Navigating the complexities of electronic funds transfers (EFT) is made significantly easier with the EFT-1 Authorization Agreement for Electronic Funds Transfers. Housed under the auspices of the Department of Revenue Services at 25 Sigourney Street, Hartford, CT, this crucial document facilitates a streamlined process for entities required to remit various types of taxes electronically. Essentially, it serves as a bridge between businesses and the Connecticut Department of Revenue Services (DRS), ensuring that tax payments are efficiently processed in a secure manner. The form is divided into two principal parts: contact information and payment options, encompassing both ACH Debit (Direct Payment) and ACH Credit setups. Specifically, it calls for detailed inputs, including the primary EFT contact person’s details and the company's banking information, to facilitate either direct payments via the Taxpayer Service Center (TSC) or ACH credit transactions. Moreover, it outlines how taxpayers can access the TSC, either online or via telephone, to file returns or make payments for a wide array of taxes. The straightforward completion process and the subsequent benefits underscore the EFT-1 form's pivotal role in modernizing tax payment frameworks, aligning with electronic banking standards, and ensuring compliance with Connecticut’s tax remittance regulations.

| Question | Answer |

|---|---|

| Form Name | Form Eft 1 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | eft 1 ct eft 1 form |

Department of Revenue Services

25 Sigourney Street

Hartford CT

(Rev. 07/07)

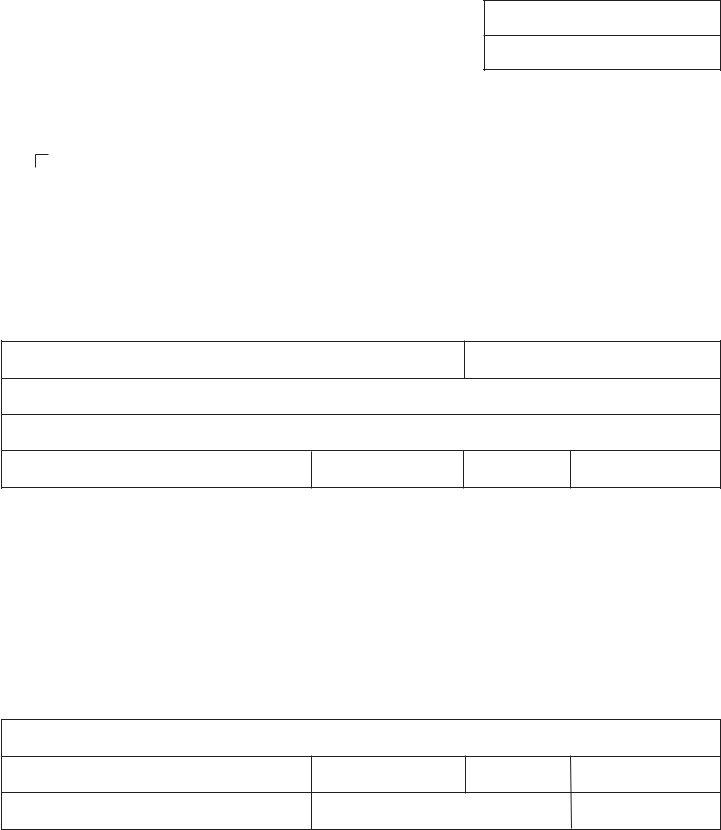

Authorization Agreement for Electronic Funds Transfers

Connecticut Tax Registration Number

Tax Type

See back for instructions. Please print or type. Complete in blue or black ink only.

Enter company name and mailing address.

Part 1: Electronic Funds Transfer (EFT) Contact

All ACH Credit applicants must complete this section.

Primary EFT Contact Person

Name

Telephone Number

()

Company Name or Service Provider

Email Address

Address (number and street)

City

State

ZIP Code

Part 2: Payment Options

ACH Debit (Direct Payment)

To make a direct payment using the Department of Revenue Services (DRS) Taxpayer Service Center (TSC), you need not submit form

ACH Credit

Payment related information must be sent in the standard National Automated Clearing House Association (NACHA) CCD + TXP format. Confirm with your bank representative that you and your bank are able to initiate ACH credit transactions. We will mail instructions and formats to the EFT contact person after we receive a completed authorization agreement.

Please provide the following information:

Bank Information

Bank Name

Bank Address (number and street) |

City |

State |

ZIP Code |

Taxpayer (Owner, Partner, or Corporate Officer) Signature |

Title |

Date |

Complete the return in blue or black ink only.

Part 1: Electronic Funds Transfers (EFT) Contact

EFT contact person

Enter the name of the primary contact person. The primary contact person should be the individual responsible for the initiation of the EFT payment.

Company Name or Service Provider

Enter the name of the company responsible for initiating the electronic payments.

Address

Enter the mailing address to be used for EFT correspondence.

Telephone Number and Email Address

Enter the telephone number and email address for the EFT contact person.

Part 2: Payment Options

ACH Debit (Direct Payment)

Taxpayers required to make payment electronically must initiate payment prior to 4:30 p.m. Eastern time on the last banking day before the due date.

Making a direct payment using the TSC, you provide your banking information and authorize DRS to initiate the EFT by entering the amount of the payment and the date of transfer. You do not have to preregister or submit Form

Taxpayer Service Center

The TSC is an interactive electronic services site that is a fast, free, accurate, and secure way to electronically file eligible tax returns and pay the tax due, or to initiate a

If you are required to remit your sales and use taxes, admissions and dues tax, business use tax, room occupancy tax, nursing home user fee, or withholding tax electronically, you are also required to file the returns for these taxes electronically using the TSC.

You may use the TSC to file the following returns on the Internet or by telephone:

•Form

•

•Form

•Form

The following returns are available electronically only on the Internet:

•Form

•Form

•Form

•Form 472, Attorney Occupational Tax Return;

•

•

•

See Informational Publication 2007(8), Paying Connecticut Taxes by Electronic Funds Transfer, for more information and for a list of additional taxes that can be filed electronically.

ACH Credit

You must send ACH credit transactions in the standard NACHA CCD+TXP format. You should confirm with your bank representative that you and your bank are able to initiate ACH credit transactions. DRS will provide the EFT contact person with additional instructions after DRS receives the completed Form

If you are required to remit your sales and use taxes, admissions and dues tax, business use tax, room occupancy tax, nursing home user fee, or withholding tax electronically, you are also required to file the returns for these taxes electronically using the TSC.

Bank Name

Enter the name of the bank you will use for EFT.

Bank Address

Enter the address of the bank branch you will use.

Taxpayer Signature

An owner, partner, or corporate officer must sign Form

Mailing Address

Complete this form and mail to:

Department of Revenue Services

PO Box 2937

Hartford CT

Payroll Companies and Tax Payment Services

ACH Debit

You do not have to preregister or submit Form

ACH Credit

Companies may submit a completed Form

EFT Unit Telephone Number: |

|

EFT Unit Fax Number: |

|

EFT Unit Email Address: |

ct.eft@po.state.ct.us |

Forms and Publications

Forms and publications are available anytime:

•Internet: Visit the DRS website at www.ct.gov/DRS to download and print Connecticut tax forms; or

•Telephone: Call