The FT-946/1046 form serves as a comprehensive document for individuals or entities seeking a refund on motor or diesel motor fuel taxes within New York State. Crafted by the New York State Department of Taxation and Finance, this critical form caters to a broad audience including exempt Indian tribes or nations, indicating a specialized focus on enabling refunds for fuel delivered on reservations. It encompasses various sections ranging from basic identification details such as names and addresses of the claimants to intricate calculations based on the type and volume of fuel purchased and consumed. The form delineates between different uses of the fuel - whether for off-highway purposes by farmers, industrial contractors, or for specific operations like running commercial boats or aircraft. Furthermore, it outlines the procedure for those eligible for refunds, including specific organizations like volunteer ambulance services and nonpublic schools, establishing a clear pathway for filing multiple claims and attaching necessary substantiations. Certification by the claimant ensures the accuracy and completeness of the information provided, emphasizing accountability and the importance of adherence to formal procedures for submitting a claim. This document is not only pivotal for the recovery of funds but also serves as a testament to the structured tax rebate processes in place aimed at supporting various sectors within the state.

| Question | Answer |

|---|---|

| Form Name | Form Ft 946 1046 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | ny diesel refund, motor tax ft form, ft946, 1046 tax |

New York State Department of Taxation and Finance |

||

Motor/Diesel Motor Fuel Tax Refund Application |

||

(6/13) |

Motor fuel tax (gasoline) |

Diesel motor fuel tax |

Both |

Do not use for refund claims of sales and use tax or petroleum business tax.

Read instructions in Form |

Filing |

Beginning |

|

Ending |

|||

|

|

period: |

|

|

|

||

|

|

|

|

|

|

|

|

Name of claimant |

|

|

|

|

Telephone number |

||

|

|

|

|

|

( |

) |

|

Street address |

City |

|

|

|

|

State |

ZIP code |

|

|

|

|

|

|

|

|

Social security number |

NYS identification number |

|

|

Federal employer identification number (EIN) |

|||

|

|

|

|

|

|

|

|

For office use only

Line 9 gallons

x $.064 = $

Line 10 gallons |

|

|

|

|

||||

|

|

|

|

x $.08 |

= $ |

|

|

|

|

Total refunds $ |

|||||||

Audited by: |

|

|

|

Date: |

|

|||

Approved by: |

|

|

|

Date: |

|

|||

|

|

|

|

|||||

Approved by: |

|

|

|

Date: |

|

|||

Refund claimed

Total refund claimed (from line 13 on page 2) ...................................................................................................................

Basis for refund

$

Mark an X in this box if you are filing multiple claims for refunds of motor/diesel motor fuel tax, sales tax, or petroleum business tax for the same period and gallonage. You must file this form and the appropriate sales tax refund claim form and/or petroleum business tax refund claim form together. Attach invoices or other substantiation as required by all forms and mail all forms in one envelope.

Mark an X in the box under section A, B, C, or D that indicates your type of operation and enter any other requested information.

A — Nontaxable use (off highway)

Farmer - number of acres under cultivation

Industrial type

Contractor - job location

Vehicles on rails or tracks

Commercial boats

Aircraft

Refrigerator (reefer) unit

Other (explain)

B — Refund assignment

Used by snowmobile club members (motor fuel)

Other (explain)

D — Specific organizations entitled to reimbursement

Voluntary ambulance service

Volunteer rescue squad

Volunteer fire company/department

Nonpublic school operator

Exempt hospital (number)

New York State and its municipalities

United States and any of its agencies or instrumentalities Indian tribe or nation

Member of exempt Indian tribe or nation – I hereby certify that I, , am an enrolled member of

,

C — Nontaxable sales

To New York State and its municipalities

To the United States and any of its agencies or instrumentalities

To airlines

For heating purposes (diesel motor fuel)

To exempt hospitals (motor fuel)

For immediate export (motor fuel)

Sales of E85 to filling stations on or after September 1, 2006

For the motor vehicles or equipment you own, indicate how many of each type that uses motor fuel (MF) or diesel motor fuel (DMF). If you do not own any of the following types of equipment, enter N/A in the box where indicated. If the fuel was used in a commercial motor boat, airplane, snowmobile, or

MF |

DMF |

MF |

DMF |

Commercial motor boat, airplane, snowmobile, or ATV registration number |

|||||||

vehicles |

|

|

equipment |

|

|

|

|

|

|

||

Automobiles |

|

|

Motor boats |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Trucks |

|

|

Airplanes |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Tractors |

|

|

Snowmobiles/ATV |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate the types |

|

|

|

Other |

|

|

|

|

Pumps/Other |

|

|

of other machinery. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 2 of 2

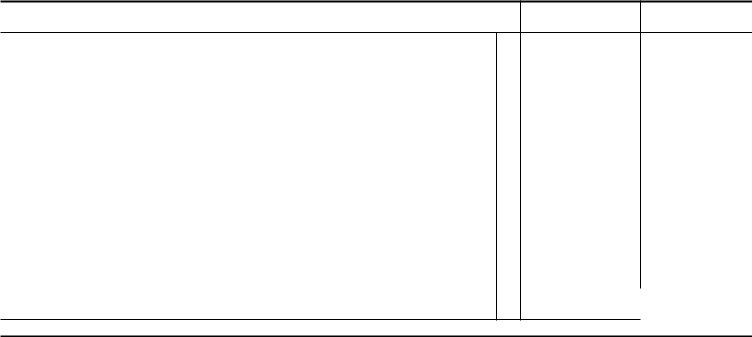

Enter separately in columns A or B the number of gallons of motor fuel/diesel motor fuel |

A |

B |

purchased and consumed in New York State on which the excise tax was paid. |

Motor fuel |

Diesel motor fuel |

|

|

1Beginning physical inventory (bulk storage only - others enter 0) (If no ending inventory was shown on the preceding claim, no beginning inventory should be shown on this claim. Beginning inventory should not include purchases made more than three years prior to date of filing a

|

claim.) |

1 |

|

|

|

|

2 |

Purchases for this filing period (do not include purchases over three years old) |

|

|

|

||

3 |

Gallons available (add lines 1 and 2) |

|

|

|

||

4 |

Ending physical inventory (bulk storage only - others enter 0) |

|

|

|

||

5 |

Total gallons used (subtract line 4 from line 3) |

|

|

|

||

6 |

Number of taxable gallons used during this filing period (explain use and type of fuel) |

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

7 |

Nontaxable gallons (subtract line 6 from line 5) |

7 |

|

|

|

|

8 |

Total amount of nontaxable gallons (add the amounts on line 7, columns A and B) |

|

|

|

||

9 |

Gallons of B20 included in line 8 that were purchased on or after September 1, 2006 |

9 |

|

|

|

|

10 |

Gallons of fuel other than B20 (subtract line 9 from line 8) |

|

|

|

||

11 |

Refund claimed on B20 (multiply line 9 by $0.064) |

|

|

|

||

12 |

Refund claimed on all other fuel (multiply line 10 by $0.08) |

|

|

|

||

13 |

Total refund claimed (add lines 11 and 12) |

13 |

|

$ |

|

|

Certification: I certify that this is a true, correct, and complete report.

|

|

|

Signature of authorized person |

|

Oficial title |

|

|

|

|

|

County |

|

||

Authorized |

|

|

|

|

|

|

|

|

|

|

|

|

||

person |

|

|

|

|

|

|

Telephone number |

|

|

Date |

|

|||

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

Paid |

|

Firm’s name (or yours if |

|

|

|

|

Firm’s EIN |

|

Preparer’s PTIN or SSN |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

preparer |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Signature of individual preparing this application |

Address |

|

|

|

|

|

City |

|

State |

ZIP code |

|||

use |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

only |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Telephone number |

Preparer’s NYTPRIN |

|

|

Date |

|

||||||

(see instr.) |

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

See Form