Making use of the online PDF tool by FormsPal, it is easy to fill in or modify f3520 right here and now. In order to make our editor better and easier to use, we continuously implement new features, with our users' feedback in mind. To begin your journey, go through these simple steps:

Step 1: Click the orange "Get Form" button above. It's going to open up our pdf tool so that you could begin completing your form.

Step 2: With our state-of-the-art PDF file editor, you'll be able to accomplish more than simply complete blanks. Edit away and make your docs seem professional with custom textual content added in, or adjust the file's original input to excellence - all comes with an ability to insert your personal pictures and sign the file off.

With regards to the blank fields of this particular document, here's what you should consider:

1. It's vital to complete the f3520 accurately, so pay close attention when filling out the segments that contain all of these blanks:

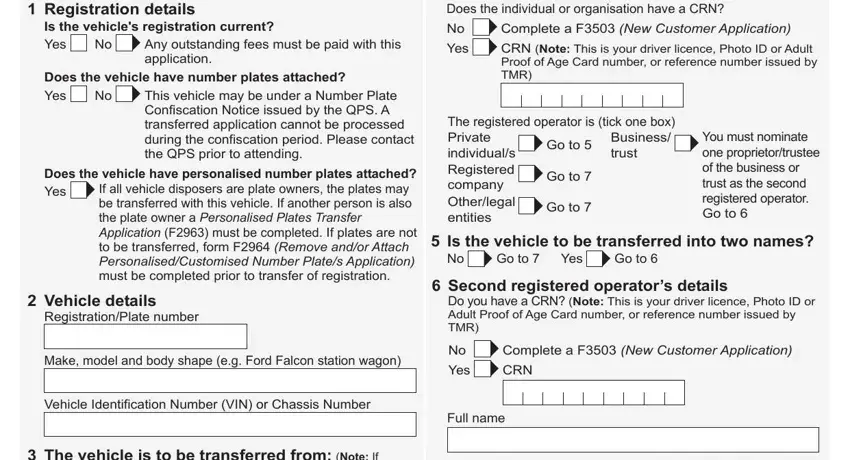

2. Just after filling out this step, go to the subsequent step and enter the essential details in all these blanks - Registration details Is the, Any outstanding fees must be paid, Does the vehicle have number, This vehicle may be under a Number, Does the vehicle have personalised, Vehicle details RegistrationPlate, Make model and body shape eg Ford, Does the individual or, Yes, Complete a F New Customer, CRN Note This is your driver, Go to, The registered operator is tick, Go to, and Go to.

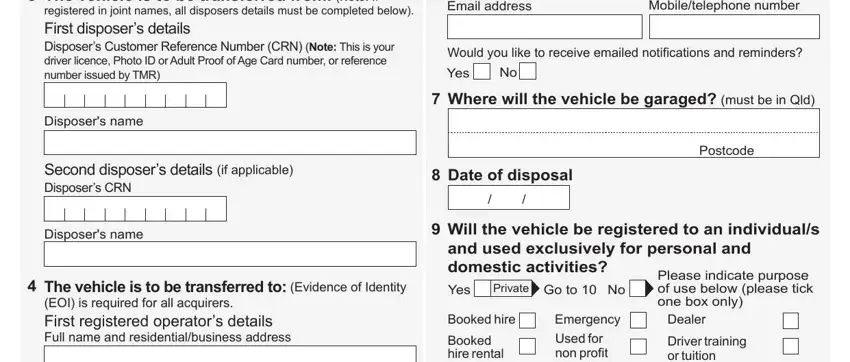

3. This next section is related to The vehicle is to be transferred, Email address, Mobiletelephone number, Would you like to receive emailed, Yes, Where will the vehicle be garaged, Disposers name, Second disposers details if, Date of disposal, Postcode, Disposers name, The vehicle is to be transferred, Will the vehicle be registered to, Yes, and Private - fill out each of these blank fields.

It's easy to make a mistake while completing the Where will the vehicle be garaged, so make sure that you go through it again before you submit it.

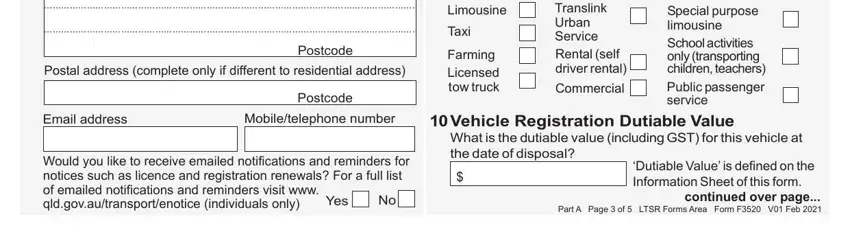

4. All set to fill out this next section! In this case you'll have these Postal address complete only if, Postcode, Postcode, Booked hire rental Limousine, Taxi, Farming Licensed tow truck, Used for non profit Translink, Commercial, Driver training or tuition Special, Email address, Mobiletelephone number, Would you like to receive emailed, Yes, Vehicle Registration Dutiable, and Dutiable Value is defined on the form blanks to do.

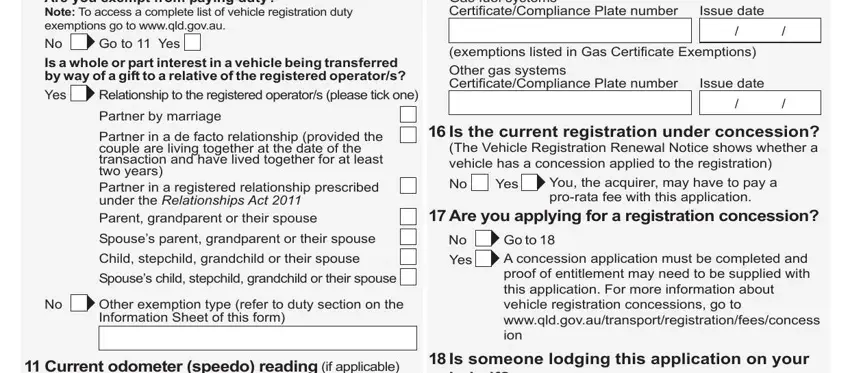

5. Since you reach the conclusion of this document, you'll find just a few extra requirements that should be satisfied. Notably, Are you exempt from paying duty, Go to Yes, Is a whole or part interest in a, Relationship to the registered, Partner by marriage, Partner in a de facto relationship, Spouses parent grandparent or, Child stepchild grandchild or, Spouses child stepchild grandchild, Other exemption type refer to duty, Current odometer speedo reading if, Gas fuel systems, Issue date, exemptions listed in Gas, and Issue date must be done.

Step 3: Look through what you've typed into the form fields and then click on the "Done" button. Download your f3520 after you subscribe to a free trial. Conveniently use the pdf file inside your personal account page, together with any modifications and adjustments being all preserved! We don't sell or share the information you enter whenever filling out forms at our website.