If you intend to fill out N203, there's no need to install any sort of programs - simply make use of our online PDF editor. To maintain our tool on the forefront of practicality, we strive to adopt user-driven capabilities and improvements regularly. We are routinely grateful for any suggestions - play a vital role in remolding PDF editing. All it takes is several easy steps:

Step 1: Access the PDF file inside our tool by hitting the "Get Form Button" at the top of this page.

Step 2: With our state-of-the-art PDF editing tool, you may accomplish more than simply complete blank fields. Edit away and make your forms appear great with custom textual content added, or modify the original content to excellence - all that backed up by the capability to insert any graphics and sign the file off.

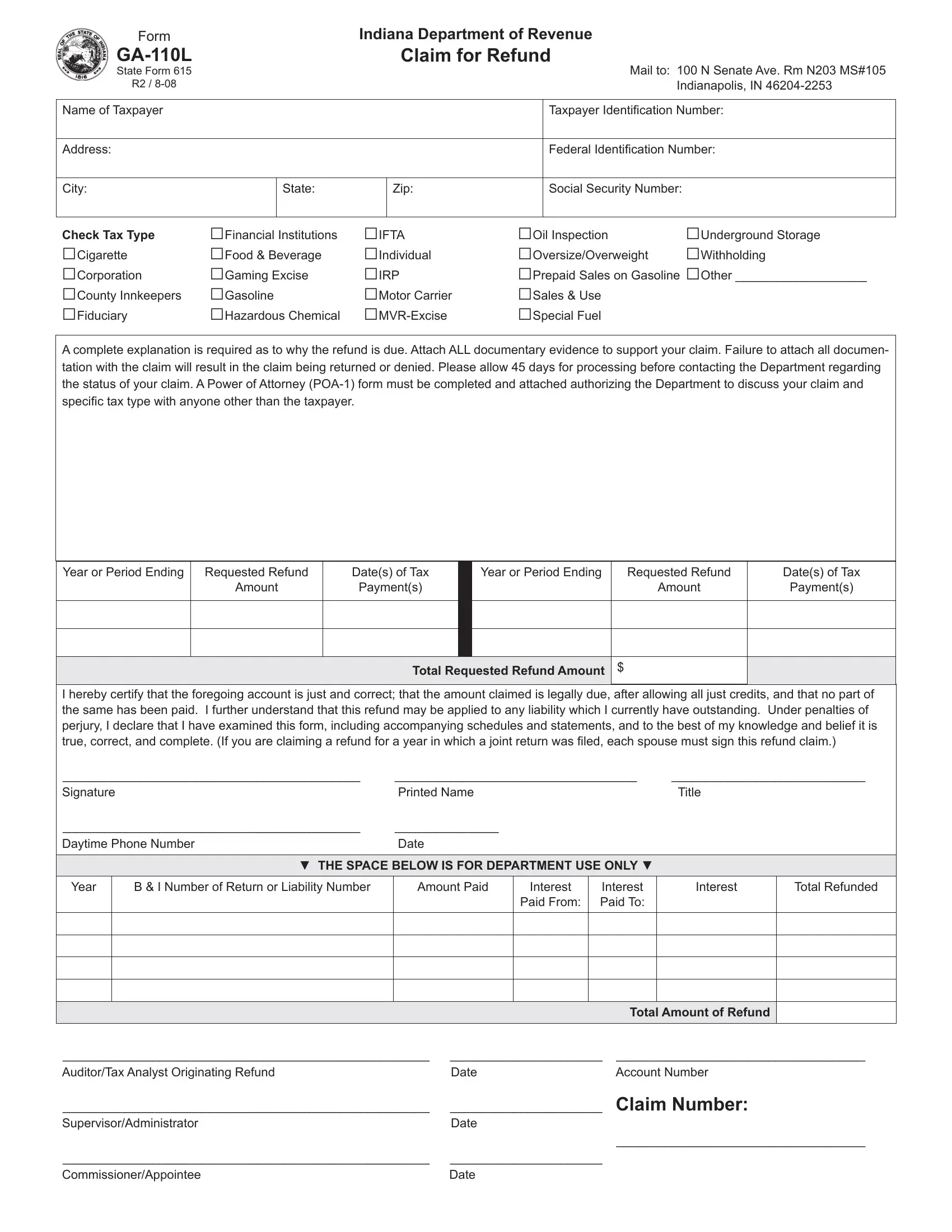

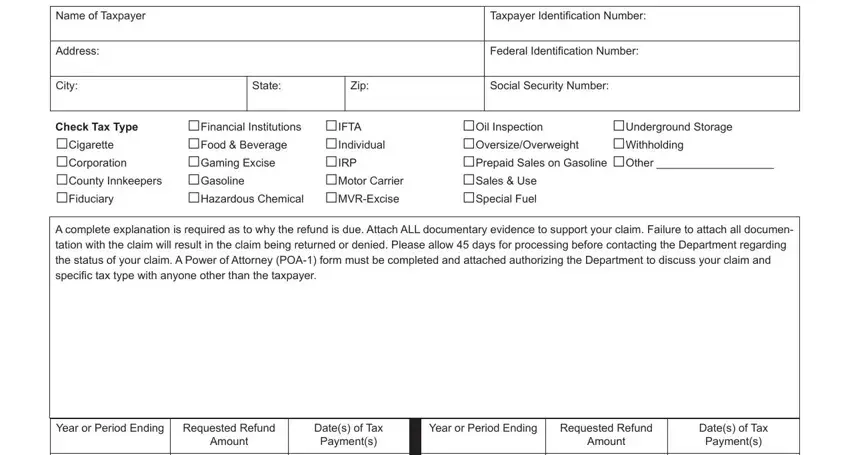

This form will need specific information; to ensure consistency, please make sure to take heed of the next steps:

1. To start with, while filling out the N203, begin with the form section that features the subsequent blanks:

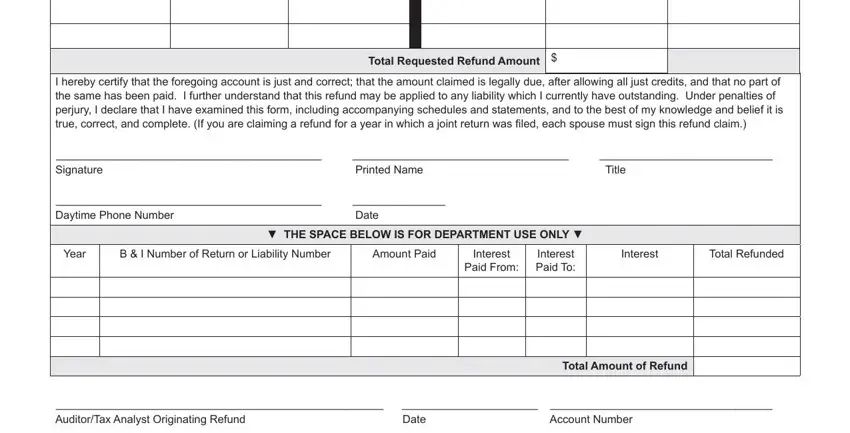

2. Once your current task is complete, take the next step – fill out all of these fields - Total Requested Refund Amount, I hereby certify that the, Signature, Printed Name, Title, Daytime Phone Number, Date, Year, B I Number of Return or Liability, THE SPACE BELOW IS FOR DEPARTMENT, Amount Paid, Interest, Paid From, Interest, and Total Refunded with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It's easy to make an error while completing the Total Requested Refund Amount, so be sure you go through it again prior to deciding to finalize the form.

3. This next stage is normally easy - complete all of the form fields in SupervisorAdministrator, Claim Number Date, CommissionerAppointee, and Date to complete this part.

Step 3: Prior to moving on, ensure that all blank fields have been filled in right. Once you verify that it's correct, click on “Done." Right after starting a7-day free trial account at FormsPal, you will be able to download N203 or email it right away. The PDF document will also be easily accessible via your personal account page with all of your modifications. At FormsPal, we endeavor to guarantee that all your information is kept private.