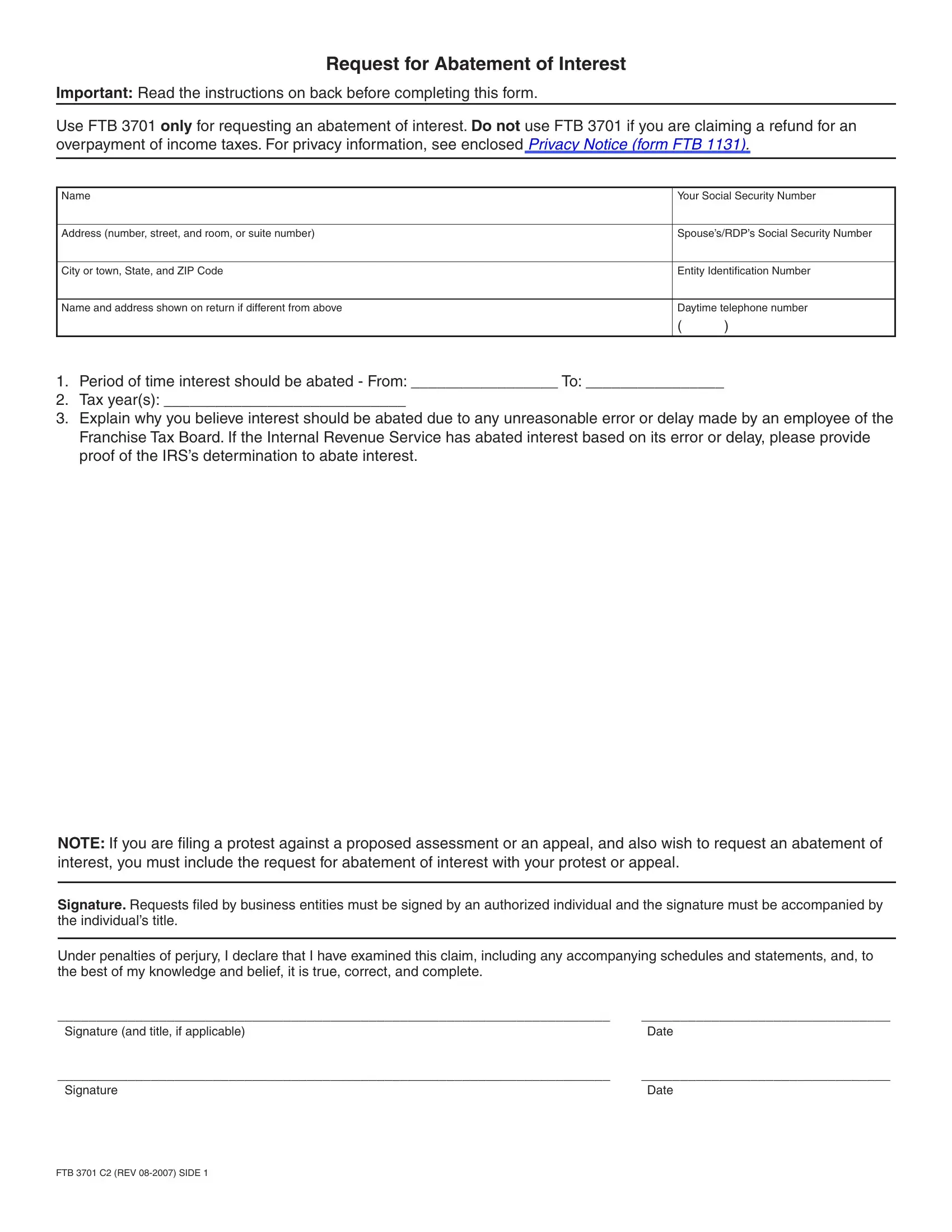

General Instructions

Purpose of Form

Use FTB 3701 to ile a request for the abatement of interest. The Franchise Tax Board (FTB) can abate all or part of interest charged when the additional interest is attributable to certain errors or delays made by FTB or the Internal Revenue Service (IRS).

Interest Abatement – Based on FTB Errors or Delays

The law only allows FTB to abate interest for FTB errors or delays under the following circumstances:

•The interest accrued on a deiciency or a proposed deiciency was attributable in whole or in part to any unreasonable error or delay by an oficer or employee of the Franchise Tax Board (acting in his or her oficial capacity) in performing a ministerial or managerial act.

•The interest accrued on a payment of any tax was attributable to an oficer or employee being dilatory in performing a ministerial or managerial act.

•The interest at issue accrued after September 25, 1987, without regard to the tax year.

•For managerial acts, the interest at issue accrued for tax years beginning on or after January 1, 1998.

•No signiicant aspect of the delay or error was attributable to the taxpayer.

•The error or delay occurred after the date FTB contacted the taxpayer, in writing, with respect to the deiciency or payment.

Note: Normal return processing or audit work within the statute of limitations time period will not in itself justify the abatement of interest. Generally, FTB has four years to make an audit adjustment.

Interest Abatement – Based on IRS Errors or Delays

The law only allows FTB to abate interest for IRS errors or delays when the IRS abated interest under the following circumstances:

•The interest accrued is attributable to an error or delay in the performance of a ministerial or managerial act by

the IRS.

•The error or delay must have occurred on or before the IRS issued a inal determination of tax.

•The deiciency upon which the federal interest abatement was allowed must be related to the state deiciency.

•The interest can only be abated for the same time period that the IRS abated interest.

•The interest at issue accrued after September 25, 1987, without regard to the tax year.

•For managerial acts, only interest accrued for tax years beginning on or after January 1, 1998, may be considered.

FTB 3701 C2 (REV 08-2007) SIDE 2

Deinitions:

A deficiency is the difference between the amount of tax shown on an original or amended tax return and the amount of tax determined by FTB.

A Managerial act is an administrative act that occurs during the processing of a taxpayer’s case, which involves the temporary or permanent loss of records. A managerial act is also the exercise

of judgment or discretion relating to management of personnel (Treas. Reg. 301.6404-2(b)(1)).

A Ministerial act is a procedural or mechanical act that does not involve the exercise of judgment or discretion and that occurs during the processing of a taxpayer’s case after all prerequisites to the act, such as conferences and review by supervisors, have taken place (Treas. Reg. 301.6404-2(b)(2)).

Who can ile

You or your authorized representative can ile FTB 3701. If your authorized representative iles for you, attach the original or a copy of a Power of Attorney (FTB 3520) to the FTB 3701.

When to ile

To request an abatement of interest shown on a Notice of Proposed Assessment, you must include your request with your protest against the Notice of Proposed Assessment or your appeal from a Notice of Action on a protest. Otherwise, the Franchise Tax Board cannot consider your request and you may lose your right to ile an appeal of any determination not to abate

the interest.

If you wish to request the abatement of interest on a inal unpaid balance due, you may ile that request at any time.

If you wish to claim a refund of paid interest, please be aware there is a statute of limitations. Generally, your claim can be iled no later than four years from the due date of your return, or one year from the date of the overpayment. You can also ile an informal refund claim within either of the four year or the one year time periods, if you have not paid the full amount. An informal claim will protect your right to ile a later appeal with the State Board of Equalization or ile suit

in court. The informal claim is perfected into a formal claim when you pay the full amount due. However, we cannot credit or refund a payment that you made more than seven years before the full amount is paid.

Where to ile

If you are iling a protest or appeal, attach the completed and signed FTB 3701 and mail both to the address on the notice you received from us. Otherwise, mail the completed and signed form to:

TAXPAYER ADVOCATE BUREAU FRANCHISE TAX BOARD MS A381 PO BOX 157

RANCHO CORDOVA CA 95741-0157 FAX: (916) 845-6614

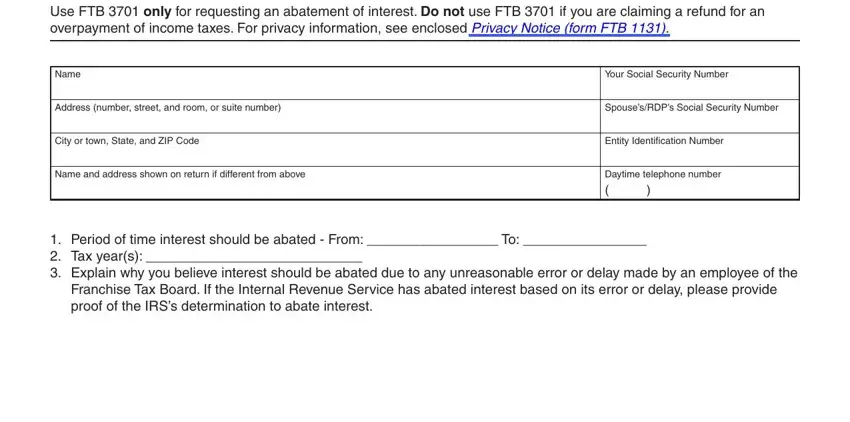

Specific Line Instructions

Social Security Number

If you are iling FTB 3701 to request an abatement relating to a joint return, enter social security numbers for both you and your spouse. Effective for tax years beginning on or after January 1, 2007, for purposes of California income tax, references to a spouse also refer to a Registered Domestic Partner (RDP), unless otherwise speciied.

Entity Identiication Number

If you are iling FTB 3701 to request an abatement of interest for a corporation, a partnership, or an LLC, enter the entity identiication number.

1.Enter the period of time for which you are requesting an abatement of interest.

2.Enter the tax year(s) for which the abatement of interest is being requested.

3.Explain in detail your reasons for iling the request:

•Describe the circumstances of your case.

•Describe the error or delay on the part of the FTB, or provide evidence that the Internal Revenue Service abated interest based on a ministerial or managerial act.

•State when you were irst contacted by the FTB in writing about the deiciency or payment.

Please attach appropriate supporting evidence to the FTB 3701.

If your request is denied

If the Franchise Tax Board denies your request for an abatement of interest, you will receive a formal letter of denial explaining your right of appeal to the State Board of Equalization.

For your appeal rights and actions, see

Procedure for Appealing a Denial or Partial Denial of a Request for Abatement of Interest (FTB 5847I).

If you do not hear from us

If you do not hear from FTB within six months of iling your request for abatement of interest, and you are not iling your FTB 3701 with a protest, you may consider your request “deemed denied” and ile an appeal with the State Board of Equalization. For your appeal rights, see FTB 5847I.

You can contact the Franchise Tax Board at (800) 852-5711, or from the United States, call (not toll-free) at (916) 845-6500.

Note: Your unpaid balance continues to accrue interest during the time that we consider your interest abatement request and during any appeal, until you pay the balance in full.

For more information, search for “Interest Abatement” on our Website.

You can download, view, and print California income tax forms and publications from our Website at www.ftb.ca.gov.