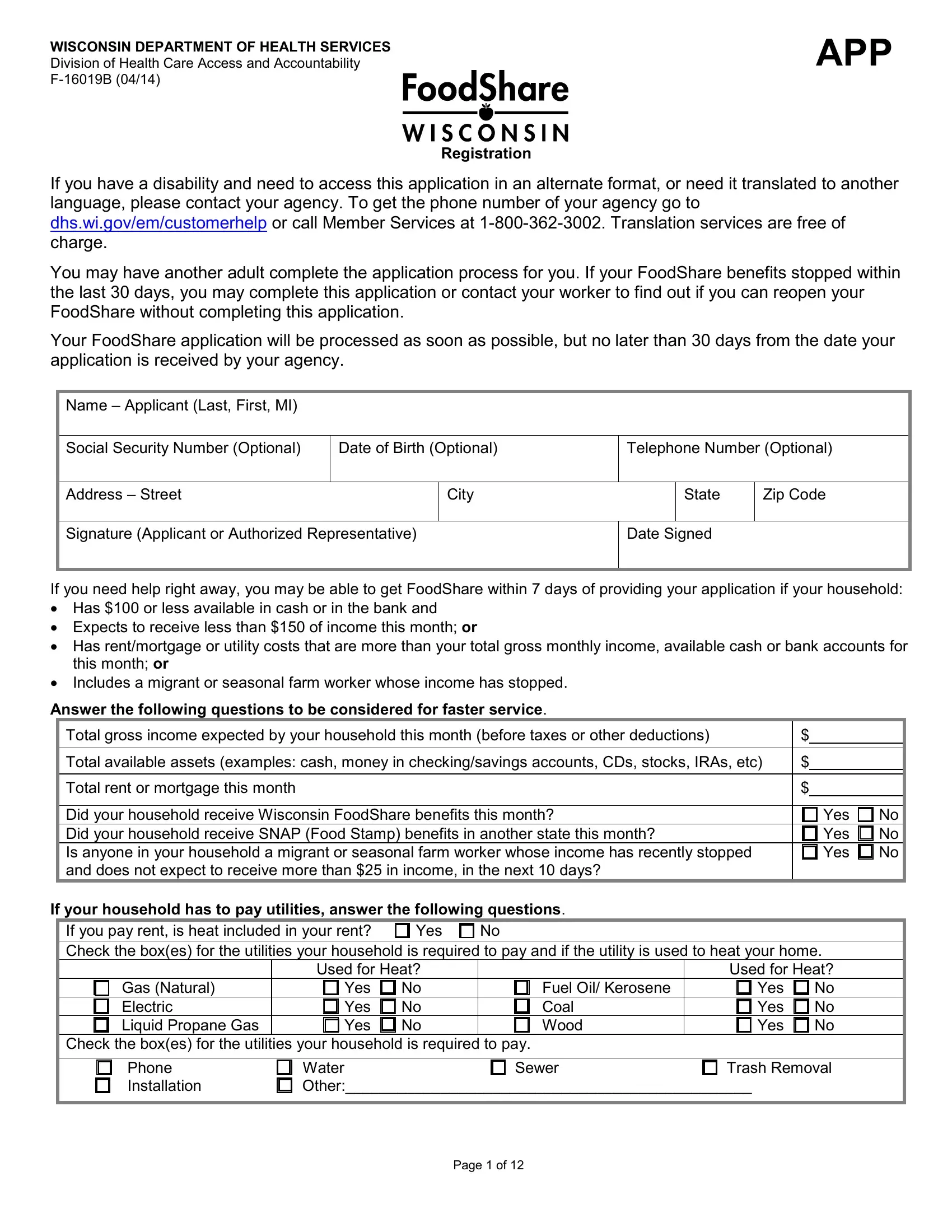

WISCONSIN DEPARTMENT OF HEALTH SERVICES

Division of Health Care Access and Accountability

F-16019B (04/14)

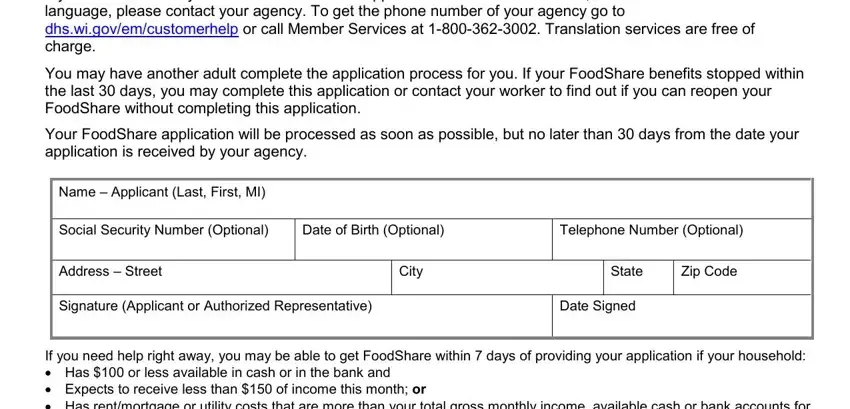

Registration

If you have a disability and need to access this application in an alternate format, or need it translated to another language, please contact your agency. To get the phone number of your agency go to dhs.wi.gov/em/customerhelp or call Member Services at 1-800-362-3002. Translation services are free of charge.

You may have another adult complete the application process for you. If your FoodShare benefits stopped within the last 30 days, you may complete this application or contact your worker to find out if you can reopen your FoodShare without completing this application.

Your FoodShare application will be processed as soon as possible, but no later than 30 days from the date your application is received by your agency.

Name – Applicant (Last, First, MI)

|

Social Security Number (Optional) |

Date of Birth (Optional) |

Telephone Number (Optional) |

|

|

|

|

|

|

|

|

|

|

Address – Street |

|

City |

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

Signature (Applicant or Authorized Representative) |

Date Signed |

|

|

|

|

|

|

|

|

|

|

If you need help right away, you may be able to get FoodShare within 7 days of providing your application if your household:

•Has $100 or less available in cash or in the bank and

•Expects to receive less than $150 of income this month; or

•Has rent/mortgage or utility costs that are more than your total gross monthly income, available cash or bank accounts for this month; or

•Includes a migrant or seasonal farm worker whose income has stopped.

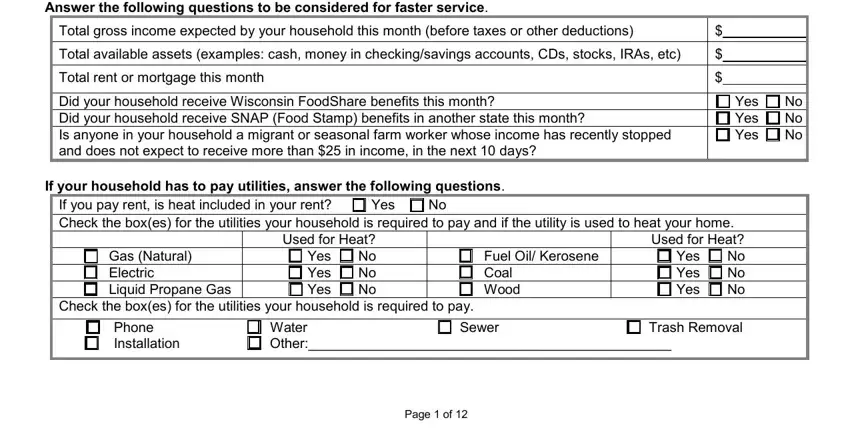

Answer the following questions to be considered for faster service.

Total gross income expected by your household this month (before taxes or other deductions) |

$ |

|

|

|

|

Total available assets (examples: cash, money in checking/savings accounts, CDs, stocks, IRAs, etc) |

$ |

|

|

|

|

Total rent or mortgage this month |

$ |

|

Did your household receive Wisconsin FoodShare benefits this month? |

Yes |

No |

Did your household receive SNAP (Food Stamp) benefits in another state this month? |

Yes |

No |

Is anyone in your household a migrant or seasonal farm worker whose income has recently stopped |

Yes |

No |

and does not expect to receive more than $25 in income, in the next 10 days? |

|

|

If your household has to pay utilities, answer the following questions.

If you pay rent, is heat included in your rent? |

Yes |

No |

Check the box(es) for the utilities your household is required to pay and if the utility is used to heat your home.

|

Used for Heat? |

|

Used for Heat? |

Gas (Natural) |

Yes |

No |

Fuel Oil/ Kerosene |

Yes |

No |

Electric |

Yes |

No |

Coal |

Yes |

No |

Liquid Propane Gas |

Yes |

No |

Wood |

Yes |

No |

Check the box(es) for the utilities your household is required to pay.

Phone |

Water |

Sewer |

Trash Removal |

Installation |

Other:_______________________________________________ |

FOODSHARE WISCONSIN APPLICATION

F-16019B (04/14)

You have the right to submit your application at any time. To do so, you will need to give at least your name, address and signature to set your filing date. You will still need to talk with your agency in person or over the phone in order to finish the rest of your application.

You may have to provide proof of some of your answers. See “Proof Needed” on page 6 for a list of proof you may need to give us.

Mail or Fax Applications and/or Proof/Verifications

If you live in Milwaukee County: |

If you do not live in Milwaukee County |

MDPU |

CDPU |

PO Box 05676 |

PO Box 5234 |

Milwaukee WI 53205 |

Janesville, WI 53547-5234 |

Fax: 1-888-409-1979 |

Fax: 1-855-293-1822 |

You can also scan and/or upload any proof online at ACCESS.wi.gov.

You can set your filing date with just your name, address, and signature or complete a full application by applying online at ACCESS.wi.gov, by mail, in person or by phone.

If you want to apply for BadgerCare Plus or Medicaid, you can apply for these health care programs online at ACCESS.wi.gov at the same time you are applying for FoodShare benefits. Or, you can complete an application for health care. Applications can be found at dhs.wi.gov/em/customerhelp or by contacting your agency.

FOODSHARE WISCONSIN APPLICATION

F-16019B (04/14)

FoodShare Wisconsin

Important Information

This application is for FoodShare benefits only. It is not an application for BadgerCare Plus, Medicaid, Child Care or Wisconsin Works (W-2). You can apply for BadgerCare Plus, Medicaid, Family Planning Only Services and Child Care online at ACCESS.wi.gov at the same time you are applying for FoodShare. You must contact your local county or tribal agency to apply for W-2.

FoodShare is an entitlement. You do not have to apply for W-2 or other programs to be able to get FoodShare benefits. FoodShare benefits are available to help meet nutritional needs of low income households. A household is usually made up of people who live together and share food. The amount of FoodShare benefits a household gets is based on the household’s size and income. FoodShare benefits are issued on a Wisconsin QUEST card which is used like a debit card at grocery stores that accept FoodShare.

NON-DISCRIMINATION

The Department of Health Services is an equal opportunity employer and service provider. If you have a disability and need to access this information in an alternate format, or need it translated to another language, please contact (608) 266- 3356 or 1-888-701-1251 (TTY) toll free. All translation services are free of charge. For civil rights questions call (608) 266-9372 or 1-888-701-1251 (TTY) toll free.

The U.S. Department of Agriculture prohibits discrimination against its customers, employees, and applicants for employment on the base of race, color, national origin, age, disability, sex, gender identity, religion, reprisal, and where applicable, political beliefs, marital status, familial or parental status, sexual orientation, or all or part of an individual’s income is derived from any public assistance program, or protected by genetic information in employment or in any program or activity conducted or funded by the Department. (Not all prohibited bases will apply to all programs and/or employment activities).

If you wish to file a Civil Rights program complaint of discrimination, complete the USDA Program Discrimination Complaint Form, found online at ascr.usda.gov/complaint_filing_cust.html, or at any USDA office, or call (866) 632-9992 to request the form. You may also write a letter containing all of the information requested in the form. Send your completed complaint form or letter to us by mail at U.S. Department of Agriculture, Director, Office of Adjudication, 1400 Independence Avenue, S.W., Washington, D.C. 20250-9410, by fax (202) 690-7442 or email at program.intake@usda.gov.

Individuals who are deaf, hard of hearing or have speech disabilities may contact USDA through the Federal Relay Service at (800) 877-8339; or (800) 845-6136 (Spanish).

For any other information dealing with Supplemental Nutrition Assistance Program (SNAP) issues, persons should either contact the USDA SNAP Hotline Number at (800) 221-5689, which is also in Spanish or call the State Information/ Hotline Numbers found online at dhs.wi.gov/forwardhealth.

USDA is an equal opportunity provider and employer.

FAIR HEARING

You have the right to a fair hearing if you do not agree with any action taken regarding your application or your ongoing benefits. You may request a fair hearing by writing:

Department of Administration

Division of Hearing and Appeals

P.O. Box 7875

Madison, WI 53707-7875

The Request for a Fair Hearing form may be downloaded at dhs.wi.gov/em/customerhelp. You may also contact your agency to ask for a Fair Hearing verbally or in writing.

Page 3 of 12

FOODSHARE WISCONSIN APPLICATION

F-16019B (04/14)

AUTHORIZED REPRESENTATIVE

You have the right to have another person apply for FoodShare benefits for you. This person will act as an “authorized representative”. If you want to have an authorized representative, complete the Authorization of Representative form (F- 10126). To get this form go to dhs.wi.gov/em/customerhelp or ask the agency. If an authorized representative provides wrong information, which is used to determine your FoodShare benefits, you will be responsible for any mistakes.

USE OF SOCIAL SECURITY NUMBERS/PERSONALLY IDENTIFIABLE INFORMATION

Personally identifiable information, including Social Security Numbers (SSN) will be used only for the direct administration of FoodShare Wisconsin. Providing or applying for an SSN is voluntary; however anyone who does not provide their SSN, or apply for one, will not be able to get FoodShare benefits. Anyone in the household who is not applying for FoodShare does not need to provide an SSN. Your SSN permits a computer check of your information from government agencies, such as the Internal Revenue Service (IRS), Social Security Administration, Department of Workforce Development or School Lunch Program. SSNs are also used to check identity and to verify income from sources such as employers.

IMMIGRATION STATUS

To be able to get FoodShare, you must be a United States citizen or have a qualifying immigration status with the United States Citizenship and Immigration Services (USCIS). Immigration status of all people applying for FoodShare will be verified with USCIS and may affect FoodShare enrollment and benefit amount. Immigration status will NOT be verified with USCIS for any person who is not applying for FoodShare or who indicate they do not have qualifying immigration status with the USCIS. However, income from those individuals may affect FoodShare enrollment or benefit amount.

WORK REGISTRATION

Every one in your FoodShare group must be registered for work, unless otherwise exempt. Those who do not have to register for work include:

•A parent or other household member who is responsible for the care of a dependent child who is less than 6 years old or for a disabled person of any age;

•A person younger than 16 years of age, or 60 years of age or older;

•People in drug addiction or alcohol treatment programs;

•People who are already working at least 30 hours per week (or are getting weekly earnings which equal 30 times the federal minimum hourly wage);

•People who are getting, or have applied for Unemployment Insurance;

•Students enrolled at least half time in a recognized school, training program, or institution of higher learning; or

•People who are physically or mentally unfit for employment as determined by the agency.

Although registration for work is required, taking part in a work program is voluntary.

Effective July 1, 2014 for residents of Kenosha, Racine and Walworth counties, certain adults within the ages of 18 through 49 with no minor children in the home will only get 3 months of FoodShare benefits within a 36-month period unless they meet the FoodShare work requirement. To meet the work requirement, they will be referred to the FoodShare Employment and Training (FSET) program, unless they are otherwise exempt. This will apply to all Wisconsin counties effective January 1, 2015. You will get more information about FSET if you are enrolled in FoodShare.

is available to you. Job Center is the largest source of job openings in Wisconsin. You can visit the Job Center website at https://jobcenterofwisconsin.com/. You can use touch-screen computers at your local Job Center. To find a Job Center near you, call 1-888-258-9966 (toll-free).

COLLECTION OF INFORMATION

The collection of information on the application, including the Social Security Number of each household member applying, is authorized under the Food and Nutrition Act of 2008, as amended through P.L. 110-246, to determine if your household is able to take part in FoodShare Wisconsin. Information will be verified through computer matching programs and will also be used to monitor compliance with FoodShare program rules and program management.

Page 4 of 12

FOODSHARE WISCONSIN APPLICATION

F-16019B (04/14)

COMPUTER CHECK

Information on your application will be subject to verification through the state income and eligibility verification system. If you work, job income and wages you report will be checked by computer against wages your employer reports to the Department of Workforce Development. The IRS, Social Security Administration and Unemployment Insurance Division are also contacted about income and assets you may have. Information from these agencies may affect your household’s enrollment and/or benefit amount.

If any information you give is found to be incorrect, you may be denied FoodShare benefits and/or be subject to criminal prosecution for knowingly providing false information. You must repay any benefits you get, if you gave false information. If a FoodShare claim is made against your household, information on the application, including all Social Security Numbers, may be referred to federal and state agencies, as well as private collection agencies for claims collection action.

FOODSHARE PENALTY WARNING

Any member of your household who intentionally breaks any of the following rules can be barred from FoodShare for 12 months after the first violation, 24 months after the second violation or for the first violation involving a controlled substance, and permanently for the third violation.

•Giving false information or hiding information to get or continue to get FoodShare benefits,

•Trading or selling FoodShare benefits,

•Using FoodShare benefits to buy nonfood items like alcohol or tobacco,

•Using another person’s FoodShare benefits, identification cards or other documentation.

Depending on the value of the misused benefits, you can also be fined up to $250,000, imprisoned up to 20 years or both. A court can also bar you from FoodShare Wisconsin for an additional 18 months. You will be permanently disqualified if you are convicted of trafficking FoodShare benefits of $500 or more. You will not be able to take part in FoodShare Wisconsin for 10 years if you are found to have made a fraudulent statement or representation with respect to identity and residence to receive multiple benefits at the same time. Fleeing felons and probation/parole violators are not able to take part in FoodShare Wisconsin. You may also be subject to further prosecution under other applicable federal laws.

If you trade (buy or sell) FoodShare benefits for a controlled substance/illegal drugs, you will be barred from the FoodShare program for a period of 2 years for the first finding and permanently for the second finding. If you trade (buy or sell) firearms, ammunition or explosives, you will be barred from FoodShare Wisconsin permanently.

Page 5 of 12