In case you intend to fill out form g5 b georgia department of revenue, you won't have to install any kind of programs - just use our online tool. We at FormsPal are focused on making sure you have the absolute best experience with our tool by regularly presenting new features and enhancements. Our editor has become even more user-friendly thanks to the latest updates! Now, editing PDF files is a lot easier and faster than ever. It merely requires a couple of basic steps:

Step 1: Click the "Get Form" button above on this page to get into our tool.

Step 2: This editor enables you to change PDF files in many different ways. Modify it by writing customized text, adjust what's originally in the document, and put in a signature - all within the reach of several mouse clicks!

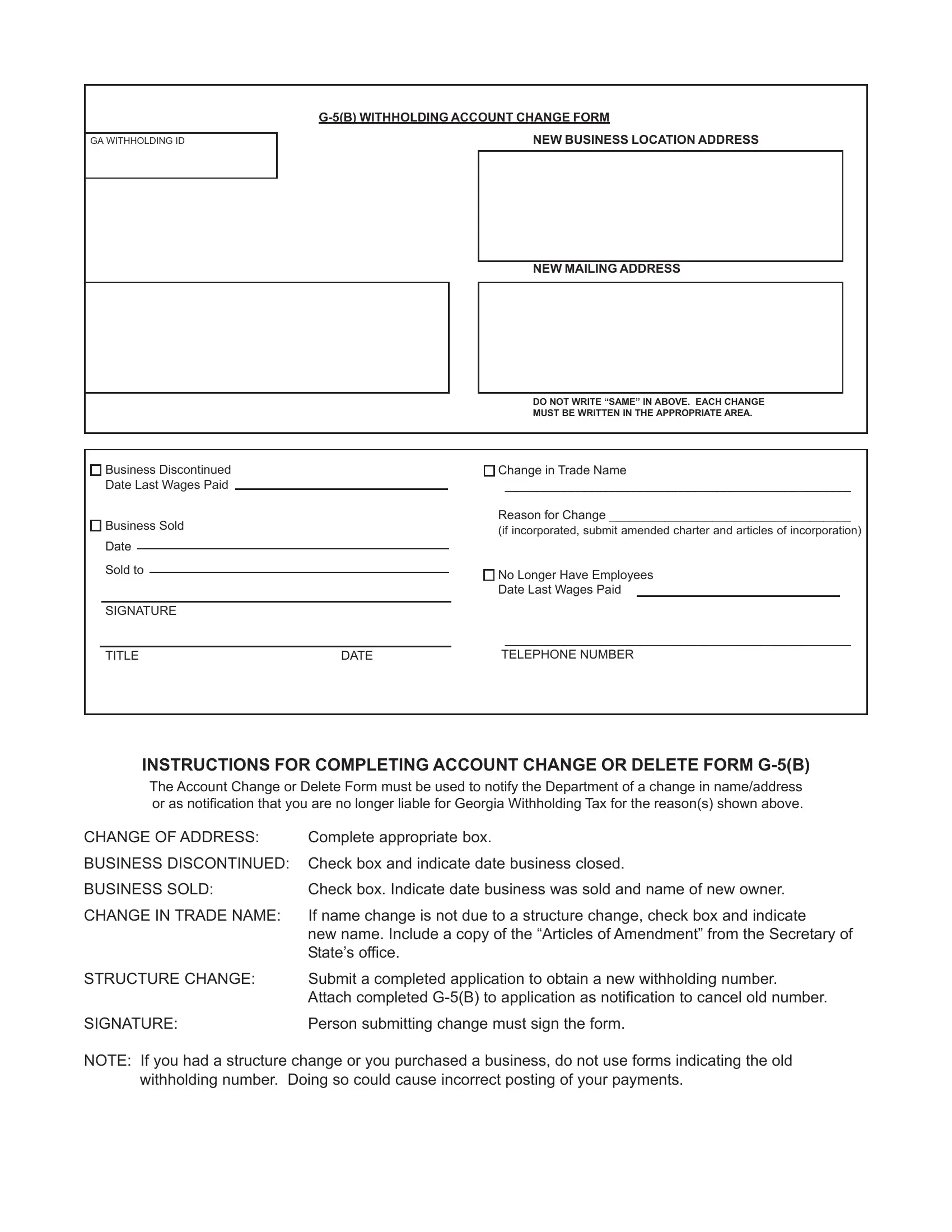

This form will need specific details; in order to guarantee accuracy and reliability, be sure to consider the next suggestions:

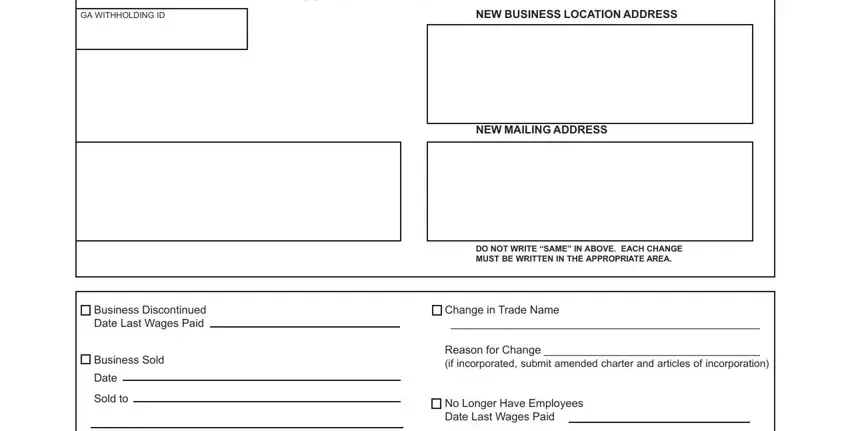

1. Begin filling out your form g5 b georgia department of revenue with a group of major blank fields. Note all of the information you need and be sure absolutely nothing is missed!

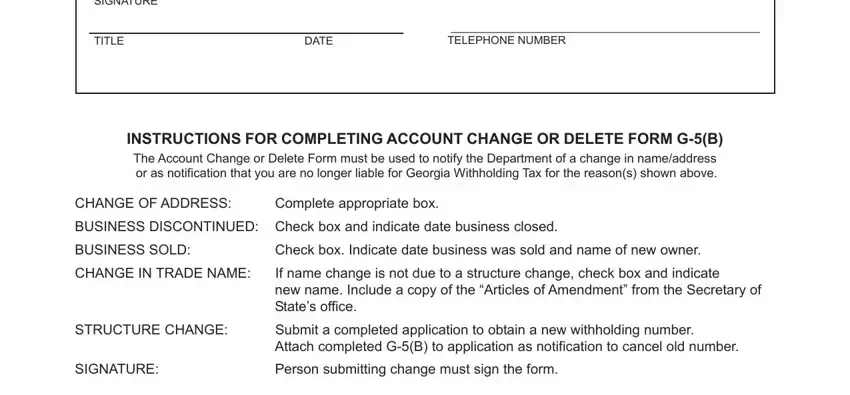

2. Soon after the first section is filled out, proceed to type in the suitable information in these - SIGNATURE, TITLE DATE, TELEPHONE NUMBER, INSTRUCTIONS FOR COMPLETING, CHANGE OF ADDRESS, Complete appropriate box, BUSINESS DISCONTINUED Check box, BUSINESS SOLD, Check box Indicate date business, CHANGE IN TRADE NAME, If name change is not due to a, STRUCTURE CHANGE, Submit a completed application to, SIGNATURE, and Person submitting change must sign.

You can potentially get it wrong when filling in the CHANGE IN TRADE NAME, and so you'll want to go through it again before you decide to finalize the form.

Step 3: When you have reviewed the information in the blanks, click "Done" to complete your document creation. Right after registering afree trial account with us, it will be possible to download form g5 b georgia department of revenue or send it through email promptly. The form will also be at your disposal in your personal account menu with all of your changes. At FormsPal.com, we endeavor to make sure your details are kept protected.