or by another for |

when a seller, exercising reasonable and ordinary due care, |

|

that person to use, whether or not owned by such person, on |

has no knowledge that the certificate is false or is fraudulently |

|

otherthanatemporaryortransientbasis.Thedwellingmay |

presented. |

|

beahome,apartment,orlat;aroom,includingaroomata |

This certificate will not be deemed to be accepted in good faith |

|

hotel,motel,boardinghouse,orclub;aroomataresidence |

|

halloperatedbyaneducational,charitable,orotherinstitution; |

where, for example: |

|

housing provided by the armed forces of the United States, |

• The purchaser marks box 1 and enters a New York State |

|

whether such housing is located on or off a military base or |

address in any of the address boxes appearing on the |

|

reservation;oratrailer,mobilehome,houseboat,oranyother |

certiicate. |

|

premises.Thisincludessecondhomes. |

|

• The purchaser marks box 1 and the seller does a courtesy |

|

Box 1 — By marking box 1, the purchaser is claiming an |

|

registration for the purchaser with the New York State |

|

|

DepartmentofMotorVehicles(DMV)oracountyclerk. |

|

exemptionfromboththestateandlocalsalestaxes. |

|

|

|

• The purchaser marks box 2 and the seller has knowledge that |

|

Box 2 — By marking box 2, the purchaser is claiming an |

|

|

|

the purchaser maintains a permanent place of abode in the |

|

exemption from the local tax imposed by the taxing jurisdiction |

localtaxingjurisdictionwherethesaleoccurs. |

|

wherethesaletakesplace.Inthiscase,thesellermustcollect |

You must keep this certificate for at least three years after the |

|

sales tax based on the combined state and local tax rate in effect |

|

wherethepurchaserresides.Ifthepurchaserisan individual, |

due date of the return to which it relates, or the date the return |

|

the applicable rate is the combined state and local rate in effect |

wasiled,iflater.Youmustalsomaintainamethodofassociating |

|

in the taxing jurisdiction where the purchaser has a permanent |

an invoice (or other source document) for an exempt sale made |

|

placeofabode.Ifthepurchaserisabusiness, the applicable |

to a customer with the certificate you have on file from that |

|

rate is the combined state and local rate in effect in the taxing |

customer. |

|

jurisdiction where the motor vehicle, trailer, or vessel will be |

|

|

|

principallygaraged. |

|

Need help? |

|

Ifmarkingbox2,thepurchasermustenterthepurchaser’s |

|

|

|

Visit our Web site at www.tax.ny.gov |

|

New York State local address, including the number and street, |

|

the city, town, or village, and the county where the purchaser |

• get information and manage your taxes online |

|

actually resides.Thecity,town,orvillagewherethepurchaser |

• check for new online services and features |

|

actually resides may be different than the city, town, or village |

|

|

|