Navigating changes in business operations requires thorough documentation, and the F1321101 form serves as a crucial tool for this purpose. At its core, this form is designed for business owners to report changes to their business tax accounts. It encompasses a wide array of alterations, including shifts in the business name, ownership type, address, and even the tax classification under which the business files its returns. The form mandates completion of specific sections such as the effective date of changes, Federal Employer Identification Number (FEIN) or Social Security Number (SSN), alongside local and state business tax account numbers. Further, it delves into more detailed changes like updates in the exact location address, mailing address, and the business's classification. For those concluding their operations, it also requests information regarding the closure of the business. Additionally, updates in contact details, such as telephone, fax numbers, and email addresses, are included, ensuring that business records are current. It emphasizes the significance of providing current information about the owners, officers, or partners, facilitating clear communication and legal compliance. Required to be signed by an authorized individual, this form bridges the gap between businesses and tax authorities, ensuring that records accurately reflect the current state of the business. It underscores the legal obligation of businesses to keep tax-related information up to date and illustrates the formal process for submitting such changes.

| Question | Answer |

|---|---|

| Form Name | Form F1321101 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 11b, 10b, 15b, business form account |

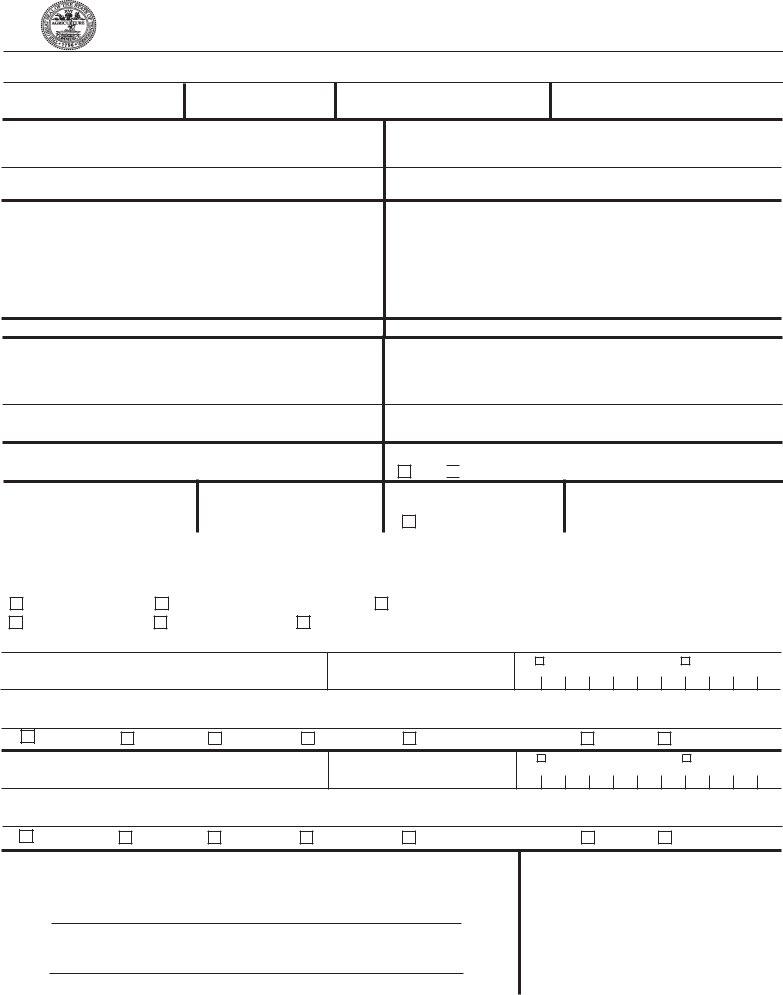

BUSINESS TAX ACCOUNT CHANGE FORM

YOU MUST COMPLETE ITEM 1, EITHER ITEM 2 OR ITEM 3 AS APPLICABLE, AND ITEM 4. ENTER INFORMATION IN ITEMS 5 THROUGH 16 IF CHANGES HAVE OCCURRED. FOR ASSISTANCE, PLEASE CONTACT YOUR LOCAL COUNTY CLERK OR DESIGNATED MUNICIPAL BUSINESS TAX REPRESENTATIVE.

1.Effective Date of Changes:

2.FEIN/SSN:

3. Local Business Tax Account No:

4.State Business Tax Account No:

5A. |

PREVIOUS ACCOUNT NAME |

5B. |

NEW ACCOUNT NAME |

|

|

|

|

BUSINESS NAME |

|

BUSINESS NAME |

|

LEGAL NAME, IF DIFFERENT

LEGAL NAME, IF DIFFERENT

|

6A. |

PREVIOUS EXACT LOCATION ADDRESS |

|

6B. |

NEW EXACT LOCATION ADDRESS |

|

|

|

|

|

|

||||

|

STREET, HIGHWAY (DO NOT USE P.O. BOX NUMBER OR RURAL ROUTE NUMBER) |

STREET, HIGHWAY (DO NOT USE P.O. BOX NUMBER OR RURAL ROUTE NUMBER) |

|||||

|

|

|

|||||

|

APARTMENT OR SUITE NUMBER (DO NOT USE P.O. BOX OR RURAL ROUTE NUMBER) |

APARTMENT OR SUITE NUMBER (DO NOT USE P.O. BOX OR RURAL ROUTE NUMBER) |

|||||

|

|

|

|

|

|

|

|

|

CITY |

STATE |

ZIP CODE |

CITY |

STATE |

ZIP CODE |

|

7A.PREVIOUS MAILING ADDRESS

7B.NEW MAILING ADDRESS

P.O. BOX, STREET, ROUTE, OR HIGHWAY |

P.O. BOX, STREET, ROUTE, OR HIGHWAY |

|

|

APARTMENT OR SUITE NUMBER (DO NOT USE P.O. BOX OR RURAL ROUTE NUMBER) |

APARTMENT OR SUITE NUMBER (DO NOT USE P.O. BOX OR RURAL ROUTE NUMBER) |

CITY |

STATE |

ZIP CODE |

CITY |

STATE |

ZIP CODE |

8.COUNTY IN WHICH BUSINESS IS LOCATED

9.IS BUSINESS LOCATED INSIDE A TENNESSEE CITY LIMITS?

NO YES (If Yes, Name of City)

10A. PREVIOUS BUSINESS TAX CLASSIFICATION

10B. NEW BUSINESS TAX CLASSIFICATION

11A. IF CLOSING BUSINESS, INDICATE BELOW

CLOSING BUSINESS

11B. EFFECTIVE DATE OF CLOSURE

12. |

BUSINESS TELEPHONE NUMBER |

|

13. |

BUSINESS FAX NUMBER |

|

14. |

BUSINESS |

|

|

|||||||

( |

) |

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

15A. PREVIOUS OWNERSHIP TYPE (SELECT ONE): |

|

|

|

|

|

15B. |

NEW OWNERSHIP TYPE |

|

|

|||||||

|

PROPRIETORSHIP |

HUSBAND/WIFE OWNERSHIP |

OTHER |

|

|

|

|

|

|

|||||||

|

PARTNERSHIP |

CORPORATION |

|

LIMITED LIABILITY COMPANY |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16.IDENTIFY CHANGES IN OWNERS, OFFICERS, PARTNERS, OR CONTACT PERSON

(1) NAME

HOME TELEPHONE #

SOCIAL SECURITY #

FEDERAL EIN

HOME ADDRESS (DO NOT USE P.O. BOX #) |

CITY |

STATE |

ZIP CODE |

Member

Owner

Officer

Partner

Contact Person

Add

Remove

(2) NAME

HOME TELEPHONE #

SOCIAL SECURITY #

FEDERAL EIN

HOME ADDRESS (DO NOT USE P.O. BOX #) |

CITY |

STATE |

ZIP CODE |

Member

Owner

Officer

Partner

Contact Person

Add

Remove

17.THE STATEMENTS MADE ON THIS APPLICATION ARE TRUE TO THE BEST OF MY KNOWLEDGE AND BELIEF. (THIS APPLICATION MUST BE SIGNED BY THE INDIVIDUAL OWNER, A PARTNER,

OR AN OFFICER OF THE CORPORATION. THE SIGNATORY MUST ALSO BE LISTED IN ITEM 16.)

SIGN

HERE:

SIGNATURE OF OWNER, PARTNER, OR OFFICER (DO NOT PRINT OR USE STAMP)

FOR OFFICIAL USE ONLY

TITLE |

DATE |

|

|

INTERNET |

BUSINESS TAX ACCOUNT CHANGE FORM

INSTRUCTIONS

1.Enter the date on which the changes you are making to the business tax accout will be effective.

2. If the business has a Federal Employer Identification Number (FEIN), enter the FEIN. If the business does not have a FEIN, enter the social security number under which the business is registered.

3. Enter the local business tax account number of the business for which the changes are being made.

4. Enter the state business tax account number of the business for which the changes are being made.

5.Enter the previous name of the business as recorded on the business tax account in Block 5a. Enter the new name to be recorded on the account in Block 5b.

6.Enter the previous location address as recorded on the business tax account in Block 6a. Enter the new location address to be recorded for the business in Block 6b.

7.Enter the previous mailing address as recorded on the business tax account in Block 7a. Enter the new mailing address to be recorded for the business in Block 7b.

8.Enter the name of the county in which the business is located.

9.Indicate whether the business is located within the limits of a city in the county. If the business is located within the limits of a city, enter the name of the city. Note: A business located within the limits of a city may have a business tax obligation for both the county and the city. If so, the business must complete a change form for both the county and the city.

10.Enter the previous business tax classification under which the business filed business tax returns in Block 10a. Enter the new business tax classification under which the business must file returns in Block 10b.

11.If the business is closing, check the “Closing Business” box in Block 11a. Enter the effective date of closing in Block 11b.

12.Enter the business telephone number.

13.If the business has a fax number, enter the business fax number.

14.Enter the business fax number.

15.Select the previous ownership type of the business by checking the appropriate box in Block 15a. Enter the new ownership type in Block 15b.

16.Enter the name, home address, home telephone number, FEIN or social security number, as applicable, of owners, officers, or partners, or contact persons for the business. Check the box that most closely identifies the relationship of the person being named to the business. Check the appropriate box to indicate if the person is to be added to the account or removed from the account. If a person is being replaced, enter both the person being added and the person being removed.

This information is critical. It will allow us to identify persons with whom we may discuss the business tax account when needed. If additional changes are required, please submit them on a separate piece of paper.

17.The application must be signed by an owner, partner, or officer of the business for which changes are being made. The person who signs the application must either have been listed in Item 14 on the original business tax application form or be added in Item 16 on this or other subsequent change forms submitted for the business. Indicate the title of the person signing the application (i.e., owner, partner, officer) and the date on which the application is signed.

INTERNET