Ensuring compliance with district regulations, the FR-368 form plays a crucial role in the operations of businesses involved in resale or rental activities within the District of Columbia. Designed to facilitate the authentication of transactions exempt from sales and use tax, this document serves as a declaration by the purchaser to the seller, stating that the items bought are intended for resale or rental, either in their original form or as a part of another property. It's imperative for the form to feature the purchaser's District of Columbia Certificate of Registration number, a signature from an authorized party, and a date to be considered valid. This certificate, once filled, acts as a blanket document applicable to all future transactions, as long as it remains unrevoked and the specific orders reference the registration number provided. Sellers are mandated to retain these certificates as proof of exemption during audits of their sales and use tax returns by the Department of Finance and Revenue. Furthermore, the form outlines the procedure for purchasers outside of the district, who do not engage in retail sales within it, to obtain a District of Columbia Certificate of Registration. This enables them to use the FR-368 for certifying items bought for resale outside the District, ensuring they too adhere to the legal requirements set forth by the Office of Tax and Revenue.

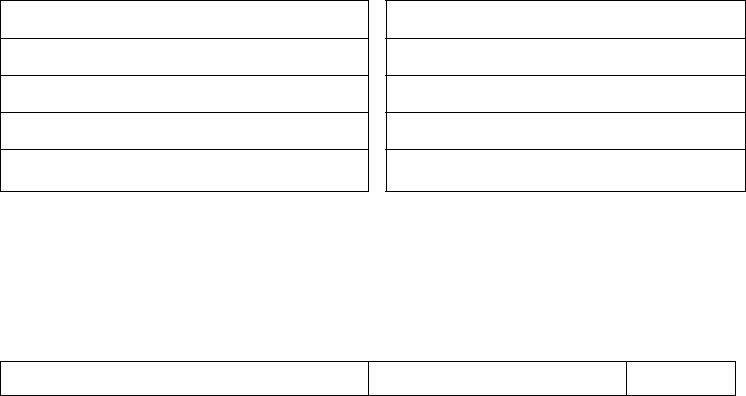

| Question | Answer |

|---|---|

| Form Name | Form Fr 368 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | FR 368 stf dc32130f form |

CERTIFICATE OF RESALE

DISTRICT OF COLUMBIA SALES AND USE TAX

TO:

SELLER

TRADE NAME (IF ANY)

SELLER’S STREET ADDRESS

CITY |

STATE |

ZIP CODE |

NOTE: SELLER MUST KEEP THIS CERTIFICATE

FROM:

PURCHASER

TRADE NAME (IF ANY)

PURCHASER’S STREET ADDRESS

CITY |

STATE |

ZIP CODE |

D.C. CERTIFICATE OF REGISTRATION NUMBER

I certify that all tangible personal property and services purchased from you are for resale or rental either in the same form or for incorporation as a material part of other property being produced for resale or rental.

This certificate shall I be considered apart of each order we shall give, provided the order contains our D.C. Certificate of Registration number and will continue In force until revoked by written notice to you.

AUTHORIZED SIGNATURE

TITLE

DATE

INSTRUCTIONS

This certificate is not valid unless it contains the purchaser's District of Columbia Sales and Use Tax Registration Number. It must be signed by the owner or authorized officer and must be dated.

If the issuer of the certificate buys from the seller items which do not qualify for tax exemption he should advise the seller to charge the appropriate tax on such items. Otherwise, the purchaser is required to report use tax directly to the Department of Finance and Revenue.

The seller must retain all Certificates of Resale on file to substantiate exemptions in the event of an audit of his D.C. Sales and Use Tax returns.

Purchasers who are located outside the District of Columbia and who make no retail sales in the District may, upon application, be issued a D.C. Certificate of Registration in order that they may furnish a Certificate of Resale for items intended for resale outside of the District.

OFFICE OF TAX AND REVENUE

STF DC32130F