of can be filled in without any problem. Just make use of FormsPal PDF editing tool to do the job promptly. To maintain our editor on the leading edge of efficiency, we aim to integrate user-oriented features and improvements on a regular basis. We are at all times grateful for any suggestions - assist us with remolding the way you work with PDF forms. To get the ball rolling, consider these simple steps:

Step 1: Press the "Get Form" button at the top of this page to open our tool.

Step 2: The editor gives you the opportunity to modify your PDF file in a variety of ways. Transform it with any text, correct what is already in the PDF, and put in a signature - all when it's needed!

Completing this form will require care for details. Make certain all mandatory blank fields are completed accurately.

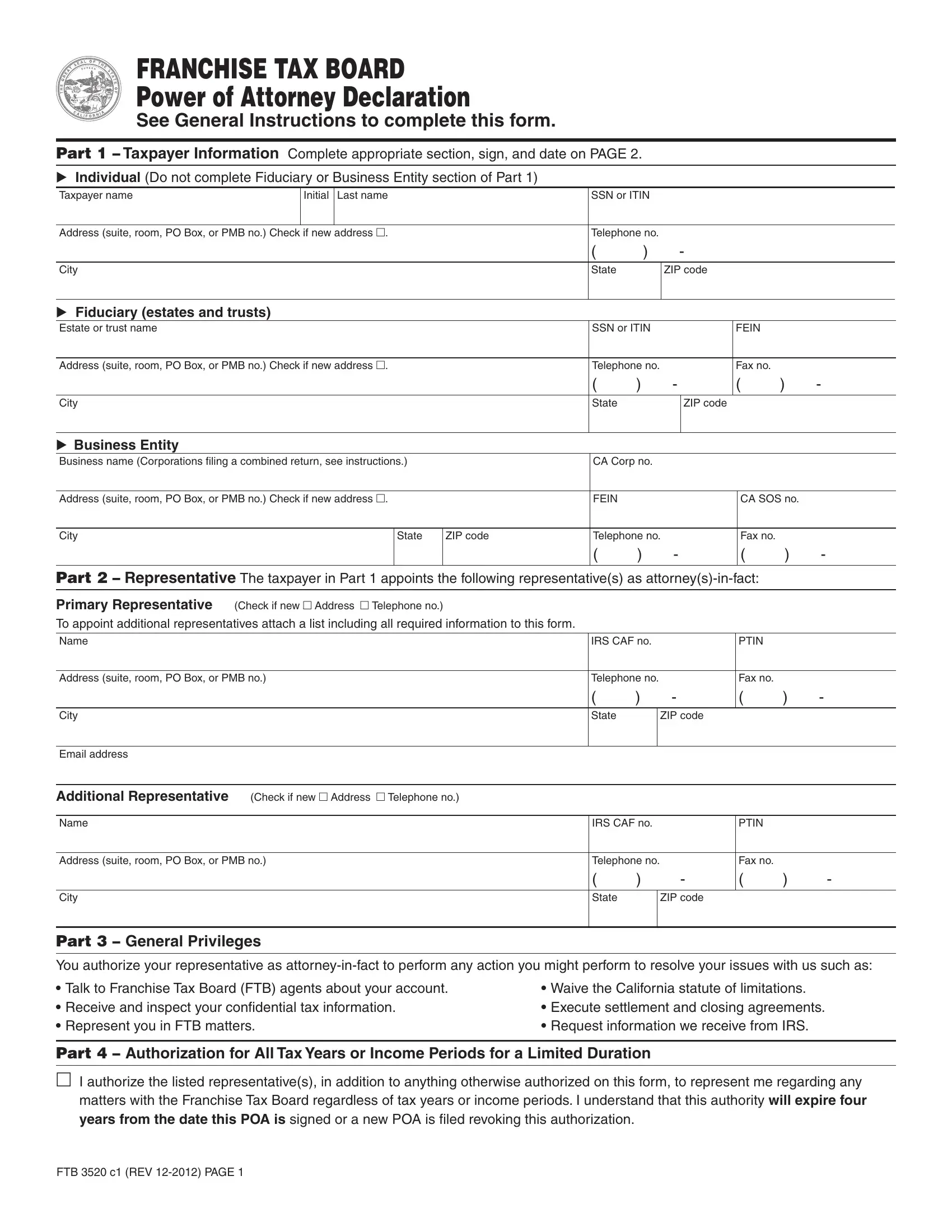

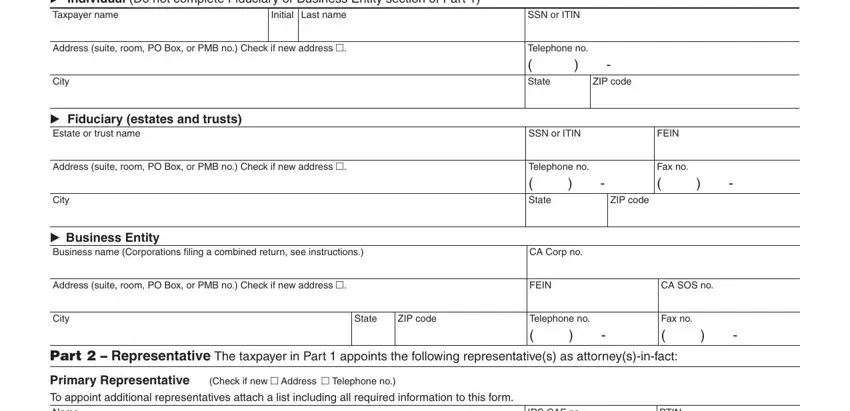

1. The of usually requires certain information to be inserted. Make certain the following blank fields are completed:

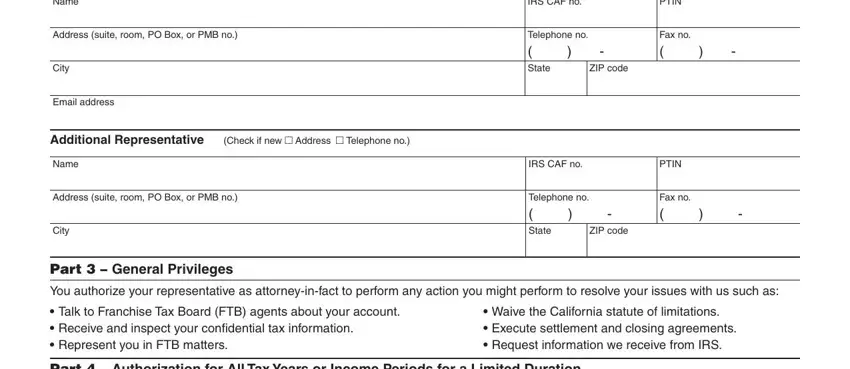

2. Soon after performing the previous section, go on to the subsequent part and fill out the necessary particulars in these fields - Primary Representative To appoint, Address suite room PO Box or PMB no, City, Email address, IRS CAF no, PTIN, Telephone no State, ZIP code, Fax no, Additional Representative, Check if new Address Telephone no, Name, IRS CAF no, PTIN, and Address suite room PO Box or PMB no.

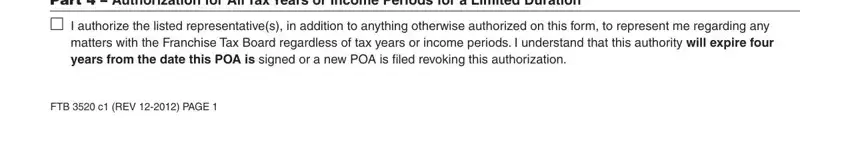

3. In this part, look at Part Authorization for All Tax, I authorize the listed, and FTB c REV PAGE. All these must be taken care of with greatest precision.

Always be really careful when completing I authorize the listed and Part Authorization for All Tax, because this is where a lot of people make some mistakes.

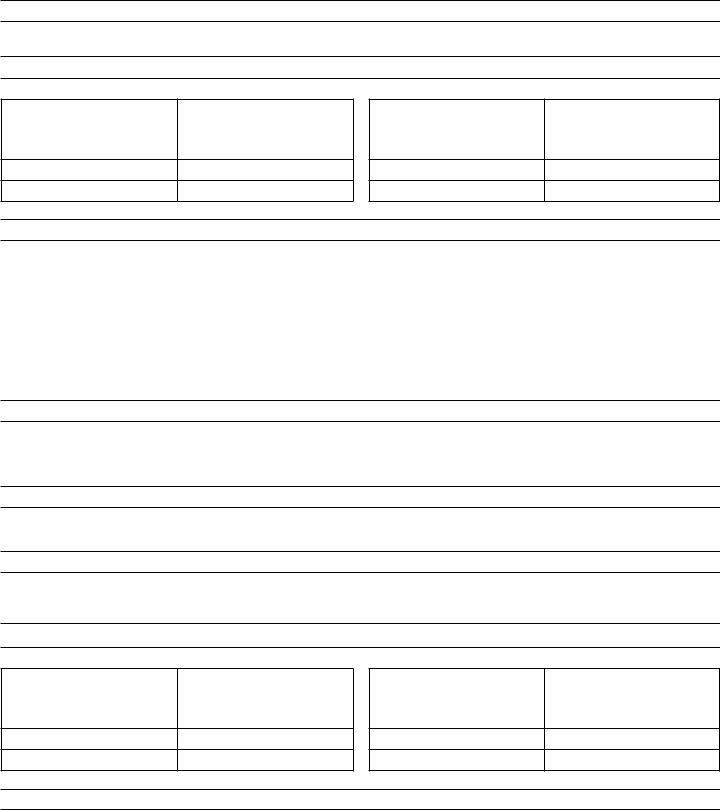

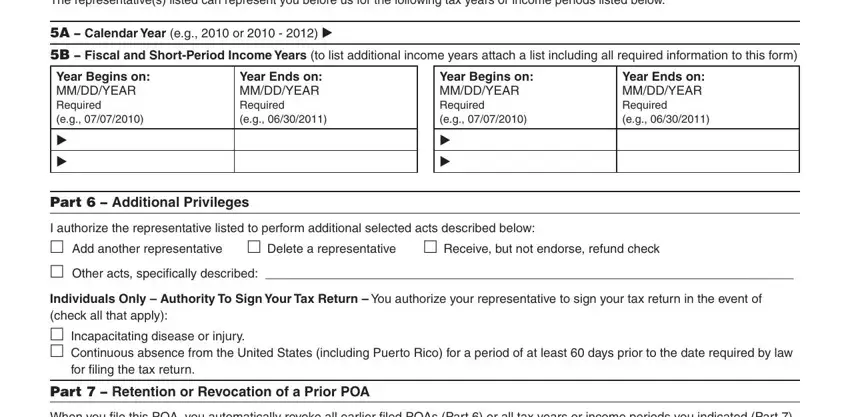

4. The form's fourth section arrives with the following blanks to fill out: The representatives listed can, A Calendar Year eg or, B Fiscal and ShortPeriod Income, Year Begins on MMDDYEAR Required, Year Ends on MMDDYEAR Required eg, Part Additional Privileges, Year Begins on MMDDYEAR Required, Year Ends on MMDDYEAR Required eg, I authorize the representative, Other acts specifically described, Individuals Only Authority To, for filing the tax return, Part Retention or Revocation of, and When you file this POA you.

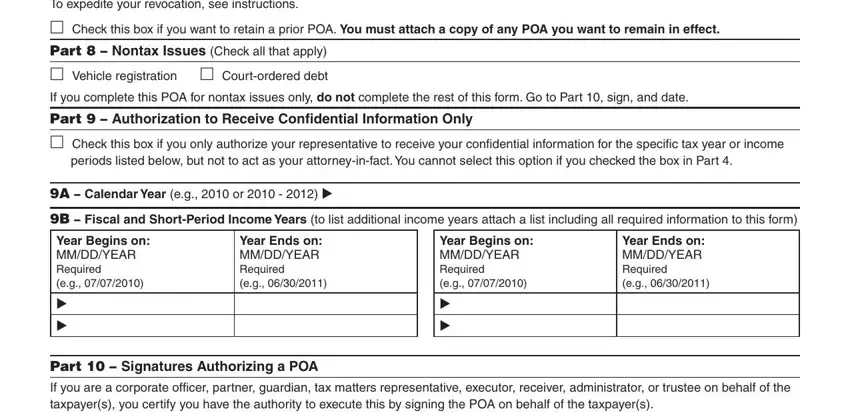

5. Last of all, the following final part is what you have to complete prior to closing the document. The blank fields in question are the following: When you file this POA you, Check this box if you want to, Part Nontax Issues Check all, Vehicle registration, If you complete this POA for, Part Authorization to Receive, Check this box if you only, periods listed below but not to, A Calendar Year eg or, B Fiscal and ShortPeriod Income, Year Begins on MMDDYEAR Required, Year Ends on MMDDYEAR Required eg, Part Signatures Authorizing a POA, Year Begins on MMDDYEAR Required, and Year Ends on MMDDYEAR Required eg.

Step 3: After double-checking the filled in blanks, hit "Done" and you are good to go! After registering afree trial account at FormsPal, it will be possible to download of or send it via email immediately. The PDF will also be at your disposal through your personal account with your adjustments. Here at FormsPal, we do our utmost to make sure all your information is kept protected.