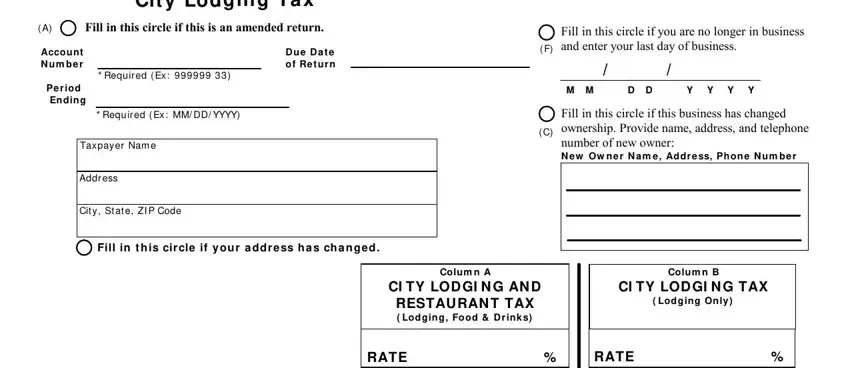

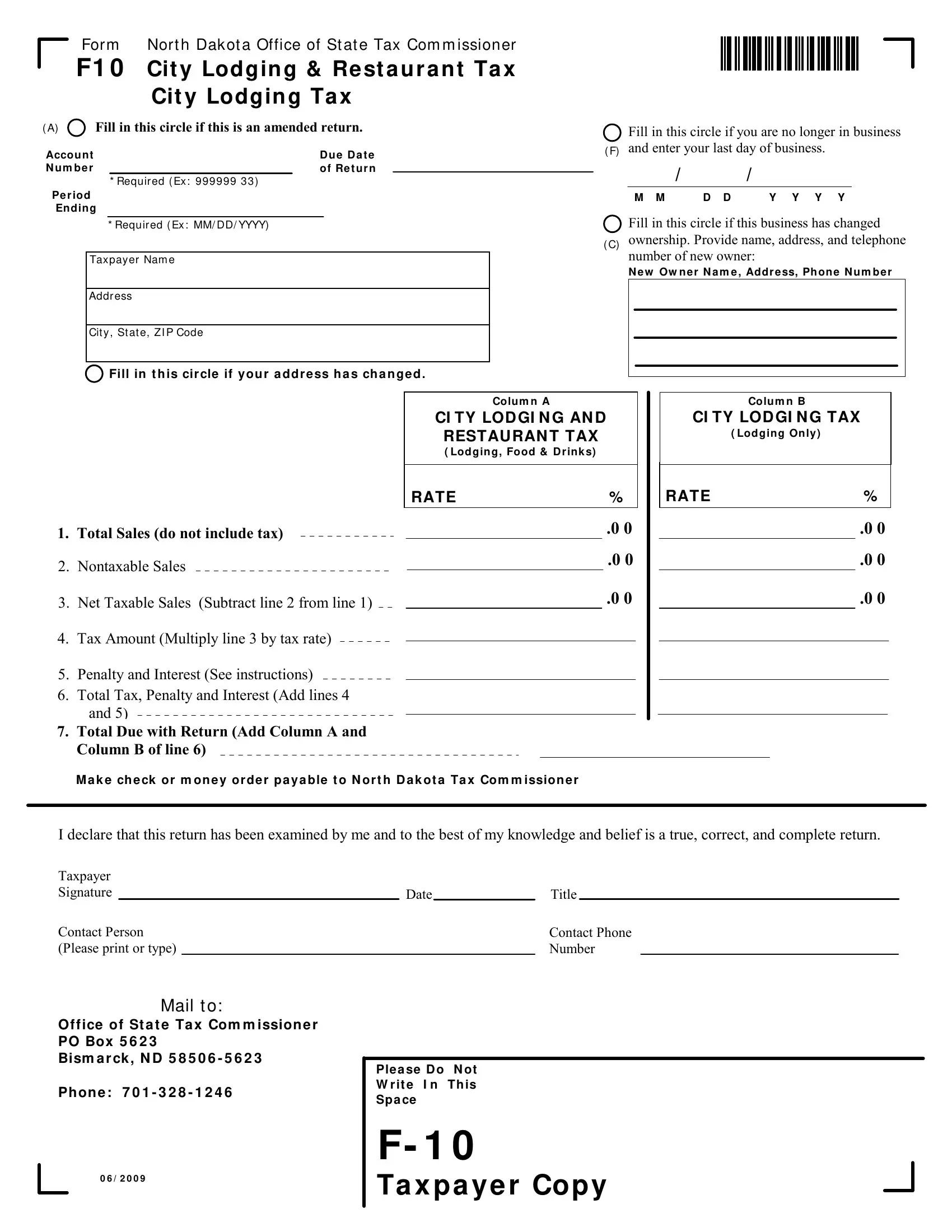

For m Nor t h Dak ot a Office of St at e Tax Com m issioner

F1 0 Cit y Lodgin g & Re st a u r a n t Ta x Cit y Lodgin g Ta x

( A) Fill in this circle if this is an amended return.

Accou nt |

|

|

D u e D a t e |

N u m b e r |

|

|

of Re t ur n |

|

* Requir ed ( Ex : 9 999 99 3 3) |

Pe r iod |

|

|

|

|

End ing |

|

|

|

|

*Requ ir ed ( Ex : MM/ DD/ YYYY)

Tax pay er Nam e

Addr ess

Cit y , St at e, Z I P Code

Fill in this circle if you are no longer in business ( F) and enter your last day of business.

Fill in this circle if this business has changed

( C) ownership. Provide name, address, and telephone number of new owner:

N e w Ow n e r N a m e , Addr e ss, Ph on e N u m be r

Fill in t h is cir cle if y ou r a dd r e ss h a s ch a n ge d .

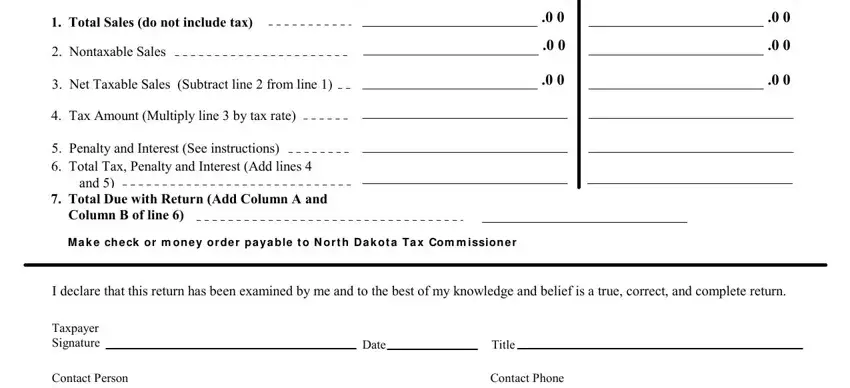

1.Total Sales (do not include tax)

2.Nontaxable Sales

3.Net Taxable Sales (Subtract line 2 from line 1)

4.Tax Amount (Multiply line 3 by tax rate)

5.Penalty and Interest (See instructions)

6.Total Tax, Penalty and Interest (Add lines 4 and 5)

7.Total Due with Return (Add Column A and Column B of line 6)

Colum n A

CI TY LOD GI N G AN D RESTAURAN T TAX

( Lodgin g, Food & D r ink s)

.0 0

.0 0

.0 0

Colu m n B

CI TY LOD GI N G TAX

( Lod ging On ly )

.0 0

.0 0

.0 0

M a k e ch e ck or m on e y or de r p a y a ble t o N or t h D a k ot a Ta x Com m ission e r

I declare that this return has been examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

Taxpayer |

|

|

|

|

|

Signature |

|

|

Date |

|

Title |

|

|

Contact Person |

|

|

Contact Phone |

Revised 07/01/2002 |

(Please print or type) |

|

|

|

Number |

|

|

|

|

Mail t o:

Of f ice of St a t e Ta x Com m ission e r PO Box 5 6 2 3

Bism a r ck , N D 5 8 5 0 6 - 5 6 2 3

Ph on e : 7 0 1 - 3 2 8 - 1 2 4 6

0 6 / 2 0 0 9

Ple a se D o N ot

W r it e I n Th is

Spa ce

F- 1 0

Ta x pa y e r Copy

Instructions

Line 1 – Total Sales. Enter on line 1, your gross sales for the period including lodging receipts, bar and lounge receipts, restaurant receipts, and all other sales and service charges for the period. This figure should not include any tax collections.

Line 2 - Nontaxable Sales. Enter all sales included in line 1 that are not subject to tax. Nontaxable sales include:

•In Column A and Column B: all sales exempt from North Dakota sales tax including sales to exempt entities, sales of nontaxable service, sales for resale, sales delivered outside of state. Also include bad debts originally reported as a taxable sale with the tax remitted, but written off during this period as uncollectible.

•In Column A: sales subject to state sales tax but not subject to city lodging and restaurant tax. The imposition of city lodging and restaurant taxes varies from city to city. Please contact the Office of State Tax Commissioner if you need additional information.

•In Column B: sales subject to state sales tax but not subject to city lodging tax. City lodging tax applies only to the gross receipts from leasing or renting hotel, motel, or tourist court accommodations within the city for periods of less than thirty consecutive days or one month. It does not apply to food, alcoholic beverages, phone service, durable goods, etc.

Line 3 - Net Taxable Sales. Subtract line 2 from line 1.

Line 4 – Tax Amount. Multiply line 3 by the tax rates printed in the column headings.

Line 5 – Penalty and Interest. Penalty and interest apply to all returns paid or filed after the due date. Penalty and Interest are calculated separately for Column A and Column B. For the first month the return is late, the penalty is 5 percent of the tax due on line 4 or $5, whichever is greater. For each additional month or fraction of a month the return is late, add an additional penalty of 5 percent of the tax on line 4 up to a maximum of 25 percent. Interest does not apply to the first month a return is late, but applies at a rate of 1 percent each month or fraction of a month the return remains late or unpaid.

Line 6 – Total Tax, Penalty, and Interest. Enter the total of line 4 and line 5.

Line 7 – Total Due with Return. Enter the total of line 6, Column A and Column B.

Make your check payable to North Dakota Tax Commissioner. The taxpayer or taxpayer’s agent must sign the return. Please PRINT the name and phone number of a contact person who can answer questions about this return.

Office of State Tax Commissioner

PO Box 5623

Bismarck, ND 58506-5623

Phone 701.328.1246

www.nd.gov/tax