reinvested can be filled out effortlessly. Just try FormsPal PDF editor to accomplish the job in a timely fashion. To retain our tool on the forefront of convenience, we work to put into action user-driven features and improvements regularly. We're always looking for suggestions - help us with revampimg how we work with PDF docs. All it takes is several basic steps:

Step 1: Press the orange "Get Form" button above. It'll open our editor so you could start filling out your form.

Step 2: This tool enables you to work with almost all PDF documents in various ways. Enhance it by writing any text, correct original content, and include a signature - all when it's needed!

It will be simple to fill out the form using this detailed guide! Here's what you should do:

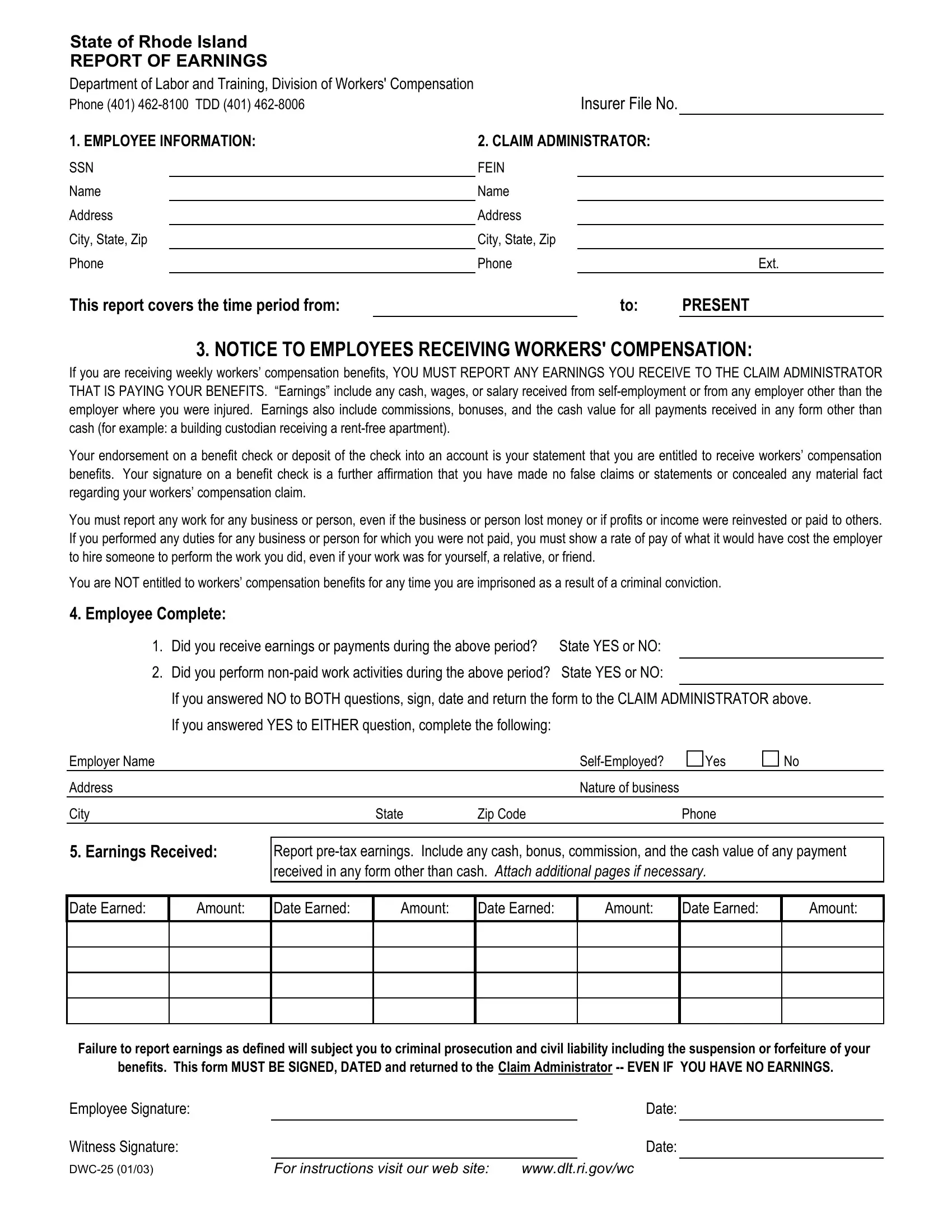

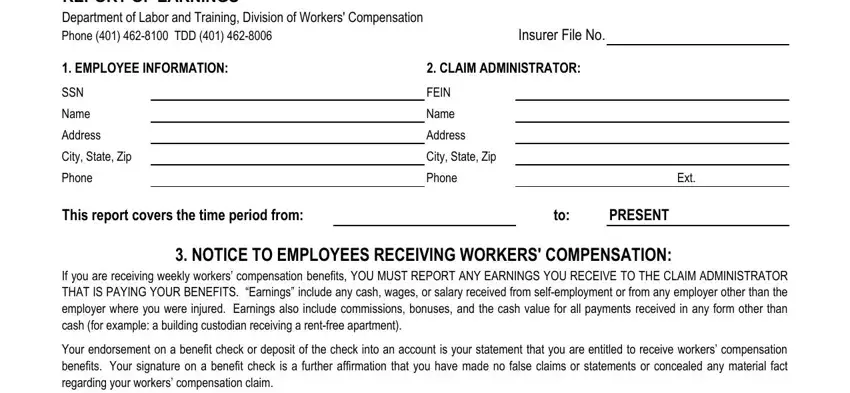

1. Fill out the reinvested with a selection of major fields. Note all of the required information and make sure nothing is forgotten!

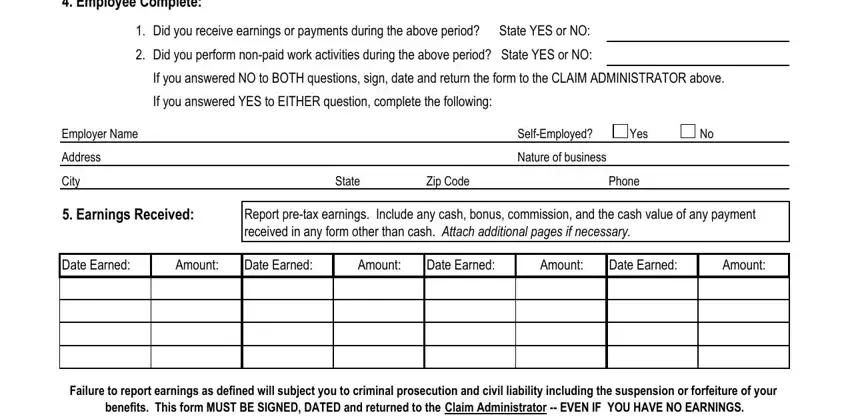

2. Just after the first part is done, go on to enter the relevant details in these - Employee Complete, Did you receive earnings or, Did you perform nonpaid work, If you answered NO to BOTH, If you answered YES to EITHER, Employer Name, Address, City, SelfEmployed, Yes, Nature of business, State, Zip Code, Phone, and Earnings Received.

3. This subsequent part is considered fairly simple, Employee Signature, Witness Signature, DWC, For instructions visit our web, Date, and Date - each one of these blanks needs to be filled in here.

A lot of people often get some points wrong when filling in Employee Signature in this section. You should double-check everything you enter right here.

Step 3: Before moving forward, double-check that blank fields were filled in as intended. Once you think it is all good, press “Done." Sign up with us today and immediately gain access to reinvested, set for downloading. All alterations made by you are saved , which enables you to modify the file later when required. Whenever you work with FormsPal, you're able to fill out forms without stressing about personal data breaches or records getting shared. Our secure software helps to ensure that your personal details are stored safe.