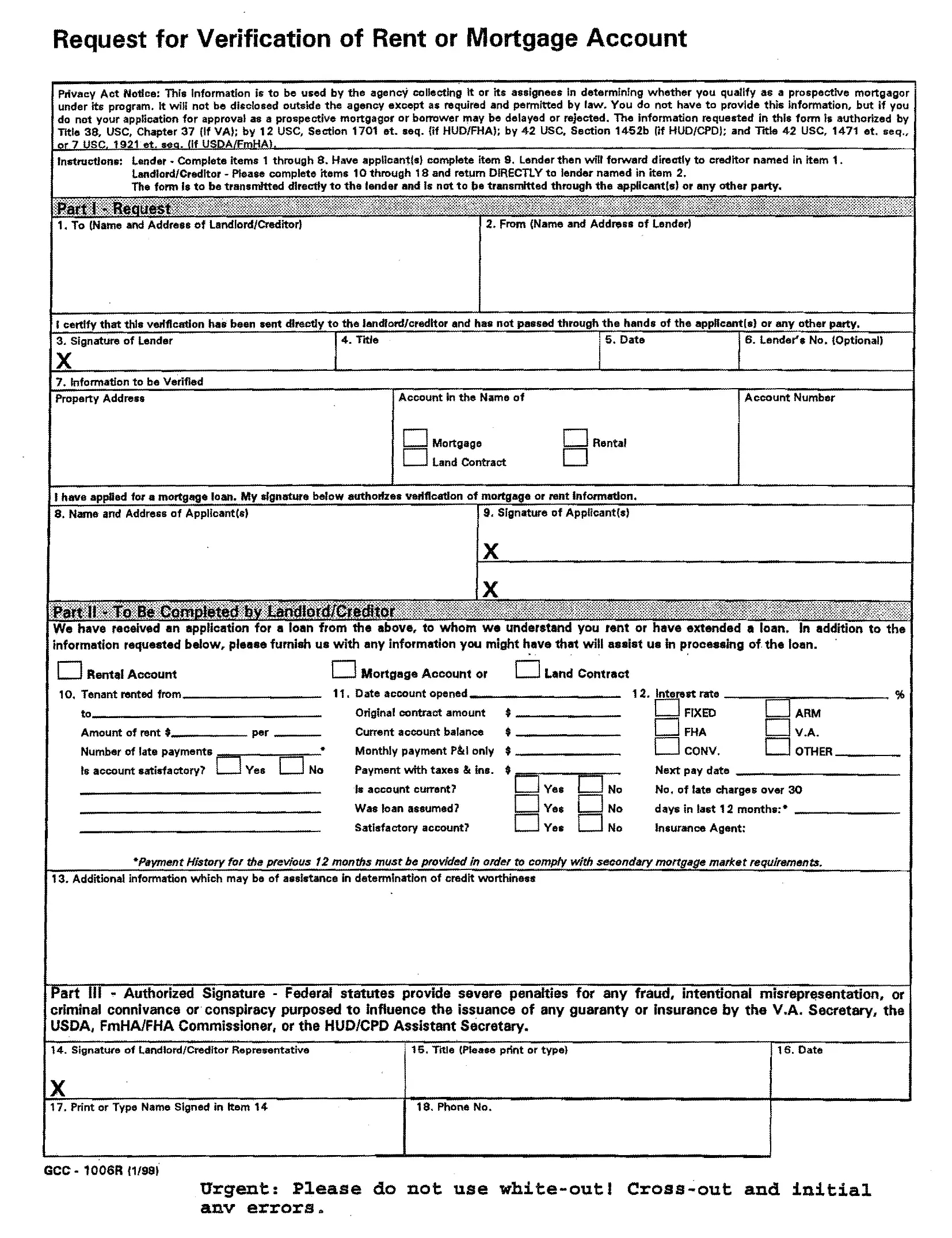

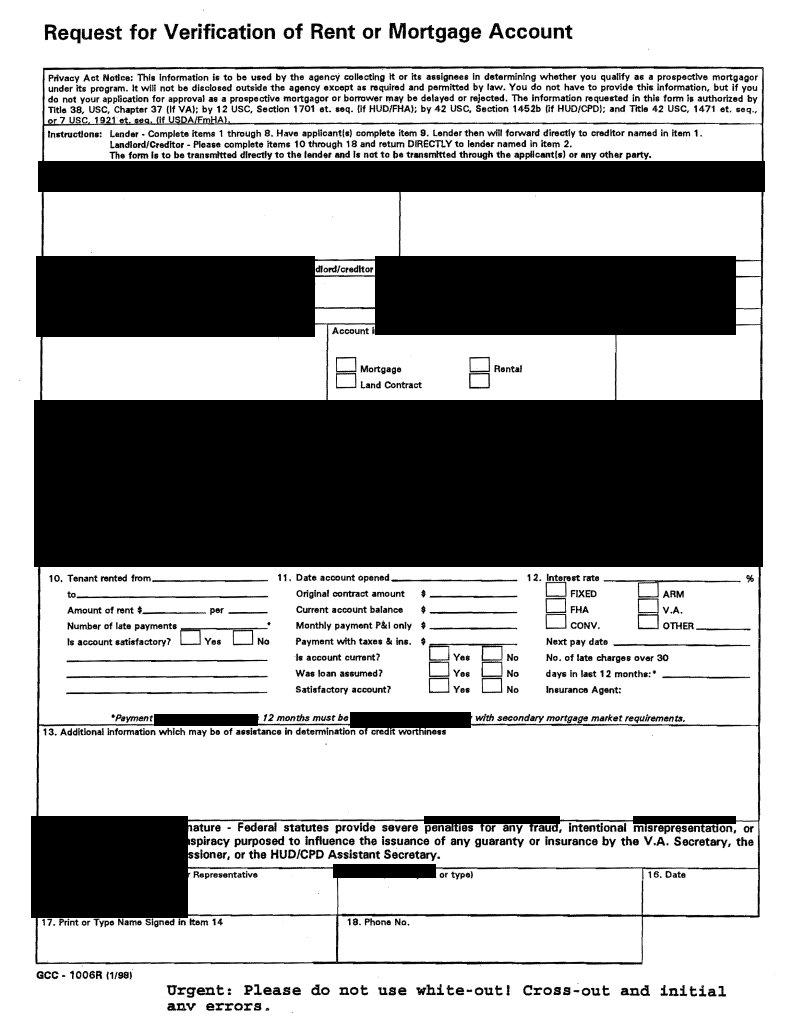

You'll be able to complete verification of mortgage request letter effortlessly with our online PDF editor. Our tool is consistently evolving to give the best user experience possible, and that is thanks to our dedication to constant enhancement and listening closely to feedback from customers. If you are seeking to get going, here is what it will require:

Step 1: Just click on the "Get Form Button" in the top section of this webpage to launch our pdf form editing tool. This way, you will find all that is necessary to fill out your file.

Step 2: When you access the file editor, you will notice the document all set to be filled in. In addition to filling in various fields, you may as well perform various other actions with the PDF, including putting on custom textual content, changing the original text, inserting graphics, putting your signature on the form, and more.

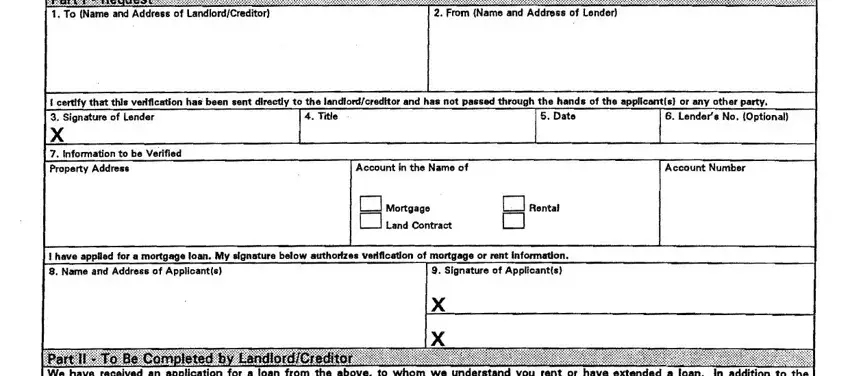

As for the blanks of this particular document, here is what you want to do:

1. While submitting the verification of mortgage request letter, ensure to complete all of the necessary blanks in their associated part. This will help to speed up the process, allowing your details to be processed without delay and correctly.

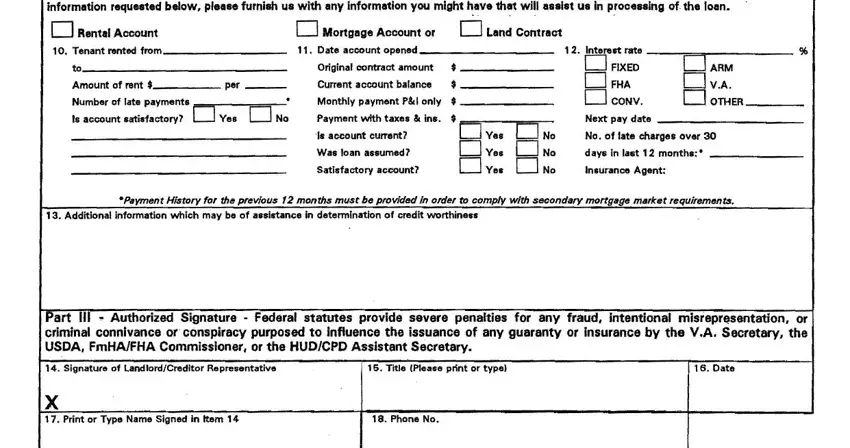

2. Soon after this part is done, go on to enter the suitable details in all these - Tenant rented from, Amount of rent Numbar of late, per, o Mortgage Account or, Date account opened, Original contract amount, Current account balance, Monthly payment PI only, Payment with taxes Ins, Is account current, OVes UNo, Was loan assumed, OVes DNo, Interest rate, and o FIXED o FHA.

People frequently get some things incorrect when filling in Monthly payment PI only in this section. You need to read twice what you enter right here.

Step 3: Before addressing the next stage, make sure that blanks were filled out as intended. Once you confirm that it is correct, click on “Done." Acquire your verification of mortgage request letter once you subscribe to a 7-day free trial. Immediately access the pdf in your FormsPal cabinet, together with any modifications and changes being all kept! FormsPal ensures your information privacy via a protected system that never records or shares any personal data provided. Be assured knowing your paperwork are kept confidential whenever you work with our service!