You could work with fsa 211 11 25 14 without difficulty using our PDFinity® PDF editor. FormsPal development team is relentlessly endeavoring to improve the editor and insure that it is much easier for clients with its handy functions. Make use of the current progressive possibilities, and discover a trove of new experiences! To get started on your journey, take these easy steps:

Step 1: Press the "Get Form" button at the top of this webpage to access our editor.

Step 2: This editor provides you with the capability to customize the majority of PDF documents in a variety of ways. Transform it by writing personalized text, adjust what is originally in the PDF, and include a signature - all manageable within a few minutes!

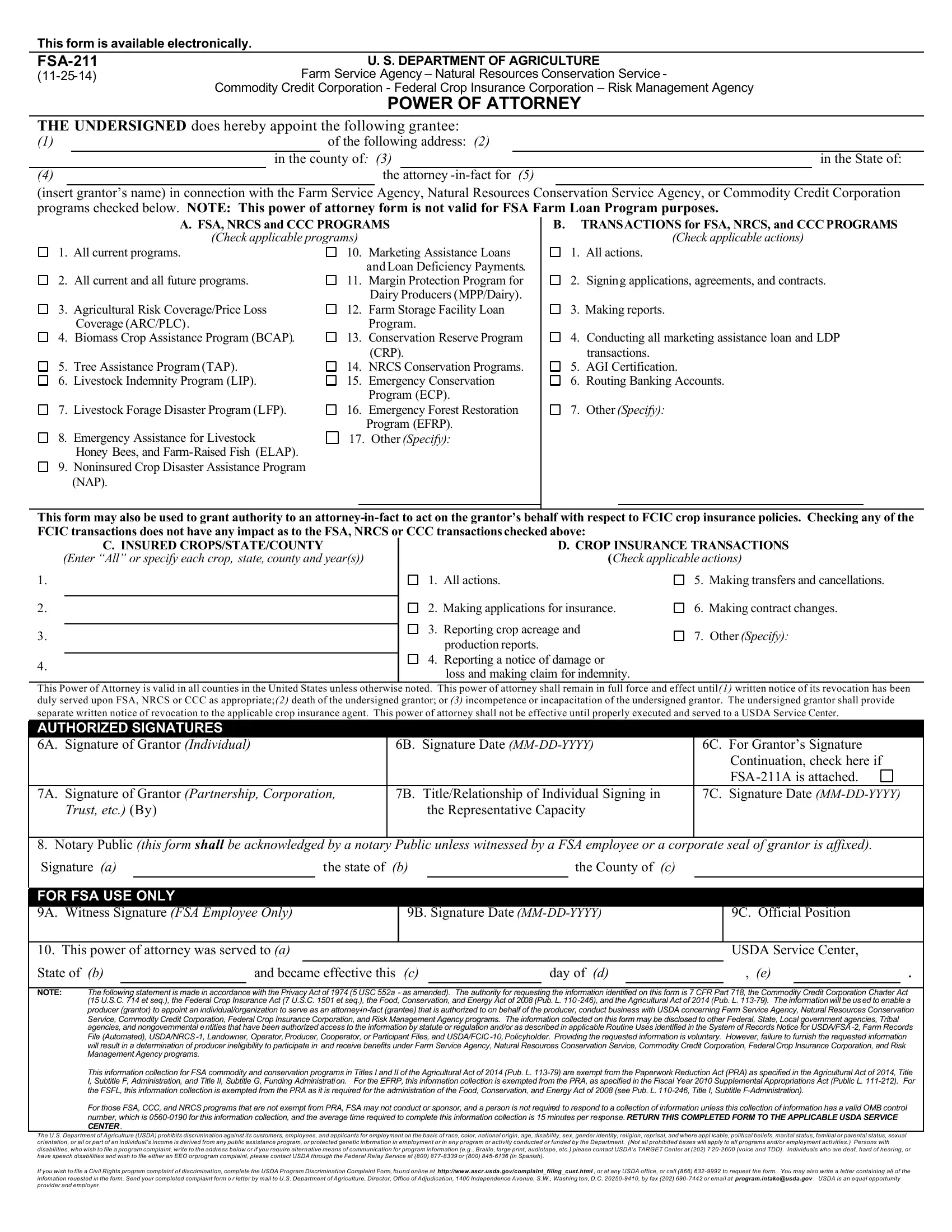

For you to complete this form, ensure that you type in the right information in every field:

1. Whenever filling out the fsa 211 11 25 14, make certain to incorporate all of the important blanks in the corresponding part. This will help to speed up the process, allowing for your information to be processed swiftly and correctly.

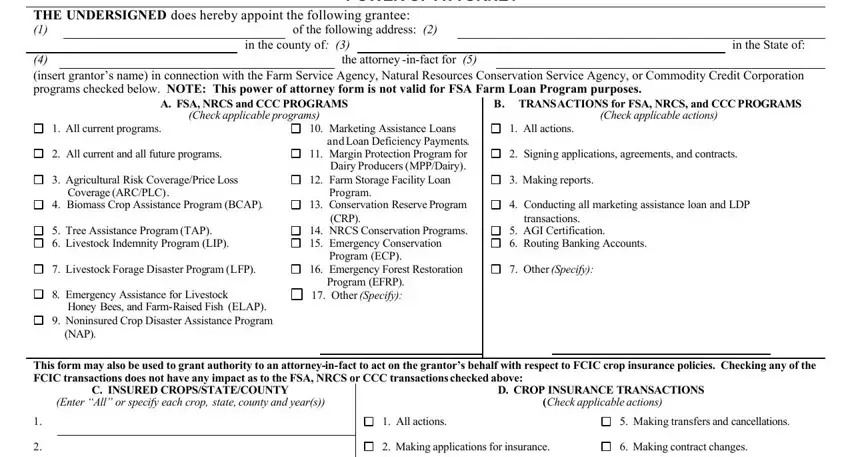

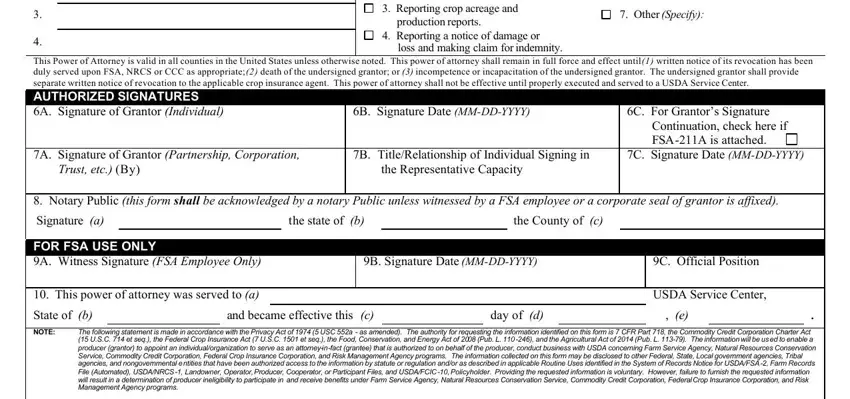

2. Soon after this section is done, proceed to type in the relevant details in all these - Reporting crop acreage and, production reports, Other Specify, Reporting a notice of damage or, loss and making claim for indemnity, This Power of Attorney is valid in, B Signature Date MMDDYYYY, A Signature of Grantor Partnership, B TitleRelationship of Individual, C For Grantors Signature, Notary Public this form shall be, Signature a FOR FSA USE ONLY A, the state of b, the County of c, and B Signature Date MMDDYYYY.

Be extremely careful when filling in loss and making claim for indemnity and B Signature Date MMDDYYYY, because this is the part where a lot of people make some mistakes.

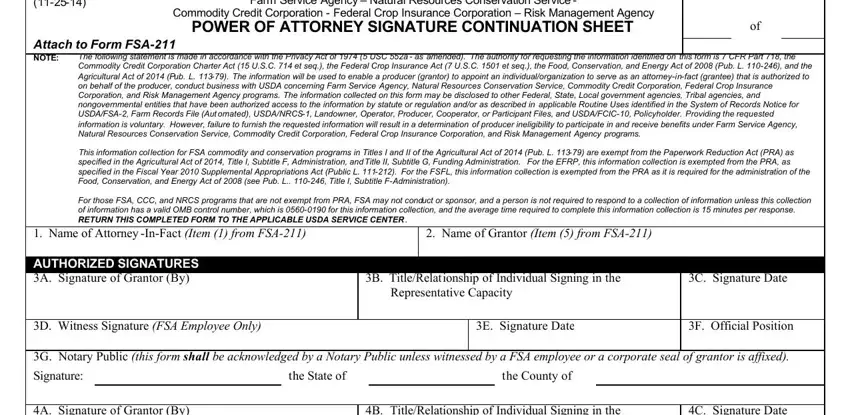

3. This subsequent step is considered fairly simple, This form is available, Farm Service Agency Natural, Commodity Credit Corporation, POWER OF ATTORNEY SIGNATURE, Attachment Pages, Attach NOTE, to Form FSA The following, this form is CFR Part the, Name of Attorney InFact Item, Name of Grantor Item from FSA, AUTHORIZED SIGNATURES A Signature, D Witness Signature FSA Employee, B TitleRelationship of Individual, E Signature Date, and C Signature Date - all of these form fields will have to be filled out here.

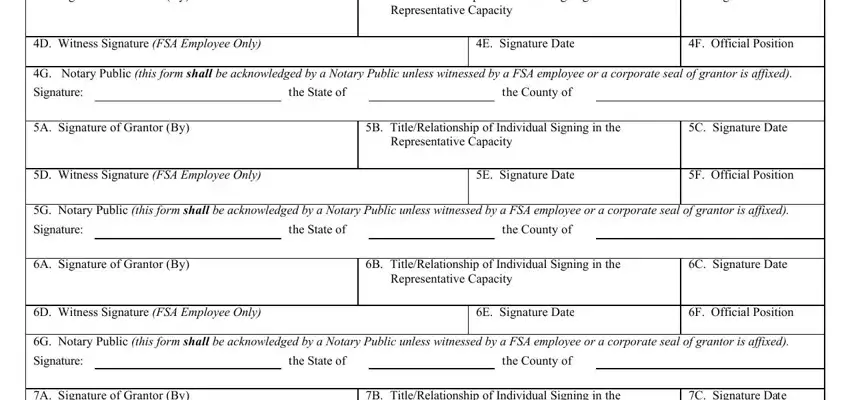

4. The following subsection requires your details in the subsequent places: Signature A Signature of Grantor By, D Witness Signature FSA Employee, B TitleRelationship of Individual, E Signature Date, C Signature Date, F Official Position, G Notary Public this form shall be, the State of, the County of, B TitleRelationship of Individual, D Witness Signature FSA Employee, E Signature Date, C Signature Date, F Official Position, and G Notary Public this form shall be. Ensure you fill in all of the needed information to go further.

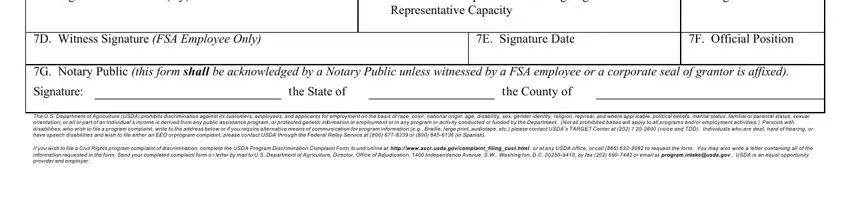

5. To wrap up your document, this final section incorporates a couple of extra blank fields. Completing G Notary Public this form shall be, B TitleRelationship of Individual, D Witness Signature FSA Employee, E Signature Date, G Notary Public this form shall be, the State of, the County of, The US Department of Agriculture, C Signature Date, and F Official Position will finalize everything and you can be done in a short time!

Step 3: Just after proofreading your fields and details, click "Done" and you're done and dusted! Get your fsa 211 11 25 14 the instant you subscribe to a 7-day free trial. Immediately view the pdf file in your personal cabinet, with any modifications and changes being all saved! FormsPal ensures your data confidentiality by having a protected method that in no way saves or shares any private data used. Feel safe knowing your documents are kept protected every time you work with our editor!