By:Date:

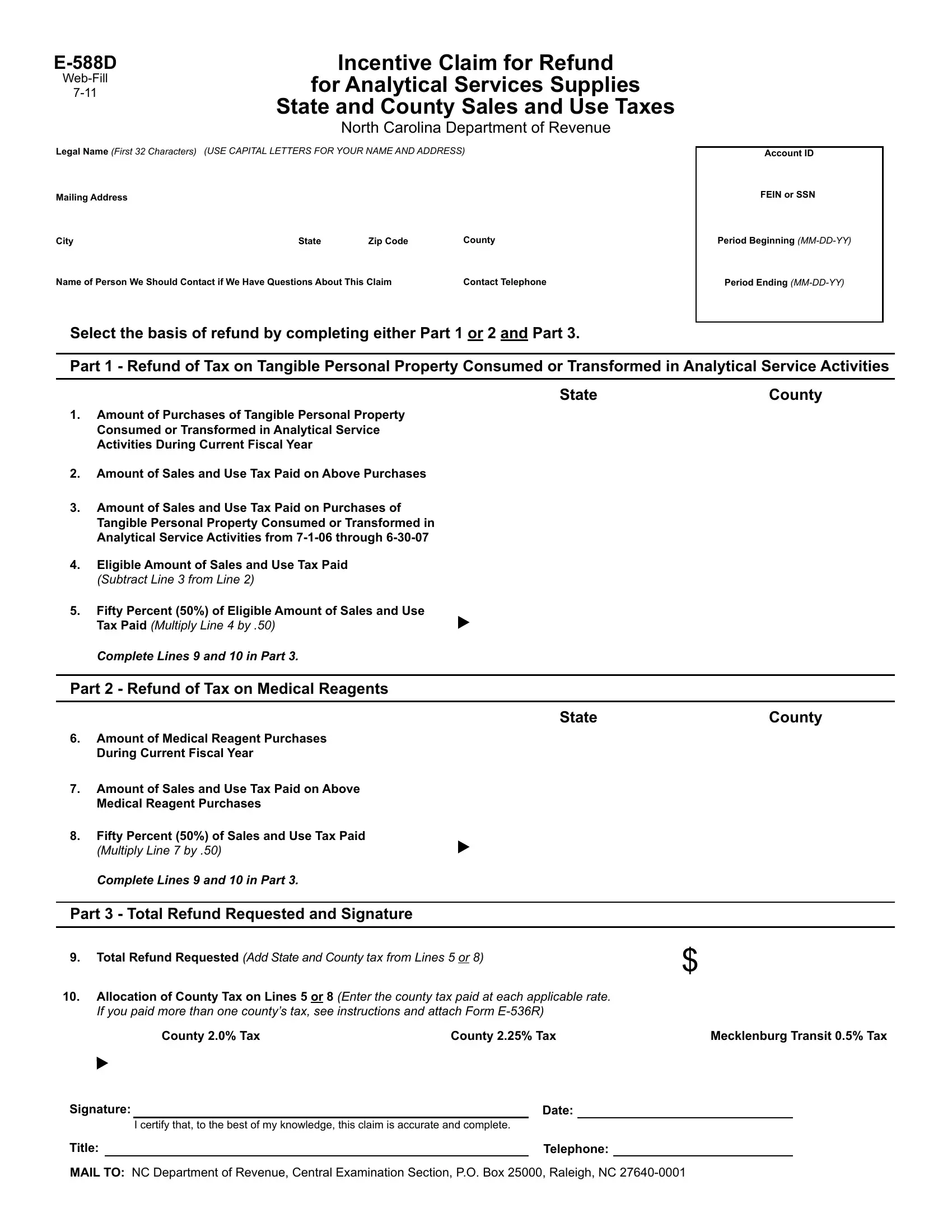

General Instructions

-G.S. 105-164.14A(a)(6) provides that a taxpayer engaged in analytical services in North Carolina is allowed a refund of sales and use tax paid by it in North Carolina. The amount of the refund is the greater of the following:

(1)Fifty percent (50%) of the eligible amount of sales and use tax paid by it on tangible personal property that is consumed or

transformed in analytical service activities. The eligible amount of sales and use tax paid by the taxpayer in this State is the amount by which sales and use taxes paid by the taxpayer in this State in the iscal year exceed the amount paid by the taxpayer in this State in the 2006‑2007 State iscal year.

(2)Fifty percent (50%) of the amount of sales and use tax paid by it in the iscal year on medical reagents.

‑ Claims for refund are due by December 31 for the prior iscal year ending June 30; a refund applied for after the due date is barred. ‑ The refund provision is repealed for purchases made on or after January 1, 2013.

‑ The Department will take one of the following actions within six months after the date the claim is iled: send the requested refund to you; adjust the amount of the refund; deny the refund; or request additional information. If the Department does not take one of the actions within six months, the inaction is considered a proposed denial of the requested refund. If you object to a proposed denial of a refund, you may request a Departmental review of the action if the request is made in writing within 45 days of the date the notice of proposed denial was mailed to you. If the Department has not taken action within six months, a request for review can be iled at any time between the end of the six‑month period and when the Department takes a prescribed action. If a timely request for a Departmental review is not iled, the proposed action is inal and is not subject to further administrative or judicial review.

‑ Use blue or black ink to complete this claim for refund. If you have questions about how to complete this claim, you may call the

Taxpayer Assistance and Collection Center toll-free at 1-877-252-3052.

Line by Line Instructions

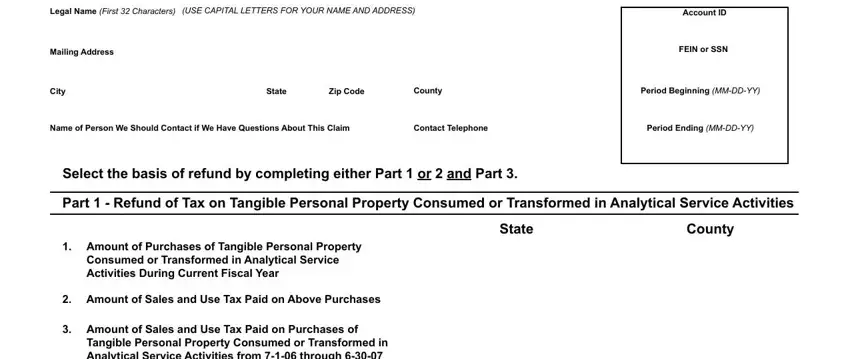

Part 1 - Lines 1 through 5 are to be completed for a refund of sales and use tax paid on tangible personal property consumed or transformed in analytical service activities.

Line 1 - Enter in the State and County Columns the total amount of purchases of tangible personal property consumed or transformed in analytical service activities during the current iscal year on which North Carolina sales or use tax was paid.

Line 2 - Enter in the State Column the total North Carolina State sales and use tax paid on purchases shown on Line 1. Enter in the County Column total county sales and use tax paid on purchases shown on Line 1.

Line 3 - Enter in the State Column the total amount of purchases of tangible personal property consumed or transformed in analytical service activities from July 1, 2006 through June 30, 2007 on which North Carolina State sales or use tax was paid. Enter in

the County Column the total amount of purchases of tangible personal property consumed or transformed in analytical service activities from July 1, 2006 through June 30, 2007 on which county sales or use tax was paid.

Line 4 - Subtract the State tax on Line 3 from the State tax on Line 2 and enter the difference in the State Column. Subtract the County tax on Line 3 from the County tax on Line 2 and enter the difference in the County Column.

Line 5 - Multiply the State tax on Line 4 by .50 and enter the result in the State Column. Multiply the County tax on Line 4 by .50 and enter the result in the County Column. If you made purchases and paid county tax in more than one county you must complete Form E-536R, Schedule of County Sales and Use Taxes for Claims for Refund, to identify the individual counties and rates to which tax was paid. The total of all entries made on Form E-536R should equal the county tax shown on Line 5. Complete Lines 9 and 10 in Part 3.

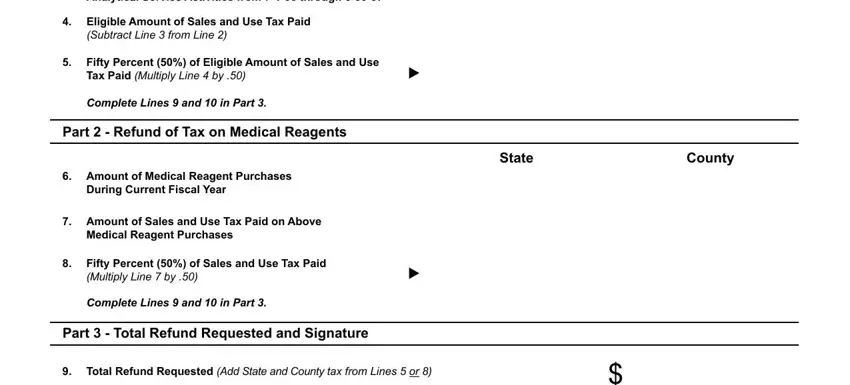

Part 2 - Lines 6 through 8 are to be completed for a refund of sales and use tax paid on medical reagents.

Line 6 ‑ Enter in the State and County Columns the total amount of purchases of medical reagents during the current iscal year on

which North Carolina sales or use tax was paid.

Line 7 - Enter in the State Column the total North Carolina State sales and use tax paid on purchases shown on Line 6. Enter in the County Column the total county sales and use tax paid on purchases shown on Line 6.

Line 8 - Multiply the State tax on Line 7 by .50 and enter the result in the State Column. Multiply the County tax on Line 7 by .50 and enter the result in the County Column. If you made purchases and paid county tax in more than one county you must complete Form E-536R, Schedule of County Sales and Use Taxes for Claims for Refund, to identify the individual counties and rates to which tax was paid. The total of all entries made on Form E-536R should equal the county tax shown on Line 8. Complete Lines 9 and 10 in Part 3.

Part 3 - Lines 9 and 10 must be completed for all refunds.

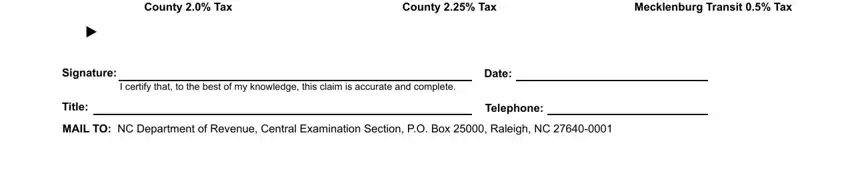

Line 9 - Add the State and county taxes on Lines 5 or 8 and enter the total. This is the total amount of refund that you are requesting. Line 10 - Allocate the amount of county tax included on Lines 5 or 8 in the County Column to the applicable rate. If you are required to

complete Form E-536R, Schedule of County Sales and Use Taxes for Claims for Refund, the amounts entered on Line 10 must equal the total amounts by rate included on Form E‑536R.