The H1205 form serves as a comprehensive tool for individuals and families across the United States seeking to apply for health coverage and financial assistance with health care costs. Designed to facilitate access to affordable health insurance, the H1205 application process streamlines the process of determining eligibility for numerous programs, including Medicaid, the Children’s Health Insurance Program (CHIP), and tax credits that offset premium costs. This application is accessible to a wide range of applicants, including families with immigrants and individuals regardless of their current health insurance status, promising an evaluative process that respects applicants' privacy and immigration status. The form requires personal, income, and household information, aimed at accurately assessing each applicant's or family's needs to provide the most suitable health coverage options. It simplifies what could be a daunting application process by consolidating crucial information into a single form, offering support through various channels for those who may need assistance during the application process. With provisions for faster online application processes and guidance on what information and documents are necessary, the H1205 form embodies a critical step toward securing affordable health care coverage for many, emphasizing inclusivity, privacy, and comprehensive assistance.

| Question | Answer |

|---|---|

| Form Name | Form H1205 |

| Form Length | 13 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 3 min 15 sec |

| Other names | form h1205 pdf, h1205 s pdf, how do i fill out renewal e form h1205 on line, where can i fill ou ta medicade form h1205 on line |

Application for Health Coverage & Help Paying Costs

Use this application |

• |

e |

|

to see what |

coverage to help you stay well. |

|

|

• A new tax credit that can immediately help pay your premiums for health |

|||

coverage choices |

|||

coverage. |

|

||

you qualify for |

• Free or |

|

|

|

Insurance Program (CHIP). |

|

|

Who can use this application?

•Use this application to apply for anyone in your family.

•Apply even if you or your child already has health coverage. You could be eligible for

•If you’re single, you may be able to use a short form. Visit HealthCare.gov.

•Families that include immigrants can apply. You can apply for your

child even if you aren’t eligible for coverage. Applying won’t immigration status or chances of becoming a permanent resident or citizen.

THINGS TO KNOW

|

• |

d to |

|

|

complete Appendix C. |

|

|

Apply faster |

Apply faster online at |

. |

|

|

|

|

|

online

What you may |

• Social Security numbers (or document numbers for any legal immigrants |

|

who need insurance). |

||

need to apply |

||

• Employer and income information for everyone in your family (for |

||

|

||

|

example, from pay stubs, |

|

|

• Policy numbers for any current health insurance. |

|

|

• Information about any |

|

Why do we ask for |

We ask about income and other information to let you know what coverage |

|

you qualify for and if you can get any help paying for it. We’ll keep all the |

||

this information? |

||

information you provide private and secure, as required by law. |

||

|

||

What happens next? |

us (See Step 7 |

|

on Page 9). If you don’t have all the information we ask for, sign and send |

||

|

||

|

your application anyway. We’ll follow up with you within 2 weeks. You’ll get |

|

|

instructions on the next steps to complete your health coverage. If you don’t |

|

|

hear from us, call |

|

|

2). Filling out this application doesn’t mean you have to buy health coverage. |

Get help with this application

•Online:

•Phone: Call us at

•In person:

or call

NEED HELP WITH YOUR APPLICATION? We can help you at no cost to you. Call us at |

Form H1205 • 01/2014 |

(after you pick a language, press 2). If you have a hearing or speech disability, call |

Page 1 of 13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STEP 1 |

Tell us about yourself |

|

|

|

|

|

|

|

|

|

|

|||

(We need one adult in the family to be the contact person for your application.) |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

1. |

First name, middle name, last name, & suffix |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

2. |

Home address (Leave blank if you don’t have one.) |

|

|

|

|

|

3. Apartment or suite number |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

City |

|

|

5. State |

|

|

6. ZIP code |

|

7. County |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

8. Do you live in Texas? |

Yes |

No |

|

9. Do you plan to stay in Texas? |

|

Yes |

No |

|

|||||||

|

|

|

|

|

|

|

|

|

|

||||||

10. Mailing address (if different from home address) |

|

|

|

|

|

|

11. Apartment or suite number |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

12. City |

|

|

13. State |

|

|

14. ZIP code |

|

15. County |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. Phone number |

|

|

|

|

|

17. Other phone number |

|

|

|

|

|

|

|

||

( |

) |

– |

|

|

|

|

( |

) |

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. Do you want to get information about this application by email?

Email address:

Yes No

19.Preferred spoken or written language (if not English)

______________________________________________________________________________________________________________________________________________

STEP 2 Tell us about your family

Who do you need to include on this application?

: We need to know about everyone on your tax return.

taxes to get health coverage).

DO Include:

•Yourself

•Your spouse

•Your children under 21 who live with you

•Anyone you include on your tax return, even if they don’t live with you

•Anyone else under 21 who you take care of and lives with you

You DON’T have to include:

•Your unmarried partner who doesn’t need health coverage

•Your unmarried partner’s children

•

tax return (if you’re over 21)

•

The amount of assistance or type of program you qualify for depends on the number of people in your family and their incomes. This information helps us make sure everyone gets the best coverage they can.

Complete Step 2 for each person in your family. Start with yourself, then add other adults and children. If you have more than two people in your family, you’ll need to make a copy of the pages and attach them. You don’t need to provide immigration status or a Social Security number (SSN) for family members who don’t need health coverage. We’ll keep all the information you provide private and secure as required by law. We’ll use personal information only to check if you’re eligible for health coverage.

NEED HELP WITH YOUR APPLICATION? We can help you at no cost to you. Call us at |

Form H1205 • 01/2014 |

(after you pick a language, press 2). If you have a hearing or speech disability, call |

Page 2 of 13 |

STEP 2: PERSON 1 (Start with yourself)

Complete Step 2 for yourself, your spouse/partner and children who live with you and/or anyone on your same federal income tax return if you

with you. |

|

|

|

1. First name, middle name, last name, & suffix |

2. Relationship to you? |

|

SELF |

|

|

3. Date of birth (mm/dd/yyyy)

4. Sex

Male

Female

5. Social Security number (SSN)- -

We need this if you want health coverage and have an SSN. Providing your SSN can be helpful if you don’t want health coverage too since it can speed up the application process. We use SSNs to check income and other information to see who’s eligible for help with health coverage costs. If someone wants help getting an SSN, call

6.Do you plan to file a federal income tax return NEXT YEAR?

(You can still apply for health insurance even if you don’t file a federal income tax return.)

YES. If yes, please answer questions |

|

|

|

|

|

NO. If no, skip to question c. |

|||||||||

a. |

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

If yes, name of spouse: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Will you claim any dependents on your tax return? |

Yes |

No |

|

|

|

|

|

|

|

|

|||||

If yes, list name(s) of dependents: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

c. Will you be claimed as a dependent on someone’s tax return? |

Yes |

No |

|||||||||||||

If yes, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. Are you pregnant? |

Yes |

No a. If yes, how many babies are expected during this pregnancy? |

|

|

|||||||||||

|

|

b. If yes, due date (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8.Do you need health coverage?

(Even if you have insurance, there might be a program with better coverage or lower costs.)

YES. If yes, answer all the questions below. |

NO. If no, SKIP to the income questions on page 4. |

|

Leave the rest of this page blank. |

9.Do you have a physical, mental, or emotional health condition that causes limitations in activities (like bathing, dressing, daily

chores, etc.) or live in a medical facility or nursing home? Yes No

10.Are you a U.S. citizen or U.S. national? Yes No

11.If you aren’t a U.S. citizen or U.S. national, do you have eligible immigration status? Yes No If yes, answer these questions: a. Immigration document type

b.Document ID number

c.Have you lived in the U.S. since 1996? Yes No

12.Are you, or your spouse or parent, an

13.Are you, or your spouse or parent, a veteran of the U.S. military? Yes No

14.Do you want help paying for medical bills from the past 3 months? Yes No

15.Do you live with at least one child under the age of 19, and are you the main person taking care of this child? Yes No

17.Were you in foster care at age 18 or older? Yes No

16.Are you a

If yes, in which state?

18. Were you in an approved Unaccompanied Refugee Minor’s Resettlement Program at age 18 or older? Yes No If yes, in which state?

Please answer the following questions if PERSON 1 is age 22 or younger:

19. Did PERSON 1 have insurance through a job and lose it within the past 3 months? |

Yes |

No |

|

|||

a. If yes, end date: |

|

b. Reason the insurance ended: |

|

|

|

|

|

|

business closing. |

|

Change in parent’s marital status. |

||

|

|

|

|

|||

|

|

Parent’s COBRA coverage ended. |

|

Private health coverage ended. |

||

|

|

|

|

|||

|

|

state ended. |

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

NEED HELP WITH YOUR APPLICATION? We can help you at no cost to you. Call us at |

Form H1205 • 01/2014 |

|||||

(after you pick a language, press 2). If you have a hearing or speech disability, call |

Page 3 of 13 |

|||||

STEP 2: PERSON 1 (Continue with yourself)

20.If Hispanic/Latino, ethnicity

Mexican

Mexican American

Chicano/a

Puerto Rican

Cuban

Other

21.Race

White

Black or African American

American Indian or Alaska Native

Asian Indian Chinese

Filipino

Japanese

Korean

Vietnamese

Other Asian

Native Hawaiian

Guamanian or Chamorro Samoan

Other

Current Job & Income Information

Employed

If you’re currently employed, tell us about your income. Start with question 22..

Skip to question 31.

Not employed Skip to question 32.

CURRENT JOB 1:

22. Employer name and address

23. Employer phone number

( ) –

24. Wages/tips (before taxes)

Hourly

Weekly

Every 2 weeks

Twice a month

Monthly

Yearly

$

25. |

Average hours worked each WEEK |

|

|

|

|

|

|

|

|

CURRENT JOB 2: (If you have more jobs and need more space, attach another sheet of paper.) |

|

|

|

|

26. |

Employer name and address |

27. Employer phone number |

||

|

|

( |

) |

– |

28. Wages/tips (before taxes)

Hourly

Weekly

Every 2 weeks

Twice a month

Monthly

Yearly

$

29. Average hours worked each WEEK

30.In the past year, did you:

Change jobs

Stop working

Start working fewer hours

None of these

31.If

a. Type of work |

b. How much net income (profits once business expenses are |

|||

|

|

paid) will you get from this |

||

|

|

$ |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

32.OTHER INCOME THIS MONTH: Check all that apply, and give the amount and how often you get it. NOTE: You don’t need to tell us about child support, veteran’s payment, or Supplemental Security Income (SSI).

None |

|

|

|

|

Net farming/fishing |

|

|

|

|

|

|

|

Unemployment |

$ |

|

How often? |

|

$ |

|

|

How often? |

|

|

||

|

|

|

|

|

||||||||

|

|

Net rental/royalty |

$ |

|

|

How often? |

|

|

||||

Pensions |

$ |

|

How often? |

|

|

|

|

|

||||

|

|

|

|

|

||||||||

Social Security |

$ |

|

How often? |

|

Other income |

$ |

|

|

How often? |

|

|

|

|

|

Type: |

|

|

|

|

|

|

|

|||

Retirement accounts |

$ |

|

How often? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Alimony received |

$ |

|

How often? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33. DEDUCTIONS: Check all that apply, and give the amount and how often you pay it.

If you pay for certain things that can be deducted on a federal income tax return, telling us about them could make the cost of health coverage a little lower.

NOTE: You shouldn’t include a cost that you already considered in your answer to net

Alimony paid |

$ |

|

How often? |

|

|

|

|

Other deductions, such as educator expenses, health savings |

|||||

Student loan interest |

$ |

|

How often? |

|

|

|

accounts, moving expenses, tuition, and fees |

||||||

|

|

|

|

$ |

|

How often? |

|

Type: |

|

|

|||

|

|

|

|

|

|

|

|||||||

34.YEARLY INCOME: Complete only if your income changes from month to month. If you don’t expect changes to your monthly income, skip to the next person.

Your total income this year

$

Your total income next

$

THANKS! This is all we need to know about you.

NEED HELP WITH YOUR APPLICATION? We can help you at no cost to you. Call us at |

Form H1205 • 01/2014 |

(after you pick a language, press 2). If you have a hearing or speech disability, call |

Page 4 of 13 |

STEP 2: PERSON 2

Complete Step 2 for yourself, your spouse/partner, and children who live with you and/or anyone on your same federal income tax return if you

with you. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

First name, middle name, last name, & suffix |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Relationship to you? |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Date of birth (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. Sex |

Male |

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

5. |

Social Security number (SSN) |

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

We need this if you want health coverage and have an SSN. |

|||

|

|

|

|

|

|

|

|

|

|||||||||||||||

6.Does PERSON 2 live at the same address as you? Yes No If no, list address:

7.Does PERSON 2 plan to file a federal income tax return NEXT YEAR?

(You can still apply for health insurance even if you don’t file a federal income tax return.)

YES. If yes, please answer questions

NO. If no, skip to question c.

a. |

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

If yes, name of spouse: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Will PERSON 2 claim any dependents on his or her tax return? Yes |

No |

|

|

|

|

|

|

|

|

|||||||

If yes, list name(s) of dependents: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

c. Will PERSON 2 be claimed as a dependent on someone’s tax return? |

Yes |

No |

||||||||||||||

If yes, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. Is PERSON 2 pregnant? Yes |

No |

a. If yes, how many babies are expected during this pregnancy? |

||||||||||||||

|

|

|

|

b. If yes, due date (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

9.Does PERSON 2 need health coverage?

(Even if they have insurance, there might be a program with better coverage or lower costs.)

YES. If yes, answer all the questions below. |

NO. If no, SKIP to the income questions on page 6. |

|

Leave the rest of this page blank. |

|

|

10.Does PERSON 2 have a physical, mental, or emotional health condition that causes limitations in activities (like bathing, dressing, daily

chores, etc) or live in a medical facility or nursing home? Yes No

11.Is PERSON 2 a U.S. citizen or U.S. national? Yes No

12.If you aren’t a U.S. citizen or U.S. national, do you have eligible immigration status? Yes No If yes, please answer these questions: a. Immigration document type:

b.Document ID number:

c.Have you lived in the U.S. since 1996? Yes No

13.Are you, or your spouse or parent, an

14.Are you, or your spouse or parent, a veteran of the U.S. military? Yes No

15. Does PERSON 2 want help paying for |

16. Does PERSON 2 live with at least one child under |

17. Was PERSON 2 in foster care at age |

||||||||

medical bills from the past 3 months? |

|

the age of 19, and are they the main person |

18 or older? |

|

|

|

||||

Yes |

No |

|

taking care of this child? |

Yes |

No |

|

|

|

||

|

|

|

|

Yes |

No |

If yes, in which state? |

|

|

||

|

|

|

|

|

|

|

|

|||

18. Was PERSON 2 in an approved Unaccompanied Refugee Minor’s Resettlement Program at age 18 or older? |

Yes |

No |

||||||||

If yes, in which state? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Please answer questions 19 and 20 if PERSON 2 is age 22 or younger:

19. Did PERSON 2 have insurance through a job and lose it within the past 3 months? |

Yes |

No |

||||

a. If yes, end date: |

|

b. Reason the insurance ended: |

|

|

|

|

|

|

business closing. |

|

Change in parent’s marital status. |

||

|

|

Parent’s COBRA coverage ended. |

Private health coverage ended. |

|||

|

|

state ended. |

|

Other |

|

|

|

|

|

|

|

|

|

20.Is PERSON 2 a

21.If Hispanic/Latino, ethnicity

Mexican |

Mexican American |

Chicano/a |

Puerto Rican |

Cuban |

Other |

|

|

|

|

|

||

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||

22. Race |

|

|

|

|

|

|

|

|

|

|||

White |

|

American Indian or Alaska |

Filipino |

|

Vietnamese |

Guamanian or Chamorro |

||||||

Black or African |

Native |

|

|

Japanese |

|

Other Asian |

Samoan |

|

|

|||

American |

|

Asian Indian |

|

Korean |

|

Native Hawaiian |

|

|

|

|

||

|

|

Chinese |

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

||||||||

NEED HELP WITH YOUR APPLICATION? We can help you at no cost to you. Call us at |

Form H1205 • 01/2014 |

|||||||||||

(after you pick a language, press 2). If you have a hearing or speech disability, call |

|

|

Page 5 of 13 |

|||||||||

STEP 2: PERSON 2

Current Job & Income Information

Employed

If you’re currently employed, tell us about your income. Start with question 23..

CURRENT JOB 1:

Skip to question 32.

Not employed Skip to question 33.

23. Employer name and address

24. Employer phone number

( ) –

25. Wages/tips (before taxes)

Hourly

Weekly

Every 2 weeks

Twice a month

Monthly

Yearly

$

26. |

Average hours worked each WEEK |

|

|

|

|

|

|

|

|

CURRENT JOB 2: (If you have more jobs and need more space, attach another sheet of paper.) |

|

|

|

|

|

|

|

||

27. |

Employer name and address |

28. Employer phone number |

||

|

|

( |

) |

– |

|

|

|

|

|

29. Wages/tips (before taxes)

Hourly

Weekly

Every 2 weeks

Twice a month

Monthly

Yearly

$

30. Average hours worked each WEEK

31.In the past year, did PERSON 2:

Change jobs

Stop working

Start working fewer hours

None of these

32.If

a. Type of work |

b. How much net income (profits once business expenses are |

||

|

paid) will you get from this |

||

|

$ |

|

|

33. OTHER INCOME THIS MONTH: Check all that apply, and give the amount and how often you get it.

NOTE: You don’t need to tell us about child support, veteran’s payment, or Supplemental Security Income (SSI).

None |

|

|

|

Unemployment |

$ |

|

How often? |

|

|||

Pensions |

$ |

|

How often? |

|

|||

Social Security |

$ |

|

How often? |

|

|||

Retirement accounts |

$ |

|

How often? |

Alimony received |

$ |

|

How often? |

|

Net farming/fishing |

$ |

|

How often? |

|

|

||||

Net rental/royalty |

$ |

|

How often? |

|

Other income |

$ |

|

How often? |

|

|

||||

Type: |

|

|

|

|

34. DEDUCTIONS: Check all that apply, and give the amount and how often you pay it.

If PERSON 2 pays for certain things that can be deducted on a federal income tax return, telling us about them could make the cost of health coverage a little lower.

NOTE: You shouldn’t include a cost that you already considered in your answer to net

Alimony paid |

$ |

|

|

How often? |

|

|

|

|

Other deductions, such as educator expenses, health savings |

|||

|

|

|

|

|

||||||||

Student loan interest |

$ |

|

|

How often? |

|

|

|

accounts, moving expenses, tuition, and fees |

||||

|

|

$ |

|

How often? |

|

|

||||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

35.YEARLY INCOME: Complete only if PERSON 2’s income changes from month to month.

If you don’t expect changes to PERSON 2’s monthly income, skip to the next section.

PERSON 2’s total income this year

$

PERSON 2’s total income next year

$

THANKS! This is all we need to know about PERSON 2.

If you have more than two people to include, make a copy of Step 2: Person 2 (pages 5 and 6) and complete.

NEED HELP WITH YOUR APPLICATION? We can help you at no cost to you. Call us at |

Form H1205 • 01/2014 |

(after you pick a language, press 2). If you have a hearing or speech disability, call |

Page 6 of 13 |

STEP 3 Things Everyone Pays for or Owns

1.VEHICLES: We need to know about all vehicles everyone, including tax dependents, pays for or owns, such as a:

• car • truck • boat • motorcycle • other

Does anyone pay for or own a vehicle? Yes No

If yes, give the facts:

Vehicle 1:

•Name of owner:

•Make / model:

•Year:

•Name of

•Money still owed on vehicle: $

•Is the vehicle used for a person with a disability? Yes No

Vehicle 2:

•Name of owner:

•Make / model:

•Year:

•Name of

•Money still owed on vehicle: $

•Is the vehicle used for a person with a disability? Yes No

Vehicle 3:

•Name of owner:

•Make / model:

•Year:

•Name of

•Money still owed on vehicle: $

• Is the vehicle used for a person with a disability? Yes No

If you need to list more than 3 vehicles, add more pages with the same facts.

2.ITEMS EVERYONE PAYS FOR OR OWNS: We need to know about items everyone, including tax dependents, pays

for or owns, such as: • cash • bank accounts • homes or other property • insurance policies • stocks

Does anyone pay for or own these types of items? If yes, give the facts:

Yes

No

Item 1:

• Item:

• Account number:

• Value: $

• Names on account or deeds (include

• Name and address of bank or business (to contact about the item):

Item 2:

• Item:

• Account number:

• Value: $

• Names on account or deeds (include

• Name and address of bank or business (to contact about the item):

Item 3:

• Item:

• Account number:

• Value: $

• Names on account or deeds (include

• Name and address of bank or business (to contact about the item):

If you need to list more than 3 items, add more pages with the same facts.

NEED HELP WITH YOUR APPLICATION? We can help you at no cost to you. Call us at |

Form H1205 • 01/2014 |

(after you pick a language, press 2). If you have a hearing or speech disability, call |

Page 7 of 13 |

STEP 4 American Indian or Alaska Native (AI/AN) family member(s)

1.Are you or is anyone in your family American Indian or Alaska Native?

If No, skip to Step 5.

Yes. If yes, go to Appendix B.

STEP 5 Your Family’s Health Coverage

Answer these questions for anyone who needs health coverage.

1.Is anyone enrolled in health coverage now from the following?

YES. If yes, check the type of coverage and write the person(s’) name(s) next to the coverage they have. |

NO. |

|||||||||||||||||||

|

Medicaid |

|

|

|

|

|

|

Employer insurance |

|

|

|

|

|

|

|

|

||||

|

Which state? |

|

|

|

Name of health insurance: |

|

|

|

|

|

||||||||||

|

Date coverage ends (if not ending, write “Not ending”) |

|

|

Policy number: |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

Coverage start date: |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

CHIP |

|

|

|

|

|

|

|

Coverage end date: |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Which state? |

|

|

|

Amount you pay each month to cover your child(ren) on this |

|||||||||||||||

|

|

|

|

|||||||||||||||||

|

Date coverage ends (if not ending, write “Not ending”) |

|

|

insurance? |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

Who pays the premium? |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

Is this COBRA coverage? |

Yes |

No |

||||||||

|

Medicare |

|

|

|

||||||||||||||||

|

|

|

Is this a retiree health plan? |

Yes |

No |

|||||||||||||||

|

TRICARE (Don’t check if you have direct care or Line of Duty) |

|

|

|||||||||||||||||

|

|

|

Other |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

Name of health insurance: |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Policy number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes

No

2. |

Check yes even if the coverage is from someone else’s job, |

such as a parent or spouse.

YES. If yes, you’ll need to complete and include Appendix A. Is this a state employee benefit plan? Yes

NO. If no, continue to Step 6.

No

These questions will not be used to decide if your family can g

1. Is a child in your home in the Children with Special Health Care Needs program? If yes, who?

2.

If yes, who?

Yes

No

Yes

No

Signing up to vote

Applying to register or declining to register to vote will not

If you are not registered to vote where you live now, would you like to apply to register to vote here today?

sagency. Yes No

IF YOU DO NOT CHECK EITHER BOX, YOU WILL BE CONSIDERED TO HAVE DECIDED NOT TO REGISTER TO VOTE AT THIS TIME.

lication form, we will help you. The decision whether to seek o application form in private. If you believe that someone has interfered with your right to register or to decline to register to vote, or your right to choose your own political

th the Elections Division, Secretary of State, PO Box 12060, Austin, TX 78711. Phone:

Agency Use Only: Voter Registration Status

Already registered |

Client declined |

Agency transmitted |

Client to mail |

Mailed to client |

Other |

Agency staff signature: |

_______________________________ |

|

NEED HELP WITH YOUR APPLICATION? We can help you at no cost to you. Call us at |

Form H1205 • 01/2014 |

(after you pick a language, press 2). If you have a hearing or speech disability, call |

Page 8 of 13 |

STEP 6 Read & sign this application

•I’m signing this application under penalty of perjury which means I’ve provided true answers to all the questions on this

form to the best of my knowledge. I know that I may be subject to penalties under federal law if I provide false or untrue information.

•

what I wrote on this application. To report changes, I can go to or call

•I know that under federal law, discrimination isn’t permitted on the basis of race, color, national origin, sex, age, sexual

.

•

(name of person)

is incarcerated.

We need this information to check your eligibility for help paying for health coverage if you choose to apply. We’ll check your answers using information in our electronic databases and databases from the Internal Revenue Service (IRS), Social Security, the Department of Homeland Security, and/or a consumer reporting agency. If the information doesn’t match, we may ask you to send us proof.

Renewal of coverage in future years

To make it easier to determine my eligibility for help paying for health coverage in future years, I agree to allow the agency to use income data, including information from tax returns. The agency will send me a notice, let me make any changes, and I can opt out at any time.

Yes, renew my eligibility automatically for the next

5 years (the maximum number of years allowed), or for a shorter number of years:

4 years |

3 years |

2 years |

1 year |

Don’t use information from tax returns to renew my coverage. |

If anyone on this application is eligible for Medicaid

•I am giving to HHSC the rights to pursue and get any money from other health insurance, legal settlements, or other third parties. I am also giving to HHSC rights to pursue and get medical support.

•I know I will be asked to cooperate with the agency that collects medical support from an absent parent. If I think that cooperating to collect medical support will harm me or my children, I can tell HHSC and I may not have to cooperate.

• Does any child on this application have a parent living outside of the home? |

Yes |

No |

|

If yes, tell us about the parent living outside of the home: |

|

|

|

First and last name __________________________________________ |

Birth date (mm/dd/yyyy) _________________________ |

||

Social Security number ______________________________________ |

Phone ___________________________________________ |

||

Mailing address _____________________________________________ |

Employer ___________________________________ |

||

City, State, ZIP _______________________________________________ |

|

|

|

My right to appeal

If I think HHSC has made a mistake, I can appeal its decision. To appeal means to tell someone at HHSC that I think the action is

Sign this application

as long as you have provided the information required in Appendix C.

Signature

Date (mm/dd/yyyy)

STEP 7

Fax: |

Mail: HHSC |

|

If your form is |

PO Box 14600 |

|

|

Midland, Texas |

|

NEED HELP WITH YOUR APPLICATION? We can help you at no cost to you. Call us at |

Form H1205 • 01/2014 |

|

(after you pick a language, press 2). If you have a hearing or speech disability, call |

Page 9 of 13 |

|

APPENDIX A

Health Coverage from Jobs

You DON’T need to answer these questions unless someone in the household is eligible for health coverage from a job. Attach a copy of this page for each job that offers coverage.

Tell us about the job that offers coverage.

Take the Employer Coverage Tool on the next page to the employer who offers coverage to help you answer these questions. You only need to include this page when you send in your application, not the Employer Coverage Tool.

EMPLOYEE Information

1. Employee name (First, Middle, Last)

2.Employee Social Security number

--

EMPLOYER Information

3.Employer name

5.Employer address

7.City

4. Employer Identification Number (EIN)

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

6. Employer phone number |

|||||||||||||

( |

) |

|

|

|

– |

|||||||||

8. State |

|

|

|

|

|

|

9. ZIP code |

|||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. Who can we contact about employee health coverage at this job?

11. Phone number (if different from above)

( |

) |

– |

12. Email address

13.A

Yes (Continue)

13a. If you’re in a waiting or probationary period, when can you enroll in coverage?

(mm/dd/yyyy)

List the names of anyone else who is eligible for coverage from this job.

Name: |

|

Name: |

|

Name: |

No (Stop here and go to Step 5 in the application)

Tell us about the health plan offered by this employer.

Yes

No

15.For the

If the employer has wellness programs, provide the premium that the employee would pay if he/ she received the maximum discount for any tobacco cessation programs, and did not receive any other discounts based on wellness programs.

a. How much would the employee have to pay in premiums for this plan? $

b. How often? |

Weekly |

Every 2 weeks |

Twice a month |

Once a month |

Quarterly Yearly

16.What change will the employer make for the new plan year (if known)? Employer won’t offer health coverage

Employer will start offering health coverage to employees or change the premium for the

the employee that meets the minimum value standard.* (Premium should reflect the discount for wellness programs. See question 15.) a. How much will the employee have to pay in premiums for that plan? $

b. How often? |

Weekly |

Every 2 weeks |

Twice a month |

Once a month |

Quarterly |

Yearly |

Date of change (mm/dd/yyyy):

*An

NEED HELP WITH YOUR APPLICATION? We can help you at no cost to you. Call us at |

Form H1205 • 01/2014 |

(after you pick a language, press 2). If you have a hearing or speech disability, call |

Page 10 of 13 |

EMPLOYER COVERAGE TOOL

Use this tool to help answer questions in Appendix A about any employer health coverage that you’re eligible for (even if it’s from another person’s job, like a parent or spouse). The information in the numbered boxes below match the boxes on Appendix A. For example, the answer to question 14 on this page should match question 14 on Appendix A.

Write your name and Social Security number in boxes 1 and 2 and ask the employer to fill out the rest of the form. Complete one tool for each employer that offers health coverage.

EMPLOYEE Information

The employee needs to fill out this section.

1. Employee name (First, Middle, Last)

2.Social Security Number

--

EMPLOYER Information

Ask the employer for this information.

3. Employer name |

|

|

4. Employer Identification Number (EIN) |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Employer address (HHSC will send notices to this address) |

|

6. Employer phone number |

||||||||||||||||||||||

|

|

|

|

|

( |

) |

|

|

|

– |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. City |

|

|

8. State |

|

|

|

|

|

|

|

|

|

|

9. ZIP code |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

10. Who can we contact about employee health coverage at this job? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

11. Phone number (if different from above) |

12. Email address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

( |

) |

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13.Is the employee currently eligible for coverage offered by this employer, or will the employee be eligible in the next 3 months?

Yes (Continue)

13a. If the employee is not eligible today, including as a result of a waiting or probationary period, when is the employee eligible for coverage? (mm/dd/yyyy) (Continue)

No (STOP and return this form to employee)

Tell us about the health plan employer.

Yes. Which people?

No

(Go to question 14)

Spouse

Dependent(s)

Yes (Go to question 15)

No (STOP and return form to employee)

15. only to the employee (don’t include family plans): If the employer has wellness programs, provide the premium that the employee would pay if he/ she received the maximum discount for any tobacco cessation programs, and didn’t receive any other discounts based on wellness programs.

a. How much would the employee have to pay in premiums for this plan? $

b. How often? Weekly |

Every 2 weeks |

Twice a month |

Once a month |

Quarterly

Yearly

If the plan year will end soon and you know that the health plans offered will change, go to question 16. If you don’t know, STOP and return form to employee.

16.What change will the employer make for the new plan year? Employer won’t offer health coverage

Employer will start offering health coverage to employees or change the premium for the

the employee that meets the minimum value standard.* (Premium should reflect the discount for wellness programs. See question 15.) a. How much will the employee have to pay in premiums for that plan? $

b. How often? Weekly |

Every 2 weeks |

Twice a month |

Once a month |

Date of change (mm/dd/yyyy):

Quarterly

Yearly

*An

NEED HELP WITH YOUR APPLICATION? We can help you at no cost to you. Call us at |

Form H1205 • 01/2014 |

(after you pick a language, press 2). If you have a hearing or speech disability, call |

Page 11 of 13 |

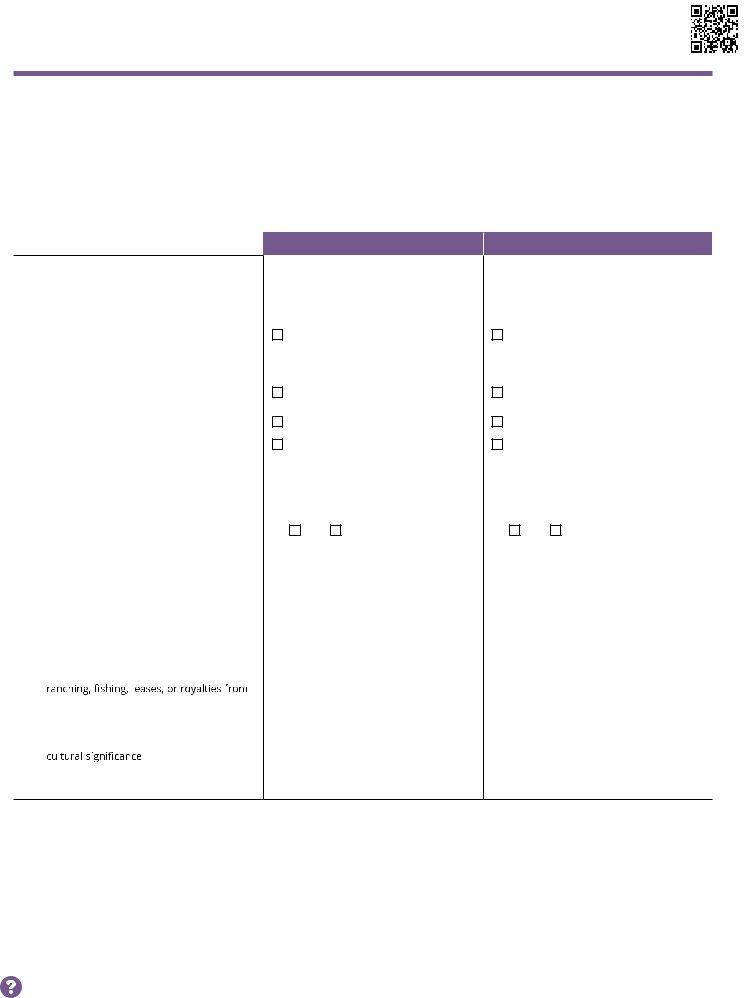

APPENDIX B

American Indian or Alaska Native Family Member (AI/AN)

Complete this appendix if you or a family member are American Indian or Alaska Native. Submit this with your application.

Tell us about your American Indian or Alaska Native family member(s).

American Indians and Alaska Natives can get services from the Indian Health Services, tribal health programs, or urban Indian health programs. They also may not have to pay cost sharing and may get special monthly enrollment periods. Answer the following questions to make sure your family gets the most help possible.

NOTE: If you have more people to include, make a copy of this page and attach.

AI/AN PERSON 1

AI/AN PERSON 2

1. Name |

First |

|

|

|

Middle |

First |

|

Middle |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(First name, Middle name, Last name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last |

|

|

|

|

|

|

Last |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Member of a federally recognized tribe? |

|

|

Yes |

|

|

|

|

|

Yes |

|

|

|

|

|||

|

|

|

|

|

If yes, tribe name |

|

|

If yes, tribe name |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

No |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Has this person ever gotten a service from the |

|

|

Yes |

|

|

|

|

|

Yes |

|

|

|

|

|||

|

Indian Health Service, a tribal health program, |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or urban Indian health program, or through a |

|

|

No |

|

|

|

|

|

No |

|

|

|

|

||

|

referral from one of these programs? |

|

|

|

If no, is this person eligible to get |

|

If no, is this person eligible to get |

|||||||||

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

services from the Indian Health Service, |

|

services from the Indian Health Service, |

|||||||||

|

|

|

|

|

tribal health programs, or urban Indian |

|

tribal health programs, or urban Indian |

|||||||||

|

|

|

|

|

health programs, or through a referral |

|

health programs, or through a referral |

|||||||||

|

|

|

|

|

from one of these programs? |

|

from one of these programs? |

|||||||||

|

|

|

|

|

Yes |

No |

|

|

Yes |

No |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Certain money received may not be counted |

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

for Medicaid or the Children’s Health Insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Program (CHIP). List any income (amount and |

How often? |

|

|

|

|

How often? |

|

|

|

|

|||||

|

how often) reported on your application that |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

includes money from these sources: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

•Per capita payments from a tribe that come from natural resources, usage rights, leases, or royalties

•Payments from natural resources, farming,

land designated as Indian trust land by the Department of Interior (including reservations and former reservations)

•Money from selling things that have

NEED HELP WITH YOUR APPLICATION? We can help you at no cost to you. Call us at |

Form H1205 • 01/2014 |

(after you pick a language, press 2). If you have a hearing or speech disability, call |

Page 12 of 13 |

APPENDIX C

Assistance with Completing this Application

You can choose an authorized representative.

You can give a trusted person permission to talk about this application with us, see your information, and act for you on matters related to this application, including getting information about your application and signing your application on your behalf. This person is called an “authorized representative.” If you ever need to change your authorized representative, contact HHSC. If you’re a legally appointed representative for someone on this application,

submit proof with the application.

1. Name of authorized representative (First name, middle name, last name)

2.Address

4.City

7. Phone number

( ) –

8. Organization name

|

3. |

Apartment or suite number |

5. State |

6. |

ZIP code |

|

|

|

9. Organization ID number (if applicable)

By signing, you allow this person to sign your application, get offi c i al i n formation about this application, and act for you on all future matters with this agency.

10. Your signature

11. Date (mm/dd/yyyy)

For certified application counselors, navigators, agents, and brokers only.

Complete this section if you’re a certified application counselor, navigator, agent, or broker filling out this application for somebody else.

1.Application start date (mm/dd/yyyy)

2.First name, middle name, last name, & suffix

3. Organization name

4. Organization ID number (if applicable)

NEED HELP WITH YOUR APPLICATION? We can help you at no cost to you. Call us at |

Form H1205 • 01/2014 |

(after you pick a language, press 2). If you have a hearing or speech disability, call |

Page 13 of 13 |