florida extension due can be filled out online in no time. Just make use of FormsPal PDF editing tool to finish the job fast. To maintain our editor on the leading edge of practicality, we work to implement user-driven capabilities and improvements on a regular basis. We're routinely pleased to receive feedback - join us in revolutionizing PDF editing. With a few basic steps, you'll be able to start your PDF editing:

Step 1: Access the PDF file inside our editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: The editor will let you change PDF files in a variety of ways. Modify it with personalized text, adjust existing content, and include a signature - all doable within minutes!

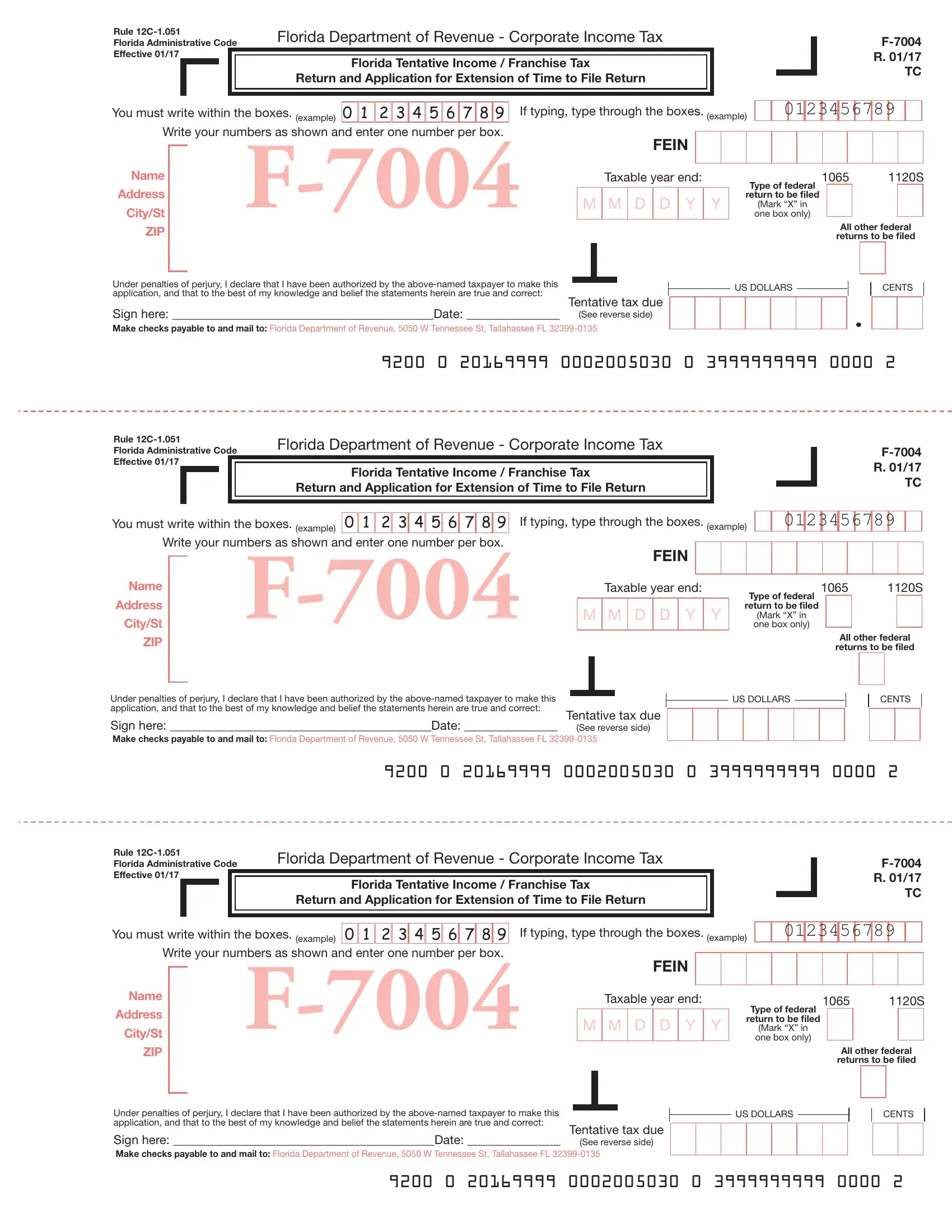

When it comes to blanks of this particular form, here is what you need to know:

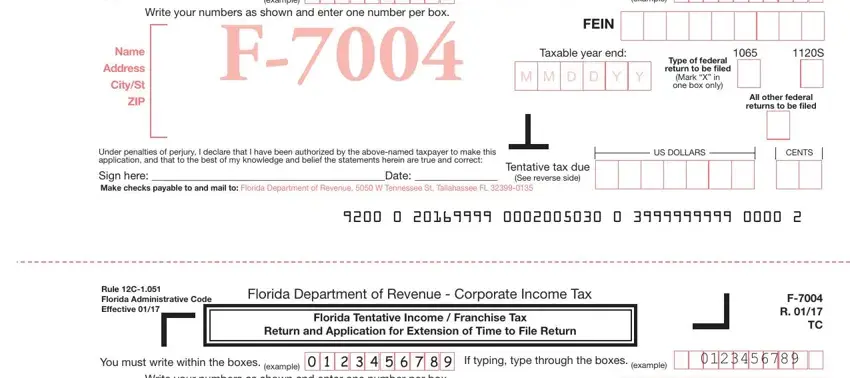

1. The florida extension due usually requires particular information to be typed in. Ensure that the following blank fields are completed:

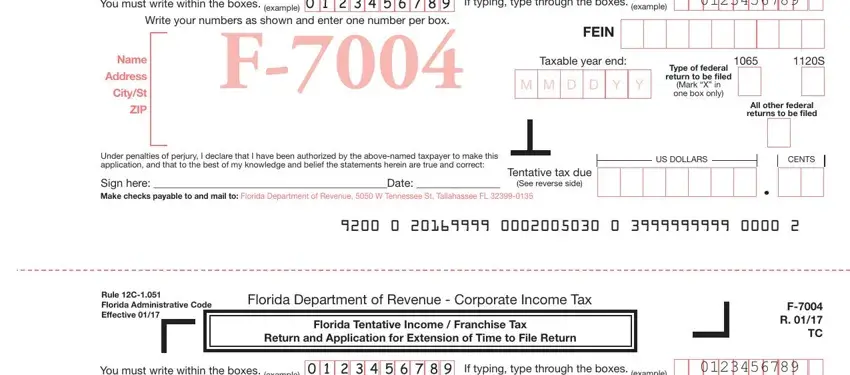

2. Soon after this part is filled out, proceed to enter the applicable details in all these: You must write within the boxes, example, If typing type through the boxes, example, Write your numbers as shown and, Name, Address, CitySt, ZIP, FEIN, Taxable year end, DMM, D Y, Type of federal return to be iled, and Mark X in one box only.

It is possible to make errors when filling out your If typing type through the boxes, consequently you'll want to take another look before you send it in.

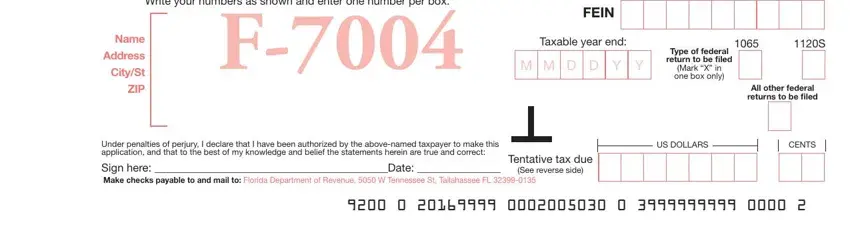

3. This 3rd section is pretty straightforward, Write your numbers as shown and, Name, Address, CitySt, ZIP, FEIN, Taxable year end, DMM, D Y, Type of federal return to be iled, Mark X in one box only, All other federal returns to be, Under penalties of perjury I, Sign here Date Make checks, and Tentative tax due - all these empty fields needs to be completed here.

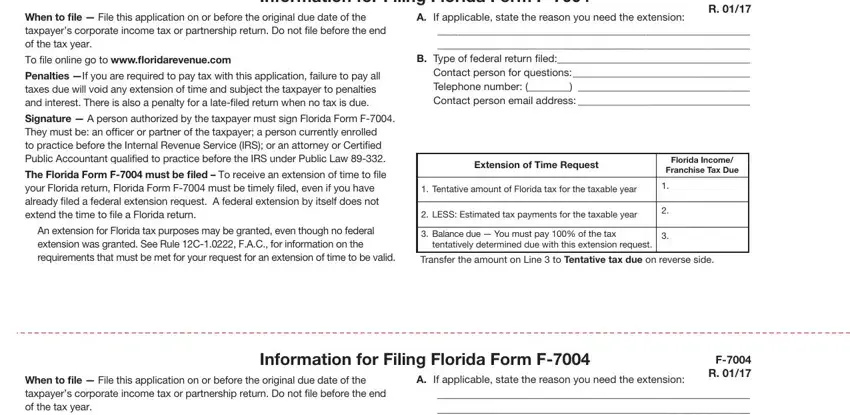

4. All set to begin working on this next section! Here you'll have all of these Information for Filing Florida, F R, A If applicable state the reason, Extension of Time Request, Florida Income, Franchise Tax Due, Tentative amount of Florida tax, LESS Estimated tax payments for, Balance due You must pay of the, tentatively determined due with, Transfer the amount on Line to, When to ile File this application, To ile online go to, Penalties If you are required to, and Signature A person authorized by blanks to do.

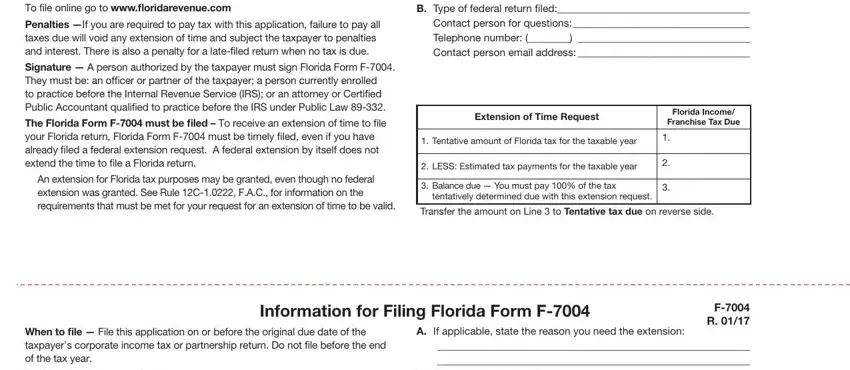

5. To conclude your document, this final part requires some additional blank fields. Completing To ile online go to, Penalties If you are required to, Signature A person authorized by, The Florida Form F must be iled, An extension for Florida tax, A If applicable state the reason, Extension of Time Request, Florida Income, Franchise Tax Due, Tentative amount of Florida tax, LESS Estimated tax payments for, Balance due You must pay of the, tentatively determined due with, Transfer the amount on Line to, and Information for Filing Florida should wrap up the process and you'll be done in the blink of an eye!

Step 3: Prior to finalizing your file, ensure that blanks are filled in right. The moment you believe it is all good, click on “Done." Right after getting a7-day free trial account with us, you will be able to download florida extension due or send it via email right away. The PDF document will also be accessible from your personal account page with your every single modification. FormsPal offers protected document editor without personal information record-keeping or any type of sharing. Be assured that your details are secure with us!