NONRESIDENT can be completed online without any problem. Simply open FormsPal PDF editor to finish the job right away. Our tool is constantly evolving to give the best user experience attainable, and that's thanks to our commitment to continual development and listening closely to comments from customers. It just takes several easy steps:

Step 1: Press the "Get Form" button above on this webpage to open our PDF editor.

Step 2: After you launch the online editor, you'll see the form all set to be filled in. Apart from filling out various blank fields, you could also perform many other actions with the file, specifically writing your own textual content, modifying the initial text, adding graphics, placing your signature to the document, and more.

It's straightforward to fill out the form using out practical tutorial! Here is what you need to do:

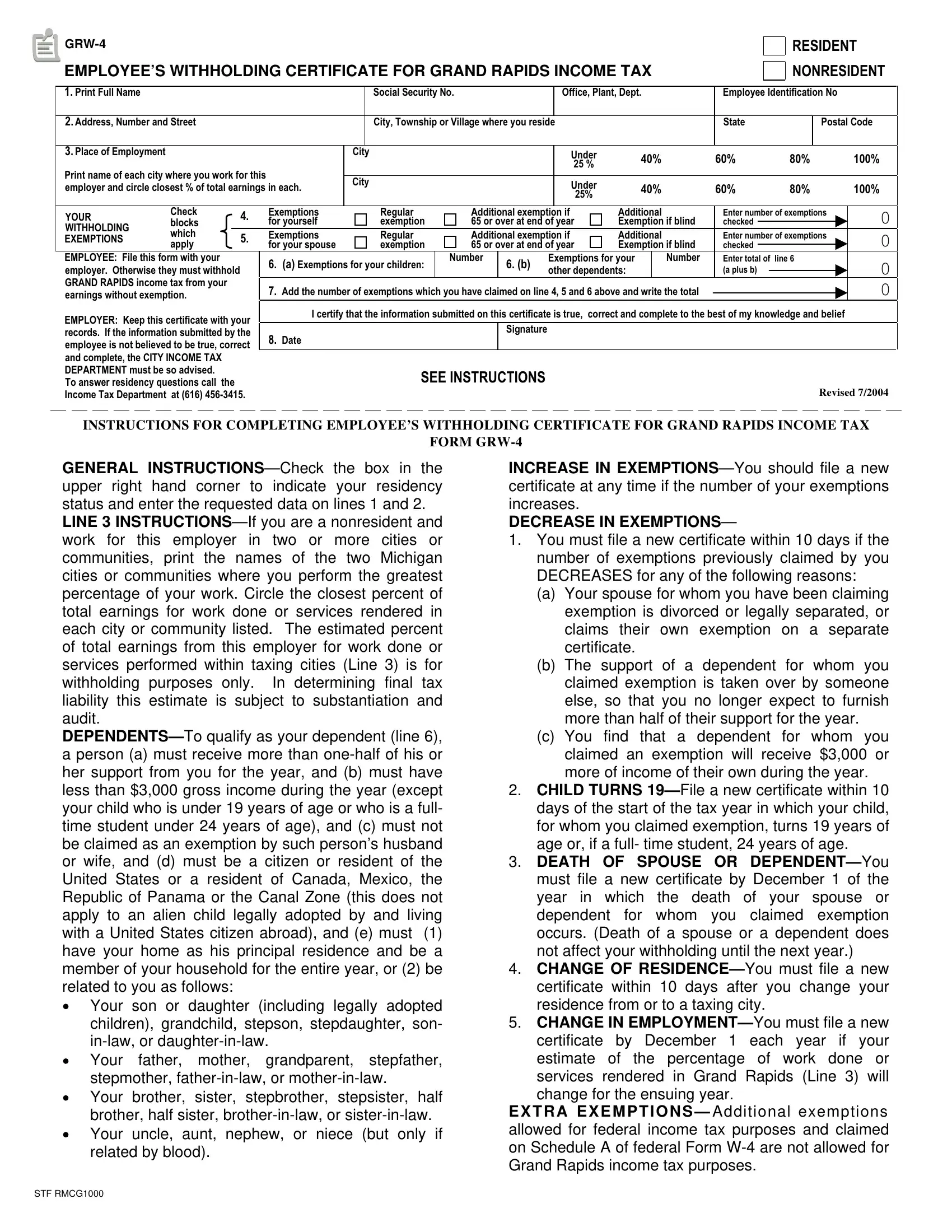

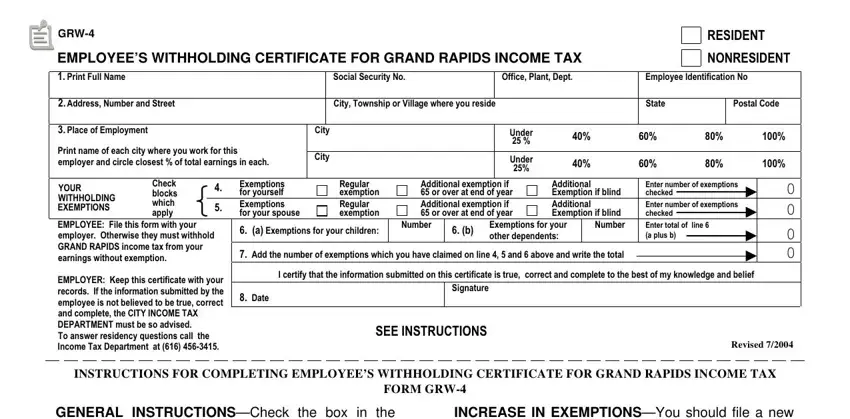

1. Start filling out your NONRESIDENT with a selection of essential blank fields. Get all of the important information and ensure not a single thing forgotten!

Step 3: Revise everything you have inserted in the form fields and hit the "Done" button. Create a 7-day free trial subscription at FormsPal and gain direct access to NONRESIDENT - downloadable, emailable, and editable inside your personal account page. FormsPal ensures your data confidentiality via a protected system that in no way saves or distributes any private information involved in the process. Rest assured knowing your documents are kept safe each time you use our tools!