You could work with guam form gross receipts tax instantly with our PDFinity® editor. FormsPal professional team is ceaselessly working to develop the tool and help it become much easier for users with its extensive features. Uncover an constantly innovative experience today - explore and discover new possibilities along the way! Getting underway is effortless! What you need to do is adhere to these simple steps below:

Step 1: Open the PDF form inside our editor by clicking on the "Get Form Button" in the top area of this page.

Step 2: With the help of this state-of-the-art PDF editor, you can accomplish more than merely complete blanks. Try each of the features and make your forms look faultless with customized textual content added in, or tweak the original content to excellence - all that supported by an ability to incorporate your own pictures and sign it off.

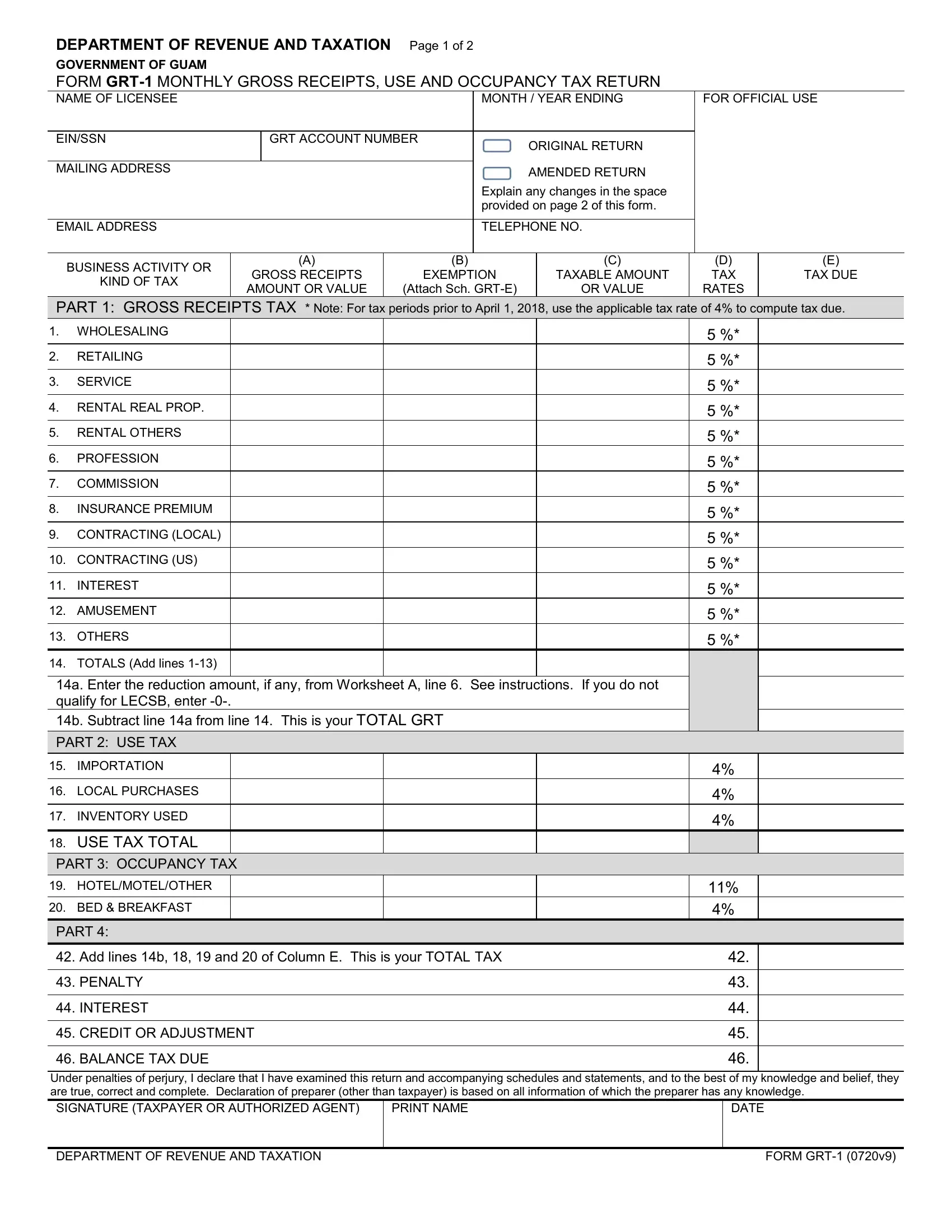

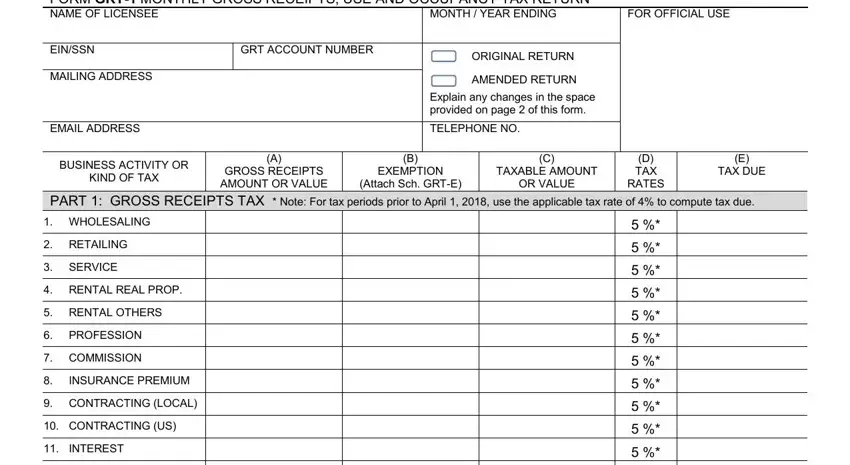

With regards to the blank fields of this particular PDF, here's what you want to do:

1. First, while filling out the guam form gross receipts tax, begin with the area that includes the following blanks:

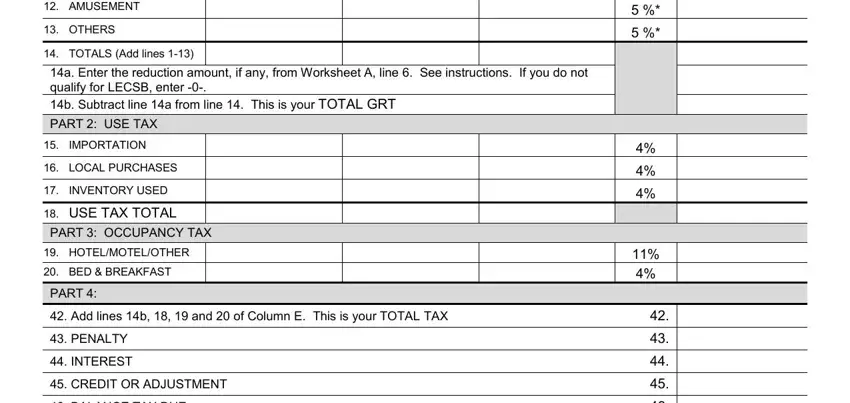

2. Once your current task is complete, take the next step – fill out all of these fields - AMUSEMENT, OTHERS, TOTALS Add lines, a Enter the reduction amount if, IMPORTATION, LOCAL PURCHASES, INVENTORY USED, USE TAX TOTAL PART OCCUPANCY TAX, HOTELMOTELOTHER, BED BREAKFAST, PART, Add lines b and of Column E, PENALTY, INTEREST, and CREDIT OR ADJUSTMENT with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It is easy to make errors while filling out the AMUSEMENT, thus be sure you take a second look prior to deciding to finalize the form.

3. The following segment will be about BALANCE TAX DUE Under penalties, PRINT NAME, DATE, DEPARTMENT OF REVENUE AND TAXATION, and FORM GRT v - fill out each one of these blanks.

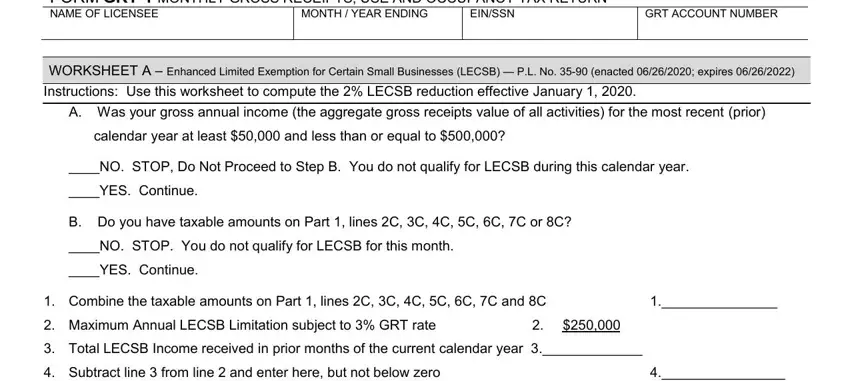

4. This next section requires some additional information. Ensure you complete all the necessary fields - GOVERNMENT OF GUAM FORM GRT, MONTH YEAR ENDING, EINSSN, GRT ACCOUNT NUMBER, WORKSHEET A Enhanced Limited, A Was your gross annual income the, calendar year at least and less, NO STOP Do Not Proceed to Step B, YES Continue, B Do you have taxable amounts on, YES Continue, and Combine the taxable amounts on - to proceed further in your process!

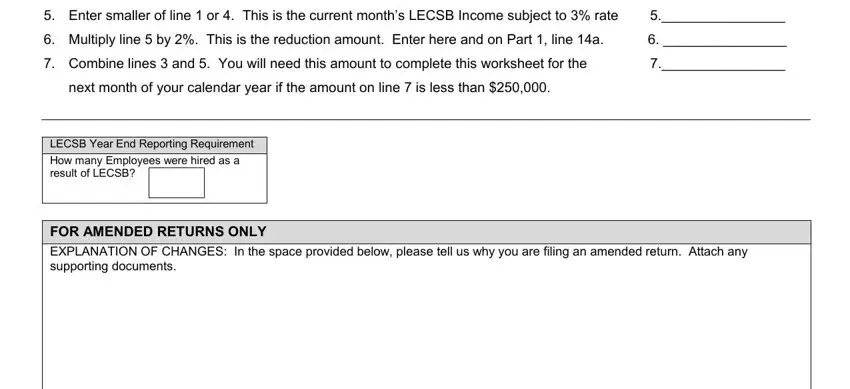

5. To conclude your document, the particular area includes a couple of extra blanks. Entering Combine the taxable amounts on, next month of your calendar year, LECSB Year End Reporting, FOR AMENDED RETURNS ONLY, and EXPLANATION OF CHANGES In the will wrap up the process and you'll be done in the blink of an eye!

Step 3: Once you have reviewed the details in the document, click on "Done" to conclude your form. Get your guam form gross receipts tax after you sign up for a 7-day free trial. Instantly use the pdf file inside your FormsPal account, along with any edits and adjustments automatically kept! We do not share or sell any information that you type in when filling out forms at FormsPal.