By using the online tool for PDF editing by FormsPal, it is easy to complete or modify California here and now. To make our tool better and less complicated to utilize, we consistently design new features, with our users' feedback in mind. All it takes is just a few simple steps:

Step 1: First of all, open the pdf tool by pressing the "Get Form Button" above on this site.

Step 2: As soon as you open the editor, you will notice the form all set to be filled out. Aside from filling out various blank fields, you may as well perform many other actions with the Document, specifically putting on your own text, changing the initial text, adding images, putting your signature on the document, and more.

It will be straightforward to fill out the pdf with our helpful guide! Here is what you should do:

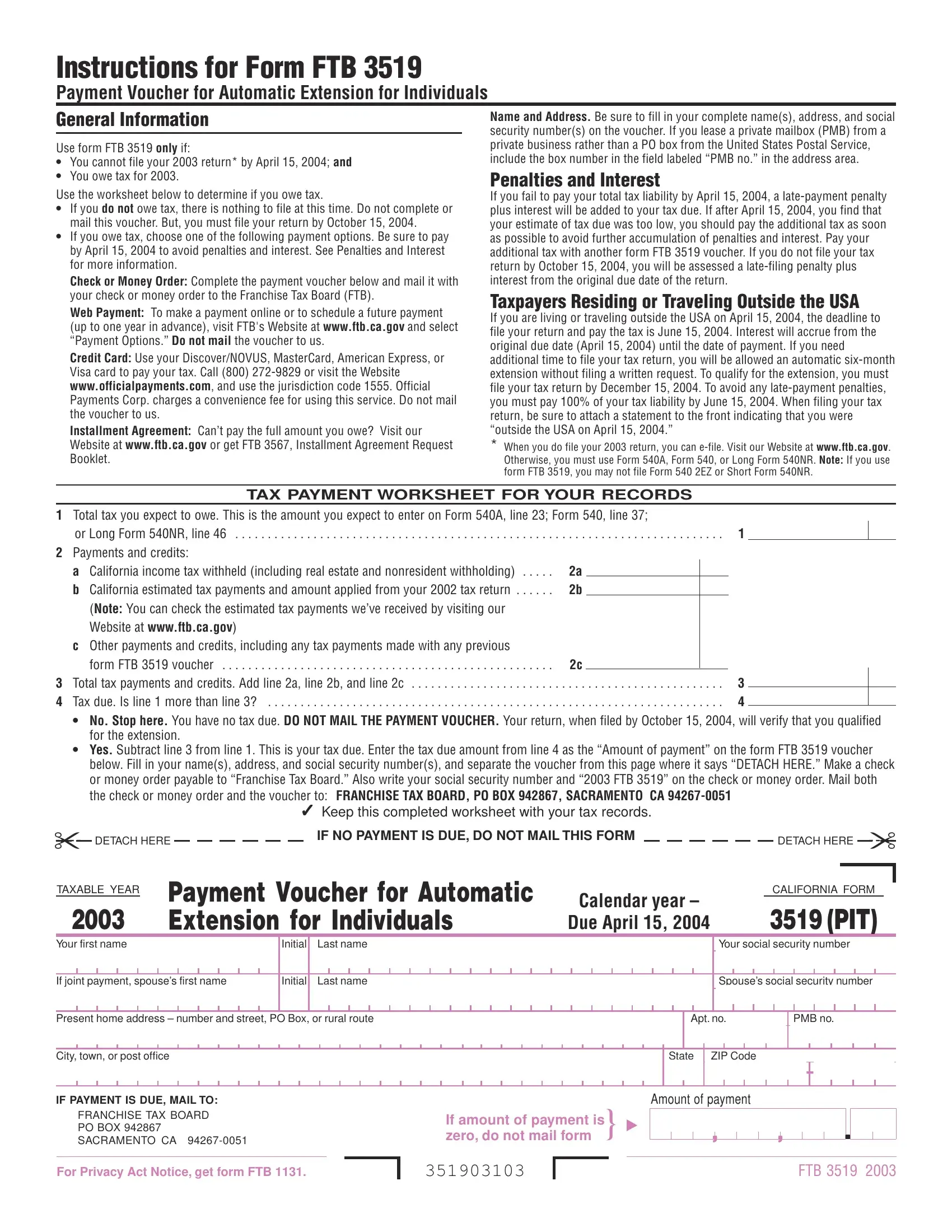

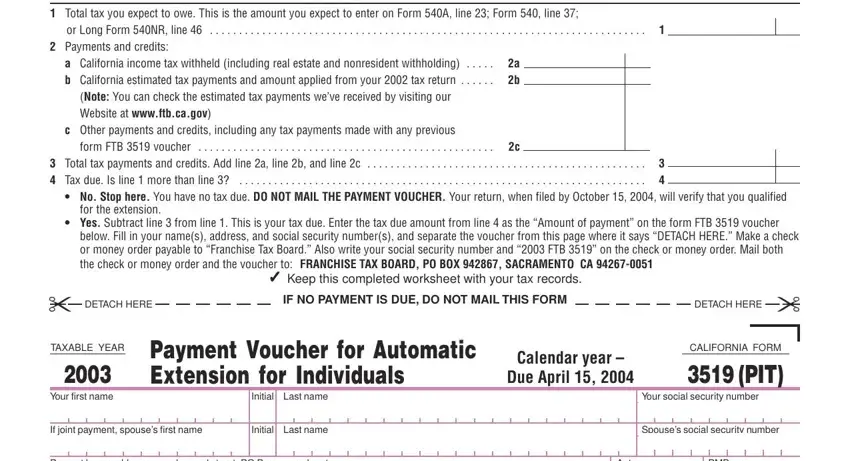

1. To start with, once filling out the California, start in the section that includes the subsequent fields:

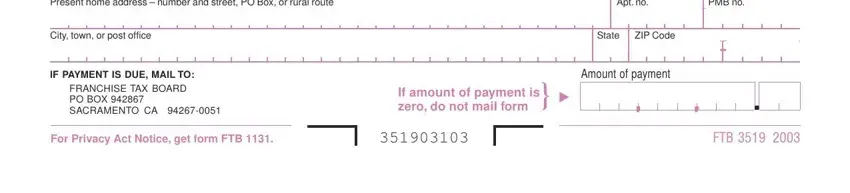

2. Just after this section is done, proceed to enter the applicable information in these - Present home address number and, Apt no, PMB no, City town or post office, IF PAYMENT IS DUE MAIL TO, FRANCHISE TAX BOARD PO BOX, State, ZIP Code, Amount of payment, If amount of payment is, zero do not mail form, For Privacy Act Notice get form, and FTB.

Those who use this document often make errors when filling in FTB in this section. Be sure you double-check what you type in right here.

Step 3: After you have glanced through the details in the document, click on "Done" to finalize your form at FormsPal. Right after setting up afree trial account with us, you will be able to download California or email it without delay. The document will also be readily accessible through your personal cabinet with your every edit. We do not share or sell the details you type in while filling out forms at our site.