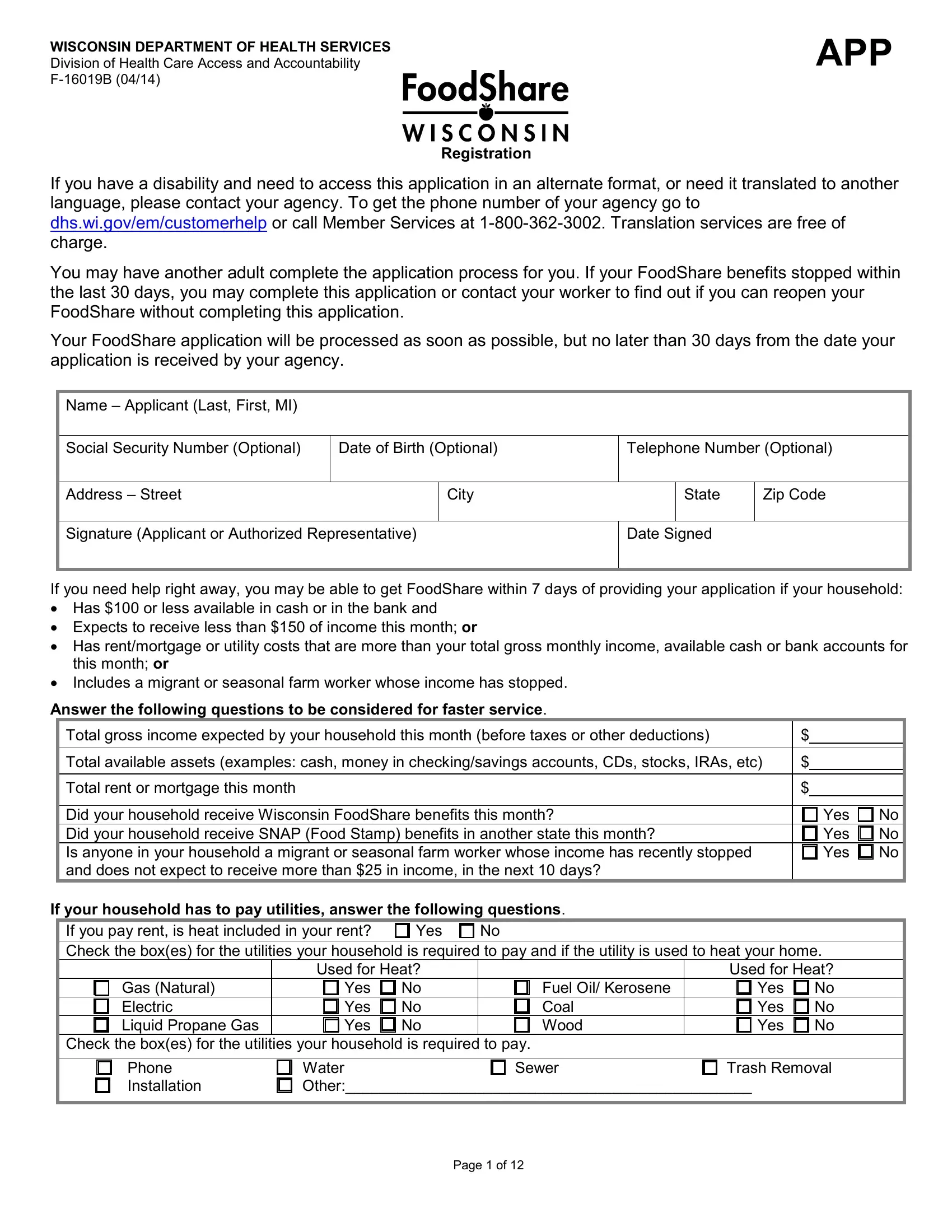

WISCONSIN DEPARTMENT OF HEALTH SERVICES

Division of Health Care Access and Accountability

F-16019B (04/14)

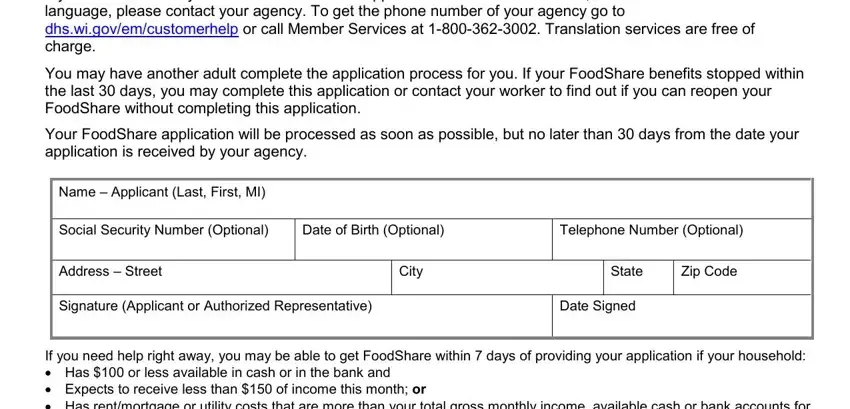

Registration

If you have a disability and need to access this application in an alternate format, or need it translated to another language, please contact your agency. To get the phone number of your agency go to dhs.wi.gov/em/customerhelp or call Member Services at 1-800-362-3002. Translation services are free of charge.

You may have another adult complete the application process for you. If your FoodShare benefits stopped within the last 30 days, you may complete this application or contact your worker to find out if you can reopen your FoodShare without completing this application.

Your FoodShare application will be processed as soon as possible, but no later than 30 days from the date your application is received by your agency.

Name – Applicant (Last, First, MI)

|

Social Security Number (Optional) |

Date of Birth (Optional) |

Telephone Number (Optional) |

|

|

|

|

|

|

|

|

|

|

Address – Street |

|

City |

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

Signature (Applicant or Authorized Representative) |

Date Signed |

|

|

|

|

|

|

|

|

|

|

If you need help right away, you may be able to get FoodShare within 7 days of providing your application if your household:

•Has $100 or less available in cash or in the bank and

•Expects to receive less than $150 of income this month; or

•Has rent/mortgage or utility costs that are more than your total gross monthly income, available cash or bank accounts for this month; or

•Includes a migrant or seasonal farm worker whose income has stopped.

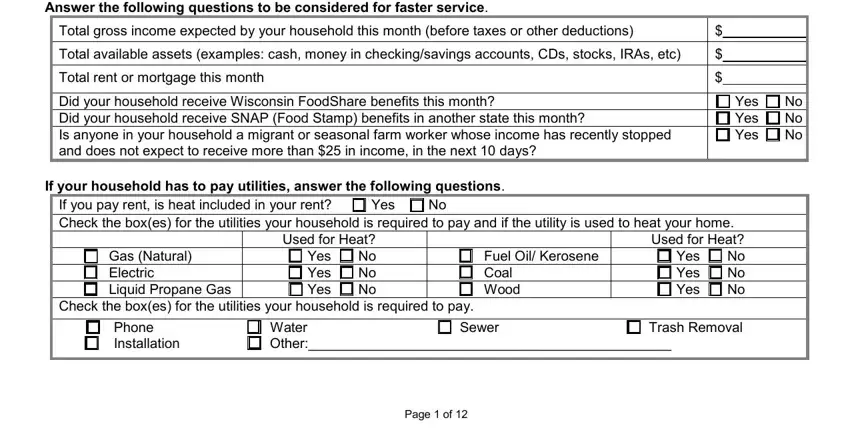

Answer the following questions to be considered for faster service.

Total gross income expected by your household this month (before taxes or other deductions) |

$ |

|

|

|

|

Total available assets (examples: cash, money in checking/savings accounts, CDs, stocks, IRAs, etc) |

$ |

|

|

|

|

Total rent or mortgage this month |

$ |

|

Did your household receive Wisconsin FoodShare benefits this month? |

Yes |

No |

Did your household receive SNAP (Food Stamp) benefits in another state this month? |

Yes |

No |

Is anyone in your household a migrant or seasonal farm worker whose income has recently stopped |

Yes |

No |

and does not expect to receive more than $25 in income, in the next 10 days? |

|

|

If your household has to pay utilities, answer the following questions.

If you pay rent, is heat included in your rent? |

Yes |

No |

Check the box(es) for the utilities your household is required to pay and if the utility is used to heat your home.

|

Used for Heat? |

|

Used for Heat? |

Gas (Natural) |

Yes |

No |

Fuel Oil/ Kerosene |

Yes |

No |

Electric |

Yes |

No |

Coal |

Yes |

No |

Liquid Propane Gas |

Yes |

No |

Wood |

Yes |

No |

Check the box(es) for the utilities your household is required to pay.

Phone |

Water |

Sewer |

Trash Removal |

Installation |

Other:_______________________________________________ |

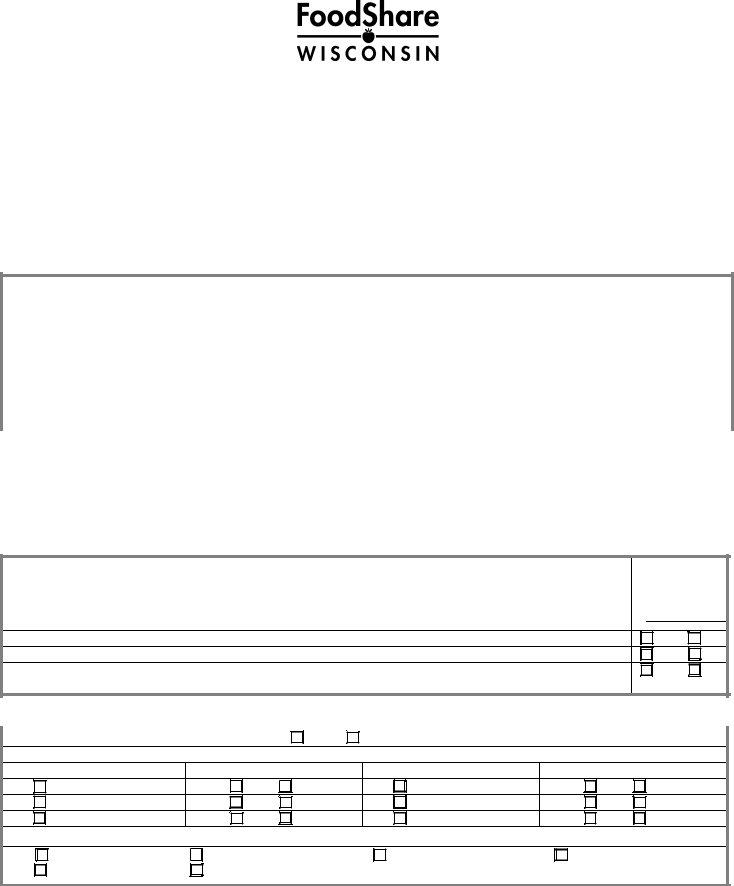

FOODSHARE WISCONSIN APPLICATION

F-16019B (04/14)

You have the right to submit your application at any time. To do so, you will need to give at least your name, address and signature to set your filing date. You will still need to talk with your agency in person or over the phone in order to finish the rest of your application.

You may have to provide proof of some of your answers. See “Proof Needed” on page 6 for a list of proof you may need to give us.

Mail or Fax Applications and/or Proof/Verifications

If you live in Milwaukee County: |

If you do not live in Milwaukee County |

MDPU |

CDPU |

PO Box 05676 |

PO Box 5234 |

Milwaukee WI 53205 |

Janesville, WI 53547-5234 |

Fax: 1-888-409-1979 |

Fax: 1-855-293-1822 |

You can also scan and/or upload any proof online at ACCESS.wi.gov.

You can set your filing date with just your name, address, and signature or complete a full application by applying online at ACCESS.wi.gov, by mail, in person or by phone.

If you want to apply for BadgerCare Plus or Medicaid, you can apply for these health care programs online at ACCESS.wi.gov at the same time you are applying for FoodShare benefits. Or, you can complete an application for health care. Applications can be found at dhs.wi.gov/em/customerhelp or by contacting your agency.

FOODSHARE WISCONSIN APPLICATION

F-16019B (04/14)

FoodShare Wisconsin

Important Information

This application is for FoodShare benefits only. It is not an application for BadgerCare Plus, Medicaid, Child Care or Wisconsin Works (W-2). You can apply for BadgerCare Plus, Medicaid, Family Planning Only Services and Child Care online at ACCESS.wi.gov at the same time you are applying for FoodShare. You must contact your local county or tribal agency to apply for W-2.

FoodShare is an entitlement. You do not have to apply for W-2 or other programs to be able to get FoodShare benefits. FoodShare benefits are available to help meet nutritional needs of low income households. A household is usually made up of people who live together and share food. The amount of FoodShare benefits a household gets is based on the household’s size and income. FoodShare benefits are issued on a Wisconsin QUEST card which is used like a debit card at grocery stores that accept FoodShare.

NON-DISCRIMINATION

The Department of Health Services is an equal opportunity employer and service provider. If you have a disability and need to access this information in an alternate format, or need it translated to another language, please contact (608) 266- 3356 or 1-888-701-1251 (TTY) toll free. All translation services are free of charge. For civil rights questions call (608) 266-9372 or 1-888-701-1251 (TTY) toll free.

The U.S. Department of Agriculture prohibits discrimination against its customers, employees, and applicants for employment on the base of race, color, national origin, age, disability, sex, gender identity, religion, reprisal, and where applicable, political beliefs, marital status, familial or parental status, sexual orientation, or all or part of an individual’s income is derived from any public assistance program, or protected by genetic information in employment or in any program or activity conducted or funded by the Department. (Not all prohibited bases will apply to all programs and/or employment activities).

If you wish to file a Civil Rights program complaint of discrimination, complete the USDA Program Discrimination Complaint Form, found online at ascr.usda.gov/complaint_filing_cust.html, or at any USDA office, or call (866) 632-9992 to request the form. You may also write a letter containing all of the information requested in the form. Send your completed complaint form or letter to us by mail at U.S. Department of Agriculture, Director, Office of Adjudication, 1400 Independence Avenue, S.W., Washington, D.C. 20250-9410, by fax (202) 690-7442 or email at program.intake@usda.gov.

Individuals who are deaf, hard of hearing or have speech disabilities may contact USDA through the Federal Relay Service at (800) 877-8339; or (800) 845-6136 (Spanish).

For any other information dealing with Supplemental Nutrition Assistance Program (SNAP) issues, persons should either contact the USDA SNAP Hotline Number at (800) 221-5689, which is also in Spanish or call the State Information/ Hotline Numbers found online at dhs.wi.gov/forwardhealth.

USDA is an equal opportunity provider and employer.

FAIR HEARING

You have the right to a fair hearing if you do not agree with any action taken regarding your application or your ongoing benefits. You may request a fair hearing by writing:

Department of Administration

Division of Hearing and Appeals

P.O. Box 7875

Madison, WI 53707-7875

The Request for a Fair Hearing form may be downloaded at dhs.wi.gov/em/customerhelp. You may also contact your agency to ask for a Fair Hearing verbally or in writing.

Page 3 of 12

FOODSHARE WISCONSIN APPLICATION

F-16019B (04/14)

AUTHORIZED REPRESENTATIVE

You have the right to have another person apply for FoodShare benefits for you. This person will act as an “authorized representative”. If you want to have an authorized representative, complete the Authorization of Representative form (F- 10126). To get this form go to dhs.wi.gov/em/customerhelp or ask the agency. If an authorized representative provides wrong information, which is used to determine your FoodShare benefits, you will be responsible for any mistakes.

USE OF SOCIAL SECURITY NUMBERS/PERSONALLY IDENTIFIABLE INFORMATION

Personally identifiable information, including Social Security Numbers (SSN) will be used only for the direct administration of FoodShare Wisconsin. Providing or applying for an SSN is voluntary; however anyone who does not provide their SSN, or apply for one, will not be able to get FoodShare benefits. Anyone in the household who is not applying for FoodShare does not need to provide an SSN. Your SSN permits a computer check of your information from government agencies, such as the Internal Revenue Service (IRS), Social Security Administration, Department of Workforce Development or School Lunch Program. SSNs are also used to check identity and to verify income from sources such as employers.

IMMIGRATION STATUS

To be able to get FoodShare, you must be a United States citizen or have a qualifying immigration status with the United States Citizenship and Immigration Services (USCIS). Immigration status of all people applying for FoodShare will be verified with USCIS and may affect FoodShare enrollment and benefit amount. Immigration status will NOT be verified with USCIS for any person who is not applying for FoodShare or who indicate they do not have qualifying immigration status with the USCIS. However, income from those individuals may affect FoodShare enrollment or benefit amount.

WORK REGISTRATION

Every one in your FoodShare group must be registered for work, unless otherwise exempt. Those who do not have to register for work include:

•A parent or other household member who is responsible for the care of a dependent child who is less than 6 years old or for a disabled person of any age;

•A person younger than 16 years of age, or 60 years of age or older;

•People in drug addiction or alcohol treatment programs;

•People who are already working at least 30 hours per week (or are getting weekly earnings which equal 30 times the federal minimum hourly wage);

•People who are getting, or have applied for Unemployment Insurance;

•Students enrolled at least half time in a recognized school, training program, or institution of higher learning; or

•People who are physically or mentally unfit for employment as determined by the agency.

Although registration for work is required, taking part in a work program is voluntary.

Effective July 1, 2014 for residents of Kenosha, Racine and Walworth counties, certain adults within the ages of 18 through 49 with no minor children in the home will only get 3 months of FoodShare benefits within a 36-month period unless they meet the FoodShare work requirement. To meet the work requirement, they will be referred to the FoodShare Employment and Training (FSET) program, unless they are otherwise exempt. This will apply to all Wisconsin counties effective January 1, 2015. You will get more information about FSET if you are enrolled in FoodShare.

is available to you. Job Center is the largest source of job openings in Wisconsin. You can visit the Job Center website at https://jobcenterofwisconsin.com/. You can use touch-screen computers at your local Job Center. To find a Job Center near you, call 1-888-258-9966 (toll-free).

COLLECTION OF INFORMATION

The collection of information on the application, including the Social Security Number of each household member applying, is authorized under the Food and Nutrition Act of 2008, as amended through P.L. 110-246, to determine if your household is able to take part in FoodShare Wisconsin. Information will be verified through computer matching programs and will also be used to monitor compliance with FoodShare program rules and program management.

Page 4 of 12

FOODSHARE WISCONSIN APPLICATION

F-16019B (04/14)

COMPUTER CHECK

Information on your application will be subject to verification through the state income and eligibility verification system. If you work, job income and wages you report will be checked by computer against wages your employer reports to the Department of Workforce Development. The IRS, Social Security Administration and Unemployment Insurance Division are also contacted about income and assets you may have. Information from these agencies may affect your household’s enrollment and/or benefit amount.

If any information you give is found to be incorrect, you may be denied FoodShare benefits and/or be subject to criminal prosecution for knowingly providing false information. You must repay any benefits you get, if you gave false information. If a FoodShare claim is made against your household, information on the application, including all Social Security Numbers, may be referred to federal and state agencies, as well as private collection agencies for claims collection action.

FOODSHARE PENALTY WARNING

Any member of your household who intentionally breaks any of the following rules can be barred from FoodShare for 12 months after the first violation, 24 months after the second violation or for the first violation involving a controlled substance, and permanently for the third violation.

•Giving false information or hiding information to get or continue to get FoodShare benefits,

•Trading or selling FoodShare benefits,

•Using FoodShare benefits to buy nonfood items like alcohol or tobacco,

•Using another person’s FoodShare benefits, identification cards or other documentation.

Depending on the value of the misused benefits, you can also be fined up to $250,000, imprisoned up to 20 years or both. A court can also bar you from FoodShare Wisconsin for an additional 18 months. You will be permanently disqualified if you are convicted of trafficking FoodShare benefits of $500 or more. You will not be able to take part in FoodShare Wisconsin for 10 years if you are found to have made a fraudulent statement or representation with respect to identity and residence to receive multiple benefits at the same time. Fleeing felons and probation/parole violators are not able to take part in FoodShare Wisconsin. You may also be subject to further prosecution under other applicable federal laws.

If you trade (buy or sell) FoodShare benefits for a controlled substance/illegal drugs, you will be barred from the FoodShare program for a period of 2 years for the first finding and permanently for the second finding. If you trade (buy or sell) firearms, ammunition or explosives, you will be barred from FoodShare Wisconsin permanently.

Page 5 of 12

FOODSHARE WISCONSIN APPLICATION

F-16019B (04/14)

PROOF NEEDED

Enrollment in FoodShare cannot be determined until you provide proof of certain answers. The list below shows what is proof is needed and some of the items you can use. If you have an appointment at the agency, please bring as many items on the list as you can to your interview. If your appointment is by phone, you will be sent a list of the items you will need after your appointment. If you are not able to get the items you need, tell your agency what items you are not able to get and we can help you. You may be asked to give proof of items not listed below. If so, the agency will send you a list of other proof that is needed.

Items You Can Use to Provide Proof

•Drivers License

•Birth Certificate

•Passport or US Citizen Card

•Paycheck

•Employee ID

•Hospital Record.

•All check stubs received in the last 30 days

•A signed statement from employer that includes gross earnings and pay dates expected in the next 30 days

•Employer Verification of Earnings form

Other Income Unemployment Insurance Disability Insurance, Social Security, Retirement, Veteran’s Benefits, Military Allotments

•Award letter

•Copy of last check

The following items may be required to get a credit.

Housing Costs and Utility Bills (Required to get a credit.)

•Current rent receipt with landlord’s name and phone number on it

•Lease or mortgage papers

•Real estate property tax statement

•Homeowner’s insurance statement

•Utility Bills

Child Support received or paid in a state other than Wisconsin (Required to get a credit.)

•Court order papers or other record of payment

•Payment record from other state

If you are age 60 or over, blind or a person with a disability, you may get a credit for certain medical costs.

Medical Costs/Expenses

Medical costs include, but are not limited to:

•Hospital, medical, dental and vision services

•Premiums for health insurance, Medicare premiums and costs for Prescriptions Drug Plans

•Prescription and over-the-counter medicine

•Nursing home and home health services

•Medical equipment and supplies

•Transportation and lodging costs to get medical care

•Related cost for seeing eye or hearing dog

•Lifeline/Medic Alert costs if prescribed by a health care professional

•Billing statement

•Itemized receipts

•Health insurance policy showing premium, coinsurance, co- payment, or deductible.

•Medicine or pill bottle with price on label

•Statement from pharmacy

•Repayment agreement with provider

•Statement from doctor verifying over-the-counter drug was prescribed

•Bill for services of a visiting nurse, home-maker, home health aide

•Lodging or transportation receipts, or both, for obtaining medical treatment or services

•Bill or receipts for dog food or veterinarian services, or both, for a seeing eye or hearing dog.

FOODSHARE WISCONSIN APPLICATION

F-16019B (04/14)

FOODSHARE WISCONSIN APPLICATION

This application is for FoodShare only. This is not an application for Medicaid, BadgerCare Plus, Child Care or W-2. You can apply for Medicaid, BadgerCare Plus and Child Care online at ACCESS.wi.gov at the same time you are applying for FoodShare. To apply for W-2, you must contact your agency. These programs can provide you help with the cost of health care, child care or finding a job as part of W-2.

How to use this form

1.Do not write in the shaded sections.

2.Print clearly. Use blue or black ink.

3.Fill out the application completely. If you need more room to provide your answer, use a blank sheet of paper. Return your application to the address listed on page 2 of this application.

4.If you need help filling out this application, contact your agency and ask for help.

5.If you want someone else to complete the application process for you, complete the Authorized Representative form (F-10026). You can get this form at dhs.wi.gov/em/customerhelp or from your agency.

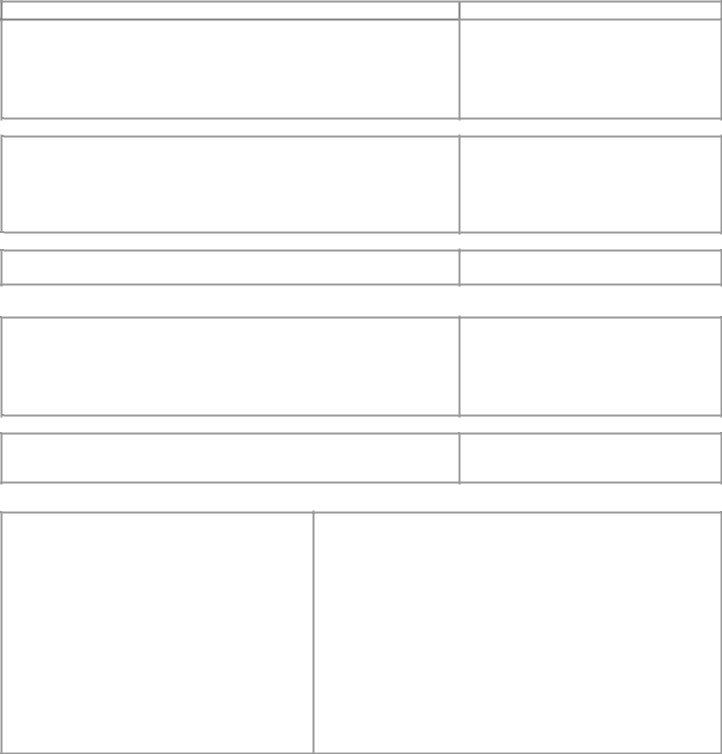

SECTION 1 — CONTACT INFORMATION

Please tell us how we can contact you. Please include the area code for all numbers.

Telephone Number |

|

|

Type of telephone |

|

|

|

( |

) |

|

|

Home |

Cell |

Work |

|

Other Telephone Number |

Who does this number belong to? |

|

|

What is this person’s name? |

|

( |

) |

Self |

Friend |

Neighbor |

Relative |

|

|

|

Email Address |

|

|

|

|

|

|

|

What is the best way and time to contact you during weekdays?

SECTION 2 — APPLICANT INFORMATION

If you are completing this application for someone else, answer the rest of the questions as if you were that person.

Name - Applicant (Last, First, MI) |

|

Which language do you want |

|

Primary language spoken in |

|

|

|

|

FoodShare notices printed |

|

|

your home |

|

|

|

|

|

|

English |

Spanish |

|

|

|

|

|

Address – Residence (Street) |

|

City |

|

|

|

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

Mailing Address – If different from your residence (Street/PO Box, City, State, Zip |

|

Social Security Number |

Code) |

|

|

|

|

|

|

|

|

|

|

|

Date of Birth |

|

Sex |

|

Marital Status |

Married |

|

|

Single |

Divorced |

|

|

Male |

Female |

|

|

|

|

|

|

|

|

U.S. Citizen (Only for those applying) |

|

|

|

|

|

|

Race or Ethnicity (Optional) |

Yes |

No |

|

|

|

|

|

|

|

|

|

SECTION 3 — HOUSEHOLD INFORMATION

If more room is needed, use a blank sheet of paper or the “Notes” section of this application to answer these questions.

Name – Spouse or Other Adult (Last, First, MI) |

|

|

Is this person applying for FoodShare? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

Social Security Number (if applying) |

|

Date of Birth (MM/DD/YY) |

|

Sex |

Male |

Female |

|

|

|

|

|

|

|

|

|

Marital Status |

Married |

Single |

Divorced |

U.S. Citizen (Only for those applying) |

Race or Ethnicity (Optional) |

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

Relationship to Applicant |

|

Do you share food with this person? |

Do you provide care for this person? |

|

|

|

Yes |

No |

|

Yes |

No |

|

|

Page 7 of 12

FOODSHARE WISCONSIN APPLICATION

F-16019B (04/14)

SECTION 3 — HOUSEHOLD INFORMATION (Continued)

Name – Child 1 (Last, First, MI) |

|

|

|

|

|

Is this person applying for FoodShare? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number (if applying) |

|

Date of Birth (MM/DD/YY) |

|

|

|

Sex |

Male |

Female |

|

|

|

|

|

|

|

|

|

|

|

Marital Status |

Married |

Single |

|

Divorced |

|

U.S. Citizen (Only for those applying) |

Race or Ethnicity (Optional) |

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

Relationship to Applicant |

|

|

Do you share food with this person? |

Do you provide care for this person? |

|

|

|

|

|

Yes |

|

No |

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

Name – Child 2 (Last, First, MI) |

|

|

|

|

|

Is this person applying for FoodShare? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

Social Security Number (if applying) |

|

Date of Birth (MM/DD/YY) |

|

|

|

Sex |

Male |

Female |

|

|

|

|

|

|

|

|

|

|

Marital Status |

Married |

Single |

|

Divorced |

|

U.S. Citizen (Only for those applying) |

Race or Ethnicity (Optional) |

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

Relationship to Applicant |

|

|

Do you share food with this person? |

Do you provide care for this person? |

|

|

|

|

|

Yes |

|

No |

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

Name – Child 3 (Last, First, MI) |

|

|

|

|

|

Is this person applying for FoodShare? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

Social Security Number (if applying) |

|

Date of Birth (MM/DD/YY) |

|

|

|

Sex |

Male |

Female |

|

|

|

|

|

|

|

|

|

|

Marital Status |

Married |

Single |

|

Divorced |

|

U.S. Citizen (Only for those applying) |

Race or Ethnicity (Optional) |

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

Relationship to Applicant |

|

|

Do you share food with this person? |

Do you provide care for this person? |

|

|

|

|

|

Yes |

|

No |

|

|

|

Yes |

|

No |

|

|

|

SECTION 4 — STUDENT INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

If more room is needed, use a blank sheet of paper to answer these questions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Is there anyone 18 – 49 years of age attending school? |

|

Name of Student (Last, First, MI) |

|

|

|

Yes |

No |

If no, go to Section 5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of School |

|

|

|

|

|

|

|

|

Is this student enrolled |

Part time or |

Full time |

|

|

|

Is the student employed at least 20 hours per week? |

|

Is the student caring for a child under 6 years of age? |

Yes |

No |

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

Is the student caring for a child 6-12 years of age where |

|

Is the student a single parent caring for a child less than |

adequate daycare is not available? |

Yes |

No |

|

12 years of age and attending school full time? |

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

Is the student participating in a federal or state funded work- |

|

Is the student unable to work due to a temporary or |

study program? |

Yes |

No |

|

|

|

|

|

|

permanent disability? |

Yes |

No |

|

|

Is the student attending school due to placement through Workforce Investment Act (WIA), Wisconsin Works (W-2) or |

FoodShare Employment and Training (FSET)? |

|

Yes |

|

No |

|

|

|

|

|

|

|

|

SECTION 5 — ADDITIONAL HOUSEHOLD INFORMATION

Has anyone been found totally disabled by the Social Security Administration (SSA), Veteran’s Administration (VA), or

Railroad Retirement Board? |

Yes |

No |

Date of Disability Determination (mm/dd/yy)

FOODSHARE WISCONSIN APPLICATION

F-16019B (04/14)

SECTION 5 — ADDITIONAL HOUSEHOLD INFORMATION (Continued)

Has anyone been convicted of

Date of Conviction (mm/dd/yy)

Is anyone a fleeing felon or in violation of probation/parole? |

|

Name (Last, First, MI) |

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 6 — ABSENT PARENT INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

Do any children have a biological or adoptive mother or father who is not living at home? |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Absent Parent (Last, First, MI) |

|

|

|

Social Security Number |

|

Date of Birth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name(s) of Child(ren) |

|

|

Relationship to Child |

|

Date Parent Left Household |

|

|

|

|

|

|

|

Mother |

Father |

|

|

|

|

|

|

|

Date Last Contact With Parent |

Court Order of Divorce / Paternity |

|

|

|

|

|

|

|

|

|

|

|

|

|

Case Number |

|

|

|

County |

|

|

|

State |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason for Parent’s Absence |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Absent Parent (Last, First, MI) |

|

|

|

Social Security Number |

|

Date of Birth |

|

|

|

|

|

|

|

|

|

|

Name(s) of Child(ren) |

|

|

Relationship to Child |

|

Date Parent Left Household |

|

|

|

|

|

|

|

Mother |

Father |

|

|

|

|

|

|

|

Date Last Contact With Parent |

Court Order of Divorce / Paternity |

|

|

|

|

|

|

|

|

|

|

|

|

|

Case Number |

|

|

|

County |

|

|

|

State |

Reason for Parent’s Absence |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 7 — ASSETS

Asset information is only needed if you are applying for emergency benefits. List all assets owned by the applicant(s).

Include assets owned jointly with anyone else. Do not include the value of personal household belongings, unless they have an unusually high value. Assets include items such as cash, checking or savings accounts, certificates of deposit, trust funds, stocks, bonds, retirement accounts, interest in annuities, U.S. savings bonds, property agreements, contracts for deeds, timeshares, rental property, life estates, livestock, tools, farm machinery, Keogh plans or other tax shelters, personal property being held for investment purposes, etc.

Type of Asset |

Name of the Owner(s) |

Current |

Description (such as Bank/Financial |

|

|

Value |

Institution Name, Account Number) |

Cash |

|

$ |

|

|

|

|

|

Checking Account |

|

$ |

|

|

|

|

|

Savings Account |

|

$ |

|

|

|

|

|

Other Type of Asset |

|

$ |

|

|

|

|

|

Other Type of Asset |

|

$ |

|

|

|

|

|

Other Type of Asset |

|

$ |

|

|

|

|

|

Page 9 of 12

FOODSHARE WISCONSIN APPLICATION

F-16019B (04/14)

SECTION 8 — EMPLOYMENT/JOB INCOME AND WAGES

Enrollment in FoodShare is based on total household income. Do not list self-employment in this section. Self-employment will be entered in Section 10. If more room is needed, use a separate sheet of paper.

Is anyone listed below a migrant worker? |

Yes |

Is any household member working? Yes No

If “Yes”, answer questions below for each household member who is working.

Name of Person Working

Employer Name and Address

How Often Paid |

Weekly |

Bi-weekly |

Once per Monthly |

Number of Hours in Pay Period |

|

|

|

|

|

How Much Paid Per Hour |

|

|

Gross |

Earnings per Pay Period |

$ |

|

|

|

$ |

|

Name of Person Working

Employer Name and Address

How Often Paid |

Weekly |

Bi-weekly |

Once per Monthly |

|

Number of Hours in Pay Period |

|

|

|

|

|

|

|

|

|

How Much Paid Per Hour |

|

|

|

|

Gross |

Earnings per Pay Period |

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

SECTION 9 — LOSS OF EMPLOYMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Has anyone recently ended employment? |

|

Yes |

No If “Yes”, complete the rest of Section 9. |

|

Name of Person |

|

|

Employer Name and Address |

|

|

|

|

|

|

|

|

Date job ended(mm/dd/ccyy) |

Reason |

Employment Ended? |

|

|

Has this person applied for unemployment |

|

|

Quit |

|

Fired |

Laid off |

Other |

insurance? |

Yes |

No |

SECTION 10 — SELF-EMPLOYMENT INCOME

List the amounts you reported to the IRS on your tax form. If you did not file taxes last year, leave the net annual income and depreciation boxes empty. Your agency will contact you for more information.

|

Is anyone in your home self-employed? |

Yes |

No |

If yes complete the following. If no, go to “Other Income”. |

|

|

Type of self-employment |

|

|

Name of business |

|

|

|

|

|

|

When did this self-employment begin?

What is the most recent year Federal taxes were filed for this business?

Has there been a significant change to the average annual income and expenses for this business since the most recent

Name of self-employed person

How many hours are worked each month?

Net annual income |

$ |

Depreciation amount claimed $ |

|

|

|

Do you expect any changes in your net income this year? |

Yes |

No |

Page 10 of 12

FOODSHARE WISCONSIN APPLICATION

F-16019B (04/14)

SECTION 11 — OTHER INCOME

If more room is needed, use a blank sheet of paper for your answers.

Does anyone in your household receive other income? |

Yes |

No |

If you answered “Yes”, complete the section below for each income type. |

Type of Income |

|

|

Name – Who gets this income? |

Gross Monthly Amount |

Social Security |

Yes |

No |

|

$ |

Supplemental Security Income SSI |

Yes |

No |

|

$ |

Alimony / Child Support |

Yes |

No |

|

$ |

Workers/Unemployment |

Yes |

No |

|

$ |

Compensation |

|

|

|

|

Disability / Sick Pay |

Yes |

No |

|

$ |

Interest / Dividends |

Yes |

No |

|

$ |

Veterans Benefits |

Yes |

No |

|

$ |

Other ______________________ |

Yes |

No |

|

$ |

SECTION 12 — EXPENSES

Dependent Care: Does anyone pay for child or adult care so they can work, look for work, go to school or receive

training? Yes |

No |

|

|

Who pays for child / adult care? |

Who is paid? |

Who is it for? |

|

|

|

|

How Often Paid |

Weekly |

Bi-weekly |

Once per Monthly |

Child Support: Is anyone court-ordered to pay child support? |

Yes |

No |

Who pays for child / adult care? |

|

Who is paid? |

|

|

|

|

|

|

|

|

|

|

How Often Paid |

Weekly |

Bi-weekly |

Once per Monthly |

|

Medical Expenses: Does any elderly or disabled household member have out-of-pocket medical costs? Yes |

No |

|

See page 12 for examples of expenses. |

|

|

|

|

Who is the expense for? |

What are the expenses? |

|

|

|

|

|

|

|

How Often Paid |

Weekly |

Bi-weekly |

Once per Monthly |

6

|

Shelter Costs: Does anyone in the household have shelter costs? (rent, mortgage, property taxes, etc.) Yes |

No |

|

|

Who pays the expense? |

What is the expense? |

|

|

|

|

|

|

|

How Often Paid |

Weekly |

|

Bi-weekly |

Once per Monthly |

|

Utilities Costs: Does anyone in the household pay for utilities? |

Yes |

No |

If you pay rent, is heat included in the rent? |

Yes |

No |

|

|

Check the box(es) for the utilities your household is required to pay and if the utility is used to heat your home.

|

Used for Heat? |

|

Used for Heat? |

Gas (Natural) |

Yes |

No |

Fuel Oil/ Kerosene |

Yes |

No |

Electric |

Yes |

No |

Coal |

Yes |

No |

Liquid Propane Gas |

Yes |

No |

Wood |

Yes |

No |

Check the box(es) for the utilities your household is required to pay. |

|

|

Phone |

Water |

Sewer |

|

Trash Removal |

Installation |

Other:_____________________________________________ |

|

|

|

Do you receive housing assistance? (Section 8 or other subsidized public housing) |

Yes |

No |

|

|

|

|

|

Page 11 of 12

FOODSHARE WISCONSIN APPLICATION

F-16019B (04/14)

SECTION 13 — RIGHTS AND RESPONSIBILITIES

Fair Hearings: I understand I have the right to file a fair hearing request to appeal any action taken concerning my application or ongoing benefits if I do not agree with that action. I understand I can ask for a Fair Hearing by writing to: Department of Administration, Division of Hearings & Appeals, Box 7875 Madison WI 53708-7875 or by calling (608) 266-3096. I may also contact the agency office where I applied and ask for a Fair Hearing verbally or in writing. I understand I can refer to the ForwardHealth Enrollment and Benefits handbook (P-00079) for more information.

Rights and Responsibilities: I have received the “Important Information” section of the FoodShare Wisconsin Application that includes my rights and responsibilities.

Reporting Changes: I understand that failure to report any changes which result in incorrect benefits will mean recovery of any amounts overpaid and could also lead to prosecution for fraud, a felony.

Expenses: I understand that expenses I report such as shelter, utilities, child care, child support or medical costs may affect the level of FoodShare benefits my household receives. I understand that failure to report or verify an expense means that I will not receive a deduction for this expense.

Income Reduction: I understand that I am not required to report a reduction or loss of income; however, I may be entitled to a higher FoodShare benefit if I do. I understand that as long as I do not report a reduction in my household’s monthly income or the loss of any household income, I will not receive any resulting increase in my FoodShare benefit.

Immigration Status: I understand that I and all other persons living in my household and who apply for aid must be citizens or in a satisfactory immigration status in order to receive assistance. I understand that the immigration status of any person in my household applying for benefits will be verified with the United States Citizenship and Immigration Services (USCIS); this information provided by USCIS may affect my household’s eligibility and amount of benefits. I understand that my status will NOT be verified with USCIS if I am not requesting assistance for myself or if I state that I am an immigrant without satisfactory immigration status.

Any person, including any financial institution, credit reporting agency, employer or educational institution, is authorized to release this information, according to Wisconsin Statute §49.22 (2) (2m): “The department may request from any person any information it determines appropriate and necessary for the administration of programs carrying out the purposes of 7USC 2011 to 2029. Any person in this state shall provide this information within seven (7) days after receiving a request under this subsection.”

I understand the questions and statements on this application form. I understand the penalties for giving false information or breaking the rules. I certify, under penalty of perjury and false swearing, that all my answers are correct and complete to the best of my knowledge, including information provided about the citizenship status of each household member applying for benefits. I understand and agree to provide documents to prove what I have said. I understand that the local agency may contact other persons or organizations to obtain the necessary proof of my eligibility and level of benefits.

By signing this application, I am acknowledging that I have read and understand the rights and responsibilities as stated above.

SIGNATURE – Applicant or Authorized Representative