Form F 16006 can be filled out online in no time. Just open FormsPal PDF tool to do the job promptly. The editor is constantly upgraded by our staff, getting new awesome features and becoming greater. This is what you would want to do to get going:

Step 1: Click the "Get Form" button above. It is going to open up our tool so you can begin completing your form.

Step 2: The tool will allow you to change PDF files in various ways. Change it by adding your own text, adjust what is originally in the file, and put in a signature - all within several mouse clicks!

It is simple to finish the document adhering to our detailed tutorial! Here is what you want to do:

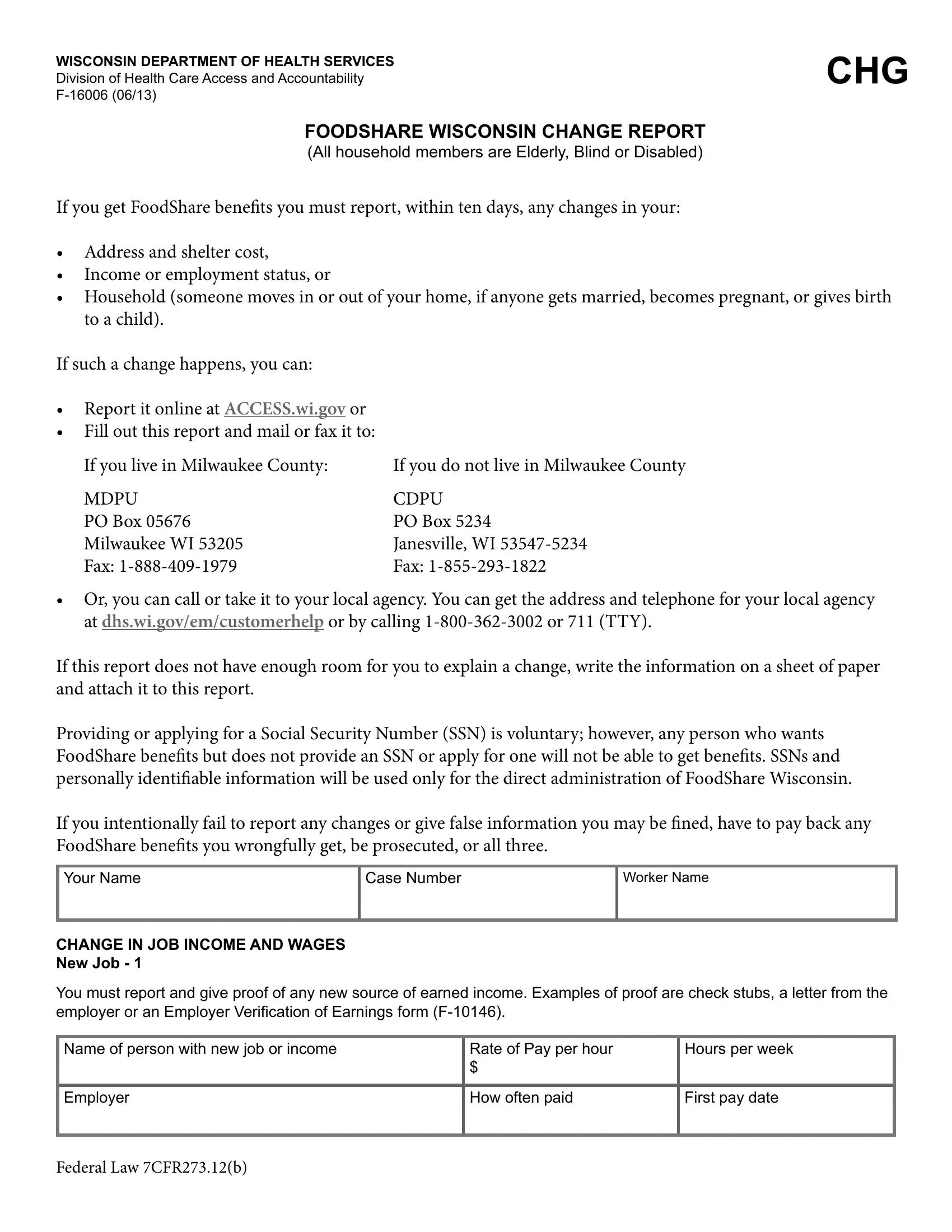

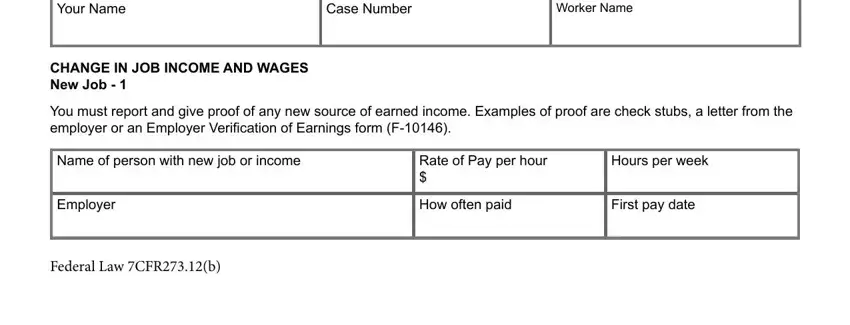

1. Complete the Form F 16006 with a group of necessary fields. Consider all the important information and be sure absolutely nothing is missed!

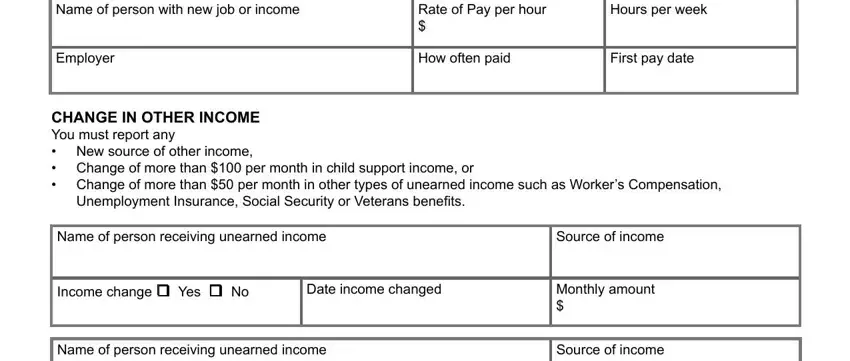

2. Soon after filling out the previous section, go on to the next part and fill out all required particulars in all these fields - Name of person with new job or, Rate of Pay per hour, Hours per week, Employer, How often paid, First pay date, CHANGE IN OTHER INCOME You must, Unemployment Insurance Social, Name of person receiving unearned, Source of income, Income change Yes No, Date income changed, Monthly amount, Name of person receiving unearned, and Source of income.

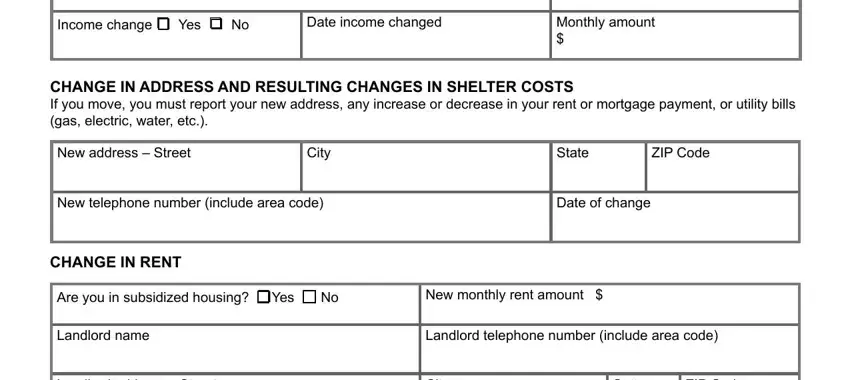

3. Completing Income change Yes No, Date income changed, Monthly amount, CHANGE IN ADDRESS AND RESULTING, New address Street, City, State, ZIP Code, New telephone number include area, Date of change, CHANGE IN RENT, Are you in subsidized housing Yes, New monthly rent amount, Landlord name, and Landlord telephone number include is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

As to ZIP Code and New monthly rent amount, make sure that you don't make any mistakes in this current part. Both of these could be the most significant fields in the page.

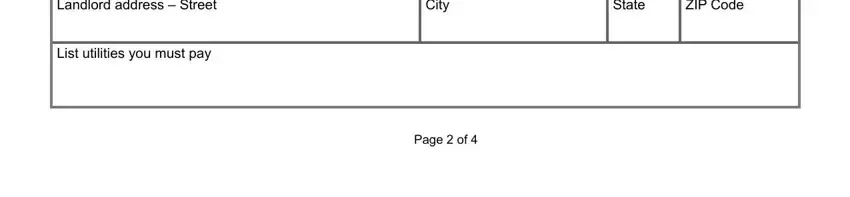

4. This specific section comes with all of the following empty form fields to fill out: Landlord address Street, City, State, ZIP Code, List utilities you must pay, and Page of.

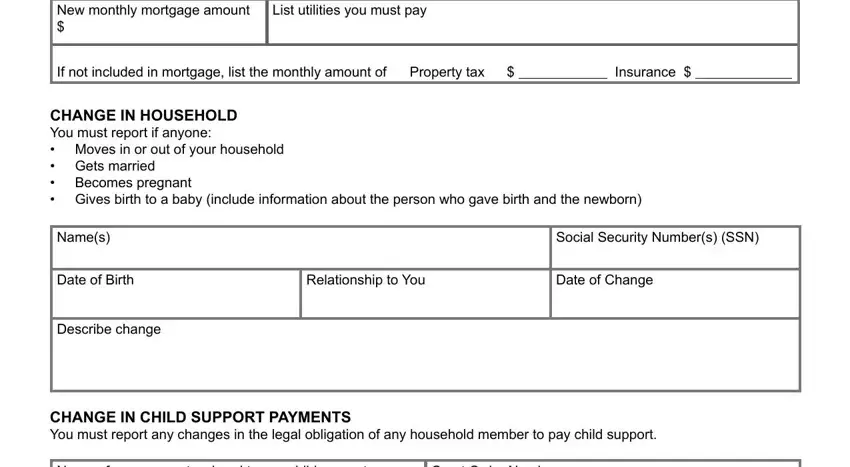

5. The final step to finish this form is integral. Be sure you fill in the mandatory fields, for instance New monthly mortgage amount, List utilities you must pay, If not included in mortgage list, CHANGE IN HOUSEHOLD You must, Names, Social Security Numbers SSN, Date of Birth, Relationship to You, Date of Change, Describe change, CHANGE IN CHILD SUPPORT PAYMENTS, Name of person courtordered to pay, and Court Order Number, prior to finalizing. Failing to do this may generate an unfinished and probably nonvalid paper!

Step 3: Right after taking another look at your form fields, press "Done" and you are good to go! Sign up with FormsPal today and easily use Form F 16006, set for download. Every single change you make is conveniently kept , meaning you can change the file later on as required. FormsPal guarantees your data confidentiality via a secure method that in no way saves or distributes any personal data involved in the process. Feel safe knowing your docs are kept protected any time you work with our service!