With the help of the online tool for PDF editing by FormsPal, you can fill in or edit proprietorship right here and now. To keep our editor on the forefront of convenience, we aim to put into practice user-driven features and enhancements on a regular basis. We're routinely happy to get feedback - join us in revampimg PDF editing. With some basic steps, it is possible to begin your PDF journey:

Step 1: Click the "Get Form" button in the top part of this webpage to access our tool.

Step 2: As you start the file editor, you'll see the document prepared to be filled out. In addition to filling in different blank fields, you may as well perform many other things with the form, including adding your own words, modifying the initial textual content, adding illustrations or photos, putting your signature on the form, and more.

As for the fields of this precise document, this is what you should know:

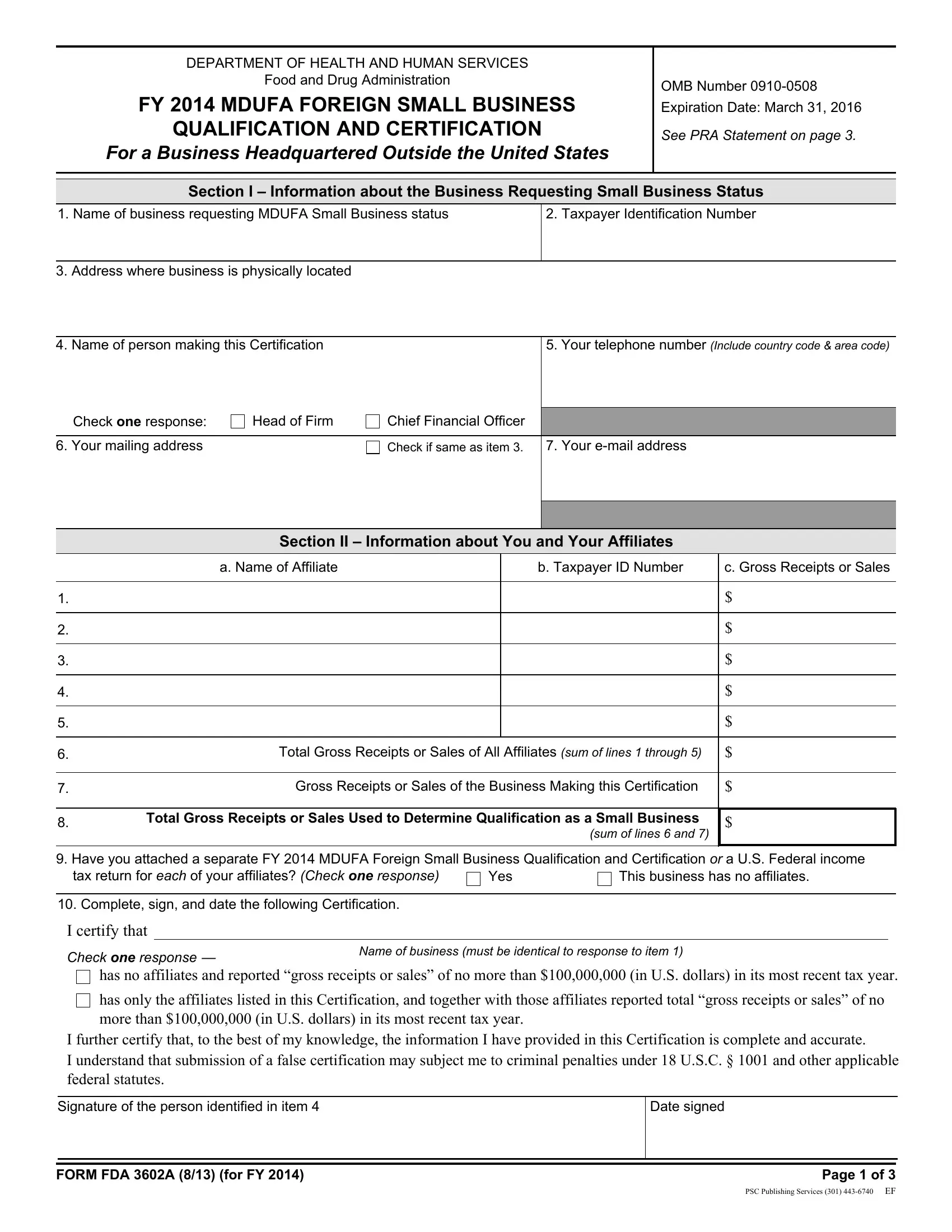

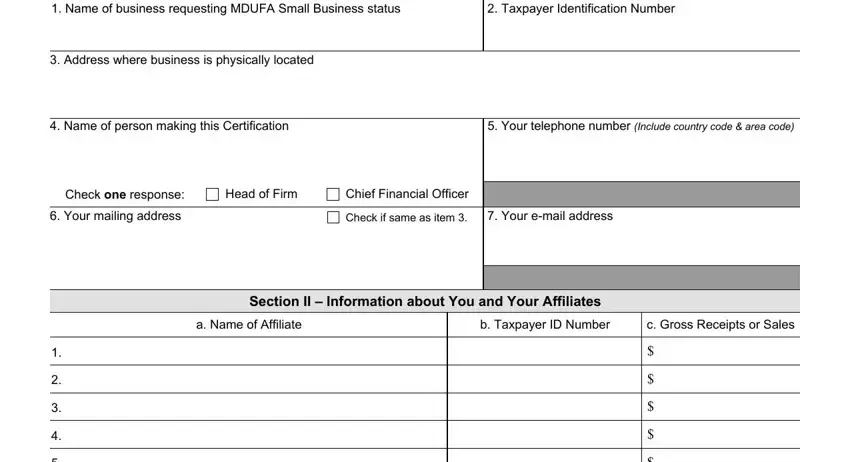

1. It is crucial to fill out the proprietorship accurately, hence take care when working with the areas that contain all of these blank fields:

2. Given that this segment is finished, it's time to insert the needed specifics in Total Gross Receipts or Sales of, Gross Receipts or Sales of the, Total Gross Receipts or Sales Used, sum of lines and, Have you attached a separate FY, tax return for each of your, Yes, This business has no affiliates, Complete sign and date the, I certify that, Check one response, Name of business must be identical, has no affiliates and reported, has only the affiliates listed in, and I further certify that to the best so you're able to proceed further.

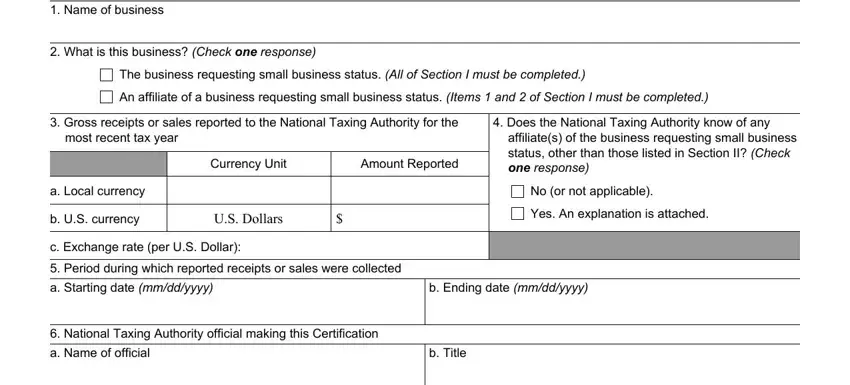

3. This next step will be about Name of business, What is this business Check one, The business requesting small, An affiliate of a business, Gross receipts or sales reported, Does the National Taxing, most recent tax year, a Local currency, Currency Unit, Amount Reported, b US currency, US Dollars, c Exchange rate per US Dollar, Period during which reported, and affiliates of the business - type in each one of these fields.

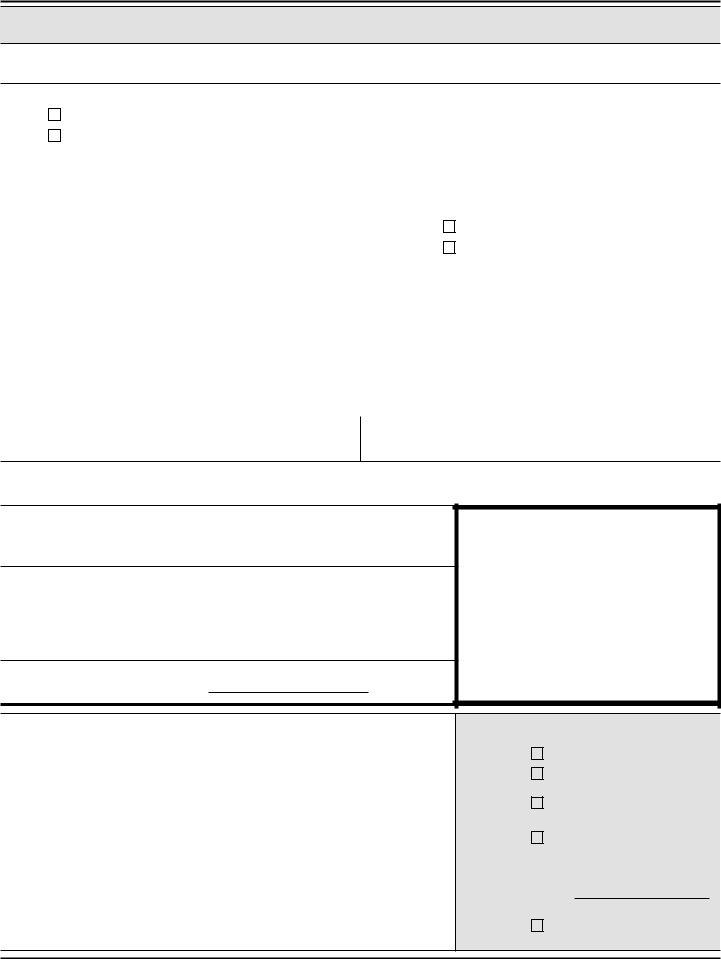

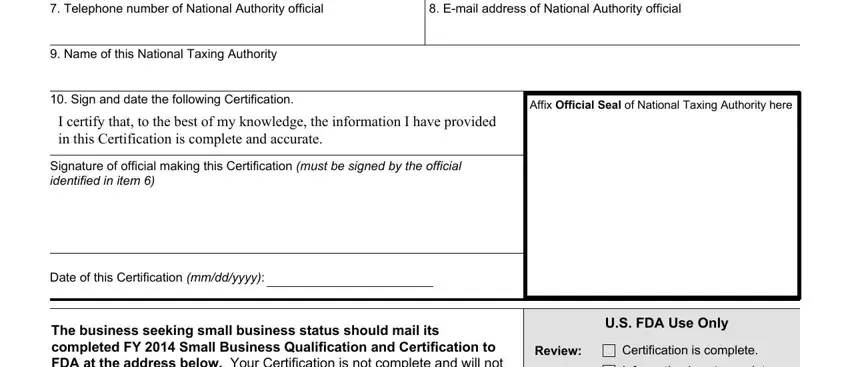

4. It's time to fill out this fourth form section! Here you'll have all of these Telephone number of National, Email address of National, Name of this National Taxing, Sign and date the following, Affix Official Seal of National, I certify that to the best of my, Signature of official making this, Date of this Certification mmddyyyy, The business seeking small, US FDA Use Only, Review, Certification is complete, and Information is not complete fields to fill out.

Be extremely mindful when filling in Sign and date the following and Name of this National Taxing, since this is where most users make mistakes.

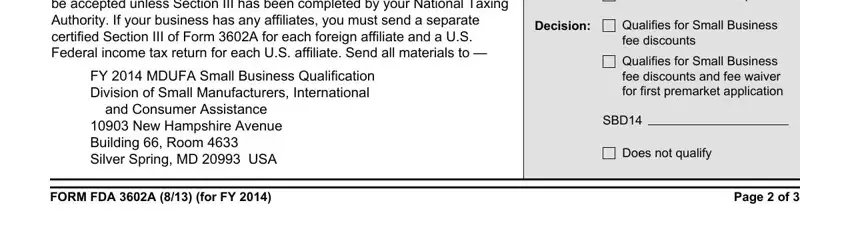

5. When you reach the completion of your document, there are just a few extra things to do. In particular, The business seeking small, FY MDUFA Small Business, and Consumer Assistance, New Hampshire Avenue Building, Information is not complete, Decision, Qualifies for Small Business fee, Qualifies for Small Business fee, SBD, Does not qualify, FORM FDA A for FY, and Page of must be filled out.

Step 3: When you have reviewed the information you filled in, click "Done" to complete your FormsPal process. Join FormsPal right now and easily use proprietorship, set for downloading. All changes you make are kept , which enables you to edit the file at a later time if necessary. FormsPal is dedicated to the confidentiality of all our users; we make sure that all personal data going through our tool stays confidential.