Employment and |

Emploi et |

Social Development Canada |

Développement social Canada |

PROTECTED B WHEN COMPLETED

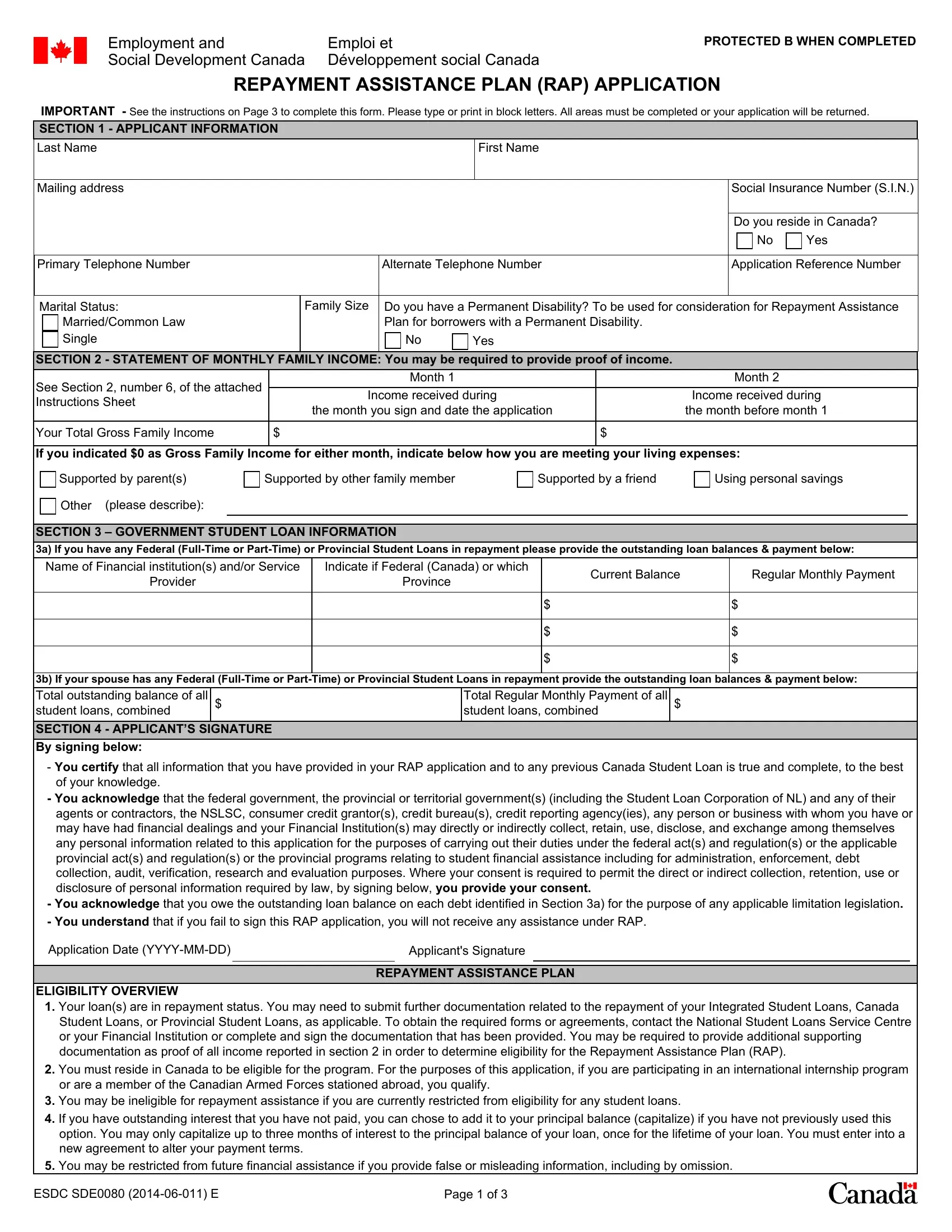

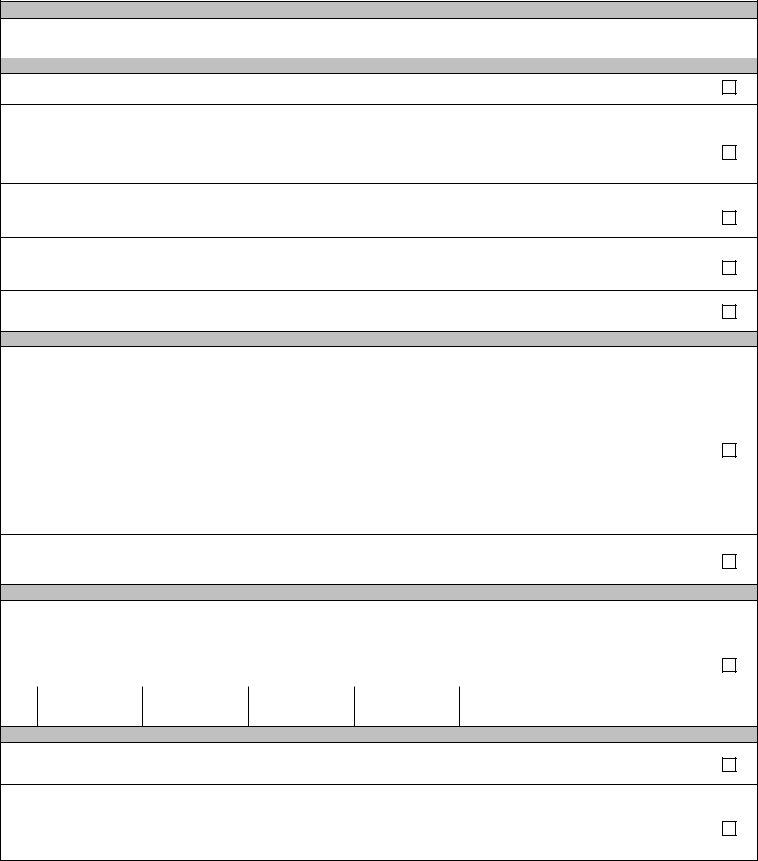

REPAYMENT ASSISTANCE PLAN (RAP) APPLICATION

IMPORTANT - See the instructions on Page 3 to complete this form. Please type or print in block letters. All areas must be completed or your application will be returned.

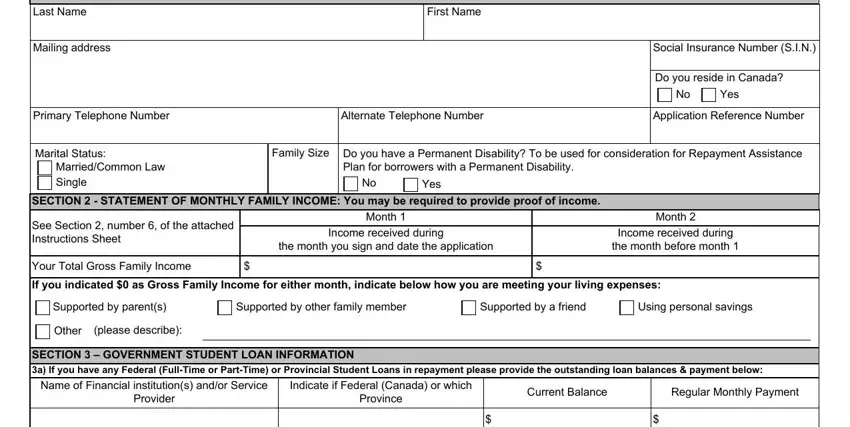

SECTION 1 - APPLICANT INFORMATION

Last Name |

|

|

First Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

Social Insurance Number (S.I.N.) |

|

|

|

|

|

|

|

|

|

|

|

|

Do you reside in Canada? |

|

|

|

|

|

|

No |

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary Telephone Number |

|

Alternate Telephone Number |

Application Reference Number |

|

|

|

|

Marital Status: |

Family Size |

Do you have a Permanent Disability? To be used for consideration for Repayment Assistance |

Married/Common Law |

|

Plan for borrowers with a Permanent Disability. |

|

|

|

|

|

Single |

|

No |

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 2 - STATEMENT OF MONTHLY FAMILY INCOME: You may be required to provide proof of income.

|

See Section 2, number 6, of the attached |

Month 1 |

Month 2 |

|

|

|

|

Income received during |

Income received during |

|

Instructions Sheet |

|

the month you sign and date the application |

the month before month 1 |

|

|

|

|

|

|

|

Your Total Gross Family Income |

$ |

$ |

|

|

|

|

If you indicated $0 as Gross Family Income for either month, indicate below how you are meeting your living expenses:

Supported by parent(s) |

|

Supported by other family member |

|

Supported by a friend |

|

Using personal savings |

Other (please describe): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 3 – GOVERNMENT STUDENT LOAN INFORMATION

3a) If you have any Federal (Full-Time or Part-Time) or Provincial Student Loans in repayment please provide the outstanding loan balances & payment below:

|

Name of Financial institution(s) and/or Service |

Indicate if Federal (Canada) or which |

Current Balance |

Regular Monthly Payment |

|

Provider |

Province |

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

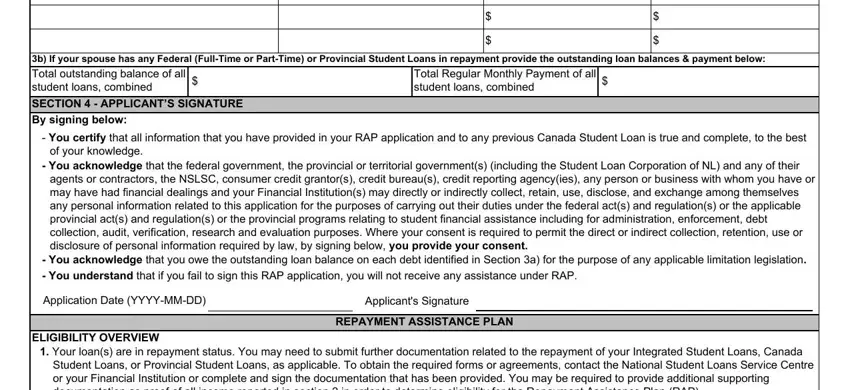

$ |

$ |

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

3b) If your spouse has any Federal (Full-Time or Part-Time) or Provincial Student Loans in repayment provide the outstanding loan balances & payment below:

Total outstanding balance of all student loans, combined

Total Regular Monthly Payment of all student loans, combined

SECTION 4 - APPLICANT’S SIGNATURE

By signing below:

-You certify that all information that you have provided in your RAP application and to any previous Canada Student Loan is true and complete, to the best of your knowledge.

-You acknowledge that the federal government, the provincial or territorial government(s) (including the Student Loan Corporation of NL) and any of their agents or contractors, the NSLSC, consumer credit grantor(s), credit bureau(s), credit reporting agency(ies), any person or business with whom you have or may have had financial dealings and your Financial Institution(s) may directly or indirectly collect, retain, use, disclose, and exchange among themselves any personal information related to this application for the purposes of carrying out their duties under the federal act(s) and regulation(s) or the applicable provincial act(s) and regulation(s) or the provincial programs relating to student financial assistance including for administration, enforcement, debt collection, audit, verification, research and evaluation purposes. Where your consent is required to permit the direct or indirect collection, retention, use or disclosure of personal information required by law, by signing below, you provide your consent.

-You acknowledge that you owe the outstanding loan balance on each debt identified in Section 3a) for the purpose of any applicable limitation legislation.

-You understand that if you fail to sign this RAP application, you will not receive any assistance under RAP.

Application Date (YYYY-MM-DD) |

|

Applicant's Signature |

|

|

|

REPAYMENT ASSISTANCE PLAN

ELIGIBILITY OVERVIEW

1.Your loan(s) are in repayment status. You may need to submit further documentation related to the repayment of your Integrated Student Loans, Canada Student Loans, or Provincial Student Loans, as applicable. To obtain the required forms or agreements, contact the National Student Loans Service Centre or your Financial Institution or complete and sign the documentation that has been provided. You may be required to provide additional supporting documentation as proof of all income reported in section 2 in order to determine eligibility for the Repayment Assistance Plan (RAP).

2.You must reside in Canada to be eligible for the program. For the purposes of this application, if you are participating in an international internship program or are a member of the Canadian Armed Forces stationed abroad, you qualify.

3.You may be ineligible for repayment assistance if you are currently restricted from eligibility for any student loans.

4.If you have outstanding interest that you have not paid, you can chose to add it to your principal balance (capitalize) if you have not previously used this option. You may only capitalize up to three months of interest to the principal balance of your loan, once for the lifetime of your loan. You must enter into a new agreement to alter your payment terms.

5.You may be restricted from future financial assistance if you provide false or misleading information, including by omission.

ESDC SDE0080 (2014-06-011) E |

Page 1 of 3 |

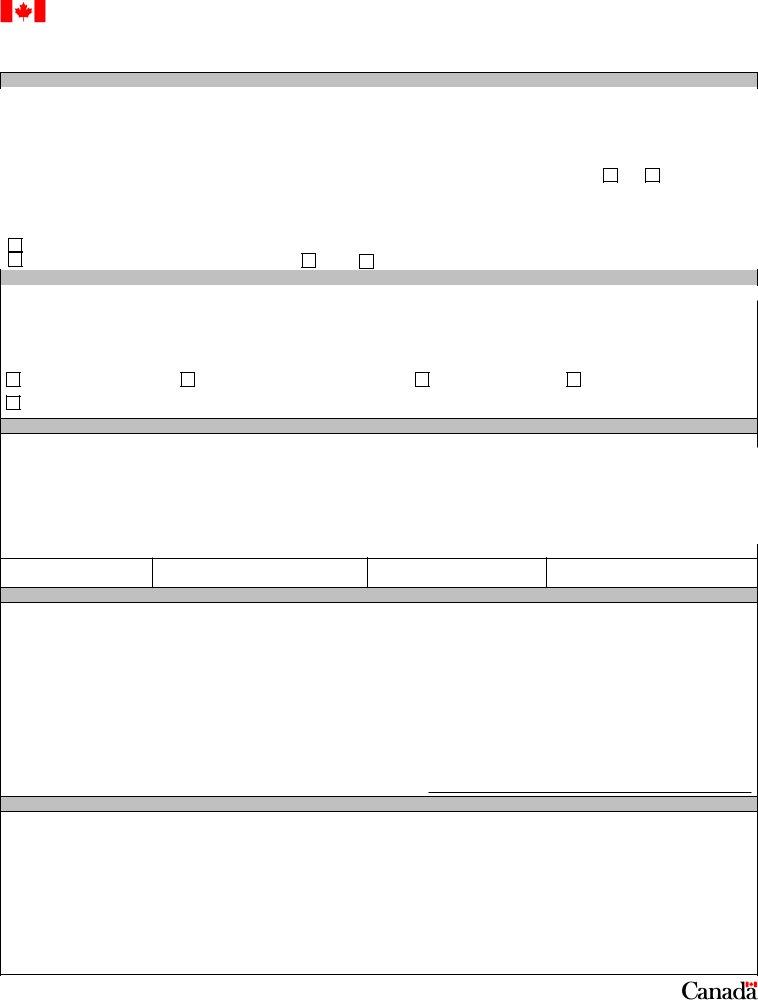

REPAYMENT ASSISTANCE PLAN

CONTACT INFORMATION

If you need help completing this application or have other questions concerning your student loans, please contact the National Student Loans Service Centre or your Financial Institution.

|

|

|

|

National Student Loans Service Centre |

On-line: CanLearn.ca |

|

Toll Free: 1 888 815-4514 (within North America) |

800 2 225-2501 (outside North America) |

TTY: 1 888 815-4556 |

FAST FACTS ABOUT THE REPAYMENT ASSISTANCE PLAN (RAP)

If you have student loans from Alberta, British Columbia, Ontario, New Brunswick, Newfoundland and Labrador, Nova Scotia or Saskatchewan, this single application will cover both your Federal and Provincial loans under the applicable Federal and Provincial RAP programs and Interest Relief for some provincial loans.

If you are approved for RAP, your loan payment terms will be altered during your approved period of RAP in accordance with the applicable Federal and Provincial RAP programs. More specifically, if you are approved for RAP, your monthly payment amount will be reduced to an affordable payment that will never exceed 20% of your family income, and may be reduced to a zero payment amount. During an approved period of RAP, all payments will be applied to your principal first. If you are not approved for RAP, you will remain responsible for making your regular loan payments in accordance with your payment terms.

Periods of Assistance - RAP is available in 6-month blocks of time (to a maximum of 180 months) at any point during your loan repayment.

Re-Application - At the end of your 6-month RAP term, if you wish to continue with repayment assistance, you must re-apply. If not, you are responsible for making your regular loan principal and interest payments in accordance with your regular payment terms. Depending on the impact of RAP on your Outstanding Loan Balance, your payment amount may increase or your amortization period may be extended.

Restrictions - If you are approved for RAP, you may be subject to restrictions IF (1) you fail to make all your affordable payments by the end of the month following your 6 month RAP period, (2) you receive "write down" benefits in RAP Stage 2, or (3) you are on RAP-PD and more than five years have passed since your completion of studies. Restrictions will prevent you from obtaining further loans and grants until you have paid off your existing student loans.

Further details on restrictions are available through NSLSC or at CanLearn.ca.

Dates - You must sign and date your application and ensure that the National Student Loans Service Centre or your Financial Institution receives your application within 40 days of your signature date. The National Student Loans Service Centre or your Financial Institution will send a letter to you with the result of your application.

NOTICE OF COLLECTION OF PERSONAL INFORMATION

The personal information that is collected and used for administration of the Canada Student Loans Program (CSLP) is authorized by the Canada Student Financial Administration Act (CSFAA) and the Canada Student Loan Act, and is administered in accordance with the Privacy Act.

The Social Insurance Number (SIN) is collected by the Minister of Employment and Social Development under the express authority of the CSFAA and in accordance with the Treasury Board Secretariat Directive on Privacy Protection regarding use of the SIN. The SIN will be used for the administration of the CSLP under the CSFAA. The SIN will be used as a file identifier and, along with the other information you provide, will also be used to validate your application, and to administer and enforce the CSLP. You must provide your SIN and the other personal information requested on this form to be considered for the CSLP.

Your personal information will be stored by Canada in Personal Information Bank No. ESDC PPU 030. You have the right to the protection of, and access to, your personal information. How to obtain access to your personal information is available in the publication InfoSource, available at Service Canada Centres, by calling 1-800 O-Canada (1-800-622-6232) or at infosource.gc.ca.

The information collected on this form will be shared with provincial governments, financial institutions and the National Student Loans Service Centre. It could also be shared with other federal government institutions, the Student Loan Corporation of NL and its agents, and any previous lender for the purpose of the administration and enforcement of the CSFAA or the CSLA.

Administration and enforcement of the CSLP means development and operation of the program, including investigations into allegations of wrongdoing, audits, and policy analysis, research and evaluation. These activities may involve the matching of various sources of data that are under the control of the Government of Canada.

NOTICE OF COLLECTION OF PERSONAL INFORMATION (relevant to borrowers with ON student loans)

The personal information provided in connection with this application, including your Social Insurance Number ("SIN"), is necessary for the proper administration of the Ontario Student Assistance Program ("OSAP"). This information is being collected and will be used by the Ministry of Training, Colleges and Universities ("the ministry") to administer and enforce OSAP including: determining eligibility; verifying the application and any Interest Relief granted; maintaining and auditing the applicant's file; and collecting loans, overpayments, and repayments. Your SIN will be used as a general identifier in administering OSAP. The ministry administers and enforces OSAP under the authority of the Ministry of Training, Colleges and Universities Act, R.S.O. 1990, c. M.19, as amended, and R.R.O. 1990, Reg. 774, as amended, O. Reg. 312/10, as amended, and O. Reg. 268/01, as amended; the Ontario Financial Administration Act, R.S.O.1990, c. F.12, as amended; the Canada Student Financial Assistance Act, S.C. 1994, c.28, as amended, and the Canada Student Financial Assistance Regulations, SOR 95-329, as amended. If you have any questions about the collection or use of this information, contact the Director, Student Support Branch, Ministry of Training, Colleges and Universities, PO Box 4500, 189 Red River Road, 4th Floor, Thunder Bay ON P7B 6G9; (807) 343-7260.

NOTICE OF COLLECTION OF PERSONAL INFORMATION (relevant to borrowers with BC student loans)

The personal information in relation to this application, or subsequently collected from you relevant to this application, is collected by or on behalf of BC under the authority of section 26(c) of the BC Freedom of Information and Protection of Privacy Act ("FOIPPA") for the purposes of assessing your on-going eligibility for and administering repayment assistance, administering and enforcing your British Columbia student loan(s), and administering the British Columbia Student Assistance Program, including verifying and investigating information provided in connection with this application. Questions about the collection and use of your personal information can be directed to the Executive Director, StudentAid BC, Ministry of Advanced Education, PO Box 9173, Stn Prov Govt, Victoria, BC V8W 9H7 (call 250-387-6100 (Victoria), 604-660-2610 (BC Lower Mainland) or 1-800-561-1818 (toll-free in Canada/USA).

ESDC SDE0080 (2014-06-011) E |

Page 2 of 3 |

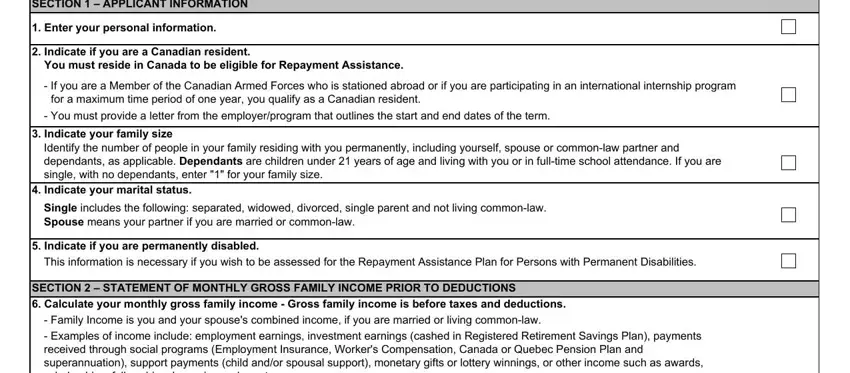

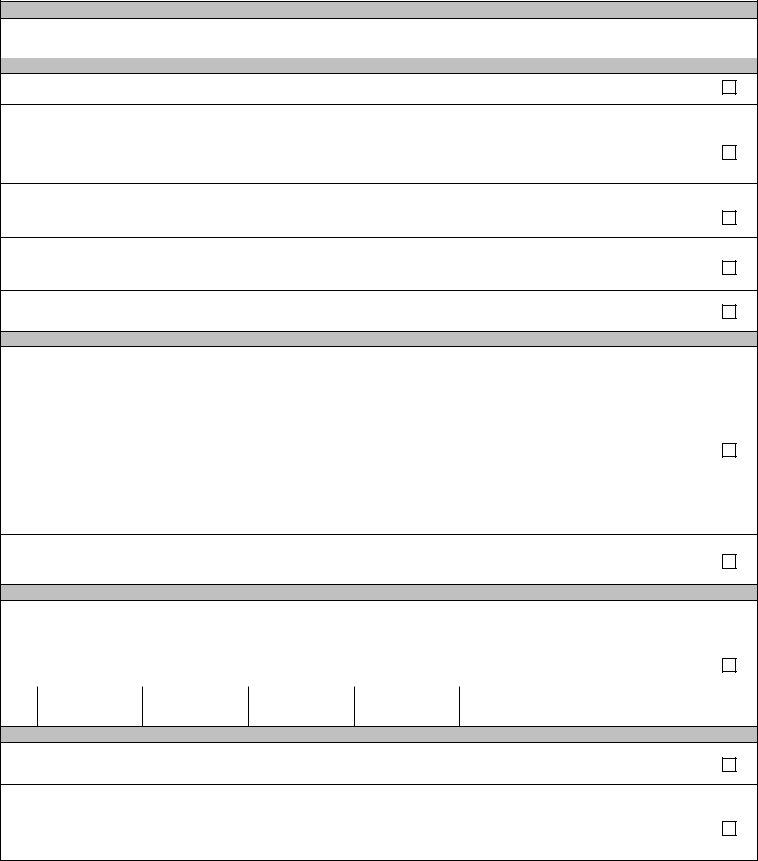

INSTRUCTIONS TO COMPLETE YOUR REPAYMENT ASSISTANCE PLAN APPLICATION

To ensure that your Repayment Assistance Application is processed as quickly as possible, it is important that you fill it out completely and correctly, and provide all supporting documentation.

Please use the checklist below to ensure you have covered all the steps.

SECTION 1 – APPLICANT INFORMATION

1. Enter your personal information.

2.Indicate if you are a Canadian resident.

You must reside in Canada to be eligible for Repayment Assistance.

-If you are a Member of the Canadian Armed Forces who is stationed abroad or if you are participating in an international internship program for a maximum time period of one year, you qualify as a Canadian resident.

-You must provide a letter from the employer/program that outlines the start and end dates of the term.

3.Indicate your family size

Identify the number of people in your family residing with you permanently, including yourself, spouse or common-law partner and dependants, as applicable. Dependants are children under 21 years of age and living with you or in full-time school attendance. If you are single, with no dependants, enter "1" for your family size.

4.Indicate your marital status.

Single includes the following: separated, widowed, divorced, single parent and not living common-law. Spouse means your partner if you are married or common-law.

5.Indicate if you are permanently disabled.

This information is necessary if you wish to be assessed for the Repayment Assistance Plan for Persons with Permanent Disabilities.

SECTION 2 – STATEMENT OF MONTHLY GROSS FAMILY INCOME PRIOR TO DEDUCTIONS

6.Calculate your monthly gross family income - Gross family income is before taxes and deductions.

-Family Income is you and your spouse's combined income, if you are married or living common-law.

-Examples of income include: employment earnings, investment earnings (cashed in Registered Retirement Savings Plan), payments received through social programs (Employment Insurance, Worker's Compensation, Canada or Quebec Pension Plan and superannuation), support payments (child and/or spousal support), monetary gifts or lottery winnings, or other income such as awards, scholarships, fellowships, bursaries and grants.

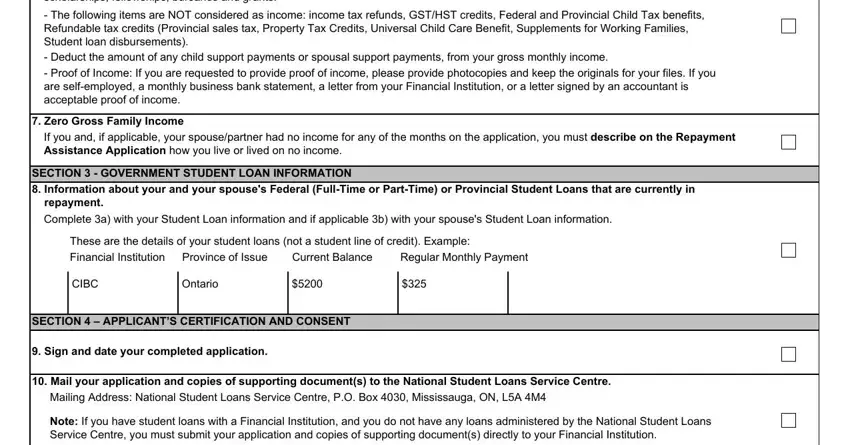

-The following items are NOT considered as income: income tax refunds, GST/HST credits, Federal and Provincial Child Tax benefits,

Refundable tax credits (Provincial sales tax, Property Tax Credits, Universal Child Care Benefit, Supplements for Working Families, Student loan disbursements).

-Deduct the amount of any child support payments or spousal support payments, from your gross monthly income.

-Proof of Income: If you are requested to provide proof of income, please provide photocopies and keep the originals for your files. If you are self-employed, a monthly business bank statement, a letter from your Financial Institution, or a letter signed by an accountant is acceptable proof of income.

7.Zero Gross Family Income

If you and, if applicable, your spouse/partner had no income for any of the months on the application, you must describe on the Repayment Assistance Application how you live or lived on no income.

SECTION 3 - GOVERNMENT STUDENT LOAN INFORMATION

8.Information about your and your spouse's Federal (Full-Time or Part-Time) or Provincial Student Loans that are currently in repayment.

Complete 3a) with your Student Loan information and if applicable 3b) with your spouse's Student Loan information.

These are the details of your student loans (not a student line of credit). Example:

Financial Institution Province of Issue |

Current Balance |

Regular Monthly Payment |

SECTION 4 – APPLICANT’S CERTIFICATION AND CONSENT

9.Sign and date your completed application.

10.Mail your application and copies of supporting document(s) to the National Student Loans Service Centre. Mailing Address: National Student Loans Service Centre, P.O. Box 4030, Mississauga, ON, L5A 4M4

Note: If you have student loans with a Financial Institution, and you do not have any loans administered by the National Student Loans Service Centre, you must submit your application and copies of supporting document(s) directly to your Financial Institution.

ESDC SDE0080 (2014-06-011) E |

Page 3 of 3 |