Using PDF forms online is a breeze using our PDF tool. You can fill out Form F Fo 0006 here and use several other options we provide. To make our editor better and more convenient to use, we constantly work on new features, taking into consideration suggestions coming from our users. By taking some simple steps, you are able to start your PDF editing:

Step 1: Press the "Get Form" button above. It's going to open up our pdf editor so you can begin filling out your form.

Step 2: As soon as you open the editor, you'll see the document made ready to be completed. In addition to filling out various blanks, you might also do several other actions with the file, namely writing custom words, modifying the original text, adding illustrations or photos, placing your signature to the form, and a lot more.

Be attentive when completing this pdf. Ensure every field is filled out correctly.

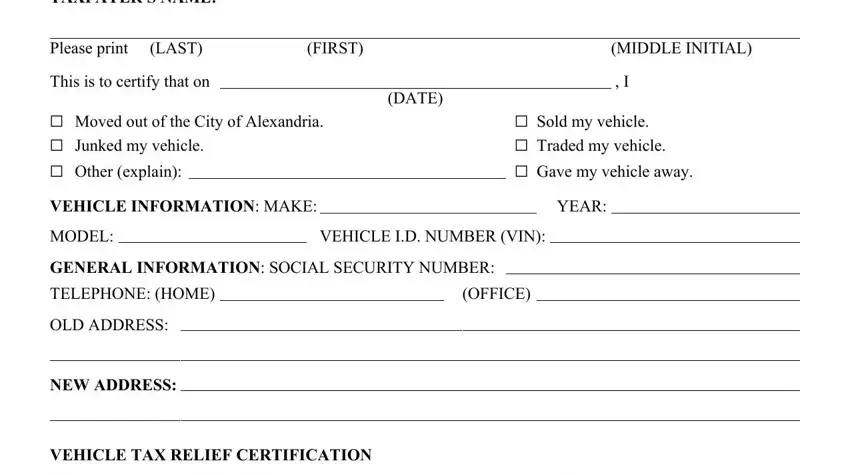

1. The Form F Fo 0006 necessitates particular details to be entered. Ensure that the next blank fields are completed:

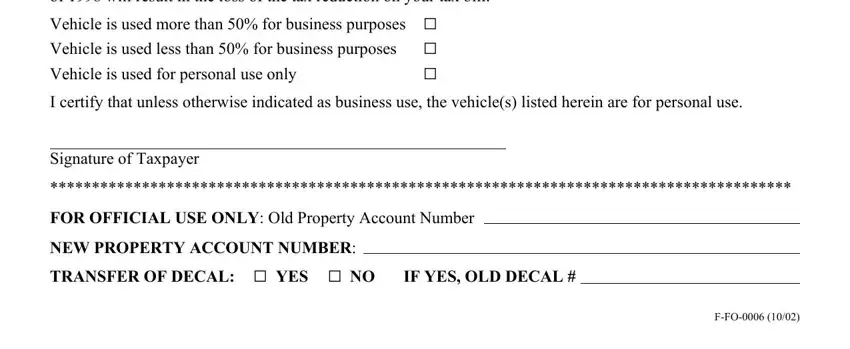

2. Now that this array of fields is done, you're ready to add the needed specifics in Effective January vehicle owners, Vehicle is used more than for, Vehicle is used for personal use, I certify that unless otherwise, Signature of Taxpayer, FOR OFFICIAL USE ONLY Old Property, NEW PROPERTY ACCOUNT NUMBER, TRANSFER OF DECAL G YES G NO, IF YES OLD DECAL, and FFO so that you can proceed to the next part.

Be really mindful when filling in TRANSFER OF DECAL G YES G NO and Vehicle is used for personal use, as this is where a lot of people make a few mistakes.

Step 3: When you have reviewed the details in the blanks, click "Done" to finalize your form at FormsPal. After registering a7-day free trial account here, you will be able to download Form F Fo 0006 or send it via email right away. The PDF document will also be at your disposal from your personal account with your every single edit. Here at FormsPal, we do our utmost to ensure that all your information is kept private.