In the complex landscape of family law, the Form F8 serves as a critical document for those navigating through divorce or separation proceedings in the Supreme Court of British Columbia. At its core, the F8 Financial Statement demands meticulous attention from the claimants, requiring the disclosure of detailed financial information. This affidavit is fundamental when claims for child support, spousal support, or other financial support are made, with specific instructions outlining under what conditions it is mandatory. The form meticulously segments various scenarios under which a party may be applying for support, adjusting for child support, or responding to claims, thereby necessitating different portions of the document to be completed. By breaking down financial obligations and resources into comprehensive sections, including income, expenses, and assets, the Form F8 stands as a pivotal step in ensuring that support determinations are made fairly and equitably. It is designed to present the court with a transparent view of an individual’s financial standing, which, in turn, influences decisions on support matters. The exclusions listed, such as instances where child support is pursued without any other support claims or under certain income thresholds, underscore the form’s adaptability to varied circumstances. The introduction of checkboxes and a guiding chart further streamlines the process, ensuring that respondents only fill out relevant sections, reflecting the form's intent to simplify the complexity of financial disclosures in family law proceedings.

| Question | Answer |

|---|---|

| Form Name | Form F8 |

| Form Length | 12 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 3 min |

| Other names | form f8 online, form f8 financial statement fillable pdf, form f8, fillable financial statement |

Form F8 (Rule

This is the 1st affidavit of [name] in this case and was made on [dd/mmm/yyyy]

Court File No.:

Court Registry:

In the Supreme Court of British Columbia

Claimant:

Respondent:

FINANCIAL STATEMENT

INSTRUCTIONS FOR COMPLETION

You do not need to complete this form if ALL of the following apply:

(a)you are applying for child support but are making no claim for any other kind of support;

(b)you are not applying for special expenses under section 7 of the child support guidelines;

(c)the child support is for children who are not stepchildren;

(d)none of the children for whom child support is claimed is 19 years of age or older;

(e)there is no application for a shared custody order;

(f)the income of the party being asked to pay child support is under $150 000 per year;

(g)there is no application for a split custody order;

(h)you are not making a claim based on undue hardship under section 10 of the child support guidelines.

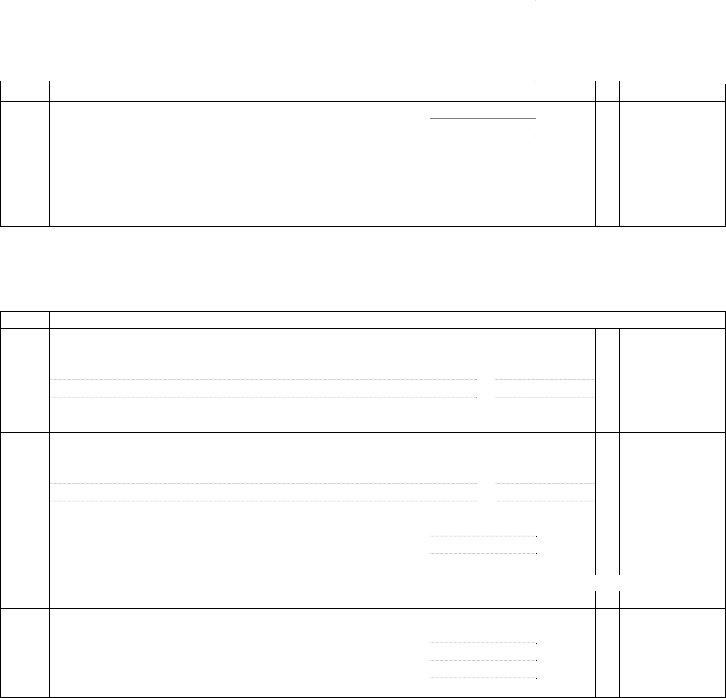

Unless ALL of the conditions above apply, you must swear the following affidavit and complete the Parts of this Form that the following chart indicates apply to you.

This Form has 6 Parts. You may not have to complete all Parts. Which Parts you have to complete depends on which categories of application apply to you as set out in the following chart.

Please check off each of the Items, 1 through 10, that apply to you and then complete the Parts that are noted for those Items. Each required Part need be completed only once regardless of the number of applicable Items for which it is required.

|

|

|

|

|

Part(s) |

Item |

Category |

1 |

2 |

3 4 5 6 |

|

1 |

|

I am applying for spousal or parental support. |

|

|

|

|

|||||

|

|

|

|

|

|

2 |

|

I am being asked to pay spousal or parental support. |

|

|

|

|

|||||

|

|

|

|

|

|

3 |

|

I am being asked to pay child support and all of the following conditions apply: |

|

|

|

|

|

|

|||

(a)there is no claim for special expenses under section 7 of the child support guidelines;

(b)the child support is only for children who are not stepchildren;

(c)none of the children for whom child support is claimed is 19 years of age or older;

(d)there is no application for a shared custody order;

(e)my income is under $150,000 per year;

(f)there is no claim based on undue hardship under section 10 of the child support guidelines.

4 |

|

I am applying for or being asked to pay child support and one or more of the |

|

|

|

|

following conditions may apply: |

|

|

|

|

(a) |

one or more of the children is a stepchild; |

|

|

|

(b) |

one or more of the children for whom child support is claimed is 19 years of |

|

|

|

|

age or older; |

|

|

|

(c) |

there is an application for shared custody; |

|

|

|

(d) |

the income of the party being asked to pay child support is more than |

|

|

|

|

$150,000 per year. |

|

www.DIVORCEmate.com 2010.0615

Form F8 – Financial Statement |

|

|

|

|

Page 2 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part(s) |

|

||

Item |

Category |

1 |

2 |

3 |

4 |

5 |

6 |

|

5 |

|

I am being asked to pay child support and I intend to make a hardship claim under |

|

|

|

|

|

|

|

|

|||||||

|

|

the child support guidelines. |

|

|

|

|

|

|

6 |

|

I am applying for child support and the opposite party intends to make a hardship |

|

|

|

|

|

|

|

|

|

||||||

|

|

claim under the child support guidelines. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

Either I claim child support or I am being asked to pay child support and there is |

|

|

|

|

|

|

|

|

a claim for special expenses under section 7 of the child support guidelines. |

|

|

|

|

|

|

8 |

|

I am making or responding to a property claim under Part 5 of the Family |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Relations Act. |

|

|

|

|

|

|

Include parts |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

I, [name], of [address for service], SWEAR (OR AFFIRM) THAT:

1.The information set out in this financial statement is true and complete to the best of my knowledge.

[Check whichever of the following boxes is correct and complete any required information.]

2.[ ] I do not anticipate any significant changes in the information set out in this financial statement. [ ] I anticipate the following significant changes in the information set out in this financial statement:

SWORN/AFFIRMED BEFORE ME at [Sworn City]

British Columbia on [dd/mmm/yyyy]

A Commissioner for taking affidavits for British Columbia

[Print name or affix stamp of commissioner]

[name]

Form F8 – Financial Statement |

Page 3 |

PART 1 – INCOME

A.Employer information:

[ ] I am employed by [name and address of employer] [ ] I am self employed as [trade or occupation]

[ ] I operate an unincorporated business, the name and address of which is [name and address of business]

B.Documentation supplied:

I have attached to this statement or serve with it a copy of each of the following applicable income

documents: (Check the first 2 boxes and check each other box that applies to you and provide the documents referred to beside each checked box)

[x] every personal income tax return, including all attachments, that I have filed for each of the 3 most recent taxation years;

[x] every income tax notice of assessment or reassessment I have received for each of the 3 most recent taxation years;

[] (if you are an employee) my most recent statement of earnings indicating the total earnings paid in the year to date, including overtime, or, if such a statement is not provided by my employer, a letter from my employer setting out that information, including my rate of annual salary or remuneration;

[] (if you are receiving Employment Insurance benefits) my 3 most recent EI benefit statements;

[] (if you are receiving Workers’ Compensation benefits) my 3 most recent WCB benefit statements;

[] (if you are receiving social assistance) a statement confirming the amount of social assistance that I receive;

[] (if you are

(i)the financial statements of my business or professional practice, other than a partnership, and

(ii)a statement showing a breakdown of all salaries, wages, management fees or other payments or benefits paid to, or on behalf of, persons or corporations with whom I do not deal at arm’s length;

[] (if you are a partner in a partnership) confirmation of my income and draw from, and capital in, the partnership for its 3 most recent taxation years;

[] (if you control a corporation) for the corporation’s 3 most recent taxation years

(i)the financial statements of the corporation and its subsidiaries, and

(ii)a statement showing a breakdown of all salaries, wages, management fees or other payments or benefits paid to, or on behalf of, persons or corporations with whom the corporation and every related corporation does not deal at arm’s length;

[] (if you are a beneficiary under a trust) the trust settlement agreement and the trust’s 3 most recent financial statements;

[] (if you own or have an interest in real property) the most recent assessment notice issued from an assessment authority for the property.

NOTE: If the applicable income documents are not attached to or served with this financial statement, they must nonetheless be provided to the other party if and as required by Rule

Form F8 – Financial Statement |

Page 4 |

C.ANNUAL INCOME

If line 150 (total income) of your most recent federal income tax return sets out what you expect your income will be for this year and you are not obliged under Note 1 below to complete Schedule A of this Form, ignore lines 1 to 7 below and record the number from line 150 of your most recent federal income tax return at line 8 below. Otherwise, record what you expect your income for this year to be from each of the following sources of income that applies to you. Record gross annual amounts.

LINE |

GUIDELINE INCOME FOR BASIC CHILD SUPPORT CLAIM |

|

|

|

||||||||||||

|

Sources and amounts of annual income |

|

|

|

|

|

|

|

|

|

|

|

||||

1 |

Employment income |

paid: |

|

|

|

|

|

monthly |

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||||||

|

|

|

twice each month |

every 2 weeks |

|

|

weekly |

|

|

annually |

+ |

|

$0.00 |

|||

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2 |

Employment insurance benefits |

|

|

|

|

|

|

|

|

+ |

|

|

||||

3 |

Workers’ compensation benefits |

|

|

|

|

|

|

|

|

+ |

|

|

||||

4 |

Interest and investment income |

|

|

|

|

|

|

|

|

+ |

|

|

||||

5 |

Pension income |

|

|

|

|

|

|

|

|

|

+ |

|

|

|||

6 |

Social assistance income relating to self |

|

|

|

|

|

|

|

|

+ |

|

|

||||

7 |

Other income (attach Schedule A) – see Note 1 |

|

|

|

|

|

|

|

|

+ |

|

$0.00 |

||||

8 |

|

|

|

|

Child support guidelines income before adjustments |

= |

|

$0.00 |

||||||||

|

(If you are required to complete lines 1 through 7 above, total the amounts of those lines here. |

|

|

|

||||||||||||

|

Otherwise, record the number from line 150 of your most recent federal |

|

|

|

|

|

|

|||||||||

|

income tax return) |

|

|

|

|

|

|

Line 150 Income (if applicable) |

|

|

|

|||||

|

Adjustments to income |

|

|

|

|

|

|

|

|

|

|

|

|

|||

9 |

Subtract union and professional dues |

|

|

|

|

|

|

|

|

- |

|

|

||||

10 |

Adjustments in accordance with Schedule III of the Guidelines per line 8 |

+ |

|

$0.00 |

||||||||||||

|

of Schedule B (attached) – see Note 2 |

|

|

|

|

|

|

|

|

|

|

|

||||

11 |

|

|

|

Child support guidelines income for basic child support |

= |

|

$0.00 |

|||||||||

|

|

|

|

|

|

|

|

(line 8 as adjusted by lines 9 and 10) |

|

|

|

|||||

|

|

|

|

|

||||||||||||

|

CHILD SUPPORT GUIDELINE INCOME TO DETERMINE SPECIAL EXPENSES |

|

|

|

||||||||||||

|

Child support guideline income (from line 11 of this table) |

|

|

|

+ |

|

$0.00 |

|||||||||

12 |

Add spousal support received from the other party to the family law case |

+ |

|

|

||||||||||||

13 |

Subtract spousal support paid to the other party to the family law case |

- |

|

|

||||||||||||

14 |

Add Universal Child Care Benefits relating to children for whom special or |

+ |

|

|

||||||||||||

|

extraordinary expenses are sought |

|

|

|

|

|

|

|

|

|

|

|

||||

15 |

|

|

|

Child support guidelines income to determine special expenses |

= |

|

$0.00 |

|||||||||

|

|

|

|

|

|

(line 11 as adjusted by lines 12, 13 and 14) |

|

|

|

|||||||

|

|

|

|

|

||||||||||||

|

INCOME TO BE INCLUDED FOR SPOUSAL OR PARENTAL SUPPORT CLAIM |

|

|

|

||||||||||||

|

Child support guideline income (from line 11 of this table) |

|

|

|

+ |

|

$0.00 |

|||||||||

16 |

Total child support received |

|

|

|

|

|

|

|

|

|

+ |

|

|

|||

17 |

Social assistance received for other members of household |

|

|

|

+ |

|

|

|||||||||

18 |

Child Tax Benefit and BC Family Bonus |

|

|

|

|

|

|

|

|

+ |

|

|

||||

19 |

|

|

|

Total income to be used for a spousal or parental support claim |

= |

|

$0.00 |

|||||||||

|

|

|

|

|

|

|

|

|

(line 11 plus lines 16, 17 and 18) |

|

|

|

||||

Note: |

1. You must complete Schedule A of this Form and include, at line 7 above, the total income recorded at line 11 of |

|

||||||||||||||

|

|

Schedule A, if you expect to receive income this year from any of the following sources: |

|

|

|

|||||||||||

|

|

(a) taxable dividends from Canadian corporations; |

|

(e) |

registered retirement savings income; |

|

||||||||||

|

|

(b) net partnership income (limited or |

|

(f) |

|

|

|

|||||||||

|

|

|

|

partners only); |

|

|

(g) any other taxable income that is not included in |

|

||||||||

|

|

(c) |

rental income; |

|

|

|

|

paragraphs (a) to (f) or in lines 1 to 5 of Schedule A. |

||||||||

|

|

(d) |

taxable capital gains; |

|

|

|

|

|

|

|

|

|

|

|

|

|

2.If there are any adjustments as set out in Schedule III of the child support guidelines that apply to you, you must

(a)complete Schedule B of this Form, and

(b)include at line 10 above, the amount recorded at line 8 of that completed Schedule B.

Form F8 – Financial Statement |

|

|

|

|

Page 5 |

|

|

|

SCHEDULE A – OTHER INCOME |

|

|

|

|

|

|

|

|

|

|

|

LINE |

OTHER SOURCES OF INCOME |

|

|

|

||

1 |

Self employment income: |

Gross = |

|

Net = |

+ |

|

|

Note: Provide financial statements of the business, including any statement of business activities filed |

|

|

|||

|

as part of your income tax return |

|

|

|

|

|

2 |

Other employment income |

|

|

|

+ |

|

3 |

Net partnership income: limited or |

|

+ |

|

||

4 |

Rental income: |

Gross = |

|

Net = |

+ |

|

|

|

|

|

|

||

5 |

Total amount of dividends from Taxable Canadian Corporations |

|

+ |

|

||

6Total capital gains

|

minus total capital losses |

- |

= |

+ |

$0.00 |

|

|

|

|

|

|

|

|

7 |

Spousal support from another relationship or marriage |

|

|

|

+ |

|

8 |

Registered retirement savings plan income |

|

|

|

+ |

|

9 |

Net federal supplements |

|

|

|

+ |

|

10 |

Any other income |

|

|

|

+ |

|

11 |

|

Total of lines 1 through 10 |

= |

$0.00 |

||

SCHEDULE B – ADJUSTMENTS TO INCOME

LINE DEDUCTIONS

1Employment expenses, other than union or professional dues, claimed under Schedule III of the Child Support Guidelines (list)

|

Total |

- |

$0.00 |

2 |

Actual business investment losses during the year |

- |

|

3Carrying charges and interest expenses paid and deductible under the Income Tax Act (Canada): (list)

|

|

|

Total |

- |

$0.00 |

4 |

Prior period earnings |

|

|

|

|

|

minus reserves |

- |

= |

- |

$0.00 |

|

|

|

|

||

5 |

Portion of partnership and sole proprietorship income required to be reinvested |

- |

|

||

|

ADDITIONS |

|

|

|

|

6 |

Capital cost allowance for real property |

|

|

+ |

|

7Employee stock options in

minus amount paid for shares |

- |

|

|

minus amount paid to acquire option |

- |

= + |

$0.00 |

|

|

|

|

8 |

|

Total adjustments |

$0.00 |